Answered step by step

Verified Expert Solution

Question

1 Approved Answer

T2125 - part 5 - line 9946 Anna's net income from her self-employment Question Federal Worksheet - Line 12100 Interest and Other Investment Income -

T2125 - part 5 - line 9946

Anna's net income from her self-employment

Question

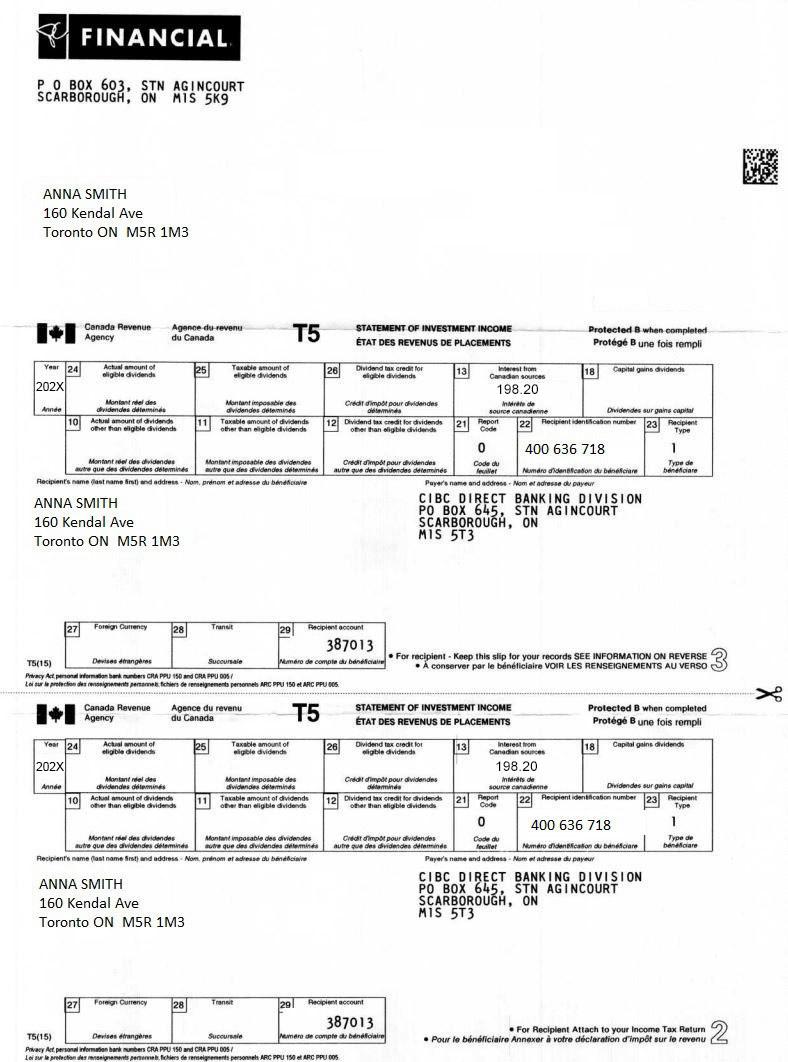

Federal Worksheet - Line 12100 Interest and Other Investment Income - line 11

This is the amount of interest income from her T5 that Anna will be taxed on

Question

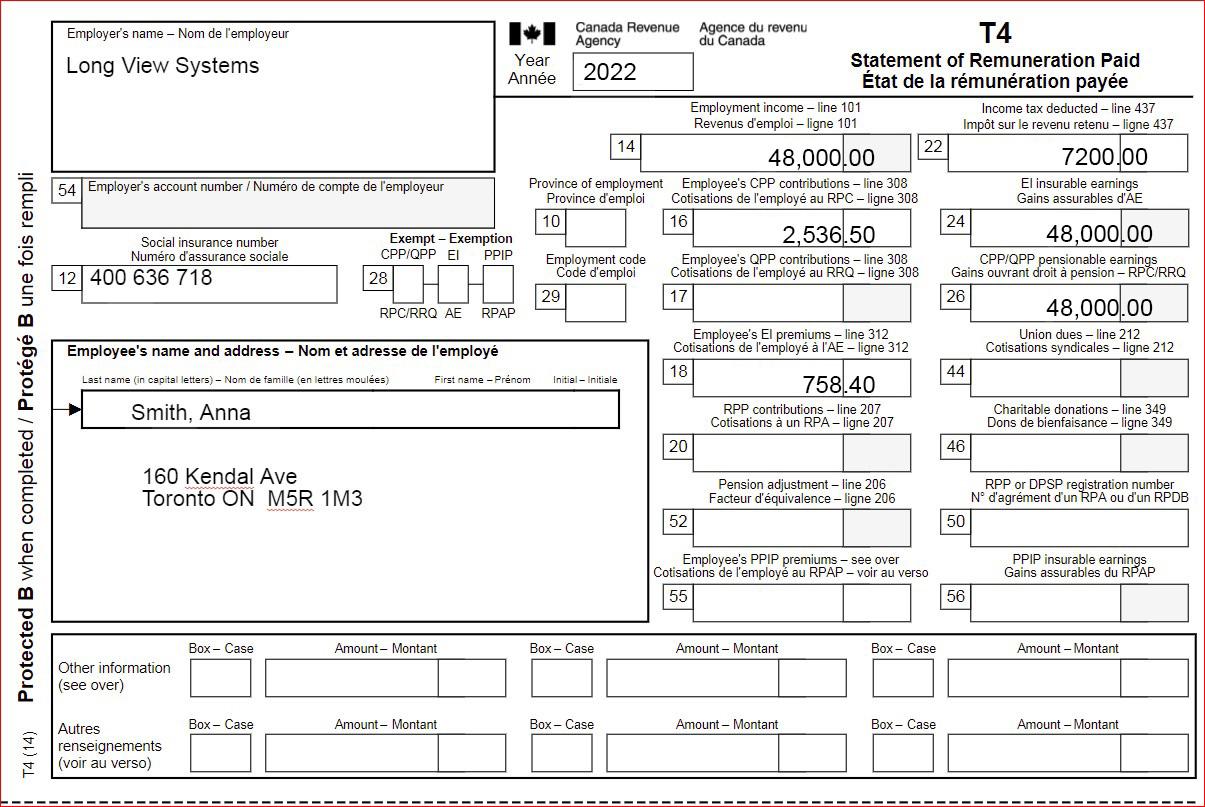

S8 - part 5b - line 51

This is the employee portion of her self-employment CPP expense that Anna recieves as a tax credit

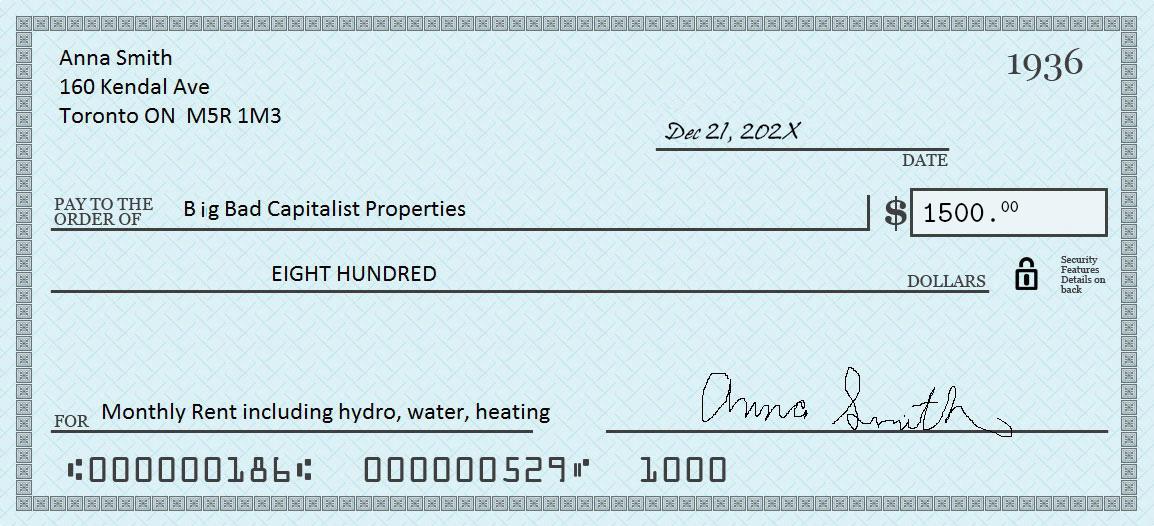

Anna Smith 160 Kendal Ave Toronto ON M5R 1M3 PAY TO THE ORDER OF Big Bad Capitalist Properties EIGHT HUNDRED FOR Monthly Rent including hydro, water, heating 000000186 000000529 Dec 21, 202X DATE 1936 1500.00 Security Features Details on DOLLARS back Anna Smith 1000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started