Answered step by step

Verified Expert Solution

Question

1 Approved Answer

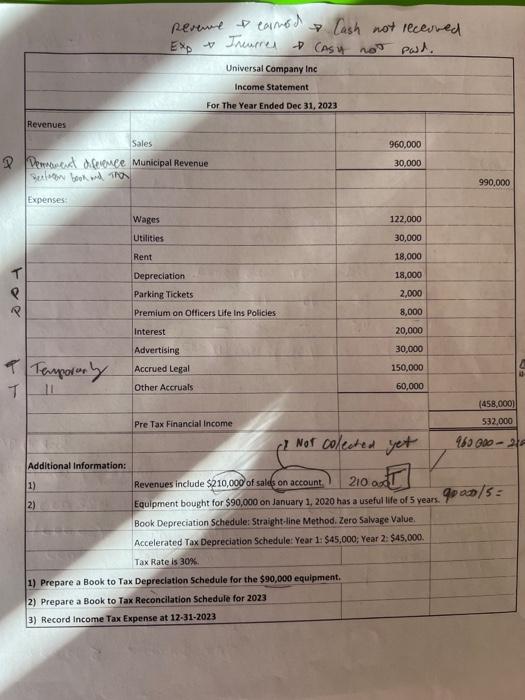

T Revenues P P Demament diference Municipal Revenue Berteren book and TAX Expenses: 9 Temporary T 11 NPR NeoS Additional Information: Sales 1) 2) Wages

T Revenues P P Demament diference Municipal Revenue Berteren book and TAX Expenses: 9 Temporary T 11 NPR NeoS Additional Information: Sales 1) 2) Wages Utilities Rent Revenue & carmod Exp+ Incurred Interest Depreciation Parking Tickets Premium on Officers Life Ins Policies Universal Company Inc Income Statement For The Year Ended Dec 31, 2023 Advertising Accrued Legal Other Accruals Cash not received + CASH not paid. Pre Tax Financial Income 960,000 30,000 1) Prepare a Book to Tax Depreciation Schedule for the $90,000 equipment. 2) Prepare a Book to Tax Reconcilation Schedule for 2023 3) Record Income Tax Expense at 12-31-2023 122,000 30,000 18,000 18,000 2,000 8,000 20,000 30,000 150,000 60,000 ( NOT colected yet 210.00 Revenues include $210,000 of sales on account. Equipment bought for $90,000 on January 1, 2020 has a useful life of 5 years. Book Depreciation Schedule: Straight-line Method. Zero Salvage Value. Accelerated Tax Depreciation Schedule: Year 1: $45,000; Year 2: $45,000. Tax Rate is 30%. 990,000 8 J (458,000) 532,000 960 000-20 90000/5=

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started