Answered step by step

Verified Expert Solution

Question

1 Approved Answer

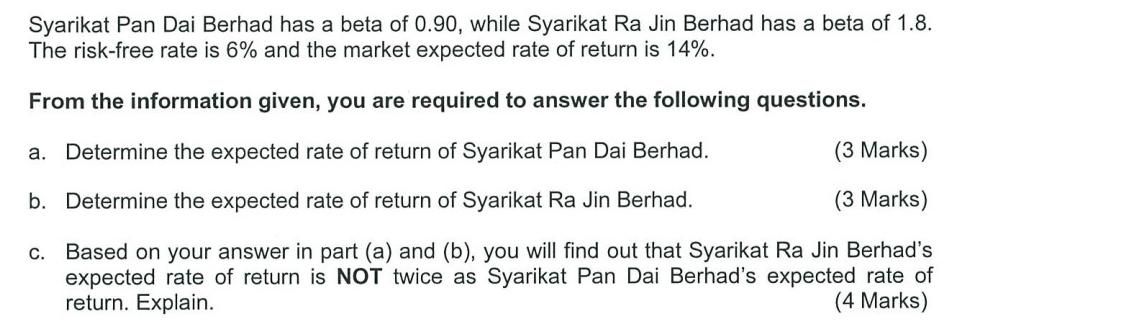

Syarikat Pan Dai Berhad has a beta of 0.90, while Syarikat Ra Jin Berhad has a beta of 1.8. The risk-free rate is 6%

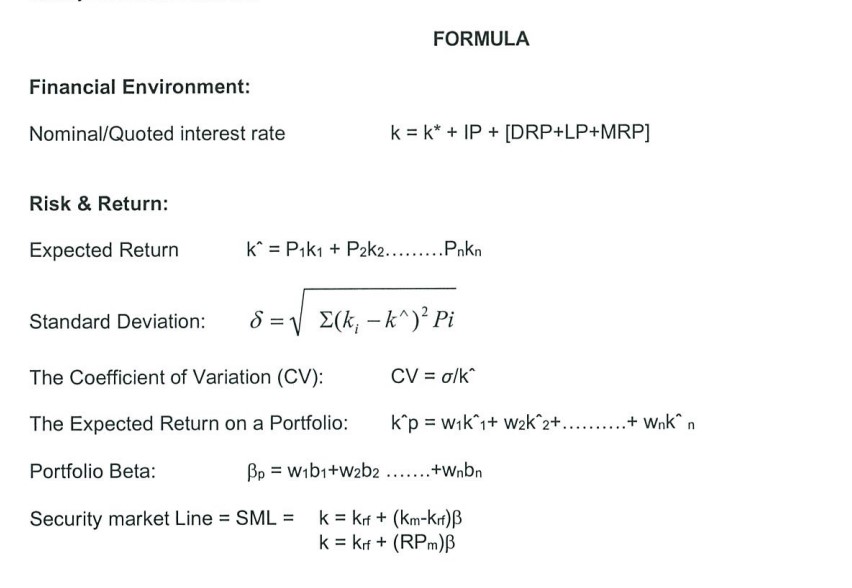

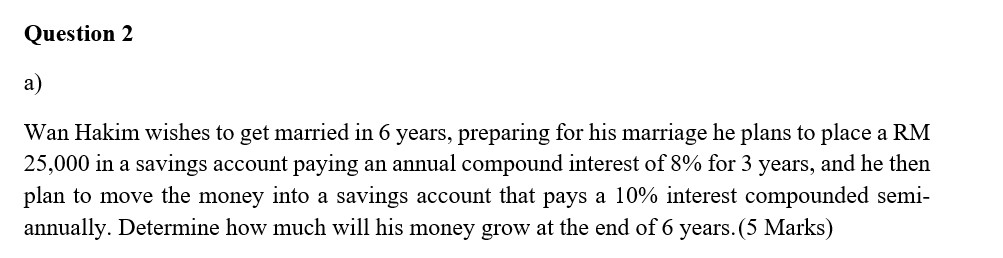

Syarikat Pan Dai Berhad has a beta of 0.90, while Syarikat Ra Jin Berhad has a beta of 1.8. The risk-free rate is 6% and the market expected rate of return is 14%. From the information given, you are required to answer the following questions. a. Determine the expected rate of return of Syarikat Pan Dai Berhad. b. Determine the expected rate of return of Syarikat Ra Jin Berhad. (3 Marks) (3 Marks) C. Based on your answer in part (a) and (b), you will find out that Syarikat Ra Jin Berhad's expected rate of return is NOT twice as Syarikat Pan Dai Berhad's expected rate of return. Explain. (4 Marks) Financial Environment: Nominal/Quoted interest rate Risk & Return: FORMULA kk+IP+[DRP+LP+MRP] Expected Return KP1k1+P2k2.........Pnkn Standard Deviation: (k,-k^) Pi The Coefficient of Variation (CV): CV = /k^ The Expected Return on a Portfolio: kp wik 1+ W2k 2+..........+ Wnk n Portfolio Beta: Bp W1b1+w2b2 .......+Wnbn Security market Line = SML = k = Krf + (Km-Krf) k = Krf + (RPM) Question 2 a) Wan Hakim wishes to get married in 6 years, preparing for his marriage he plans to place a RM 25,000 in a savings account paying an annual compound interest of 8% for 3 years, and he then plan to move the money into a savings account that pays a 10% interest compounded semi- annually. Determine how much will his money grow at the end of 6 years. (5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Determine the expected rate of return of Syarikat Pan Dai Berhad Formula k krf km krf beta where k is the expected rate of return krf is the riskfree rate 6 km is the market expected rate of return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e9bb749b0a_954048.pdf

180 KBs PDF File

663e9bb749b0a_954048.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started