Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sycamore Company is negotiating with a customer for the lease of a large machine manufactured by Sycamore. The machine has a cash price of

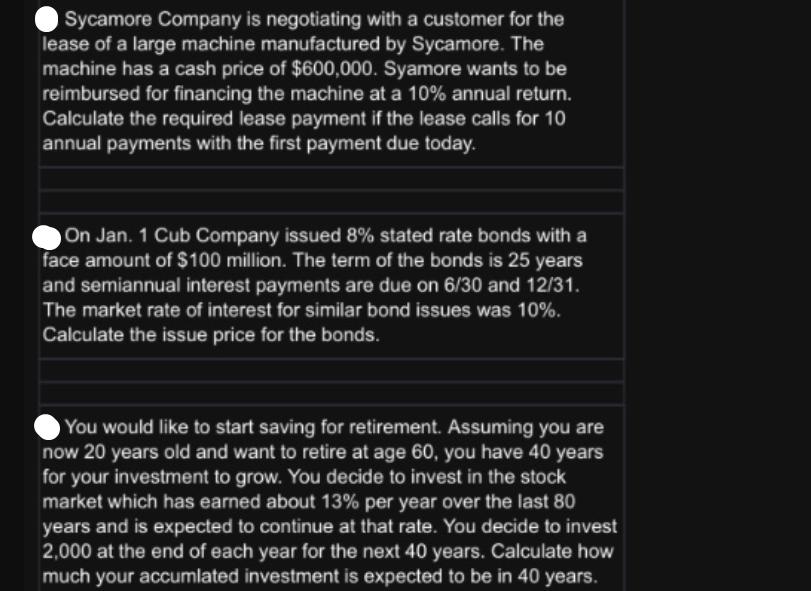

Sycamore Company is negotiating with a customer for the lease of a large machine manufactured by Sycamore. The machine has a cash price of $600,000. Syamore wants to be reimbursed for financing the machine at a 10% annual return. Calculate the required lease payment if the lease calls for 10 annual payments with the first payment due today. On Jan. 1 Cub Company issued 8% stated rate bonds with a face amount of $100 million. The term of the bonds is 25 years and semiannual interest payments are due on 6/30 and 12/31. The market rate of interest for similar bond issues was 10%. Calculate the issue price for the bonds. You would like to start saving for retirement. Assuming you are now 20 years old and want to retire at age 60, you have 40 years for your investment to grow. You decide to invest in the stock market which has earned about 13% per year over the last 80 years and is expected to continue at that rate. You decide to invest 2,000 at the end of each year for the next 40 years. Calculate how much your accumlated investment is expected to be in 40 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started