Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Table 1: DJIA Futures Question 4: Futures Contracts (2/10) The table above shows the daily closing values of the Dow Jones Industrial Average index (DJIA),

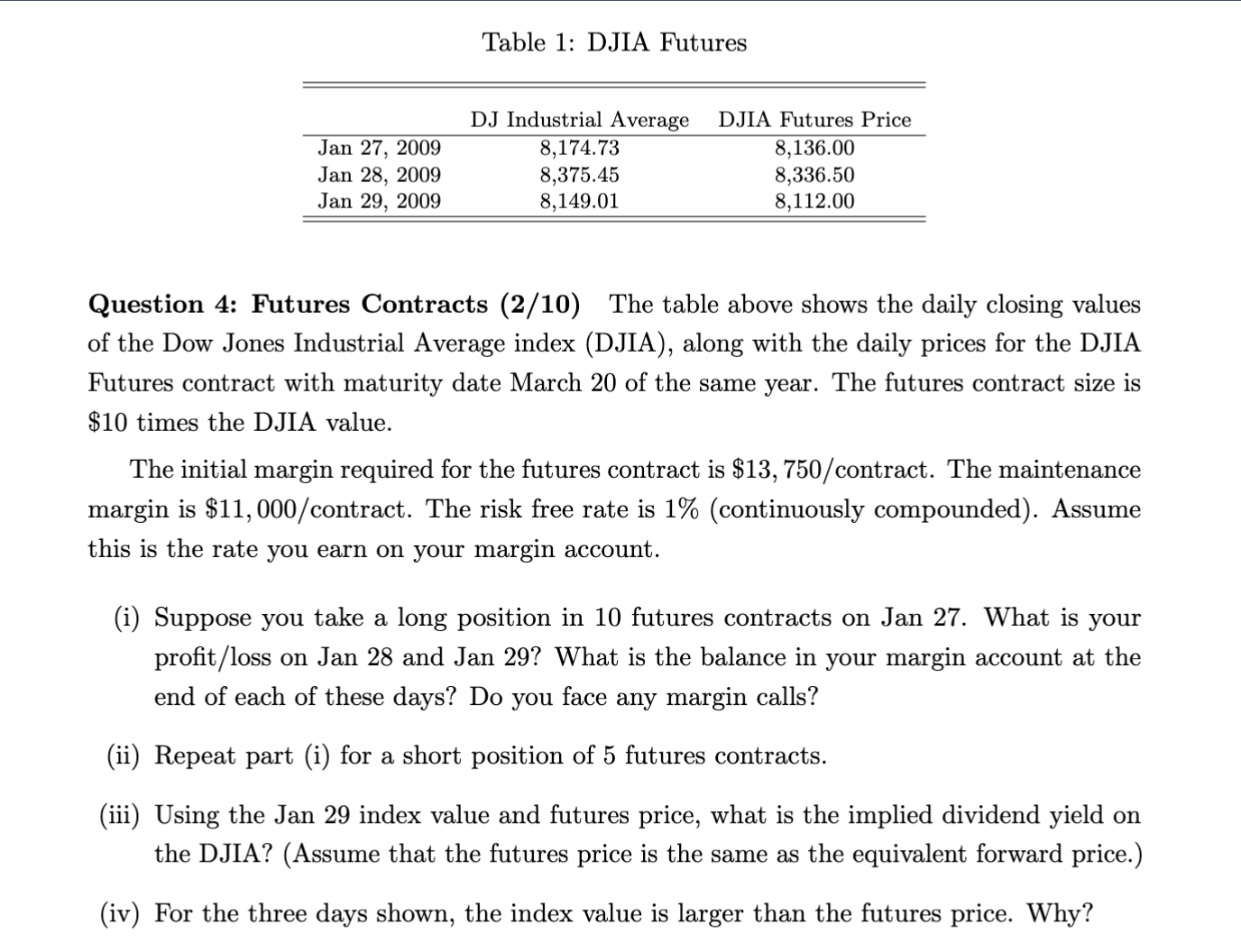

Table 1: DJIA Futures Question 4: Futures Contracts (2/10) The table above shows the daily closing values of the Dow Jones Industrial Average index (DJIA), along with the daily prices for the DJIA Futures contract with maturity date March 20 of the same year. The futures contract size is $10 times the DJIA value. The initial margin required for the futures contract is $13,750/ contract. The maintenance margin is $11,000/ contract. The risk free rate is 1% (continuously compounded). Assume this is the rate you earn on your margin account. (i) Suppose you take a long position in 10 futures contracts on Jan 27. What is your profit/loss on Jan 28 and Jan 29? What is the balance in your margin account at the end of each of these days? Do you face any margin calls? (ii) Repeat part (i) for a short position of 5 futures contracts. (iii) Using the Jan 29 index value and futures price, what is the implied dividend yield on the DJIA? (Assume that the futures price is the same as the equivalent forward price.) (iv) For the three days shown, the index value is larger than the futures price. Why

Table 1: DJIA Futures Question 4: Futures Contracts (2/10) The table above shows the daily closing values of the Dow Jones Industrial Average index (DJIA), along with the daily prices for the DJIA Futures contract with maturity date March 20 of the same year. The futures contract size is $10 times the DJIA value. The initial margin required for the futures contract is $13,750/ contract. The maintenance margin is $11,000/ contract. The risk free rate is 1% (continuously compounded). Assume this is the rate you earn on your margin account. (i) Suppose you take a long position in 10 futures contracts on Jan 27. What is your profit/loss on Jan 28 and Jan 29? What is the balance in your margin account at the end of each of these days? Do you face any margin calls? (ii) Repeat part (i) for a short position of 5 futures contracts. (iii) Using the Jan 29 index value and futures price, what is the implied dividend yield on the DJIA? (Assume that the futures price is the same as the equivalent forward price.) (iv) For the three days shown, the index value is larger than the futures price. Why Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started