Answered step by step

Verified Expert Solution

Question

1 Approved Answer

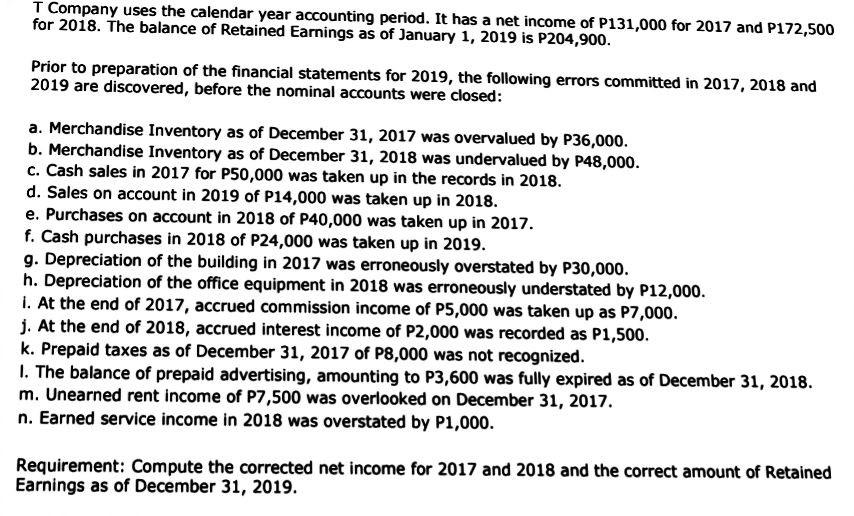

T Company uses the calendar year accounting period. It has a net income of P131,000 for 2017 and P172,500 for 2018. The balance of Retained

T Company uses the calendar year accounting period. It has a net income of P131,000 for 2017 and P172,500 for 2018. The balance of Retained Earnings as of January 1, 2019 is P204,900. Prior to preparation of the financial statements for 2019, the following errors committed in 2017, 2018 and 2019 are discovered, before the nominal accounts were closed: a. Merchandise Inventory as of December 31, 2017 was overvalued by P36,000. b. Merchandise Inventory as of December 31, 2018 was undervalued by P48,000. c. Cash sales in 2017 for P50,000 was taken up in the records in 2018. d. Sales on account in 2019 of P14,000 was taken up in 2018. e. Purchases on account in 2018 of P40,000 was taken up in 2017. f. Cash purchases in 2018 of P24,000 was taken up in 2019. g. Depreciation of the building in 2017 was erroneously overstated by P30,000. h. Depreciation of the office equipment in 2018 was erroneously understated by P12,000. 1. At the end of 2017, accrued commission income of P5,000 was taken up as P7,000. j. At the end of 2018, accrued interest income of P2,000 was recorded as P1,500. k. Prepaid taxes as of December 31, 2017 of P8,000 was not recognized. 1. The balance of prepaid advertising, amounting to P3,600 was fully expired as of December 31, 2018. m. Unearned rent income of P7,500 was overlooked on December 31, 2017. n. Earned service income in 2018 was overstated by P1,000. Requirement: Compute the corrected net income for 2017 and 2018 and the correct amount of Retained Earnings as of December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started