Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Table 1 contains the complete cash flow analysis based on GP Manufacturings basic information. Explain the inputs into 1) the net initial investment outlay at

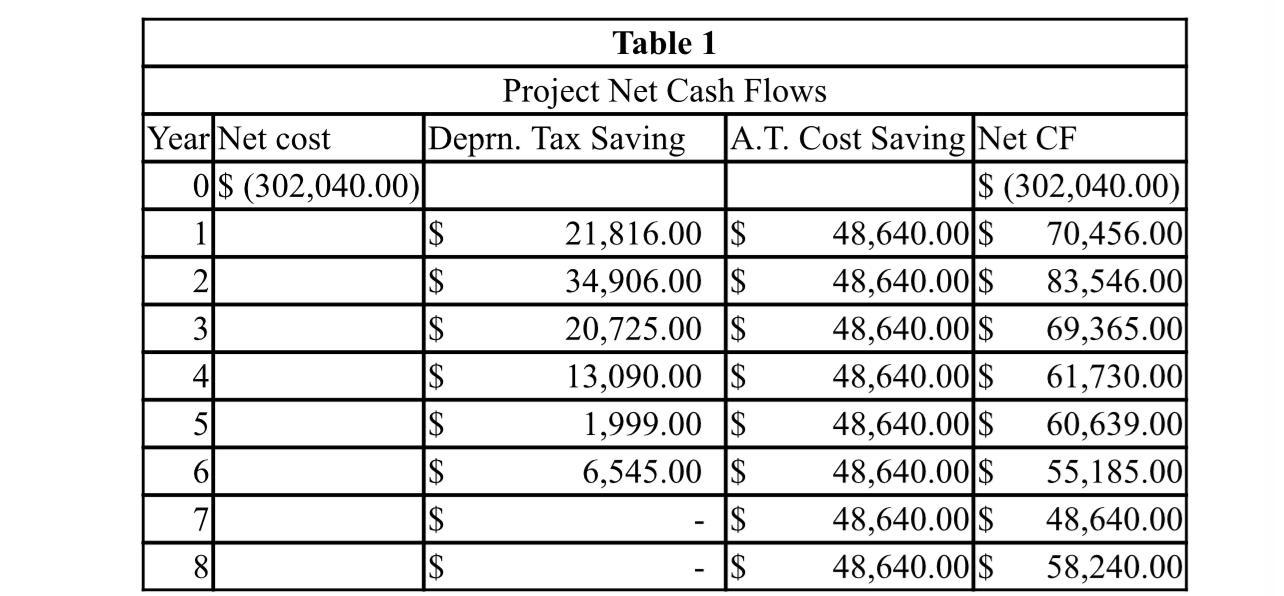

Table 1 contains the complete cash flow analysis based on GP Manufacturing’s basic information. Explain the inputs into 1) the net initial investment outlay at year 0, 2) the depreciation tax savings in each year of the project’s economic life, and 3) the project’s incremental cash flows?

Year Net cost 0$ (302,040.00) 1 2 3 5 6 7 8 Table 1 Project Net Cash Flows Deprn. Tax Saving A.T. Cost Saving Net CF $ $ $ $ $ $ $ $ 21,816.00 $ 34,906.00 $ 20,725.00 $ 13,090.00 $ 1,999.00 $ 6,545.00 $ $ $ $ (302,040.00)| 70,456.00 83,546.00 69,365.00 61,730.00 60,639.00 55,185.00 48,640.00 58,240.00 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $ 48,640.00 $

Step by Step Solution

★★★★★

3.29 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 Net Initial Investment Outlay at Year 0 The net initial investment outlay at year 0 represents the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started