Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sylvana is given a job offer with two alternative compensation packages to choose from. The first package offers her $250,000 annual salary with no qualified

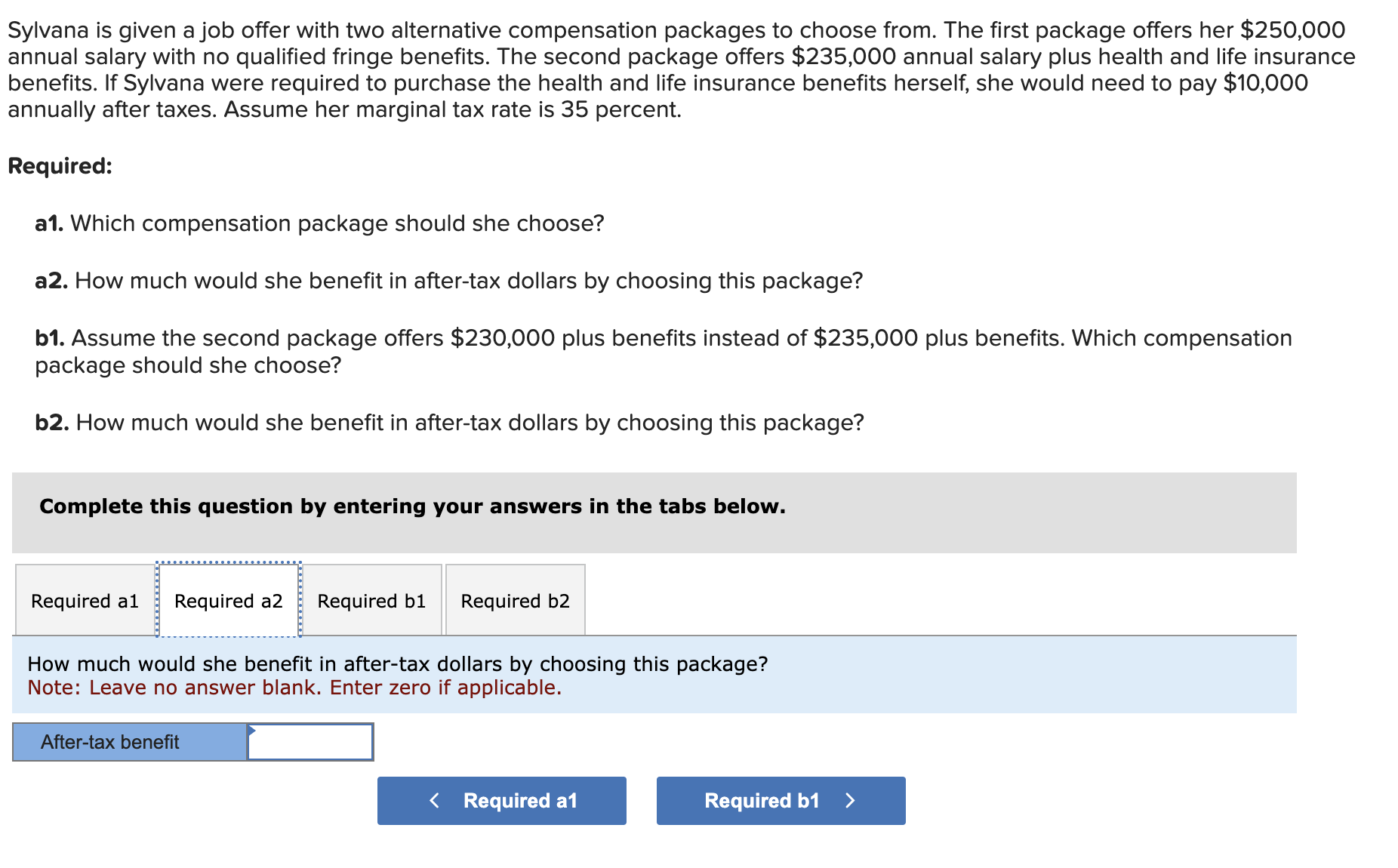

Sylvana is given a job offer with two alternative compensation packages to choose from. The first package offers her $250,000 annual salary with no qualified fringe benefits. The second package offers $235,000 annual salary plus health and life insuranc benefits. If Sylvana were required to purchase the health and life insurance benefits herself, she would need to pay $10,000 annually after taxes. Assume her marginal tax rate is 35 percent. Required: a1. Which compensation package should she choose? a2. How much would she benefit in after-tax dollars by choosing this package? b1. Assume the second package offers $230,000 plus benefits instead of $235,000 plus benefits. Which compensation package should she choose? b2. How much would she benefit in after-tax dollars by choosing this package? Complete this question by entering your answers in the tabs below. How much would she benefit in after-tax dollars by choosing this package? Note: Leave no answer blank. Enter zero if applicable. Sylvana is given a job offer with two alternative compensation packages to choose from. The first package offers her $250,000 annual salary with no qualified fringe benefits. The second package offers $235,000 annual salary plus health and life insuranc benefits. If Sylvana were required to purchase the health and life insurance benefits herself, she would need to pay $10,000 annually after taxes. Assume her marginal tax rate is 35 percent. Required: a1. Which compensation package should she choose? a2. How much would she benefit in after-tax dollars by choosing this package? b1. Assume the second package offers $230,000 plus benefits instead of $235,000 plus benefits. Which compensation package should she choose? b2. How much would she benefit in after-tax dollars by choosing this package? Complete this question by entering your answers in the tabs below. Assume the second package offers $230,000 plus benefits instead of $235,000 plus benefits. Which compensation package should she choose? Sylvana is given a job offer with two alternative compensation packages to choose from. The first package offers her $250,000 annual salary with no qualified fringe benefits. The second package offers $235,000 annual salary plus health and life insuranc benefits. If Sylvana were required to purchase the health and life insurance benefits herself, she would need to pay $10,000 annually after taxes. Assume her marginal tax rate is 35 percent. Required: a1. Which compensation package should she choose? a2. How much would she benefit in after-tax dollars by choosing this package? b1. Assume the second package offers $230,000 plus benefits instead of $235,000 plus benefits. Which compensation package should she choose? b2. How much would she benefit in after-tax dollars by choosing this package? Complete this question by entering your answers in the tabs below. How much would she benefit in after-tax dollars by choosing this package? Note: Leave no answer blank. Enter zero if applicable

Sylvana is given a job offer with two alternative compensation packages to choose from. The first package offers her $250,000 annual salary with no qualified fringe benefits. The second package offers $235,000 annual salary plus health and life insuranc benefits. If Sylvana were required to purchase the health and life insurance benefits herself, she would need to pay $10,000 annually after taxes. Assume her marginal tax rate is 35 percent. Required: a1. Which compensation package should she choose? a2. How much would she benefit in after-tax dollars by choosing this package? b1. Assume the second package offers $230,000 plus benefits instead of $235,000 plus benefits. Which compensation package should she choose? b2. How much would she benefit in after-tax dollars by choosing this package? Complete this question by entering your answers in the tabs below. How much would she benefit in after-tax dollars by choosing this package? Note: Leave no answer blank. Enter zero if applicable. Sylvana is given a job offer with two alternative compensation packages to choose from. The first package offers her $250,000 annual salary with no qualified fringe benefits. The second package offers $235,000 annual salary plus health and life insuranc benefits. If Sylvana were required to purchase the health and life insurance benefits herself, she would need to pay $10,000 annually after taxes. Assume her marginal tax rate is 35 percent. Required: a1. Which compensation package should she choose? a2. How much would she benefit in after-tax dollars by choosing this package? b1. Assume the second package offers $230,000 plus benefits instead of $235,000 plus benefits. Which compensation package should she choose? b2. How much would she benefit in after-tax dollars by choosing this package? Complete this question by entering your answers in the tabs below. Assume the second package offers $230,000 plus benefits instead of $235,000 plus benefits. Which compensation package should she choose? Sylvana is given a job offer with two alternative compensation packages to choose from. The first package offers her $250,000 annual salary with no qualified fringe benefits. The second package offers $235,000 annual salary plus health and life insuranc benefits. If Sylvana were required to purchase the health and life insurance benefits herself, she would need to pay $10,000 annually after taxes. Assume her marginal tax rate is 35 percent. Required: a1. Which compensation package should she choose? a2. How much would she benefit in after-tax dollars by choosing this package? b1. Assume the second package offers $230,000 plus benefits instead of $235,000 plus benefits. Which compensation package should she choose? b2. How much would she benefit in after-tax dollars by choosing this package? Complete this question by entering your answers in the tabs below. How much would she benefit in after-tax dollars by choosing this package? Note: Leave no answer blank. Enter zero if applicable Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started