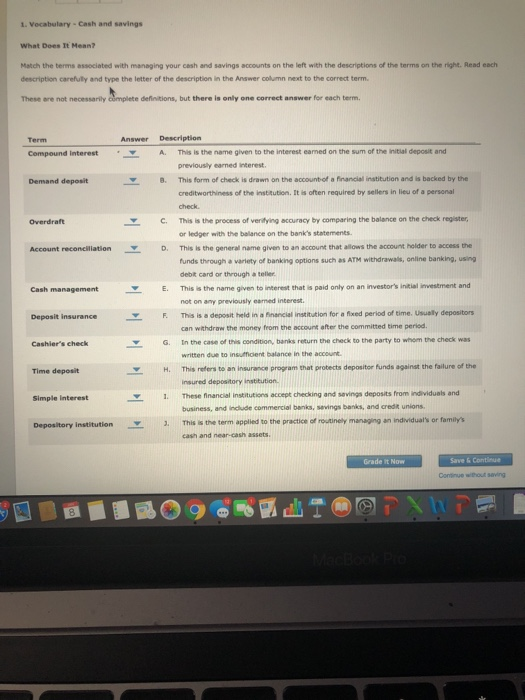

t. Vocabulary-Cash and savings What Does It Mean? Match the terms associated with managing your cesh and savings accounts on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer collumn next to the correct term. These are not necessarily definitions, but there is only one correct answer for each term. Term Answer Description Compound InterestA A. This is the name given to the interest eamed on the sum of the initial deposit and previously earned interest Demand deposit . This form of check is drawn on the accountof a financial institution and is backed by the creditworthiness of the institution. It is often required by sellers in lieu of a personal check Overdraft CThis is the process of veritying accuracy by comparing the balance on the check register, or ledger with the balance on the bank's statements Account reconciliationD. This is the general name given to an account that allows the account holder to access the funds through a variety of banking options such as ATM withdrawalis, online banking, usinyg debit card or through a teler This-the name given tonterest that is paid only on an investor's initial investment and not on any previously earmed interest Cash management E. Deposit insurance F. This is a deposit held in a Financiel institution for a fixed period of time. Usually depositors can withdraw the money from the account after the committed time period. In the case of this condition, banks return the check to the party to whom the check was written due to insuficient balance in the account This refers to an insurance program that protects depositor funds against the failure of the insured depository institution. These financial institutions accept checking and savings deposits from ndviduals and business, and include commercial banks, sevings banks, and credt unions. Cashiers check G. Time deposit H. Simple interest 1. institution3. This is the term applied to the practice of routinely managing an individual's or family's cash and near-cash assets Continue whout saving