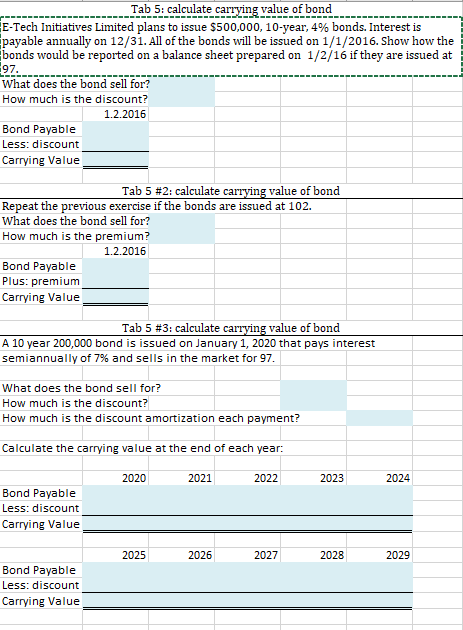

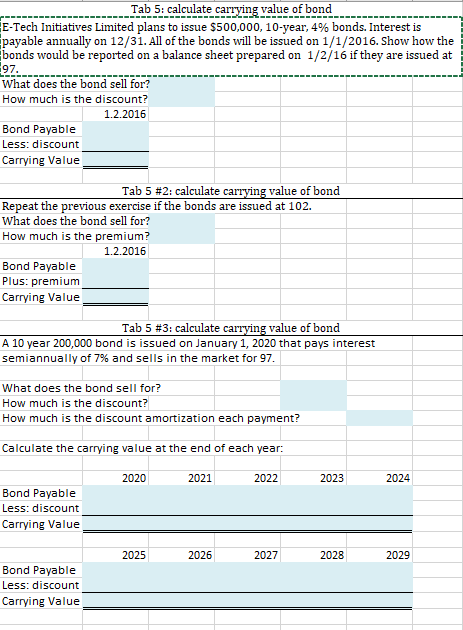

Tab 5: calculate carrying value of bond E-Tech Initiatives Limited plans to issue $500,000, 10-year, 4% bonds. Interest is payable annually on 12/31. All of the bonds will be issued on 1/1/2016. Show how the bonds would be reported on a balance sheet prepared on 1/2/16 if they are issued at 97. What does the bond sell for? How much is the discount? 1.2.2016 Bond Payable Less: discount Carrying Value Tab 5 #2: calculate carrying value of bond Repeat the previous exercise if the bonds are issued at 102. What does the bond sell for? How much is the premium? 1.2.2016 Bond Payable Plus: premium Carrying Value Tab 5 #3: calculate carrying value of bond A 10 year 200,000 bond is issued on January 1, 2020 that pays interest semiannually of 7% and sells in the market for 97. What does the bond sell for? How much is the discount? How much is the discount amortization each payment? Calculate the carrying value at the end of each year: 2020 2021 2022 2023 2024 Bond Payable Less: discount Carrying Value 2025 2026 2027 2028 2029 Bond Payable Less: discount Carrying Value Tab 5: calculate carrying value of bond E-Tech Initiatives Limited plans to issue $500,000, 10-year, 4% bonds. Interest is payable annually on 12/31. All of the bonds will be issued on 1/1/2016. Show how the bonds would be reported on a balance sheet prepared on 1/2/16 if they are issued at 97. What does the bond sell for? How much is the discount? 1.2.2016 Bond Payable Less: discount Carrying Value Tab 5 #2: calculate carrying value of bond Repeat the previous exercise if the bonds are issued at 102. What does the bond sell for? How much is the premium? 1.2.2016 Bond Payable Plus: premium Carrying Value Tab 5 #3: calculate carrying value of bond A 10 year 200,000 bond is issued on January 1, 2020 that pays interest semiannually of 7% and sells in the market for 97. What does the bond sell for? How much is the discount? How much is the discount amortization each payment? Calculate the carrying value at the end of each year: 2020 2021 2022 2023 2024 Bond Payable Less: discount Carrying Value 2025 2026 2027 2028 2029 Bond Payable Less: discount Carrying Value