Answered step by step

Verified Expert Solution

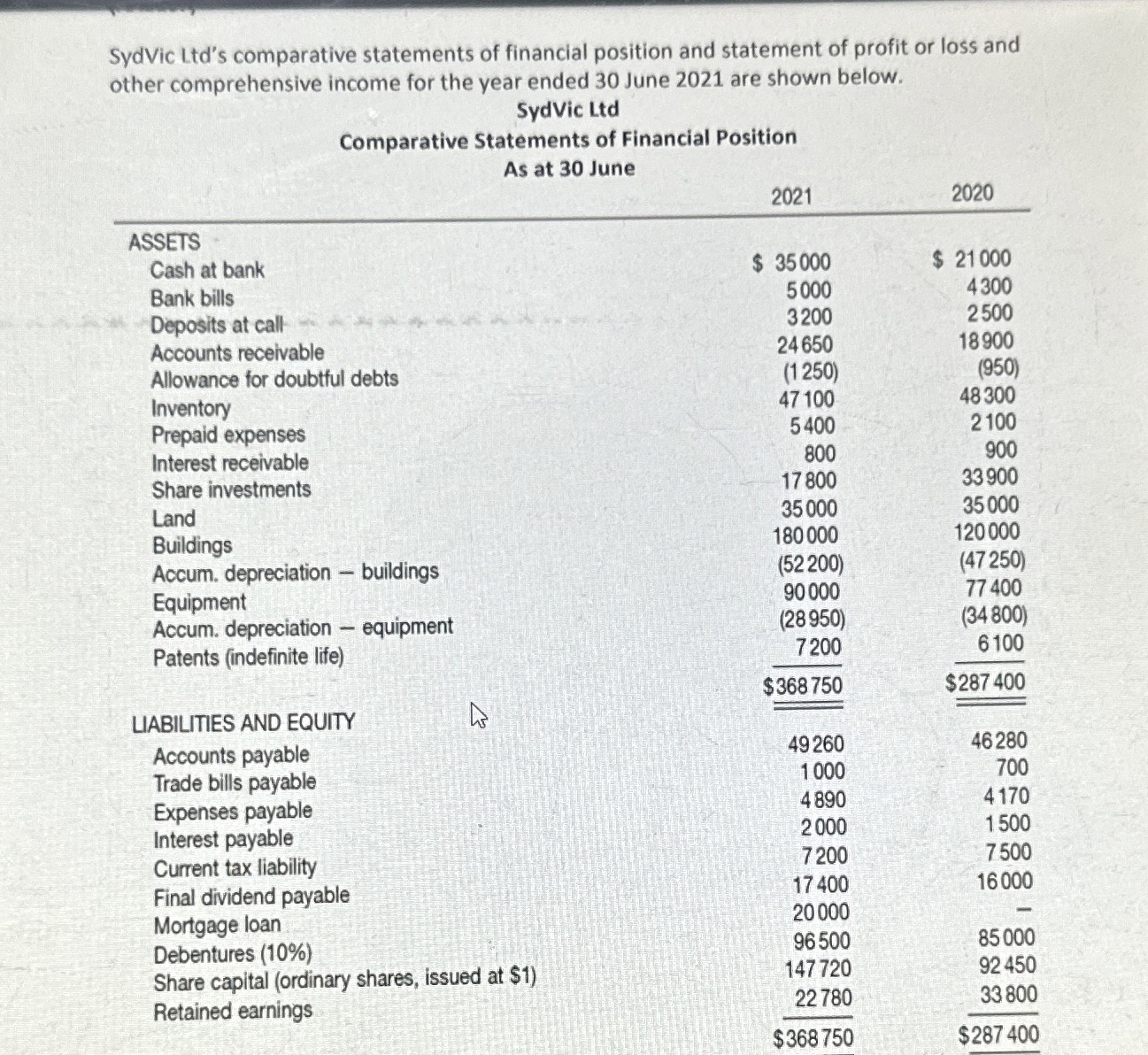

Question

1 Approved Answer

SydVic LtdStatement of Profit or Loss and other Comprehensive IncomeFor year ended 3 0 June 2 0 2 1 Sales = 6 9 3 0

SydVic LtdStatement of Profit or Loss and other Comprehensive IncomeFor year ended June

Sales

intersst income

dividend income

discount rec

gain on sale of share investments

total

Expenses

cost of sales

bad debt expense

loss on sale kf equipment

dep equipemnt

dep building

discount allowed

interest expense

other expense

total expenses

Profit before tax

income tax

profit after tax

Additional information New equipment was purchased at a cost of $ paid in cash Equipment that cost $ and had a carrying amount of $ was sold for cash Additions to buildings were partly funded by a mortgage loan Debentures were issued at nominal value $ for cash Share investments with a carrying amount of $ were sold for cash at a profit The company was given permission to pay income tax in one instalment No interim dividends were paid during the year.Requireda Prepare the statement of cash flows for SydVic Ltd for the year ended June inaccordance with AASB using the classifications shown in illustrative example A to thestandard.b Prepare the note showing the reconciliation of net cash from operating activities to profitfor the year ended June

pls solve this question asap and pls do it correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started