Answered step by step

Verified Expert Solution

Question

1 Approved Answer

t the taxi was sold on January 1,20 fo: Ppre re journal entry for 10A Computing and recording straight-line versus double-declining- inning of 201 the

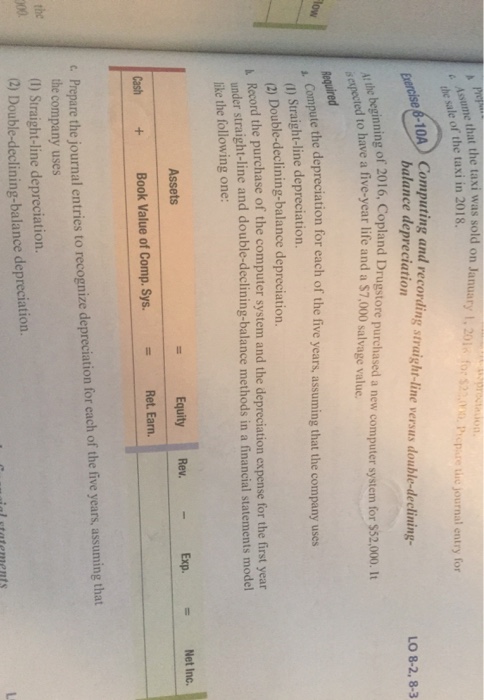

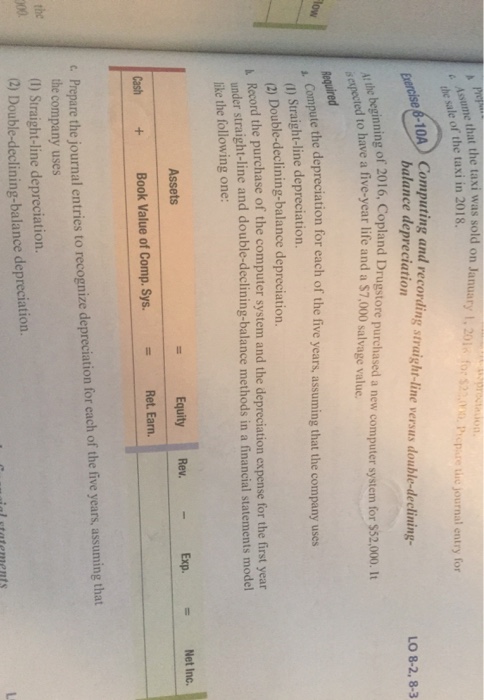

t the taxi was sold on January 1,20 fo: Ppre re journal entry for 10A Computing and recording straight-line versus double-declining- inning of 201 the sale of the taxi in 2018. balance depreciation LO 8-2, 8-3 the bed to have a five-year life and a $7,000 salvage value. er system for $52,000. It e the depreciation for each of the five years, assuming that the company uses . Compute I) Straight-line depreciation. uble-declining-balance depreciation (2) Do A Record the purchase of the computer system and the depreciation expense for the first year der straight-line and double-declining-balance methods in a financial statements model like the following one: Assets Equity-| Rev. - Exp. = Net Inc. Cash+ Book Value of Comp. Sys. Ret. Earn Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. c uble-declining-balance depreciation

t the taxi was sold on January 1,20 fo: Ppre re journal entry for 10A Computing and recording straight-line versus double-declining- inning of 201 the sale of the taxi in 2018. balance depreciation LO 8-2, 8-3 the bed to have a five-year life and a $7,000 salvage value. er system for $52,000. It e the depreciation for each of the five years, assuming that the company uses . Compute I) Straight-line depreciation. uble-declining-balance depreciation (2) Do A Record the purchase of the computer system and the depreciation expense for the first year der straight-line and double-declining-balance methods in a financial statements model like the following one: Assets Equity-| Rev. - Exp. = Net Inc. Cash+ Book Value of Comp. Sys. Ret. Earn Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses (1) Straight-line depreciation. c uble-declining-balance depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started