Answered step by step

Verified Expert Solution

Question

1 Approved Answer

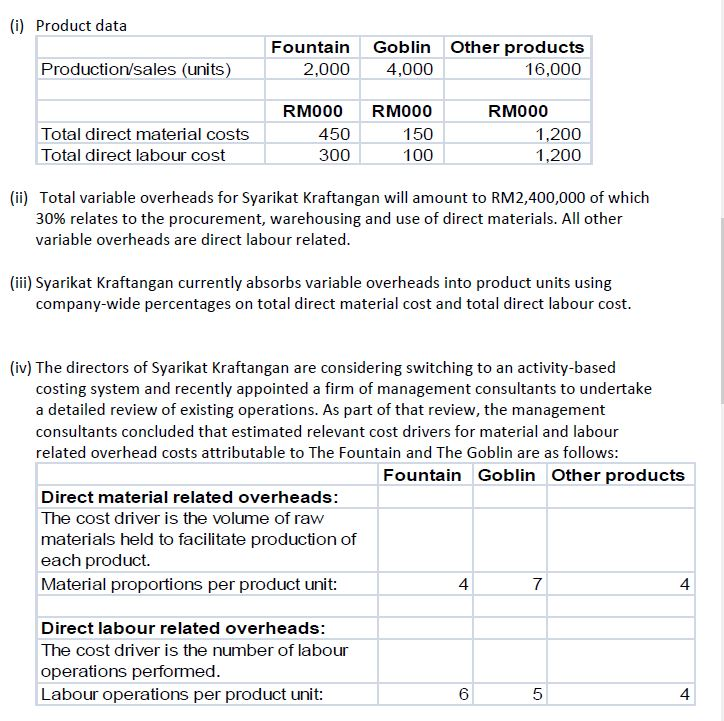

Syarikat Kraftangan makes and sells a range of ornamental products in Balikland. Syarikat Kraftangan employs experienced sculptors who have an excellent reputation for producing high-quality

Syarikat Kraftangan makes and sells a range of ornamental products in Balikland. Syarikat Kraftangan employs experienced sculptors who have an excellent reputation for producing high-quality products. They have two key products i.e. water fountain known as Fountain and a large garden statute known as Goblin. The management accountant of Syarikat Kraftangan has estimated the variable costs per unit of The Fountain and The Goblin as being RM622.50 and RM103.75 respectively. He based his calculations on the following information:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started