Answered step by step

Verified Expert Solution

Question

1 Approved Answer

T F 1. The return for a portfolio is the sum of the return for cach stock in the portfolio multiplied by the proportion of

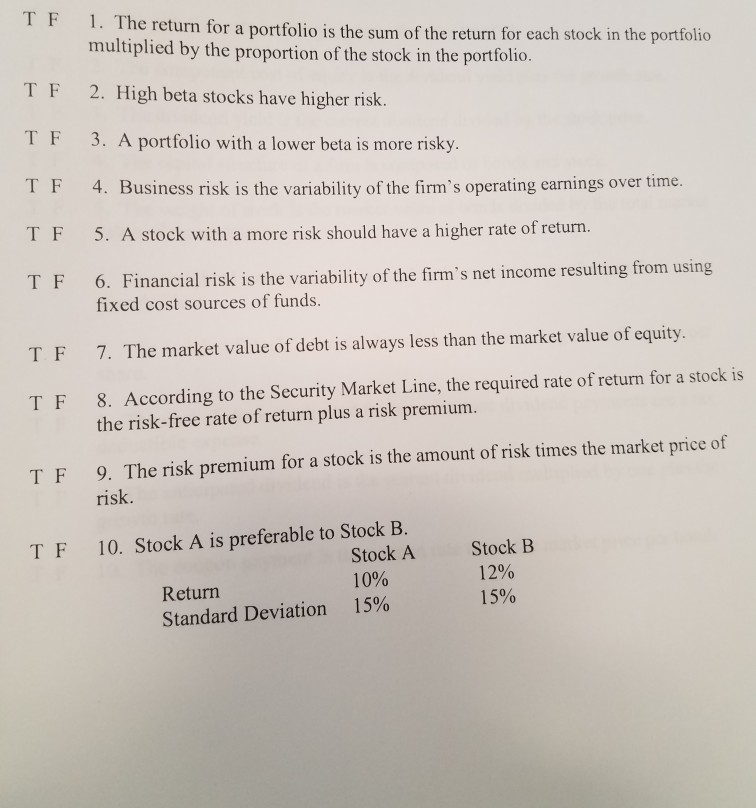

T F 1. The return for a portfolio is the sum of the return for cach stock in the portfolio multiplied by the proportion of the stock in the portfolio. 2. High beta stocks have higher risk. 3. A portfolio with a lower beta is more risky. T F TF TF4. Busine ri TF 5. A stock with a more risk should have a higher rate of return. T F 6. Financial risk is the variability of the firm's net income resulting from using fixed cost sources of funds. 7. The market value of debt is always less than the market value of equity. 8. According to the Security Market Line, the required rate of return for a stock is T F T F the risk-free rate of return plus a risk premium. T F 9. The risk premium for a stock is the amount of risk times the market price of risk. T F 10. Stock A is preferable to Stock B. Stock AStock B 10% 15% 12% 15% Return Standard Deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started