Answered step by step

Verified Expert Solution

Question

1 Approved Answer

T Total Net Revenue Decision Preston Petroleum has spent $202,000 to refine 60,000 gallons of petroleum distillate, which can be sold for $6.10 per gallon.

T

Total Net Revenue

Decision

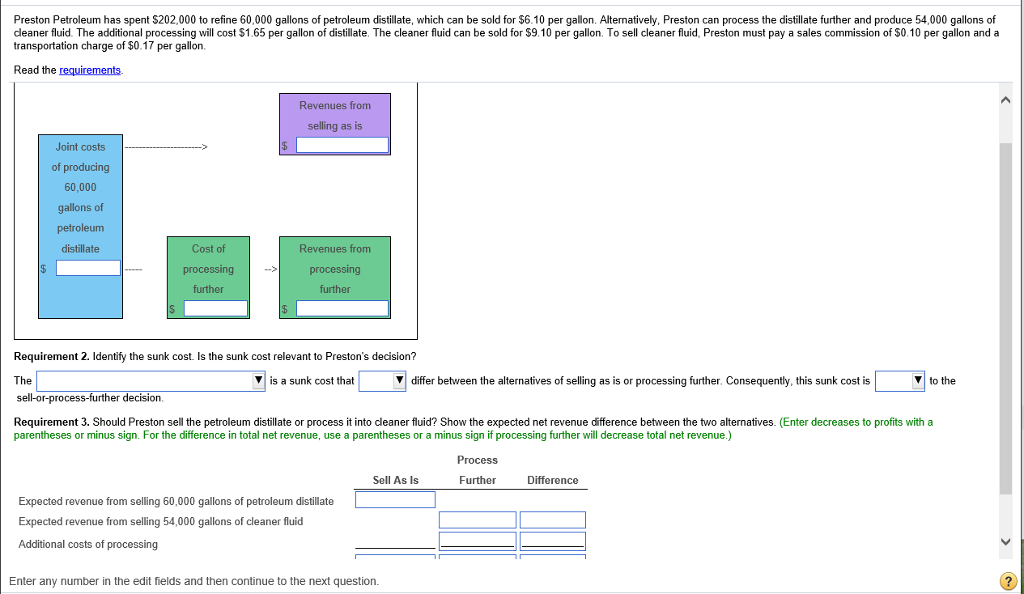

Preston Petroleum has spent $202,000 to refine 60,000 gallons of petroleum distillate, which can be sold for $6.10 per gallon. Alternatively, Preston can process the distillate further and produce 54,000 gallons of dleaner fluid. The additional processing will cost $1.65 per gallon of distillate. The cleaner fluid can be sold for $9.10 per gallon. To sell cleaner fluid, Preston must pay a sales commission of $0.10 per gallon and a transportation charge of $0.17 per gallon Read the requirements Revenues from selling as is of producing 60,000 gallons of petroleum distillate Cost of Revenues from further further Requirement 2. Identify the sunk cost. Is the sunk cost relevant to Preston's decision? The sell-or-process-further decision Requirement 3. Should Preston sell the petroleum distillate or process it into cleaner fluid? Show the expected net revenue difference between the two alternatives. (Enter decreases to profits with a ? is a sunk cost that V differ between the alternatives of selling as is or processing further. Consequently, this sunk cost is to the parentheses or minus sign. For the difference in total net revenue, use a parentheses or a minus sign if processing further will decrease total net revenue.) Process Sell As Is Further Difference Expected revenue from selling 60,000 gallons of petroleum distillate Expected revenue from selling 54,000 gallons of cleaner fluid Additional costs of processing Enter any number in the edit fields and then continue to the nextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started