Question

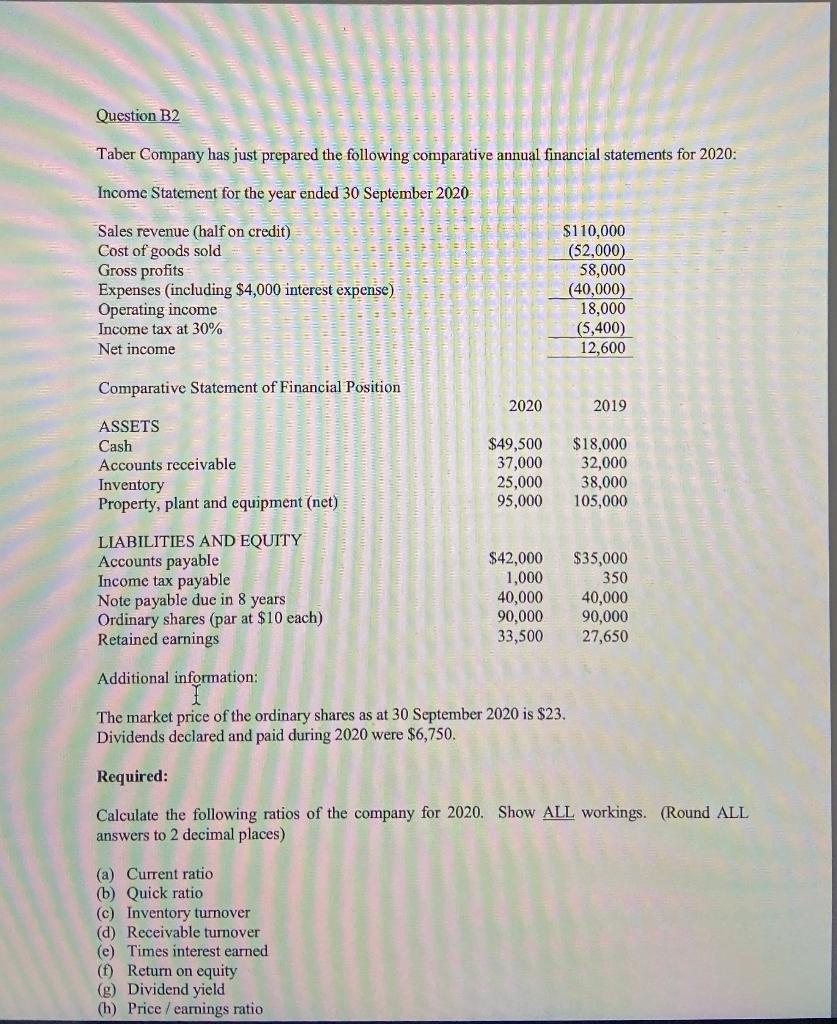

Taber Company has just prepared the following comparative annual Income Statement for the year ended 30 September 2020 financial statements for 2020: $110,000 (52,000) 58,000

Taber Company has just prepared the following comparative annual Income Statement for the year ended 30 September 2020

financial statements for 2020:

$110,000 (52,000) 58,000 (40,000) 18,000 (5,400) 12,600

2019

$18,000 32,000 38,000

105,000

$35,000 350 40,000 90,000 27,650

Sales revenue (half on credit) Cost of goods sold Gross profits Expenses (including $4,000 interest expense) Operating income

Income tax at 30% Net income

Comparative Statement of Financial Position

ASSETS Cash $49,500 Accounts receivable 37,000 Inventory 25,000

Property, plant and equipment (net)

LIABILITIES AND EQUITY Accounts payable Income tax payable Note payable due in 8 years Ordinary shares (par at $10 each) Retained earnings

Additional information:

95,000

$42,000 1,000 40,000 90,000 33,500

The market price of the ordinary shares as at 30 September 2020 is $23. Dividends declared and paid during 2020 were $6,750.

Required:

Calculate the following ratios of the company for 2020. Show ALL workings. (Round ALL answers to 2 decimal places)

-

(a) Current ratio

-

(b) Quick ratio

-

(c) Inventory turnover

-

(d) Receivableturnover

-

(e) Times interest earned

-

(f) Return on equity

-

(g) Dividendyield

-

(h) Price/earningsratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started