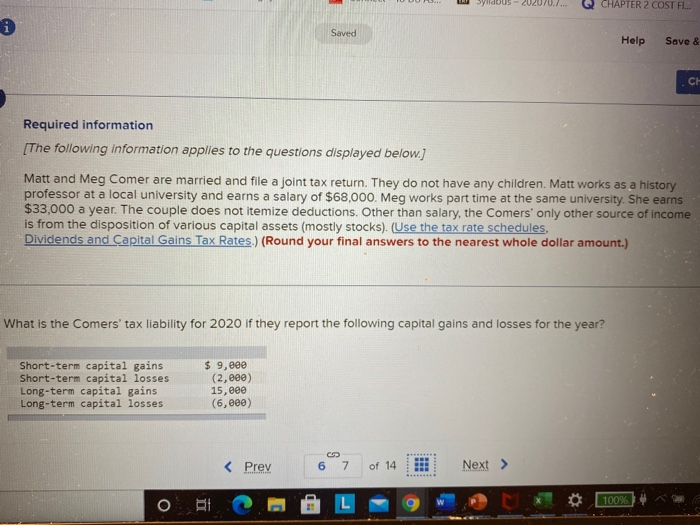

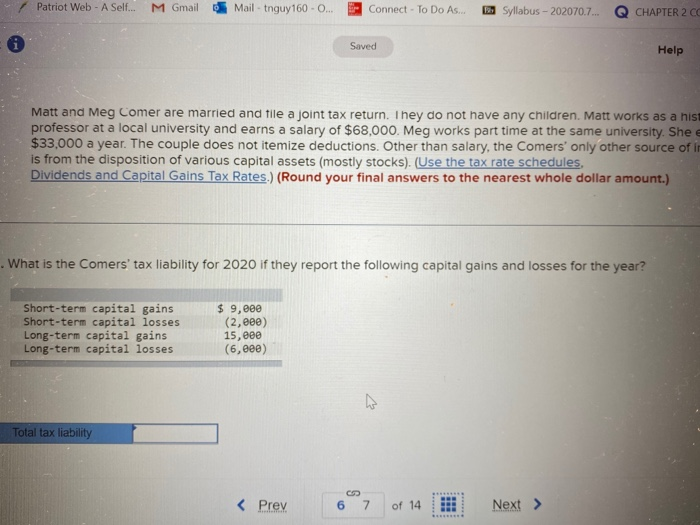

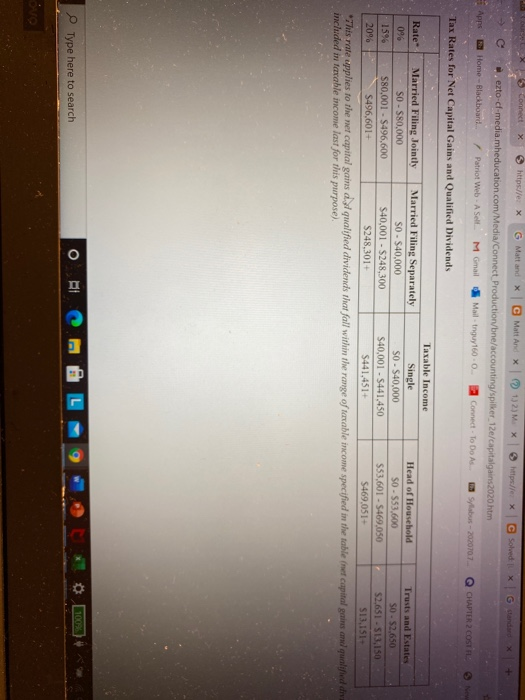

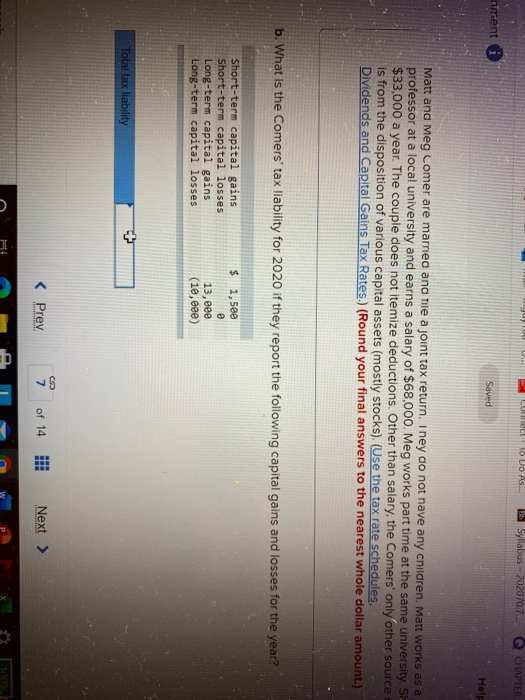

SylldDUS CHAPTER 2 COST F... i Saved Help Save & CH Required information [The following information applies to the questions displayed below.] Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $68,000. Meg works part time at the same university. She earns $33,000 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount.) What is the Comers' tax liability for 2020 if they report the following capital gains and losses for the year? Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses $ 9,000 (2,000) 15, eee (6,eee) 100% o el Patriot Web - A Self... M Gmail Mail - tnguy160 - O... Connect - To Do As... Be Syllabus - 202070.7... CHAPTER 2 CO Saved Help Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a his professor at a local university and earns a salary of $68,000. Meg works part time at the same university. She e $33,000 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of in is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount.) . What is the Comers' tax liability for 2020 if they report the following capital gains and losses for the year? Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses $ 9,eee (2,000) 15,00 (6,000) ho Total tax liability https://ex G Matt X C Matt And X (?) 152) MX https//ex C Solved iX ezto-cf-media.mheducation.com/Media/Connect Production/bne/accounting/spilker 12e/capitalgains2020 htm Home - Blackboard Patriot Web - A Sell M Gmail Mail-tnguy 1600 Connect To Do As. Stabus-2020707 Apps CHAPTER 2 COST NA Tax Rates for Net Capital Gains and Qualified Dividends Taxable income Rate" Married Filing Jointly Married Filing Separately Single Head of Household Trusts and Estates 06 SO - 580.000 SO - $40.000 SO - S40,000 SO - 553,600 SO - $2,650 15% S80,001 - S496,600 $40,001 - $248,300 $40,001 - 5441.450 553,601 - 5469,050 $2,651 - 513,150 20% S496,601 $248,301 $441,451+ $469,051- $13,151 This rate upplies to the net capital gains de qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified div. included in ferable income last for this purpose). 100 Type here to search ORE LUC 10 DO AS... B. Syllabus - 202070.7... CHAPTER nment Saved Hele Matt and Meg Comer are married and tile a joint tax return. iney do not have any children. Matt works as a professor at a local university and earns a salary of $68,000. Meg works part time at the same university.SE $33,000 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount.) b. What is the Comers' tax liability for 2020 if they report the following capital gains and losses for the year? $ 1,500 Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses 13,000 (10, eee) Total tax liability SylldDUS CHAPTER 2 COST F... i Saved Help Save & CH Required information [The following information applies to the questions displayed below.] Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $68,000. Meg works part time at the same university. She earns $33,000 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount.) What is the Comers' tax liability for 2020 if they report the following capital gains and losses for the year? Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses $ 9,000 (2,000) 15, eee (6,eee) 100% o el Patriot Web - A Self... M Gmail Mail - tnguy160 - O... Connect - To Do As... Be Syllabus - 202070.7... CHAPTER 2 CO Saved Help Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a his professor at a local university and earns a salary of $68,000. Meg works part time at the same university. She e $33,000 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of in is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount.) . What is the Comers' tax liability for 2020 if they report the following capital gains and losses for the year? Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses $ 9,eee (2,000) 15,00 (6,000) ho Total tax liability https://ex G Matt X C Matt And X (?) 152) MX https//ex C Solved iX ezto-cf-media.mheducation.com/Media/Connect Production/bne/accounting/spilker 12e/capitalgains2020 htm Home - Blackboard Patriot Web - A Sell M Gmail Mail-tnguy 1600 Connect To Do As. Stabus-2020707 Apps CHAPTER 2 COST NA Tax Rates for Net Capital Gains and Qualified Dividends Taxable income Rate" Married Filing Jointly Married Filing Separately Single Head of Household Trusts and Estates 06 SO - 580.000 SO - $40.000 SO - S40,000 SO - 553,600 SO - $2,650 15% S80,001 - S496,600 $40,001 - $248,300 $40,001 - 5441.450 553,601 - 5469,050 $2,651 - 513,150 20% S496,601 $248,301 $441,451+ $469,051- $13,151 This rate upplies to the net capital gains de qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified div. included in ferable income last for this purpose). 100 Type here to search ORE LUC 10 DO AS... B. Syllabus - 202070.7... CHAPTER nment Saved Hele Matt and Meg Comer are married and tile a joint tax return. iney do not have any children. Matt works as a professor at a local university and earns a salary of $68,000. Meg works part time at the same university.SE $33,000 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount.) b. What is the Comers' tax liability for 2020 if they report the following capital gains and losses for the year? $ 1,500 Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses 13,000 (10, eee) Total tax liability