Answered step by step

Verified Expert Solution

Question

1 Approved Answer

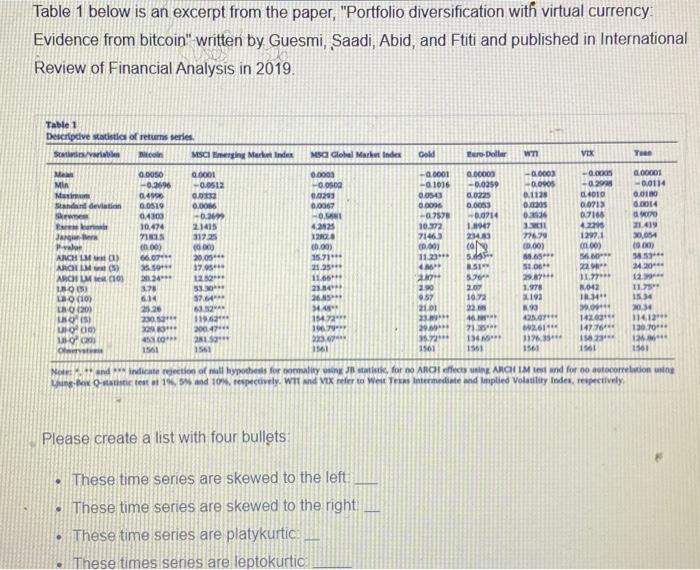

Table 1 below is an excerpt from the paper, Portfolio diversification with virtual currency: Evidence from bitcoin written by Guesmi, Saadi, Abid, and Ftiti

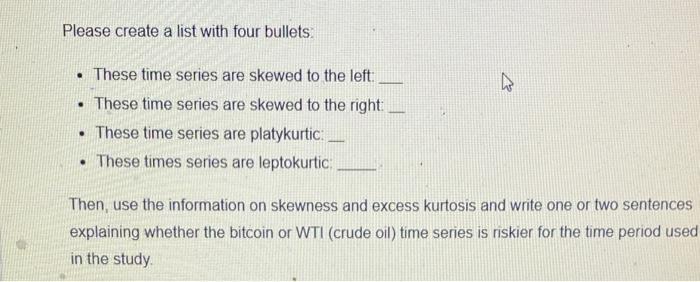

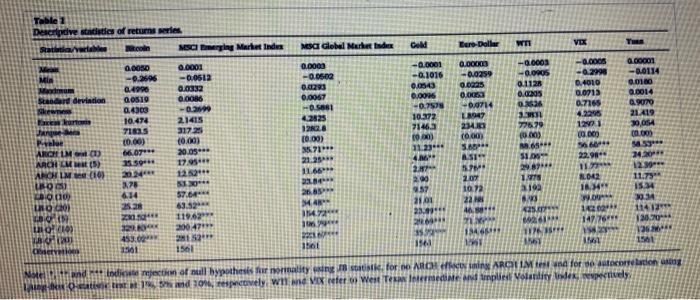

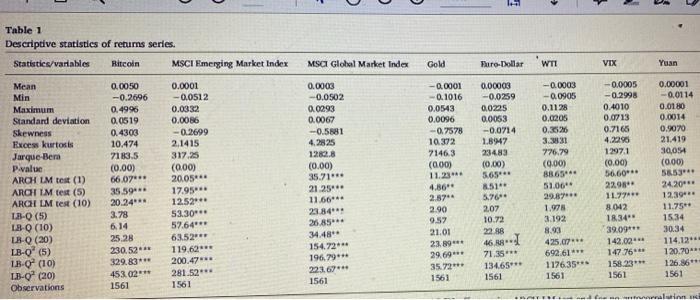

Table 1 below is an excerpt from the paper, "Portfolio diversification with virtual currency: Evidence from bitcoin" written by Guesmi, Saadi, Abid, and Ftiti and published in International Review of Financial Analysis in 2019. Table 1 Descriptive statistics of returns series. Statis/variable Bitcoin Jargin-Bera ARCHIM (3) ARCHIM (5) ARCH LM sest (10) 180 (5) LBO (10) LB-Q (20) L8Q (5) 193 18-Q (0) Char 0.0050 -0.2696 04996 0.0519 04303 10,474 71835 (0.00) 66.07 35.59** 201.24** 3.78 634 25.26 230.52*** 320 83** 453.00 1561 MSCI Emerging Market Index 0.0001 -0.0512 0.0332 0.0066 -0.2699 21415 317.25 (0.00) 20.05*** 17.95 12.52** 53.30*** 57.64*** 63.52*** 119.62 200.47444 281.52** 1561 MSCI Global Market Index Gold Please create a list with four bullets 0.0003 -0.0500 0.0291 0.0067 -0.581 4,2825 32808 (0.00) 15.71 21.25*** 1166 25.84 26.85** HA 154.72 196.79- 223. 356) -0.0001 -0.1016 0.0543 0.0096 These time series are skewed to the left These time series are skewed to the right These time series are platykurtic These times series are leptokurtic -0.7578 10.372 7146.3 (0.00) 11.23** 4360" 230 1.90 9.57 21.01 219 29.9 35.72 1561 Euro-Dollar Wn 0.00000 -0.0259 0.0225 0.0053 -0.0714 1.8947 234.83 cog 5.695. 851 5.36** 2.07 10.72 22. 46. 71.35** 134 1561 -0.0003 -0,0905 0.1128 0.0305 03136 338011 776.79 (0.00) 56.65*** 51.00 29.87144 3.978 X192 8.90 425.07*** 692.61*** 3176.3544 1561 VIX -0.0005 -0.2998 04010 0.0713 07166 4.2295 1297.1 (100) 560** 22.98 31.779*** 8.042 18.34" 39.09 142.024 14776*** 158.23*** 1961 THED 0.00001 -0.0114 0.0180 0.0014 a 90070 21.419 30,054 (0(X) 58.53*** 24.20*** Notes? and *** indicate rejection of mall hypothesis for normality using JB statistic, for no ARCH effects using ARCH LM test and for no autocorrelation using Lung-Box Q-statistic test at 1%, 5% and 10%, respectively. WIT and VIX refer to West Texas Intermediate and Implied Volatility Indes, respectively. 12.39 11.75 15.34 30.34 114.12 130.70*** 1264 1561 Please create a list with four bullets: . These time series are skewed to the left: . These time series are skewed to the right: . These time series are platykurtic: . These times series are leptokurtic: - 4 Then, use the information on skewness and excess kurtosis and write one or two sentences explaining whether the bitcoin or WTI (crude oil) time series is riskier for the time period used in the study. Table 1 pive statistics of returns series. coln Statistica/verlable deviation 1M (1) ARCH CA seat (5) ANCH LM e (10) (8025) 280 (10) (0) C 0.0050 -0.2696 0.4996 0.0519 0.4303 BOI mo! (19) 1801301 10.474 71835 (0.00) 66.07 25.59*** 30.24*** 3.78 6.34 25.28 21.52*** 329.8 453.00 MSCI Emerging Market Index 0.0001 -0.0612 TOGE 0.0332 0.0086 -0.3699 21415 317.25 (0.00) 20.05*** 17.95*** 12.52** 53.3*** 57.64*** 63.52** 119.62 20047 MSCI Global Market Index 0.0003 -0.0602 0.01293 0.0067 -0.5861 4.2825 12828 (0.00) 281 52 1561 Gold -0.0001 -0.1016 0,0543 9000/0 -0.7578 10.372 71463 9.57 Euro-Dollar 1563 0.00K -0.0259 0.0225 0.0053 -0.0714 18047 234.83 (0.00) SA** ASI 5.76 WTI 2.07 10.72 22 M -0.0003 35.71*** 21.25*** 11.66 23.84** 26.85 MA 154.72 306 pe 1561 and indicate rejection of null bypothesis for normality sing statistic, for oo ARCH effect saing ARC 1M test and for so autocorrelation using Ljung des Q-static test at 1, 5 and 10%, respectively, WI and VIX refer to West Tesan Intermediate and implied Molandity Indes, respectively 0.1128 0.0205 BABY'S 3.192 6:03 VIX 1561 -0.0005 -0.2998 0.4010 0.0713 0.7165 4.2295 1290 1 (0.000) 56.68 22.98** TIRE 2961 0.00001 -0.0114 0.0180 0.0014 0.9070 21.419 30,054 (0.00) 54.53*** 24.20 12.3 11.79 15.34 33.34 114 12 1561 Table 14 Descriptive statistics of returns series. Bitcoin Statistics/variables Mean Min Maximum Standard deviation Skewness Excess kurtosis Jarque-Bera P-value ARCH LM test (1) ARCH IM test (5) ARCH LM test (10) LB-Q (5) LB-Q (10) LB-Q (20) LB-Q (5) LB-Q (10) LB-Q (20) Observations 0.0050 -0.2696 0.4996 0.0519 0.4303 10.474 7183.5 (0.00) 66.07*** 35.59*** 20.24*** 3.78 6.14 25.28 MSCI Emerging Market Index 0.0001 -0.0512 0.0332 0.0086 -0.2699 2.1415 317.25 (0.00) 20.05*** 17.95*** 12.52*** 53.30*** 57.64*** 63.52*** 230.52*** 119.62*** 329.83*** 200.47*** 453.02*** 1561 281.52*** 1561 MSCI Global Market Index 0.0003 -0.0502 0.0293 0.0067 -0.5881 4.2825 1282.8 (0.00) 35.71*** 21.25*** 11.66*** 23.84*** 26.85*** 34.48** 154.72*** 196.79*** 223.67*** 1561 Gold -0.0001 -0.1016 0.0543 0.0096 -0.7578 10.372 7146.3 (0.00) 11.23*** 4.86** 2.87** 2.90 9.57 21.01 23.89*** 29.69*** 35.72*** 1561 I Furo-Dollar WTI 0.00003 -0.0259 0.0225 0.0053 -0.0714 1.8947 23483 (0.00) 5.65*** 8.51** 5.76** 2.07 10.72 22.88 46.88-- 71.35*** 134.65*** 1561 -0.0003 -0.0905 0.1128 0.0205 0.3526 3.3831 3 1 776.79 (0.00) 88.65*** 51.06 29.87*** VIX -0.0005 -0.2998 0.4010 0.0713 0.7165 4.2296 1297.1 (0.00) 56.60*** 22.98** 11.77*** 8.042 18.34** 1.978 3.192 39.09*** 8.93 425.07*** 142.02*** 692.61*** 147.76*** 1561 1176.35*** 158.23*** 1561 Yuan 0.00001 -0.0114 0.0180 0.0014 0.9070 21.419 30,054 (0.00) 58.53*** 24.20*** 12.39*** 11.75 15.34 30.34 114.12*** 120.70*** 126.86*** 1561 and for an altion usi

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

These time series are skewed to the left MSCI emerging market index MSCI global market index Gold Eu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started