Question

TA PILVA Plcs shares are not traded in any recognized market. Its sole activity is saloon and car hire. It is financed by a combination

TA PILVA Plcs shares are not traded in any recognized market. Its sole activity is saloon and car hire. It is financed by a combination of 2 million $0.5 ordinary shares and a $1.5 bank loan. Very recently, Mavis Plc, a national car hire group offered a total of $5.5 million to acquire equity of TA PILVA Plc. The bid failed because majority of shareholders rejected since they wished to retain control of business, despite believing the offer to represent a fair price for the shares. The bank loan is at a floating rate of 10% p.a. and is secured on various fixed assets. The value of the bank loan is considered to be very close to its nominal value.

TA PILVA Plcs current capital structure (by market value) represents what has been and is intended to continue to be its target capital structure.

TA PILVA Plcs management is in the process of assessing a major investment, to be financed from retained earnings, in some new deposits, similar to the businesss existing ones. An appropriate cost of capital is required to this purpose. The dividend growth model has been proposed as a suitable basis for the estimation of equity.

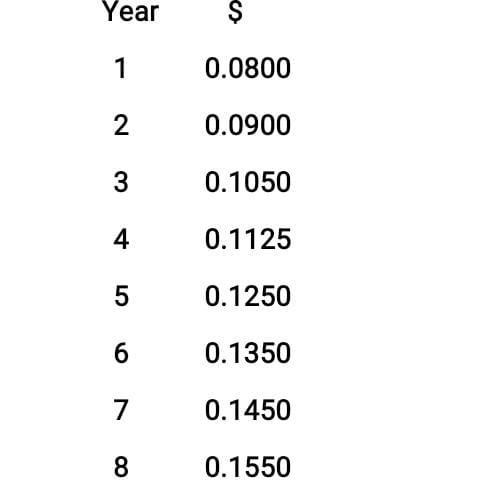

Recent annual dividends per share have been:

Corporation tax rate is expected to be 33% p.a. for the foreseeable future.

Required:

Estimate:

i)Growth rate, g

ii)Cost of equity, Ke

Year $ 1 0.0800 2 0.0900 3 0.1050 4 0.1125 5 0.1250 6 0.1350 7 0.1450 8 0.1550Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started