Answered step by step

Verified Expert Solution

Question

1 Approved Answer

T Other variables held constant, there is an inverse relation between bond prices and interest rates F 18. Red Mountain, Inc. bonds have a face

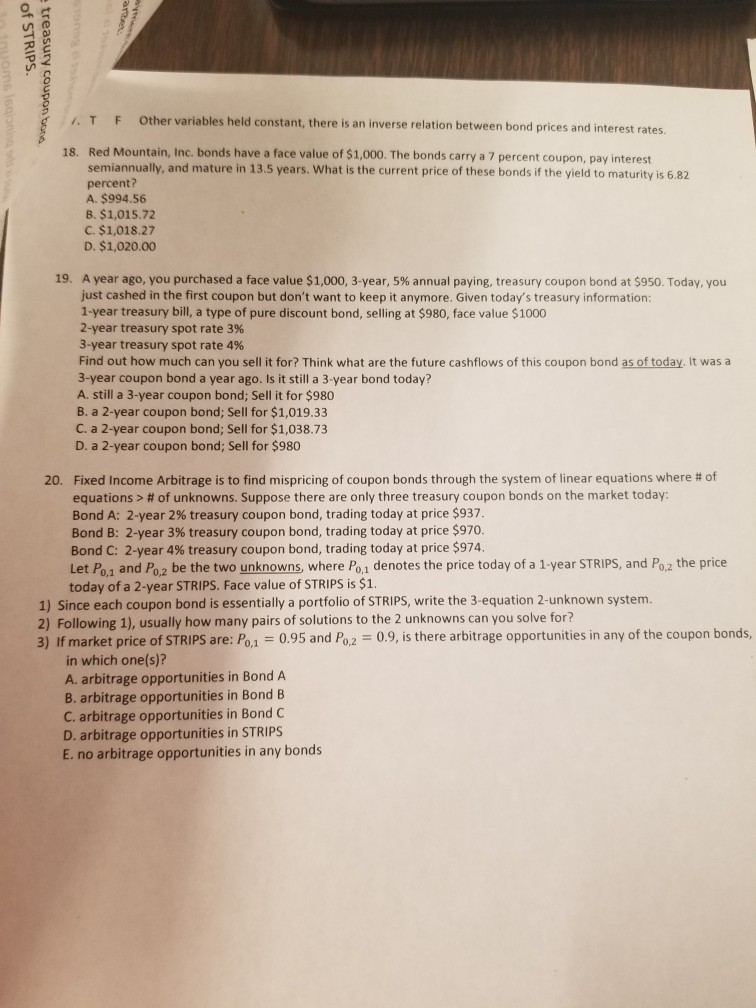

T Other variables held constant, there is an inverse relation between bond prices and interest rates F 18. Red Mountain, Inc. bonds have a face value of $1,000. The bonds carry a 7 percent coupon, pay interest semiannually, and mature in 13.5 years. What is the current price of these bonds if the yield to maturity is 6.82 percent? A. $994.56 B. $1,015.72 C. $1,018.27 D. $1,020.00 19, A year ago, you purchased a face value $1,000, 3-year, 5% annual paying, treasury coupon bond at $950. Today, you just cashed in the first coupon but don't want to keep it anymore. Given today's treasury information: 1-year treasury bill, a type of pure discount bond, selling at $980, face value $1000 2-year treasury spot rate 396 3-year treasury spot rate 496 Find out how much can you sell it for? Think what are the future cashflows of this coupon bond as of today. It was a 3-year coupon bond a year ago. Is it still a 3-year bond today? A. still a 3-year coupon bond; Sell it for $980 B. a 2-year coupon bond; Sell for $1,019.33 C. a 2-year coupon bond; Sell for $1,038.73 D. a 2-year coupon bond; Sell for $980 Fixed Income Arbitrage is to find mispricing of coupon bonds through the system of linear equations where # of equations # of unknowns. Suppose there are only three treasury coupon bonds on the market today: Bond A: 2-year 2% treasury coupon bond, trading today at price $937 20, Bond B: 2-year 3% treasury coupon bond, trading today at price $970. Bond C: 2-year 4% treasury coupon bond, trading today at price $974. Let Po1 and Po2 be the two unknowns, where Po,i denotes the price today of a 1-year STRIPS, and Po.2 the price today of a 2-year STRIPS. Face value of STRIPS is $1 1) Since each coupon bond is essentially a portfolio of STRIPS, write the 3-equation 2-unknown system. 2) Following 1), usually how many pairs of solutions to the 2 unknowns can you solve for? 3) If market price of STRIPS are: Po1 0.95 and Po2 0.9, is there arbitrage opportunities in any of the coupon bonds, in which one(s)? A. arbitrage opportunities in Bond A B. arbitrage opportunities in Bond B C. arbitrage opportunities in Bond C D. arbitrage opportunities in STRIPS E. no arbitrage opportunities in any bonds T Other variables held constant, there is an inverse relation between bond prices and interest rates F 18. Red Mountain, Inc. bonds have a face value of $1,000. The bonds carry a 7 percent coupon, pay interest semiannually, and mature in 13.5 years. What is the current price of these bonds if the yield to maturity is 6.82 percent? A. $994.56 B. $1,015.72 C. $1,018.27 D. $1,020.00 19, A year ago, you purchased a face value $1,000, 3-year, 5% annual paying, treasury coupon bond at $950. Today, you just cashed in the first coupon but don't want to keep it anymore. Given today's treasury information: 1-year treasury bill, a type of pure discount bond, selling at $980, face value $1000 2-year treasury spot rate 396 3-year treasury spot rate 496 Find out how much can you sell it for? Think what are the future cashflows of this coupon bond as of today. It was a 3-year coupon bond a year ago. Is it still a 3-year bond today? A. still a 3-year coupon bond; Sell it for $980 B. a 2-year coupon bond; Sell for $1,019.33 C. a 2-year coupon bond; Sell for $1,038.73 D. a 2-year coupon bond; Sell for $980 Fixed Income Arbitrage is to find mispricing of coupon bonds through the system of linear equations where # of equations # of unknowns. Suppose there are only three treasury coupon bonds on the market today: Bond A: 2-year 2% treasury coupon bond, trading today at price $937 20, Bond B: 2-year 3% treasury coupon bond, trading today at price $970. Bond C: 2-year 4% treasury coupon bond, trading today at price $974. Let Po1 and Po2 be the two unknowns, where Po,i denotes the price today of a 1-year STRIPS, and Po.2 the price today of a 2-year STRIPS. Face value of STRIPS is $1 1) Since each coupon bond is essentially a portfolio of STRIPS, write the 3-equation 2-unknown system. 2) Following 1), usually how many pairs of solutions to the 2 unknowns can you solve for? 3) If market price of STRIPS are: Po1 0.95 and Po2 0.9, is there arbitrage opportunities in any of the coupon bonds, in which one(s)? A. arbitrage opportunities in Bond A B. arbitrage opportunities in Bond B C. arbitrage opportunities in Bond C D. arbitrage opportunities in STRIPS E. no arbitrage opportunities in any bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started