Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Synovec Co. is growing quickly. Dividends are expected to grow at a rate of 16.3 percent for the next three years, with the growth

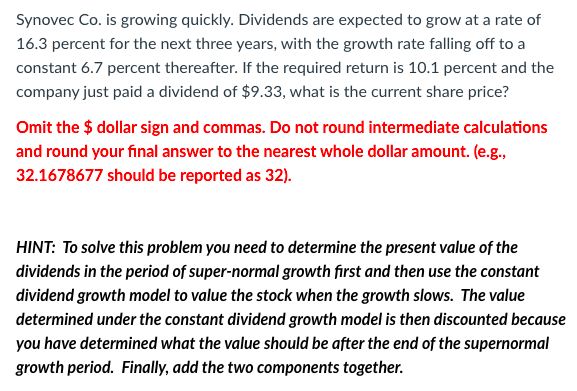

Synovec Co. is growing quickly. Dividends are expected to grow at a rate of 16.3 percent for the next three years, with the growth rate falling off to a constant 6.7 percent thereafter. If the required return is 10.1 percent and the company just paid a dividend of $9.33, what is the current share price? Omit the $ dollar sign and commas. Do not round intermediate calculations and round your final answer to the nearest whole dollar amount. (e.g., 32.1678677 should be reported as 32). HINT: To solve this problem you need to determine the present value of the dividends in the period of super-normal growth first and then use the constant dividend growth model to value the stock when the growth slows. The value determined under the constant dividend growth model is then discounted because you have determined what the value should be after the end of the supernormal growth period. Finally, add the two components together.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started