Answered step by step

Verified Expert Solution

Question

1 Approved Answer

T Prepare the journal entry for each of the following transactions and adjustments that occurred during the first year (1 January to 31 December 2018)

T

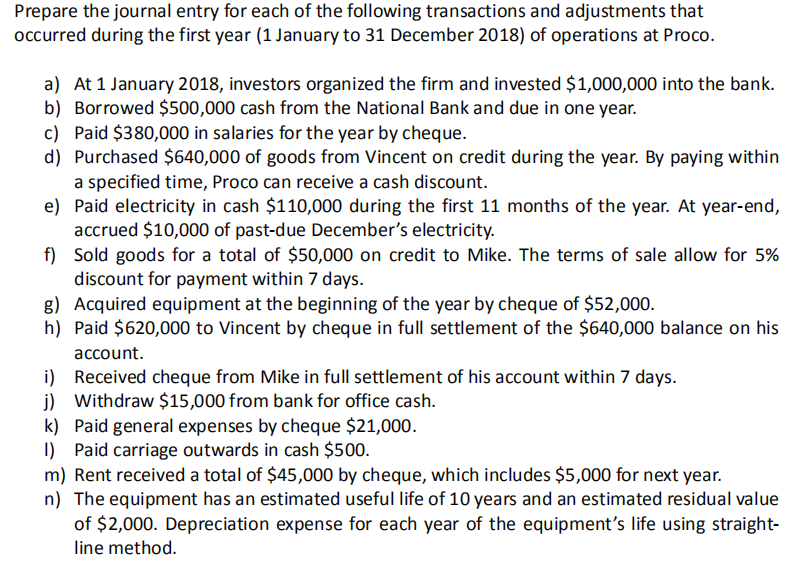

Prepare the journal entry for each of the following transactions and adjustments that occurred during the first year (1 January to 31 December 2018) of operations at Proco. a) At 1 January 2018, investors organized the firm and invested $1,000,000 into the bank. b) Borrowed $500,000 cash from the National Bank and due in one year. c) Paid $380,000 in salaries for the year by cheque. d) Purchased $640,000 of goods from Vincent on credit during the year. By paying within a specified time, Proco can receive a cash discount. e) Paid electricity in cash $110,000 during the first 11 months of the year. At year-end, accrued $10,000 of past-due December's electricity. f) Sold goods for a total of $50,000 on credit to Mike. The terms of sale allow for 5% discount for payment within 7 days. g) Acquired equipment at the beginning of the year by cheque of $52,000. h) Paid $620,000 to Vincent by cheque in full settlement of the $640,000 balance on his account. i) Received cheque from Mike in full settlement of his account within 7 days. j) Withdraw $15,000 from bank for office cash. k) Paid general expenses by cheque $21,000. 1) Paid carriage outwards in cash $500. m) Rent received a total of $45,000 by cheque, which includes $5,000 for next year. n) The equipment has an estimated useful life of 10 years and an estimated residual value of $2,000. Depreciation expense for each year of the equipment's life using straight- line methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started