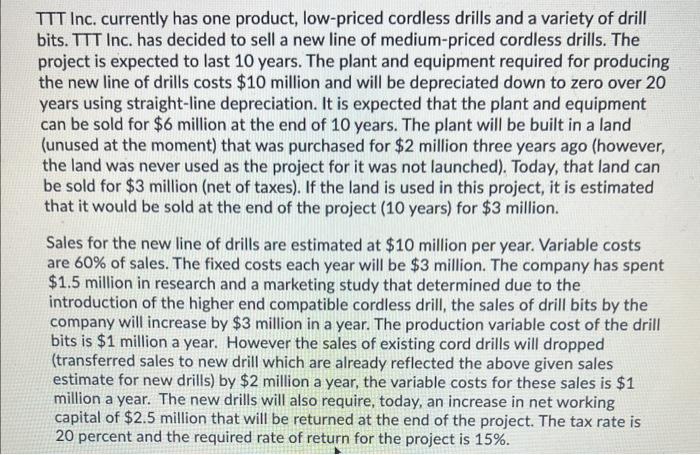

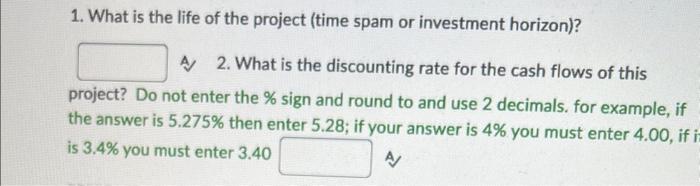

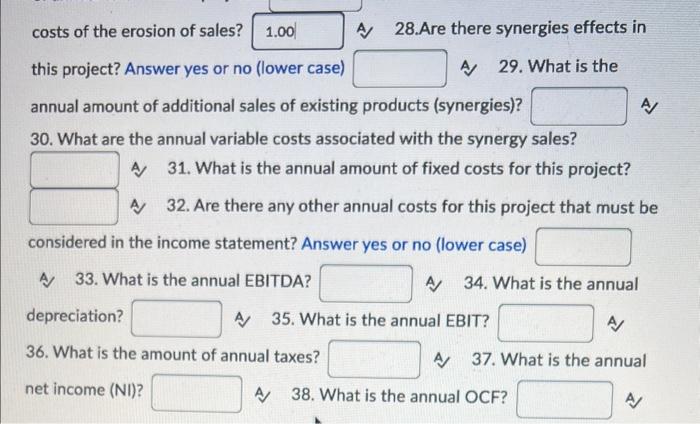

T Inc. currently has one product, low-priced cordless drills and a variety of drill bits. TT Inc. has decided to sell a new line of medium-priced cordless drills. The project is expected to last 10 years. The plant and equipment required for producing the new line of drills costs $10 million and will be depreciated down to zero over 20 years using straight-line depreciation. It is expected that the plant and equipment can be sold for $6 million at the end of 10 years. The plant will be built in a land (unused at the moment) that was purchased for $2 million three years ago (however, the land was never used as the project for it was not launched). Today, that land can be sold for $3 million (net of taxes). If the land is used in this project, it is estimated that it would be sold at the end of the project (10 years) for $3 million. Sales for the new line of drills are estimated at $10 million per year. Variable costs are 60% of sales. The fixed costs each year will be $3 million. The company has spent $1.5 million in research and a marketing study that determined due to the introduction of the higher end compatible cordless drill, the sales of drill bits by the company will increase by $3 million in a year. The production variable cost of the drill bits is $1 million a year. However the sales of existing cord drills will dropped (transferred sales to new drill which are already reflected the above given sales estimate for new drills) by $2 million a year, the variable costs for these sales is $1 million a year. The new drills will also require, today, an increase in net working capital of $2.5 million that will be returned at the end of the project. The tax rate is 20 percent and the required rate of return for the proiect is 15% 1. What is the life of the project (time spam or investment horizon)? 2. What is the discounting rate for the cash flows of this project? Do not enter the % sign and round to and use 2 decimals. for example, if the answer is 5.275% then enter 5.28; if your answer is 4% you must enter 4.00, if i is 3.4% you must enter 3.40 A costs of the erosion of sales? A 28.Are there synergies effects in this project? Answer yes or no (lower case) A 29. What is the annual amount of additional sales of existing products (synergies)? 30. What are the annual variable costs associated with the synergy sales? A 31. What is the annual amount of fixed costs for this project? A 32. Are there any other annual costs for this project that must be considered in the income statement? Answer yes or no (lower case) A 33. What is the annual EBITDA? A 34. What is the annual depreciation? A 35. What is the annual EBIT? 36. What is the amount of annual taxes? A 37. What is the annual net income (NI)? A 38. What is the annual OCF? A