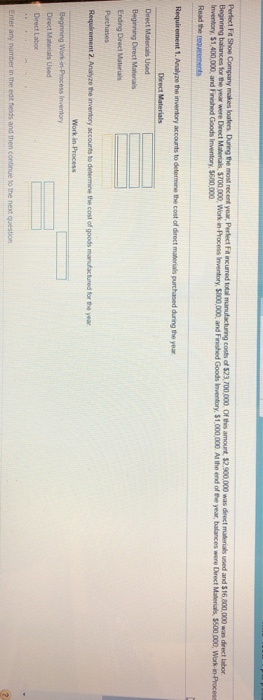

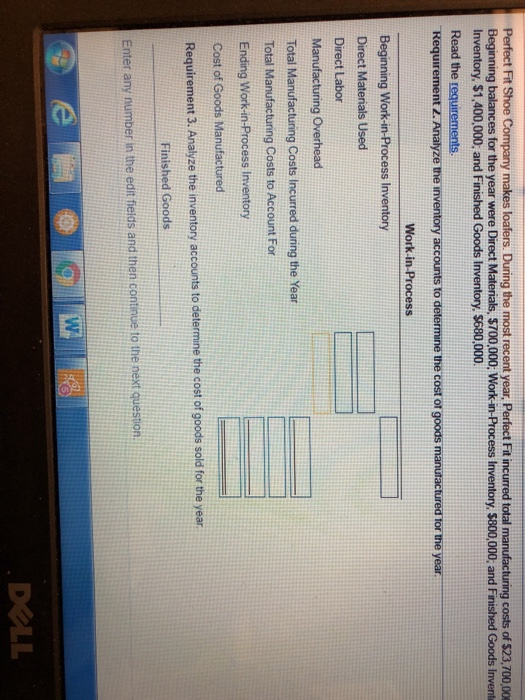

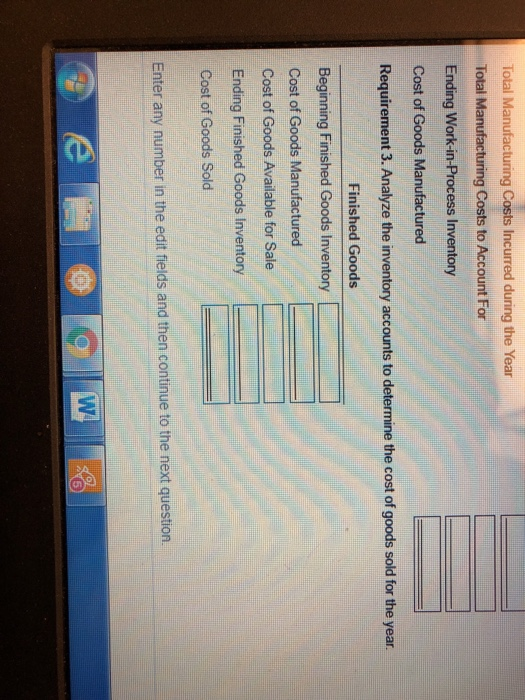

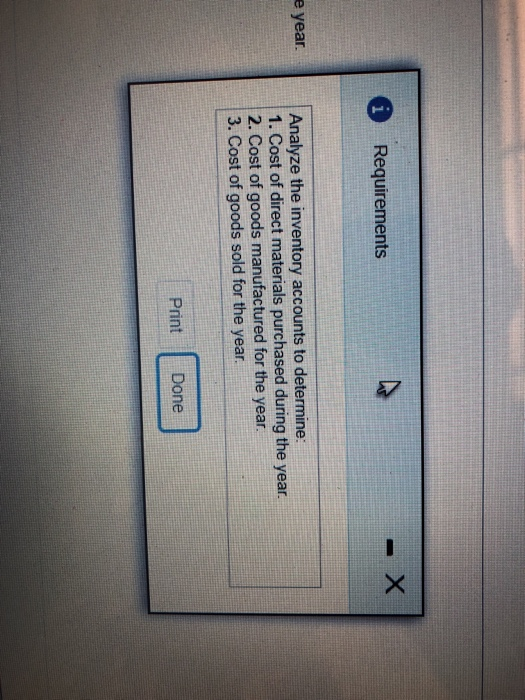

t Fit Shoe Company makes loaters During the most recent year, Perfect Fa incurred total manufacturing costs of $23,700,000 Of this amourt $2,900,000 was deect maberias used and 516.800,000 was direct labor Inventory, $1.400,000, and Finished Goods Inventory, $680,000 Read the ter moment 00 000 Work in Process Inventory, $800,000, and Finished Goods Inventory, $1,000,000 A the end of the year, balances we Direct Materials,$500,000, Work-in-Proces Direct Materials Used Beginning Direct Mateials Ending Direct Materals Work in-Process Direct Materials Used Perfect Fit Shoe Company makes loafers. During the most recent year, Perfect Fit incurred total manufacturing costs of s23,700,00 Beginning balances for the year were Direct Materials, $700,000 Work-in-Process Inventory, $800,000; and Finished Goods Invent Inventory, $1,400,000, and Finished Goods Inventory, $680,000 Read the requirements Requirement Z. Analyze t to determine the cost of goods manutactured tor they Work in-Process Beginning Work-in-Process Inventory Direct Materials Used Direct Labor Manufacturing Overhead Total Manufacturing Costs Incurred during the Year Total Manufacturing Costs to Account For Ending Work-in-Process Inventory Cost of Goods Manufactured Requirement 3. Analyze the inventory accounts to determine the cost of goods sold for the year Finished Goods Enter any number in the edit fieids and then continue to the next question DOLL Total Manufacturing Costs Incurred during the Year Total Manufacturing Costs to Account For Ending Work-in-Process Inventory Cost of Goods Manufactured Requirement 3. Analyze the inventory accounts to determine the cost of goods sold for the year Finished Goods Beginning Finished Goods Inventory[ Cost of Goods Manufactured CostofGoods Available for Sale [ Ending Finished Goods Inventory Cost of Goods Sold Enter any number in the edit fields and then continue to the next question 5 Requirements e year Analyze the inventory accounts to determine: 1. Cost of direct materials purchased during the year. 2. Cost of goods manufactured for the year 3. Cost of goods sold for the year Print Done