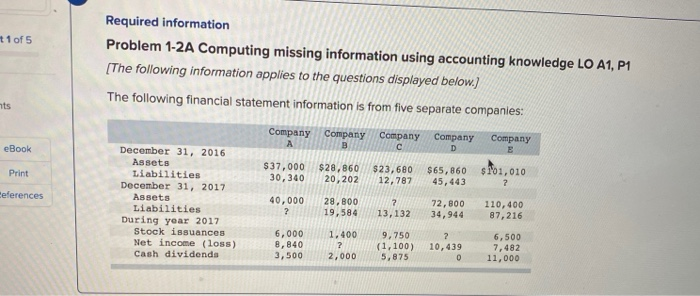

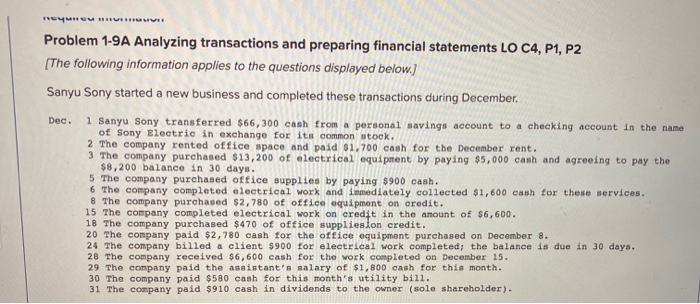

t1 of 5 Required information Problem 1-2A Computing missing information using accounting knowledge LO A1, P1 [The following information applies to the questions displayed below.) The following financial statement information is from five separate companies: nts Company Company B Company Company D eBook Company E Print $37,000 30, 340 $28,860 20,202 $ 23,680 12,787 $65,860 45,443 $ 101,010 2 Ceferences December 31, 2016 Assets Liabilities December 31, 2017 Assets Liabilities During year 2017 Stock issuances Net income (loss) Cash dividenda 40,000 ? 28,800 19,584 2 13, 132 72,800 34,944 110,400 87,216 6,000 8,840 3,500 1.400 ? 2,000 9.750 (1,100) 5,875 2 10,439 0 6,500 7,482 11,000 neye HOME Problem 1-9A Analyzing transactions and preparing financial statements LO C4, P1, P2 [The following information applies to the questions displayed below.) Sanyu Sony started a new business and completed these transactions during December Dec. 1 Sanyu Sony transferred $66,300 cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock. 2 The company rented office space and paid $1,700 cash for the December rent. 3 The company purchased $13,200 of electrical equipment by paying $5,000 cash and agreeing to pay the $8,200 balance in 30 days. 5 The company purchased office supplies by paying $900 cash. 6 The company completed electrical work and immediately collected $1,600 cash for these services. 8 The company purchased $2,780 of office equipment on credit. 15 The company completed electrical work on credit in the anount of $6,600. 18 The company purchased $470 of office suppliesion credit. 20 The company paid $2,780 cash for the office equipment purchased on December 8. 24 The company billed a client $900 for electrical work completed; the balance is due in 30 days. 28 The company received $6,600 cash for the work completed on December 15. 29 The company paid the assistant's salary of $1,800 cash for this month. 30 The company paid $580 cash for this month's utility bill. 31 The company paid $910 cash in dividends to the owner (sole shareholder). t1 of 5 Required information Problem 1-2A Computing missing information using accounting knowledge LO A1, P1 [The following information applies to the questions displayed below.) The following financial statement information is from five separate companies: nts Company Company B Company Company D eBook Company E Print $37,000 30, 340 $28,860 20,202 $ 23,680 12,787 $65,860 45,443 $ 101,010 2 Ceferences December 31, 2016 Assets Liabilities December 31, 2017 Assets Liabilities During year 2017 Stock issuances Net income (loss) Cash dividenda 40,000 ? 28,800 19,584 2 13, 132 72,800 34,944 110,400 87,216 6,000 8,840 3,500 1.400 ? 2,000 9.750 (1,100) 5,875 2 10,439 0 6,500 7,482 11,000 neye HOME Problem 1-9A Analyzing transactions and preparing financial statements LO C4, P1, P2 [The following information applies to the questions displayed below.) Sanyu Sony started a new business and completed these transactions during December Dec. 1 Sanyu Sony transferred $66,300 cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock. 2 The company rented office space and paid $1,700 cash for the December rent. 3 The company purchased $13,200 of electrical equipment by paying $5,000 cash and agreeing to pay the $8,200 balance in 30 days. 5 The company purchased office supplies by paying $900 cash. 6 The company completed electrical work and immediately collected $1,600 cash for these services. 8 The company purchased $2,780 of office equipment on credit. 15 The company completed electrical work on credit in the anount of $6,600. 18 The company purchased $470 of office suppliesion credit. 20 The company paid $2,780 cash for the office equipment purchased on December 8. 24 The company billed a client $900 for electrical work completed; the balance is due in 30 days. 28 The company received $6,600 cash for the work completed on December 15. 29 The company paid the assistant's salary of $1,800 cash for this month. 30 The company paid $580 cash for this month's utility bill. 31 The company paid $910 cash in dividends to the owner (sole shareholder)