Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tablas Charts Layout Alignment abc Wrap Font Home Edit 10 A- A- M F Arial A U Clear Paste X K30 D B 93 94

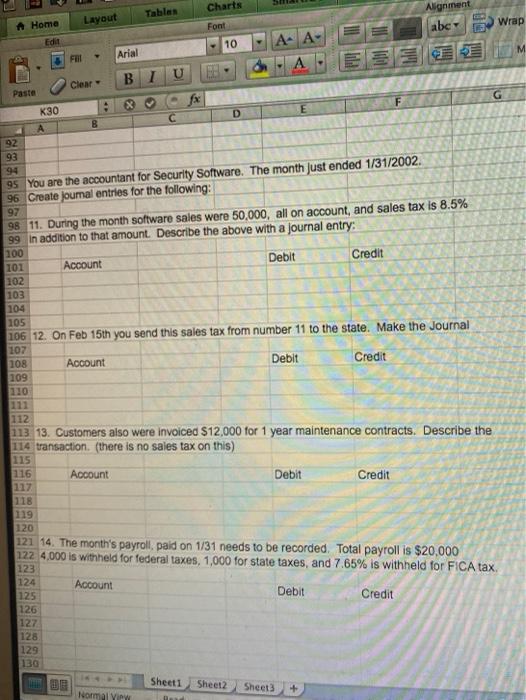

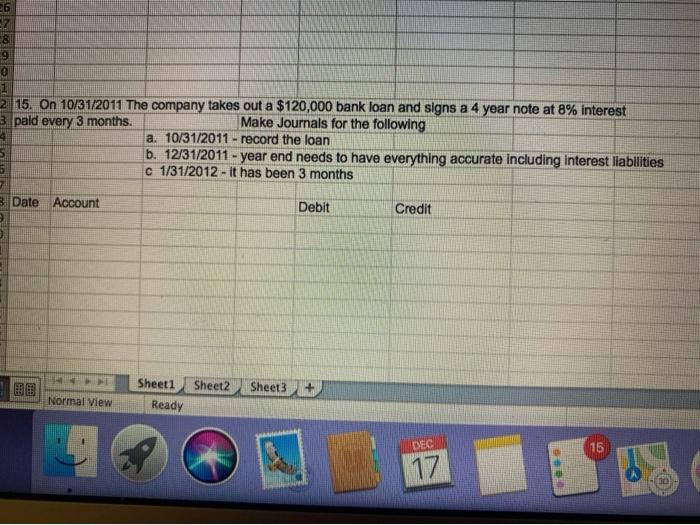

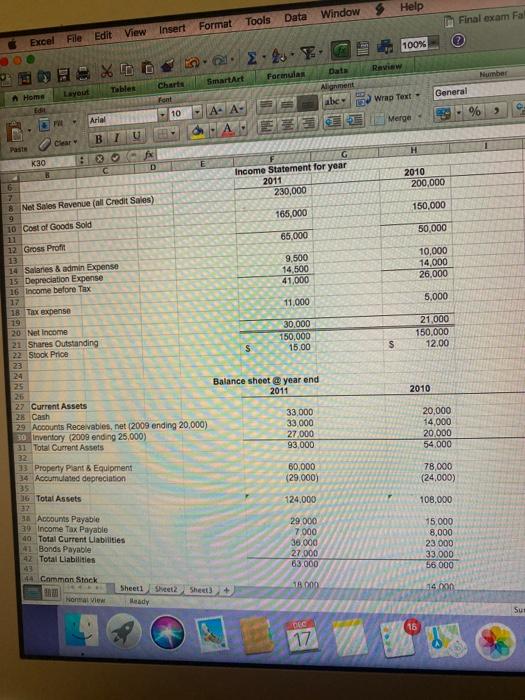

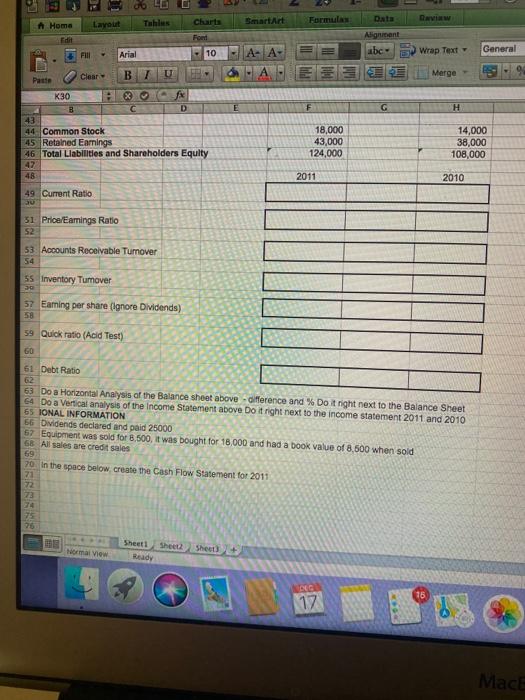

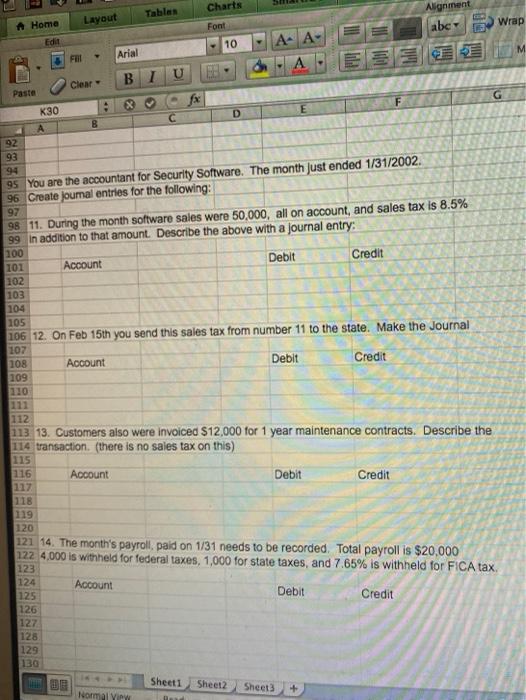

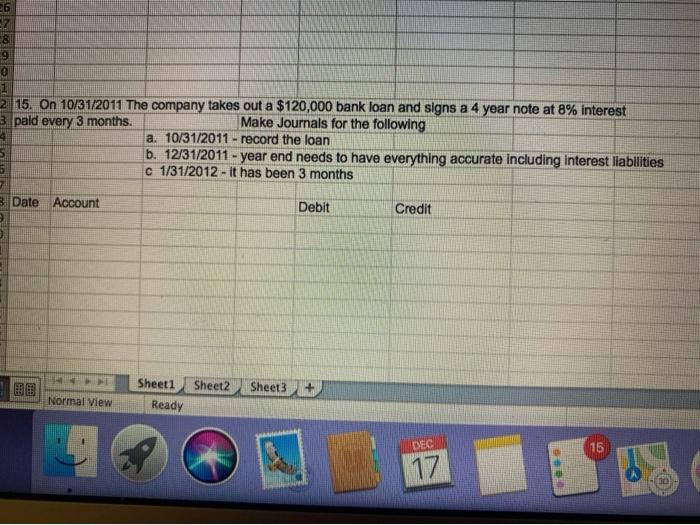

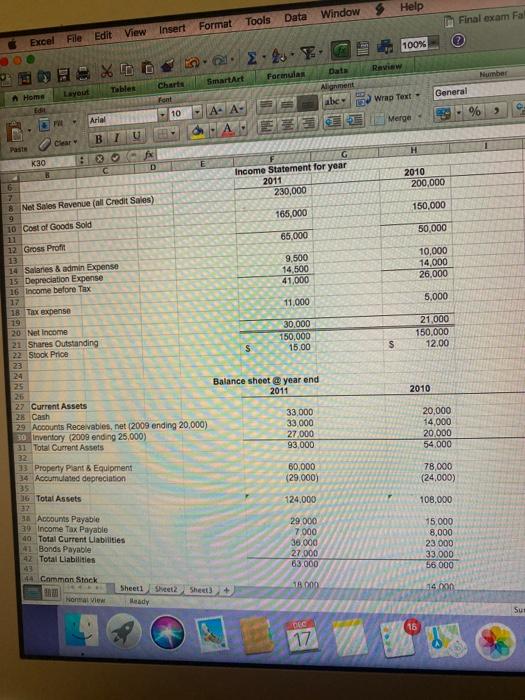

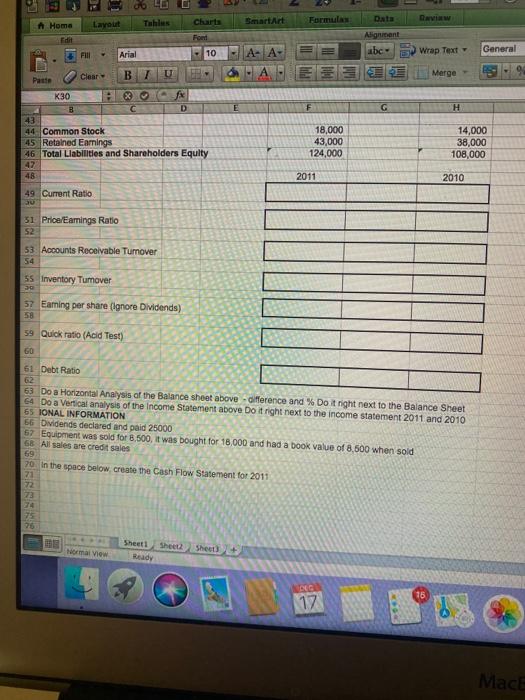

Tablas Charts Layout Alignment abc Wrap Font Home Edit 10 A- A- M F Arial A U Clear Paste X K30 D B 93 94 95 You are the accountant for Security Software. The month just ended 1/31/2002. 96 Create joumal entries for the following: 97 98 11. During the month software sales were 50,000, all on account, and sales tax is 8.5% 99 In addition to that amount Describe the above with a journal entry: 100 101 Account Debit Credit 102 103 104 105 106 12. On Feb 15th you send this sales tax from number 11 to the state. Make the Journal 107 108 Account Debit Credit 109 110 112 113. 13. Customers also were invoiced $12,000 for 1 year maintenance contracts. Describe the 114 transaction (there is no sales tax on this) 115 116 Account Debit Credit 117 118 119 120 121 14. The month's payroll, paid on 1/31 needs to be recorded. Total payroll is $20,000 122 4.000 is withheld for federal taxes, 1,000 for state taxes, and 7.65% is withheld for FICA tax. 123 124 Account Debit Credit 125 126 127 128 129 130 Sheet1 Sheet2 Sheet3 Normal 6 27 8 9 0 1 2 15. On 10/31/2011 The company takes out a $120,000 bank loan and signs a 4 year note at 8% interest 3 paid every 3 months. Make Journals for the following a. 10/31/2011 - record the loan b. 12/31/2011 - year end needs to have everything accurate including interest liabilities c 1/31/2012 - it has been 3 months 5 Date Account Debit Credit Sheet2 Sheet3 + Normal View Sheet1 Ready DEC 15 17 Data Window 3 Help Final exam Fal Edit View Insert Format Tools Excel Fide 100% 2.2.7. Data Review Formulas Number XD Tables Charte Font SmartArt Layout General Home abe Wrap Text - 10 IA A 96) Ariel Merge - A U Clear H Income Statement for year 2011 230,000 2010 200,000 150,000 165,000 50,000 65,000 K30X D B 6 7 8 Net Sales Revenue (all Credit Sales) 9 10 Cost of Goods Sold 11 12 Gross Prof 13 14 Salaries & admin Expense 15 Depreciation Expense 16 Income before Tax 17 18 Tax expense 19 20 Net Income 21 Shares Outstanding 22 Stock Price 23 24 25 9.500 14.500 41,000 10,000 14,000 26,000 11,000 5,000 30 000 150,000 15.00 21,000 150.000 12.00 S $ Balance sheet year end 2011 2010 33,000 33.000 27.000 93,000 20,000 14,000 20,000 54.000 60,000 (29,000) 27 Current Assets 28 Cash 29 Accounts Receivables, net (2009 ending 20,000) 30 Inventory ending 25.000) 31 Total Current Assets 32 13 Property Piant & Equipment 34 Acoumulated depreciation 35 16 Total Assets 37 1 Accounts Payable 39 Income Tax Payable 40 Total Current Liabilities 41 Bonds Payable 42 Total Liabilities 78,000 (24,000) 124.000 108,000 29.000 7000 36.000 27000 63 000 15,000 8,000 23000 33.000 56 000 4. Common Stock 15 000 14.000 Normal View Sheet1 Heady Sut DEC 16 17 Tables SmartArt Formula Data Layout Home DAVI Charts Fondi Edit Alignant abc Arial Fill 10 A-A- General Wrap Text Merge F G H Patte Clear B K30 & C D 43 44 Common Stock 45 Retained Earnings 46 Total Liabilities and Shareholders Equity 47 48 18,000 43,000 124,000 14,000 38,000 108,000 2011 2010 49 Current Ratio 30 51 Price/Eamings Ratio 52 53 Accounts Receivable Tumover 54 5 Inventory Tumover 30 57 Earning per share (ignore Dividends) 58 59 Quick ratio (Acid Test) 60 61 Debt Ratio 63 Do a Horizontal Analysis of the Balance sheet above-ofference and % Do it right next to the Balance Sheet 64 Do a Vertical analysis of the Income Statement above Do it right next to the income statement 2011 and 2010 65 IONAL INFORMATION 66 Dividends declared and paid 25000 67 Equipment was sold for 6.500, it was bought for 16 000 and had a book value of 8,500 when sold 66 All sales are credit sales 69 70. In the space below create the Cash Flow Statement for 2011 71 75 76 Norma Sheet Ready Sheet) + 15 17 Mace

Tablas Charts Layout Alignment abc Wrap Font Home Edit 10 A- A- M F Arial A U Clear Paste X K30 D B 93 94 95 You are the accountant for Security Software. The month just ended 1/31/2002. 96 Create joumal entries for the following: 97 98 11. During the month software sales were 50,000, all on account, and sales tax is 8.5% 99 In addition to that amount Describe the above with a journal entry: 100 101 Account Debit Credit 102 103 104 105 106 12. On Feb 15th you send this sales tax from number 11 to the state. Make the Journal 107 108 Account Debit Credit 109 110 112 113. 13. Customers also were invoiced $12,000 for 1 year maintenance contracts. Describe the 114 transaction (there is no sales tax on this) 115 116 Account Debit Credit 117 118 119 120 121 14. The month's payroll, paid on 1/31 needs to be recorded. Total payroll is $20,000 122 4.000 is withheld for federal taxes, 1,000 for state taxes, and 7.65% is withheld for FICA tax. 123 124 Account Debit Credit 125 126 127 128 129 130 Sheet1 Sheet2 Sheet3 Normal 6 27 8 9 0 1 2 15. On 10/31/2011 The company takes out a $120,000 bank loan and signs a 4 year note at 8% interest 3 paid every 3 months. Make Journals for the following a. 10/31/2011 - record the loan b. 12/31/2011 - year end needs to have everything accurate including interest liabilities c 1/31/2012 - it has been 3 months 5 Date Account Debit Credit Sheet2 Sheet3 + Normal View Sheet1 Ready DEC 15 17 Data Window 3 Help Final exam Fal Edit View Insert Format Tools Excel Fide 100% 2.2.7. Data Review Formulas Number XD Tables Charte Font SmartArt Layout General Home abe Wrap Text - 10 IA A 96) Ariel Merge - A U Clear H Income Statement for year 2011 230,000 2010 200,000 150,000 165,000 50,000 65,000 K30X D B 6 7 8 Net Sales Revenue (all Credit Sales) 9 10 Cost of Goods Sold 11 12 Gross Prof 13 14 Salaries & admin Expense 15 Depreciation Expense 16 Income before Tax 17 18 Tax expense 19 20 Net Income 21 Shares Outstanding 22 Stock Price 23 24 25 9.500 14.500 41,000 10,000 14,000 26,000 11,000 5,000 30 000 150,000 15.00 21,000 150.000 12.00 S $ Balance sheet year end 2011 2010 33,000 33.000 27.000 93,000 20,000 14,000 20,000 54.000 60,000 (29,000) 27 Current Assets 28 Cash 29 Accounts Receivables, net (2009 ending 20,000) 30 Inventory ending 25.000) 31 Total Current Assets 32 13 Property Piant & Equipment 34 Acoumulated depreciation 35 16 Total Assets 37 1 Accounts Payable 39 Income Tax Payable 40 Total Current Liabilities 41 Bonds Payable 42 Total Liabilities 78,000 (24,000) 124.000 108,000 29.000 7000 36.000 27000 63 000 15,000 8,000 23000 33.000 56 000 4. Common Stock 15 000 14.000 Normal View Sheet1 Heady Sut DEC 16 17 Tables SmartArt Formula Data Layout Home DAVI Charts Fondi Edit Alignant abc Arial Fill 10 A-A- General Wrap Text Merge F G H Patte Clear B K30 & C D 43 44 Common Stock 45 Retained Earnings 46 Total Liabilities and Shareholders Equity 47 48 18,000 43,000 124,000 14,000 38,000 108,000 2011 2010 49 Current Ratio 30 51 Price/Eamings Ratio 52 53 Accounts Receivable Tumover 54 5 Inventory Tumover 30 57 Earning per share (ignore Dividends) 58 59 Quick ratio (Acid Test) 60 61 Debt Ratio 63 Do a Horizontal Analysis of the Balance sheet above-ofference and % Do it right next to the Balance Sheet 64 Do a Vertical analysis of the Income Statement above Do it right next to the income statement 2011 and 2010 65 IONAL INFORMATION 66 Dividends declared and paid 25000 67 Equipment was sold for 6.500, it was bought for 16 000 and had a book value of 8,500 when sold 66 All sales are credit sales 69 70. In the space below create the Cash Flow Statement for 2011 71 75 76 Norma Sheet Ready Sheet) + 15 17 Mace

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started