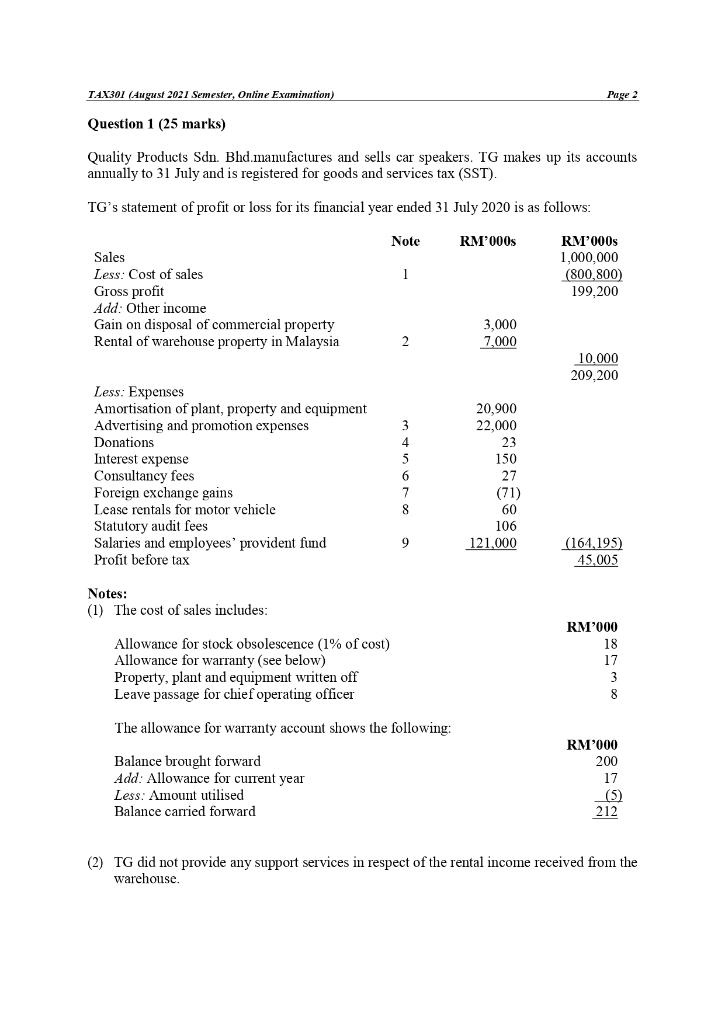

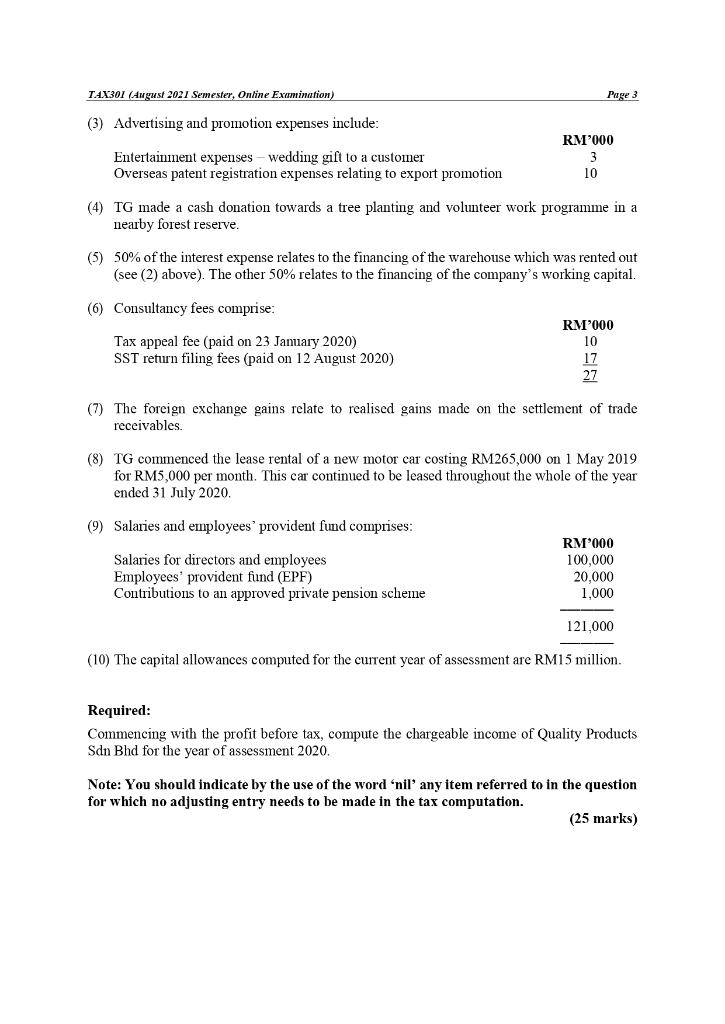

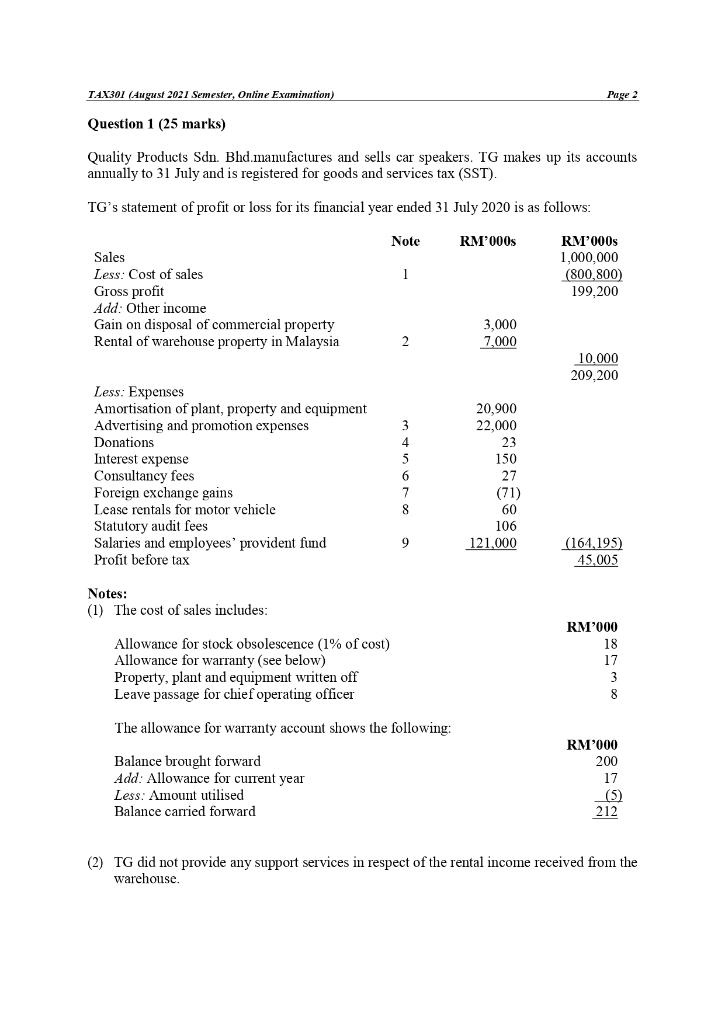

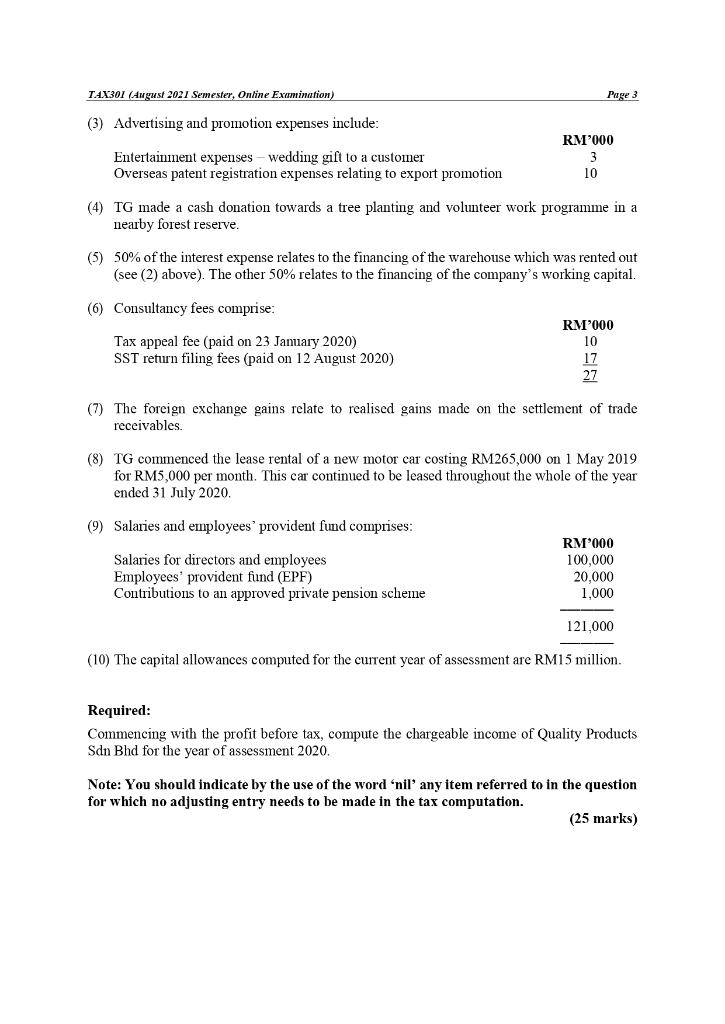

T.4X301 (August 2027 Semester, Online Examination) Page 2 Question 1 (25 marks) Quality Products Sdn. Bhd.manufactures and sells car speakers. TG makes up its accounts annually to 31 July and is registered for goods and services tax (SST). TG's statement of profit or loss for its financial year ended 31 July 2020 is as follows: Note RM000s RM'000s 1,000,000 (800,800) 199,200 1 Sales Less: Cost of sales Gross profit Add: Other income Gain on disposal of commercial property Rental of warehouse property in Malaysia 3,000 7,000 2 10.000 209,200 Less: Expenses Amortisation of plant, property and equipment Advertising and promotion expenses Donations Interest expense Consultancy fees Foreign exchange gains Lease rentals for motor vehicle Statutory audit fees Salaries and employees' provident fund Profit before tax 3 4 5 6 20,900 22,000 23 150 27 (71) 60 106 121.000 namese 8 9 (164,195) 45,005 Notes: (1) The cost of sales includes: Allowance for stock obsolescence (1% of cost) Allowance for warranty (see below) Property, plant and equipment written off Leave passage for chief operating officer RM'000 18 17 3 8 The allowance for warranty account shows the following: Balance brought forward Add: Allowance for current year Less: Amount utilised Balance carried forward RM'000 200 17 (5) 212 (2) TG did not provide any support services in respect of the rental income received from the warehouse. TAX301 (August 2021 Semester, Online Examination) Page 3 (3) Advertising and promotion expenses include: Entertainment expenses - wedding gift to a customer Overseas patent registration expenses relating to export promotion RM'000 3 10 (4) TG made a cash donation towards a tree planting and volunteer work programme in a nearby forest reserve. (5) 50% of the interest expense relates to the financing of the warehouse which was rented out (see (2) above). The other 50% relates to the financing of the company's working capital. (6) Consultancy fees comprise: Tax appeal fee (paid on 23 January 2020) SST return filing fees (paid on 12 August 2020) RM'000 10 17 27 (7) The foreign exchange gains relate to realised gains made on the settlement of trade receivables. (8) TG commenced the lease rental of a new motor car costing RM265,000 on 1 May 2019 for RM5,000 per month. This car continued to be leased throughout the whole of the year ended 31 July 2020. (9) Salaries and employees' provident fund comprises: Salaries for directors and employees Employees' provident fund (EPF) Contributions to an approved private pension scheme RM7000 100,000 20,000 1,000 121,000 (10) The capital allowances computed for the current year of assessment are RM15 million. Required: Commencing with the profit before tax, compute the chargeable income of Quality Products Sdn Bhd for the year of assessment 2020. Note: You should indicate by the use of the word 'nil' any item referred to in the question for which no adjusting entry needs to be made in the tax computation. (25 marks) T.4X301 (August 2027 Semester, Online Examination) Page 2 Question 1 (25 marks) Quality Products Sdn. Bhd.manufactures and sells car speakers. TG makes up its accounts annually to 31 July and is registered for goods and services tax (SST). TG's statement of profit or loss for its financial year ended 31 July 2020 is as follows: Note RM000s RM'000s 1,000,000 (800,800) 199,200 1 Sales Less: Cost of sales Gross profit Add: Other income Gain on disposal of commercial property Rental of warehouse property in Malaysia 3,000 7,000 2 10.000 209,200 Less: Expenses Amortisation of plant, property and equipment Advertising and promotion expenses Donations Interest expense Consultancy fees Foreign exchange gains Lease rentals for motor vehicle Statutory audit fees Salaries and employees' provident fund Profit before tax 3 4 5 6 20,900 22,000 23 150 27 (71) 60 106 121.000 namese 8 9 (164,195) 45,005 Notes: (1) The cost of sales includes: Allowance for stock obsolescence (1% of cost) Allowance for warranty (see below) Property, plant and equipment written off Leave passage for chief operating officer RM'000 18 17 3 8 The allowance for warranty account shows the following: Balance brought forward Add: Allowance for current year Less: Amount utilised Balance carried forward RM'000 200 17 (5) 212 (2) TG did not provide any support services in respect of the rental income received from the warehouse. TAX301 (August 2021 Semester, Online Examination) Page 3 (3) Advertising and promotion expenses include: Entertainment expenses - wedding gift to a customer Overseas patent registration expenses relating to export promotion RM'000 3 10 (4) TG made a cash donation towards a tree planting and volunteer work programme in a nearby forest reserve. (5) 50% of the interest expense relates to the financing of the warehouse which was rented out (see (2) above). The other 50% relates to the financing of the company's working capital. (6) Consultancy fees comprise: Tax appeal fee (paid on 23 January 2020) SST return filing fees (paid on 12 August 2020) RM'000 10 17 27 (7) The foreign exchange gains relate to realised gains made on the settlement of trade receivables. (8) TG commenced the lease rental of a new motor car costing RM265,000 on 1 May 2019 for RM5,000 per month. This car continued to be leased throughout the whole of the year ended 31 July 2020. (9) Salaries and employees' provident fund comprises: Salaries for directors and employees Employees' provident fund (EPF) Contributions to an approved private pension scheme RM7000 100,000 20,000 1,000 121,000 (10) The capital allowances computed for the current year of assessment are RM15 million. Required: Commencing with the profit before tax, compute the chargeable income of Quality Products Sdn Bhd for the year of assessment 2020. Note: You should indicate by the use of the word 'nil' any item referred to in the question for which no adjusting entry needs to be made in the tax computation. (25 marks)