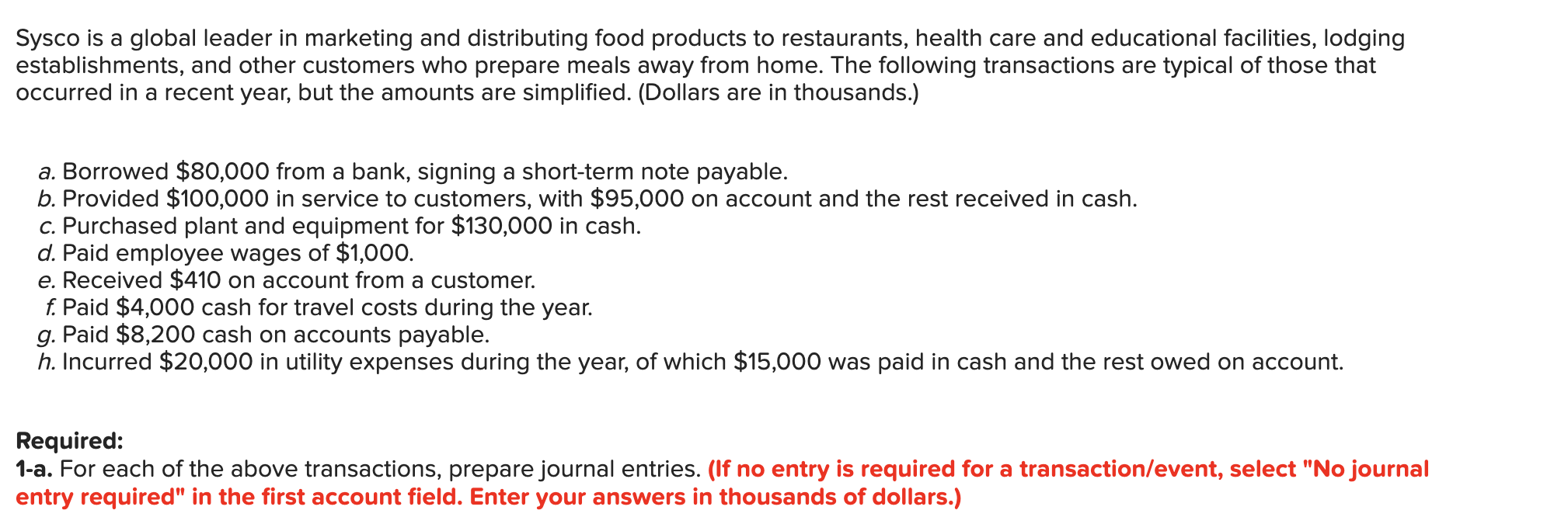

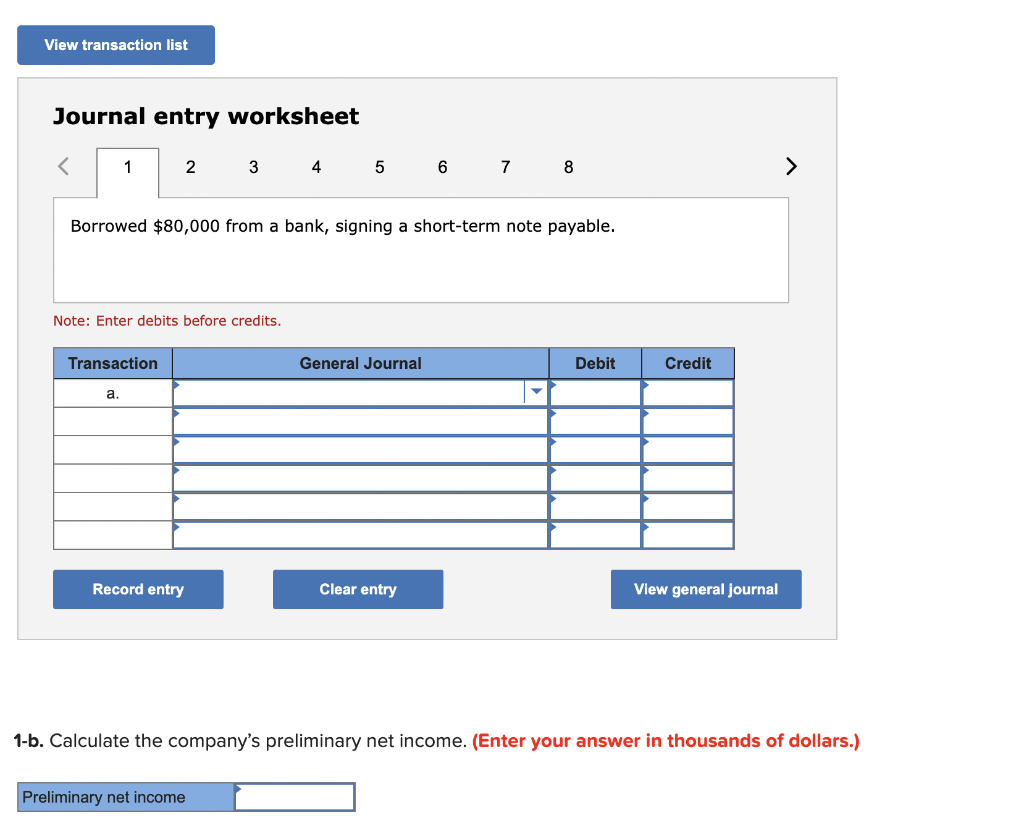

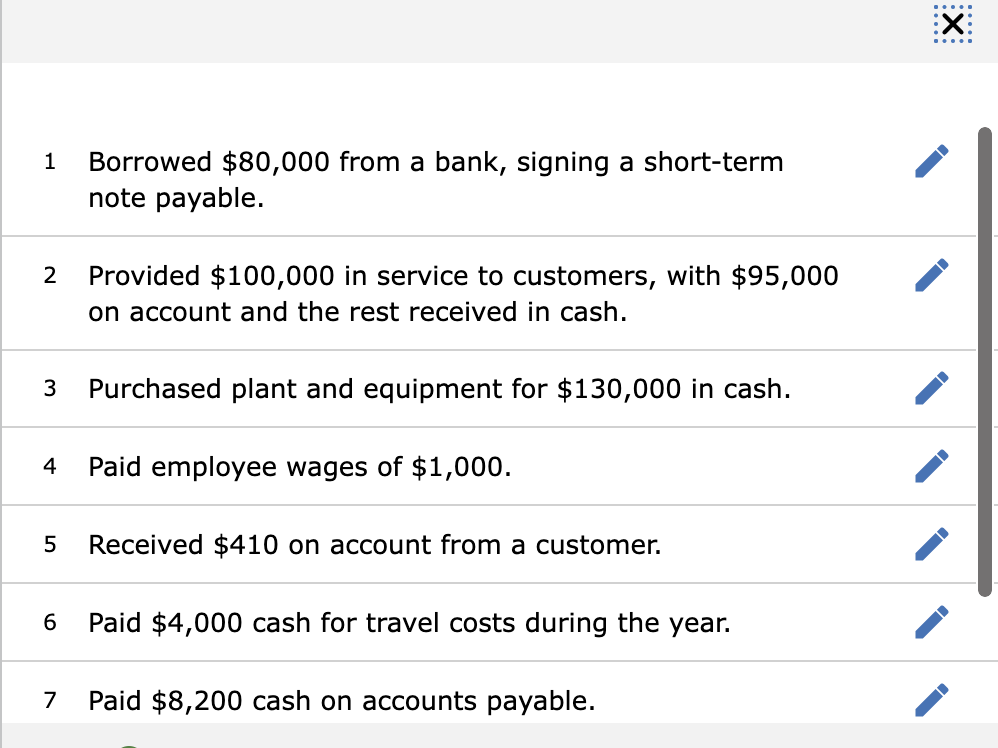

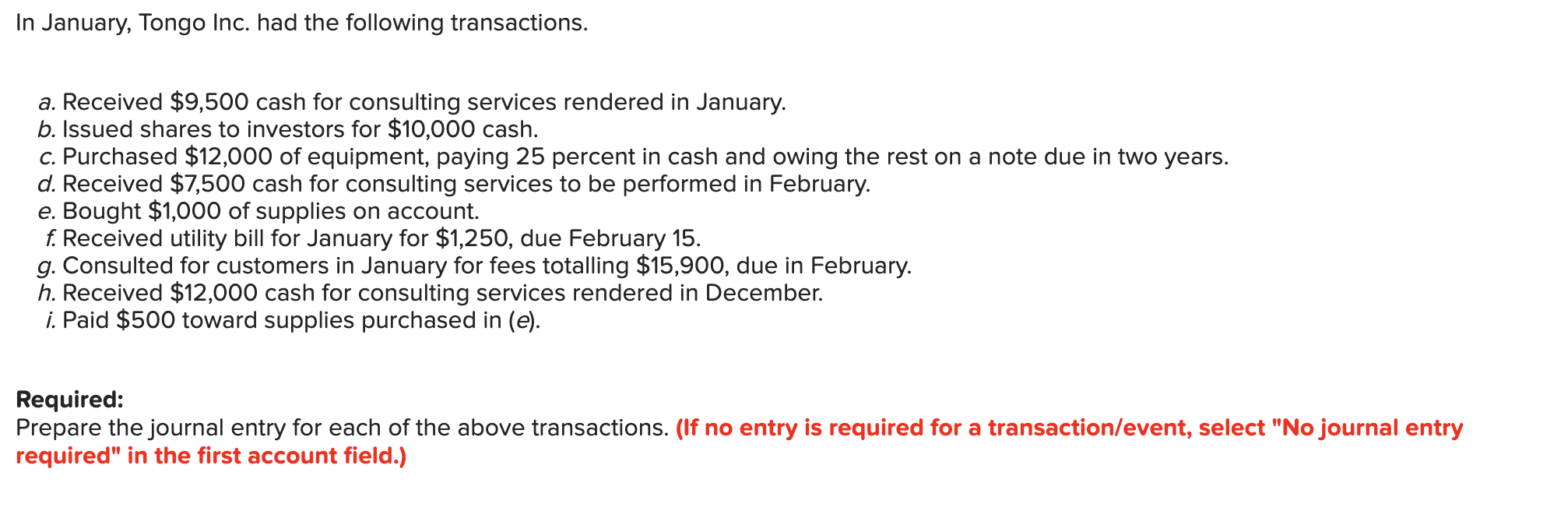

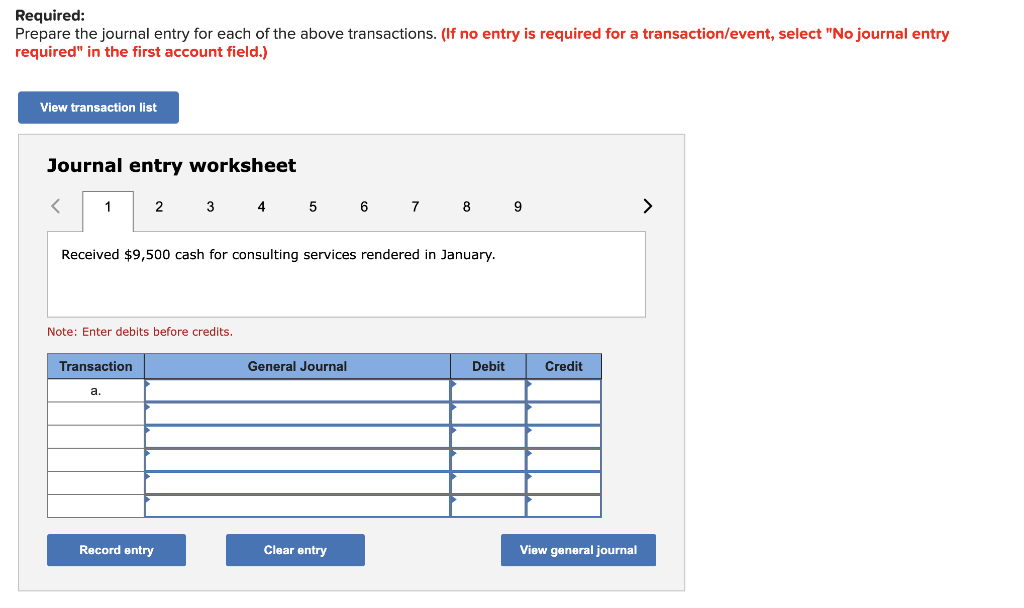

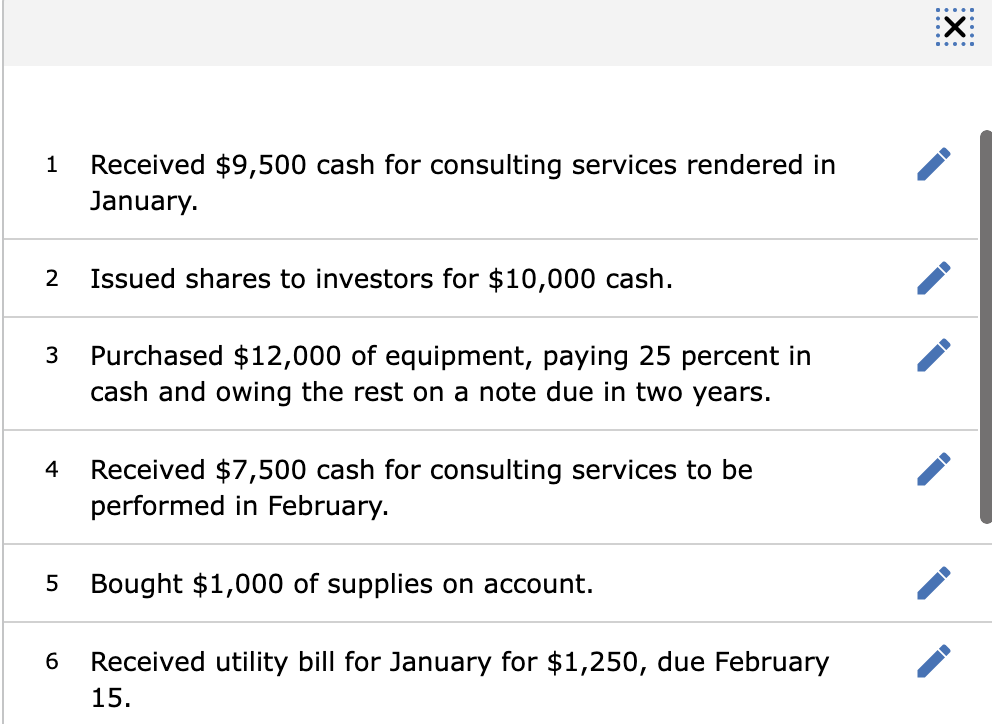

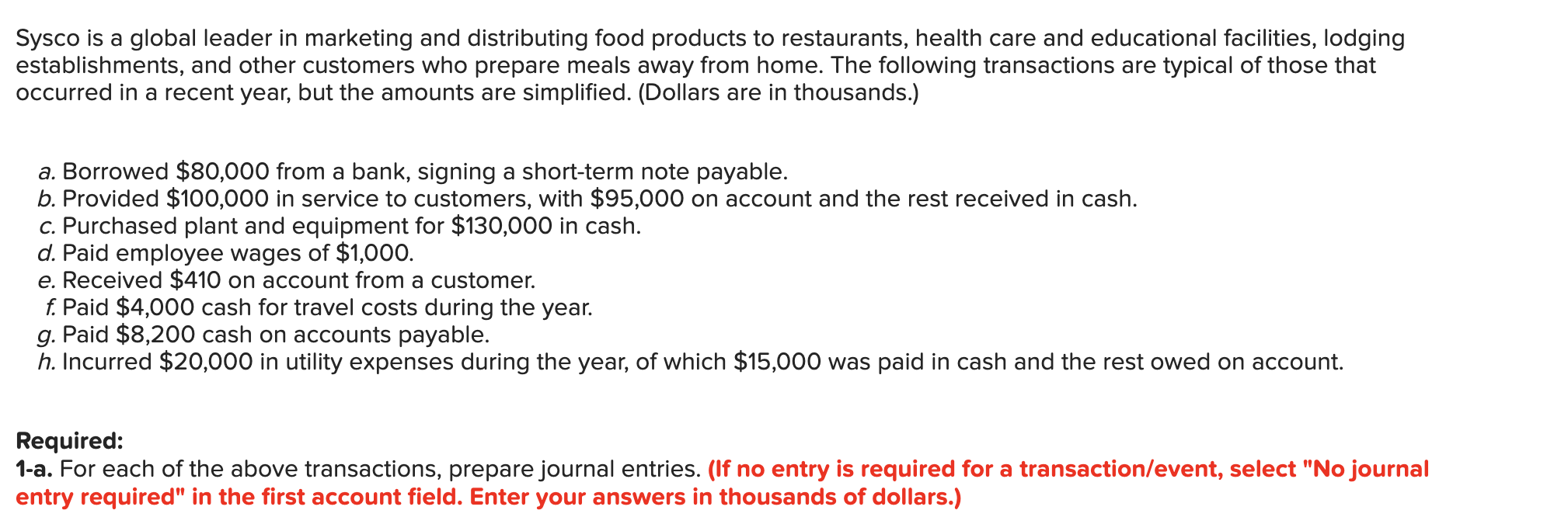

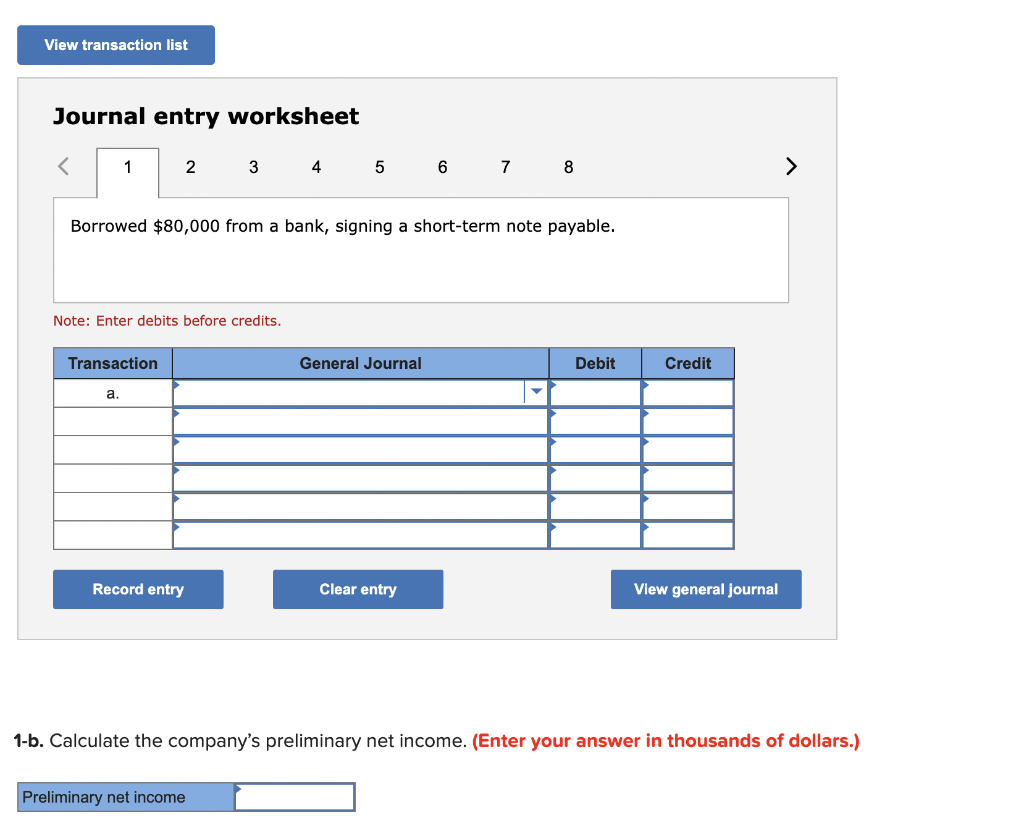

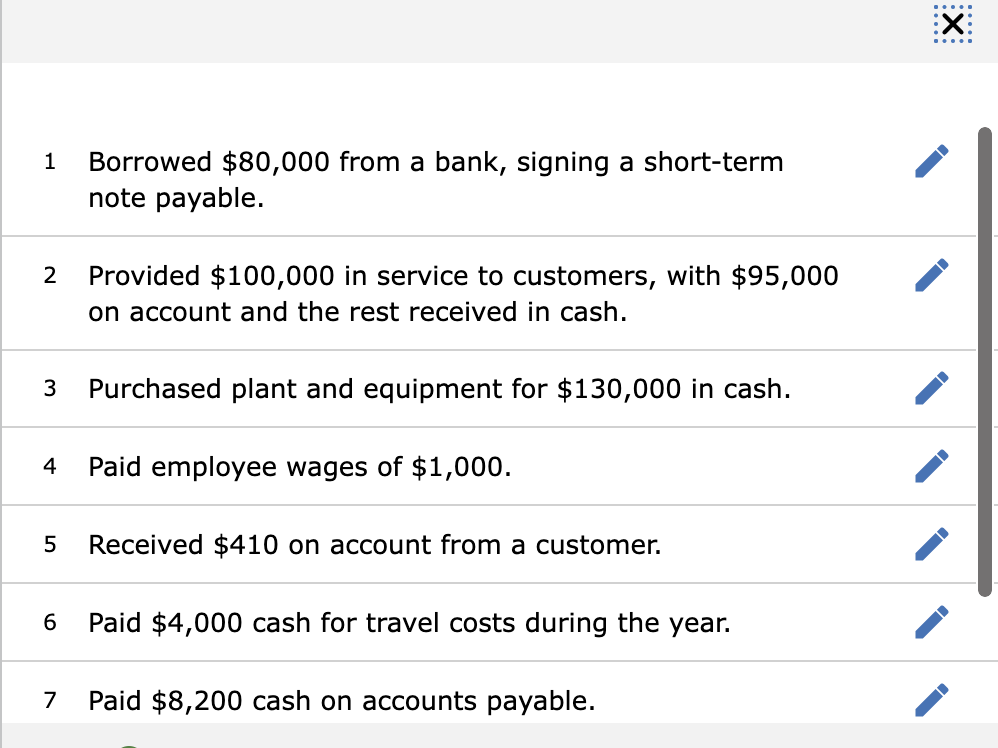

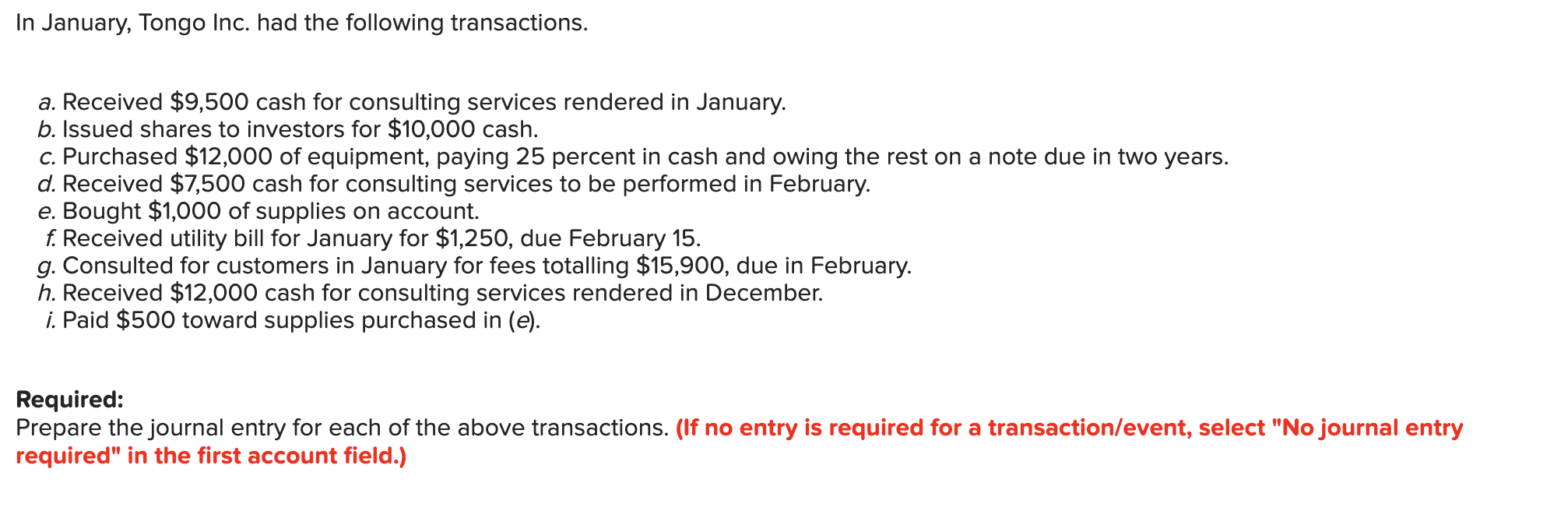

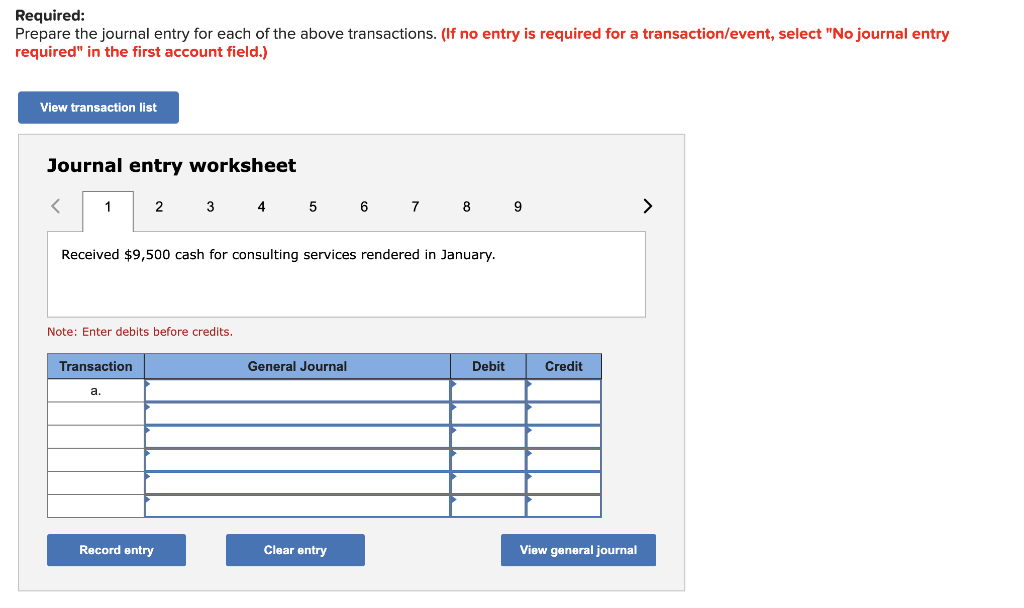

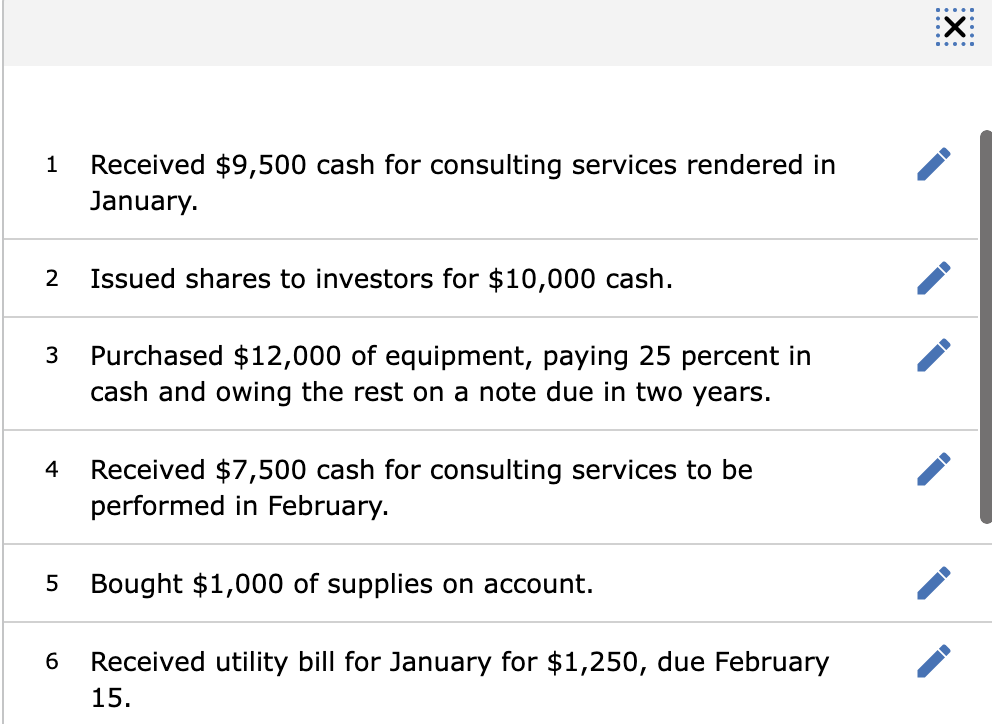

Sysco is a global leader in marketing and distributing food products to restaurants, health care and educational facilities, lodging establishments, and other customers who prepare meals away from home. The following transactions are tyoul the the occurred in a recent year, but the amounts are simplified. (Dollars are in thousands.) a. Borrowed $80,000 from a bank, signing a short-term note payable. b. Provided $100,000 in service to customers, with $95,000 on account and the rest received in cash. c. Purchased plant and equipment for $130,000 in cash. d. Paid employee wages of $1,000. e. Received $410 on account from a customer. f. Paid \$4,000 cash for travel costs during the year. g. Paid $8,200 cash on accounts payable. h. Incurred $20,000 in utility expenses during the year, of which $15,000 was paid in cash and the rest owed on account. Required: 1-a. For each of the above transactions, prepare journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands of dollars.) Journal entry worksheet 1 Borrowed $80,000 from a bank, signing a short-term note payable. 2 Provided $100,000 in service to customers, with $95,000 on account and the rest received in cash. 3 Purchased plant and equipment for $130,000 in cash. 4 Paid employee wages of $1,000. 5 Received $410 on account from a customer. 6 Paid $4,000 cash for travel costs during the year. 7 Paid $8,200 cash on accounts payable. In January, Tongo Inc. had the following transactions. a. Received $9,500 cash for consulting services rendered in January. b. Issued shares to investors for $10,000 cash. c. Purchased $12,000 of equipment, paying 25 percent in cash and owing the rest on a note due in two years. d. Received $7,500 cash for consulting services to be performed in February. e. Bought $1,000 of supplies on account. f. Received utility bill for January for $1,250, due February 15. g. Consulted for customers in January for fees totalling $15,900, due in February. h. Received $12,000 cash for consulting services rendered in December. i. Paid $500 toward supplies purchased in (e). Required: Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: Prepare the journal entry for each of the above transactions. (If no entry is required for a transaction/event, select "No journal entry 'equired" in the first account field.) Journal entry worksheet Received $9,500 cash for consulting services rendered in January. Note: Enter debits before credits. 1 Received $9,500 cash for consulting services rendered in January. 2 Issued shares to investors for $10,000 cash. 3 Purchased $12,000 of equipment, paying 25 percent in cash and owing the rest on a note due in two years. 4 Received $7,500 cash for consulting services to be performed in February. 5 Bought $1,000 of supplies on account. 6 Received utility bill for January for $1,250, due February 15