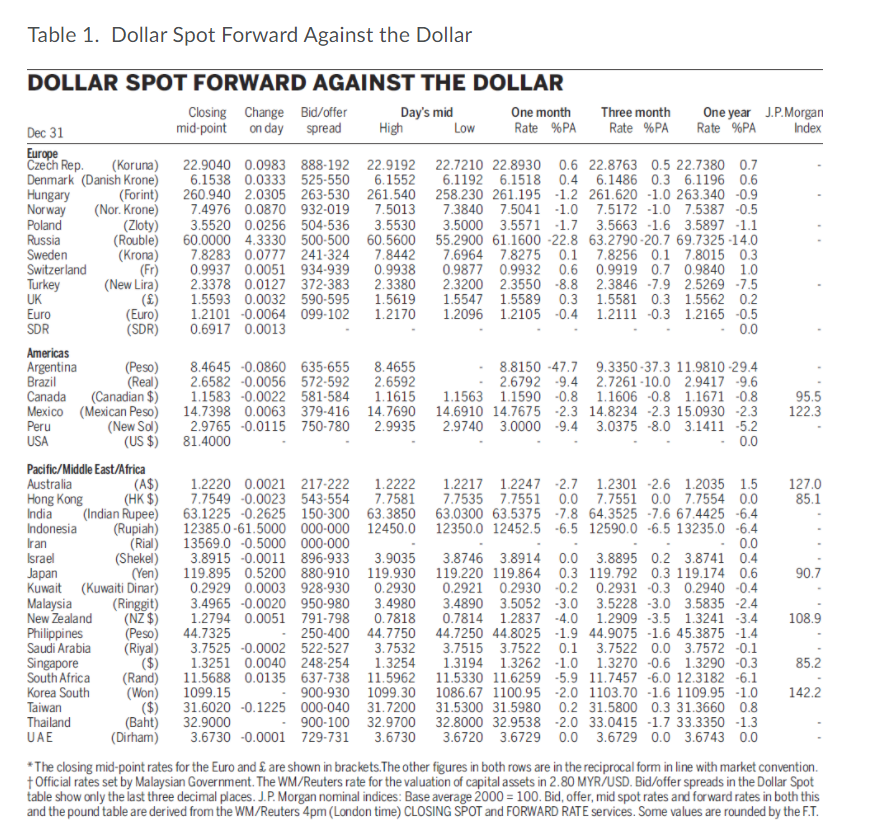

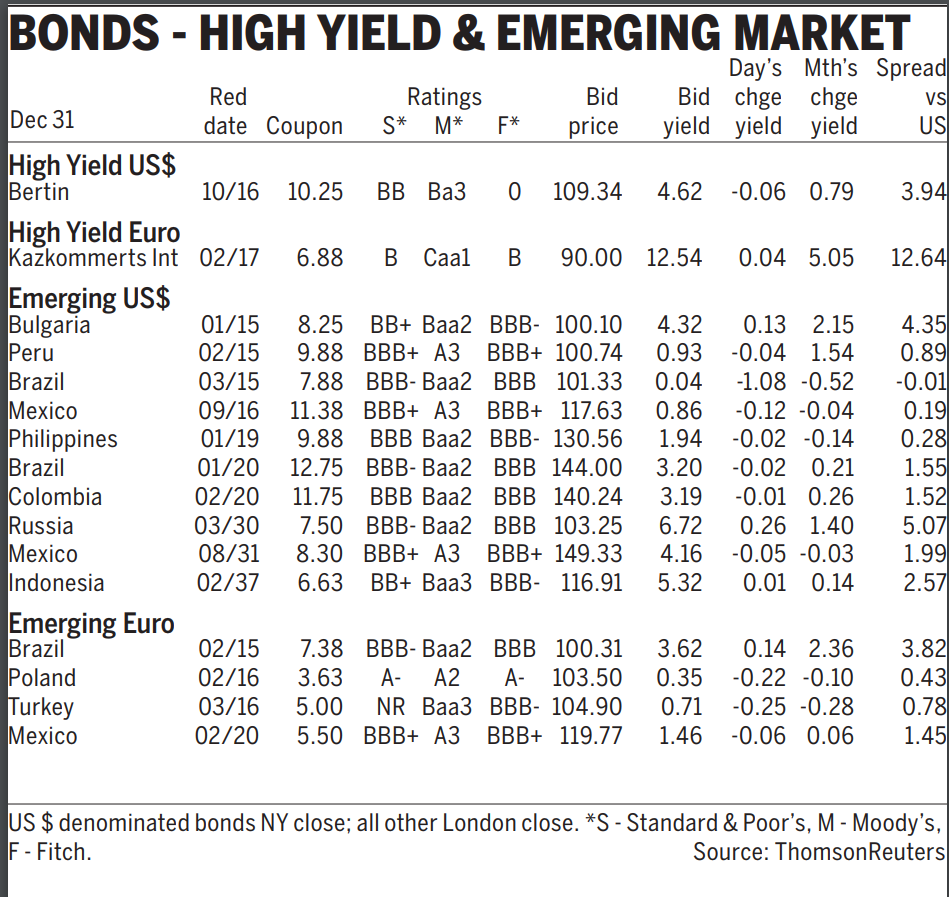

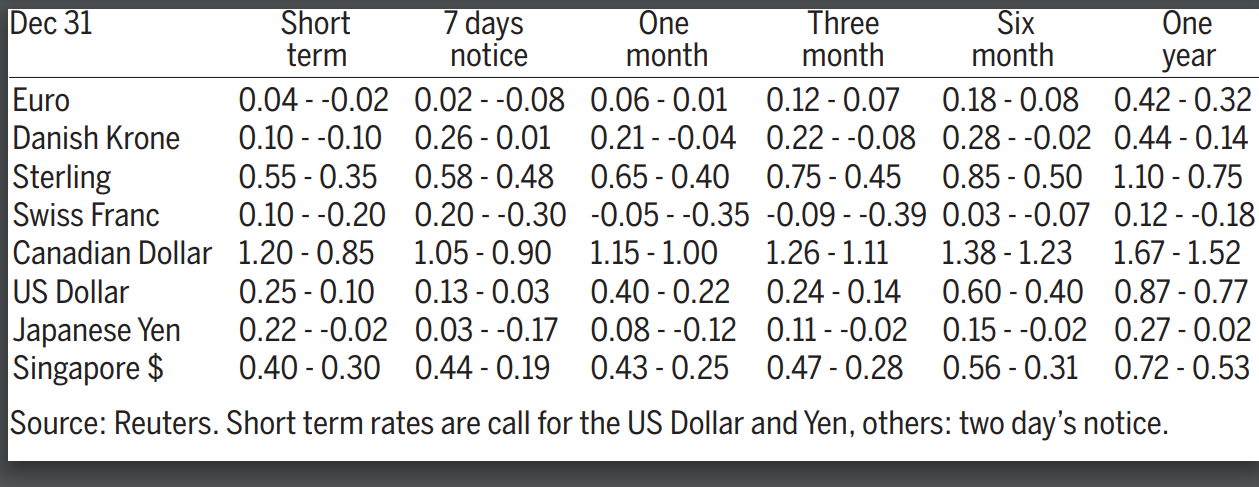

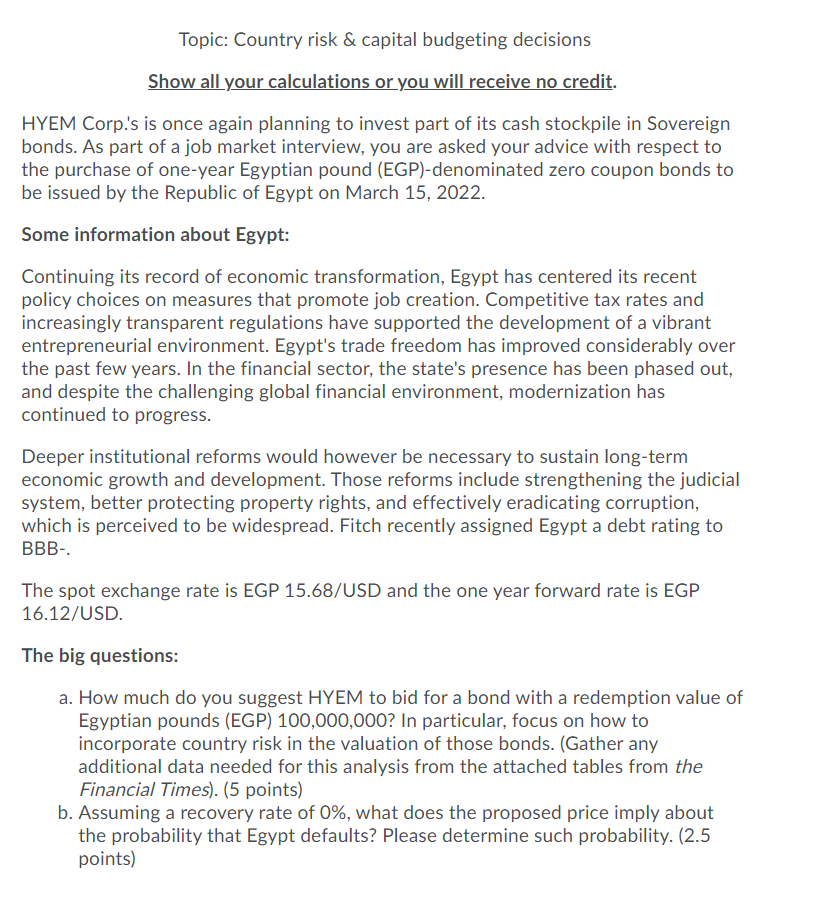

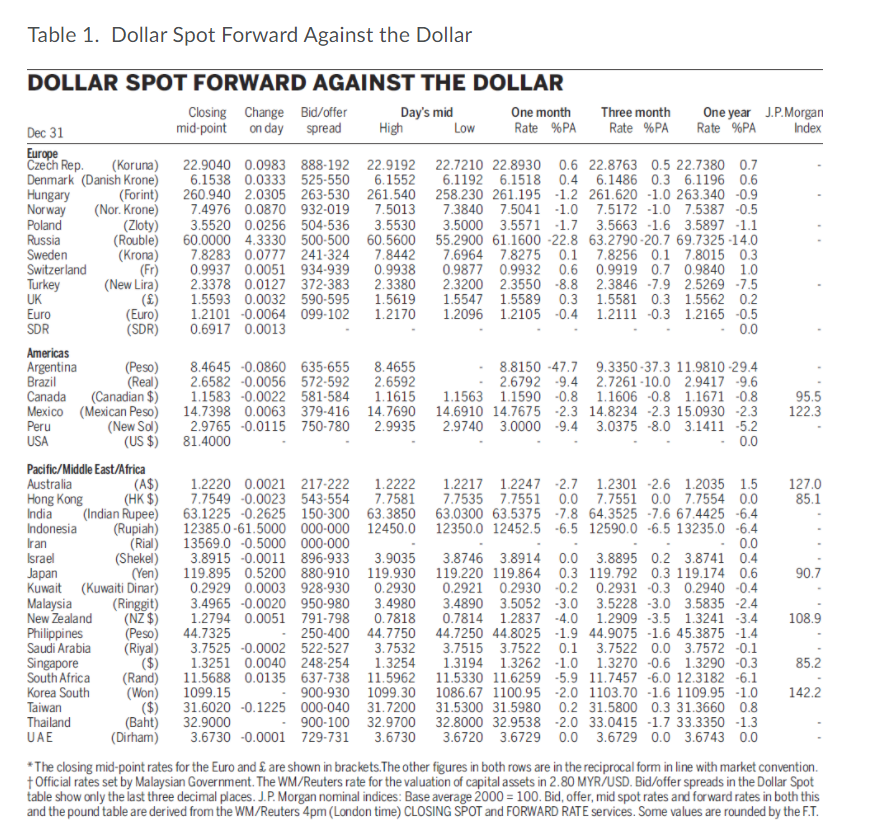

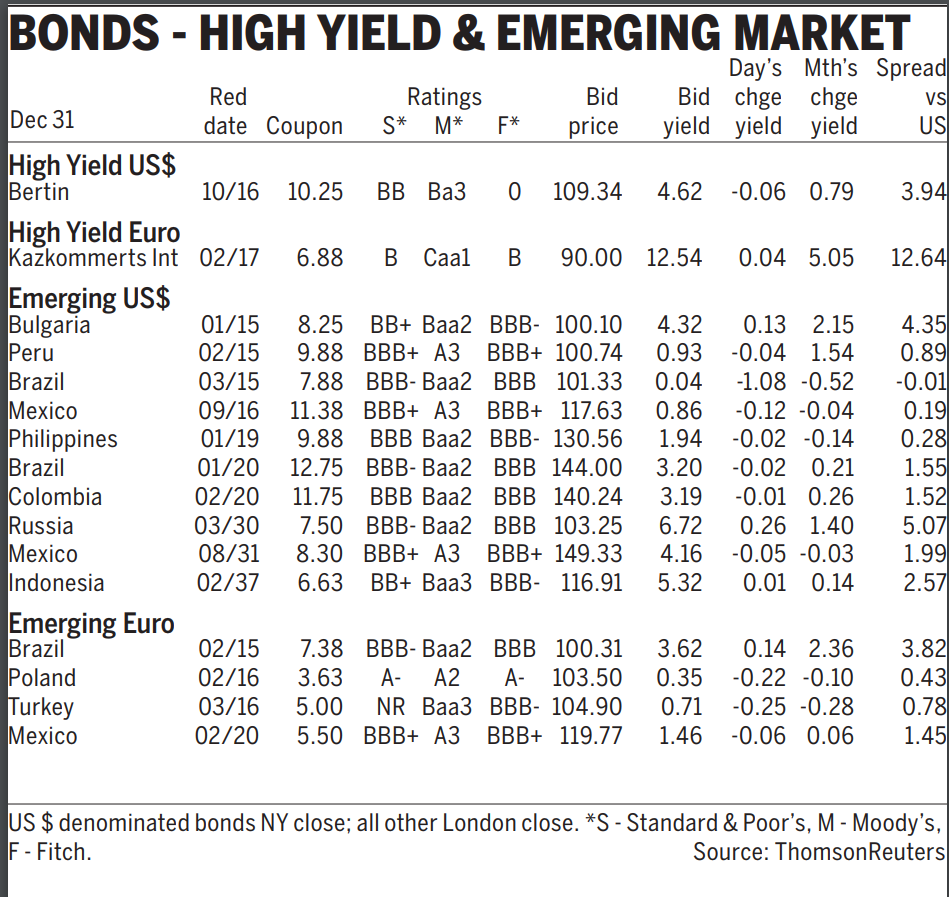

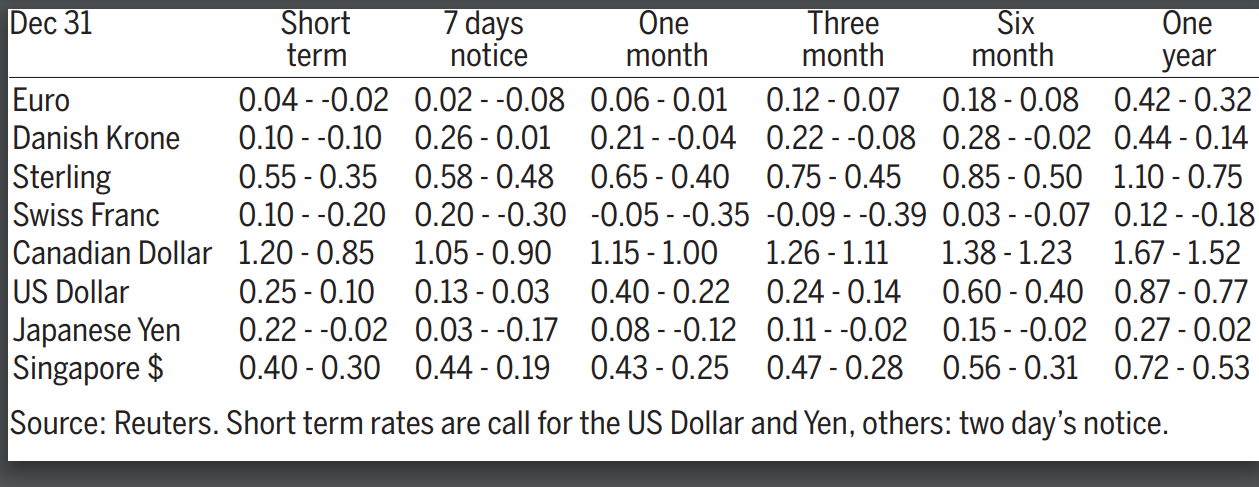

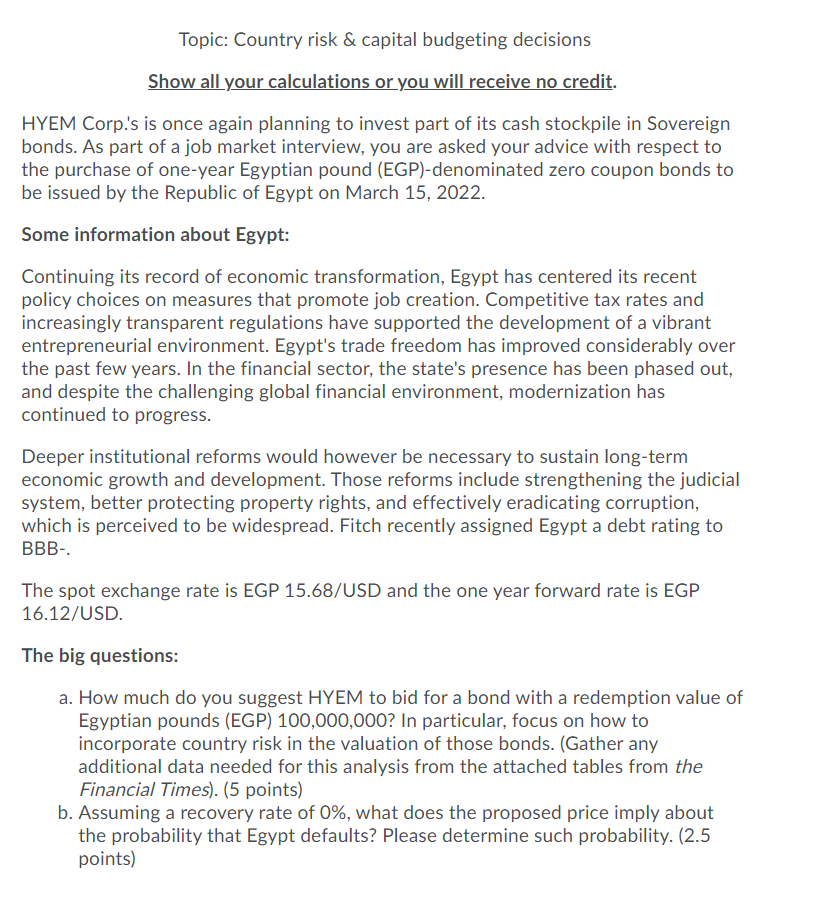

Table 1. Dollar Spot Forward Against the Dollar High 0.0 DOLLAR SPOT FORWARD AGAINST THE DOLLAR Closing Change Bid/offer Day's mid One month Three month One year J.P. Morgan Dec 31 mid-point on day spread Low Rate %PA Rate %PA Rate %PA Index Europe Czech Rep. (Koruna) 22.9040 0.0983 888-192 22.9192 22.7210 22.8930 0.6 22.8763 0.5 22.7380 0.7 Denmark (Danish Krone) 6.1538 0.0333 525-550 6.1552 6.1192 6.1518 0.4 6.1486 0.3 6.1196 0.6 Hungary (Forint) 260.940 2.0305 263-530 261.540 258.230 261.195 -1.2 261.620 -1.0 263.340 -0.9 Norway (Nor. Krone) 7.4976 0.0870 932-019 7.5013 7.3840 7.5041 -1.0 7.5172 -1.0 7.5387 -0.5 Poland (Zloty) 3.5520 0.0256 504-536 3.5530 3.5000 3.5571 1.7 3.5663 -1.6 3.5897 1.1 Russia (Rouble) 60.0000 4.3330 500-500 60.5600 55.2900 61.1600 -22.8 63.2790-20.7 69.7325-14.0 Sweden (Krona) 7.8283 0.0777 241-324 7.8442 7.6964 7.8275 0.1 7.8256 0.1 7.8015 0.3 Switzerland (Fr) 0.9937 0.0051 934-939 0.9938 0.9877 0.9932 0.6 0.9919 0.7 0.9840 1.0 Turkey (New Lira) 2.3378 0.0127 372-383 2.3380 2.3200 2.3550 -8.8 2.3846 -7.9 2.5269 -7.5 UK () 1.5593 0.0032 590-595 1.5619 1.5547 1.5589 0.3 1.5581 0.3 1.5562 0.2 Euro (Euro) 1.2101 -0.0064 099-102 1.2170 1.2096 1.2105 -0.4 1.2111 -0.3 1.2165 -0.5 SDR (SDR) 0.6917 0.0013 Americas Argentina (Peso) 8.4645 -0.0860 635-655 8.4655 8.8150 -47.7 9.3350-37.3 11.9810-29.4 Brazil (Real) 2.6582 -0.0056 572-592 2.6592 2.6792 -9.4 2.7261-10.0 2.9417 .9.6 Canada (Canadian $) 1.1583 -0.0022 581-584 1.1615 1.1563 1.1590 -0.8 1.1606 -0.8 1.1671 -0.8 95.5 Mexico (Mexican Peso) 14.7398 0.0063 379-416 14.7690 14.6910 14.7675 -2.3 14.8234 2.3 15.0930 -2.3 122.3 Peru (New Sol) 2.9765 -0.0115 750-780 2.9935 2.9740 3.0000 -9.4 3.0375 -8.0 3.1411 -5.2 USA (US$) 81.4000 -0.0 Pacific/Middle East/Africa Australia (A$) 1.2220 0.0021 217-222 1.2222 1.2217 1.2247 2.7 1.2301 -2.6 1.2035 1.5 127.0 Hong Kong (HK$) 7.7549 -0.0023 543-554 7.7581 7.7535 7.7551 0.0 7.7551 0.0 7.7554 0.0 85.1 India (Indian Rupee) 63.1225 -0.2625 150-300 63.3850 63.0300 63.5375 -7.8 64.3525 -7.6 67.4425 -6.4 Indonesia (Rupiah) 12385.0-61.5000000-000 12450.0 12350.0 12452.5 -6.5 12590.0 -6.5 13235.0 -6.4 (Rial) 13569.0 -0.5000000-000 0.0 Israel (Shekel) 3.8915 -0.0011 896-933 3.9035 3.8746 3.8914 0.0 3.8895 0.2 3.8741 0.4 Japan (Yen) 119.895 0.5200 880-910 119.930 119.220 119.864 0.3 119.792 0.3 119.174 0.6 90.7 Kuwait (Kuwaiti Dinar) 0.2929 0.0003 928-930 0.2930 0.2921 0.2930 0.2 0.2931 0.3 0.2940 -0.4 Malaysia (Ringgit) 3.4965 -0.0020 950-980 3.4980 3.4890 3.5052 -3.0 3.5228 -3.0 3.5835 -2.4 New Zealand (NZ$) 1.2794 0.0051 791-798 0.7818 0.7814 1.2837 -4.0 1.2909 -3.5 1.3241 -3.4 108.9 Philippines (Peso) 44.7325 250-400 44.7750 44.7250 44.8025 -1.9 44.9075 -1.6 45.3875 -1.4 Saudi Arabia (Riyal) 3.7525 -0.0002 522-527 3.7532 3.7515 3.7522 0.1 3.7522 0.0 3.7572 -0.1 Singapore ($) 1.3251 0.0040 248-254 1.3254 1.3194 1.3262.1.0 1.3270 -0.6 1.3290 -0.3 85.2 South Africa (Rand) 11.5688 0.0135 637-738 11.5962 11.5330 11.6259 -5.9 11.7457 -6.0 12.3182 -6.1 Korea South (Won) 1099.15 900-930 1099.30 1086.67 1100.95 -2.0 1103.70 -1.6 1109.95 -1.0 142.2 Taiwan ($) 31.6020 -0.1225 000-040 31.7200 31.5300 31.5980 0.2 31.5800 0.3 31.3660 0.8 Thailand (Baht) 32.9000 900-100 32.9700 32.8000 32.9538 -2.0 33.0415 -1.7 33.3350 -1.3 UAE (Dirham) 3.6730 -0.0001 729-731 3.6730 3.6720 3.6729 0.0 3.6729 0.0 3.6743 0.0 *The closing mid-point rates for the Euro and are shown in brackets. The other figures in both rows are in the reciprocal form in line with market convention. Official rates set by Malaysian Government. The WM/Reuters rate for the valuation of capital assets in 2.80 MYR/USD. Bid/offer spreads in the Dollar Spot table show only the last three decimal places. J.P. Morgan nominal indices: Base average 2000 = 100. Bid, offer, mid spot rates and forward rates in both this and the pound table are derived from the WM/Reuters 4pm (London time) CLOSING SPOT and FORWARD RATE services. Some values are rounded by the F.T. Iran - BONDS - HIGH YIELD & EMERGING MARKET Day's Mth's Spread Red Ratings Bid Bid chge chge VS Dec 31 date Coupon S* M* F* price yield yield yield US High Yield US$ Bertin 10/16 10.25 BB Ba3 0 109.34 4.62 -0.06 0.79 3.94 High Yield Euro Kazkommerts Int 02/17 6.88 B Caal B 90.00 12.54 0.04 5.05 12.64 Emerging US$ Bulgaria 01/15 8.25 BB+ Baa2 BBB- 100.10 4.32 0.13 2.15 4.35 Peru 02/15 9.88 BBB+ A3 BBB+ 100.74 0.93 -0.04 1.54 0.89 Brazil 03/15 7.88 BBB- Baa2 BBB 101.33 0.04 -1.08 -0.52 -0.01 Mexico 09/16 11.38 BBB+ A3 BBB+ 117.63 0.86 -0.12 -0.04 0.19 Philippines 01/19 9.88 BBB Baa2 BBB- 130.56 1.94 -0.02 -0.14 0.28 Brazil 01/20 12.75 BBB- Baa2 BBB 144.00 3.20 -0.02 0.21 1.55 Colombia 02/20 11.75 BBB Baa2 BBB 140.24 3.19 -0.01 0.26 1.52 Russia 03/30 7.50 BBB- Baa2 BBB 103.25 6.72 0.26 1.40 5.07 Mexico 08/31 8.30 BBB+ A3 BBB+ 149.33 4.16 -0.05 -0.03 1.99 Indonesia 02/37 6.63 BB+ Baa3 BBB- 116.91 5.32 0.01 0.14 2.57 Emerging Euro Brazil 02/15 7.38 BBB- Baa2 BBB 100.31 3.62 0.14 2.36 3.82 Poland 02/16 3.63 A- A2 A- 103.50 0.35 -0.22 -0.10 0.43 Turkey 03/16 5.00 NR Baa3 BBB- 104.90 0.71 -0.25 -0.28 0.78 Mexico 02/20 5.50 BBB+ A3 BBB+ 119.77 1.46 -0.06 0.06 1.45 US $ denominated bonds NY close; all other London close. *S - Standard & Poor's, M - Moody's, F - Fitch. Source: Thomson Reuters Dec 31 Short 7 days One Three Six One term notice month month month year Euro 0.04 - -0.02 0.02 - -0.08 0.06 -0.01 0.12 -0.07 0.18 -0.08 0.42 -0.32 Danish Krone 0.10--0.10 0.26 -0.01 0.21--0.04 0.22--0.08 0.28--0.02 0.44 -0.14 Sterling 0.55 -0.35 0.58 -0.48 0.65 -0.40 0.75 -0.45 0.85 -0.50 1.10 - 0.75 Swiss Franc 0.10 - -0.20 0.20--0.30 -0.05--0.35 -0.09--0.39 0.03 - -0.07 0.12--0.18 Canadian Dollar 1.20 - 0.85 1.05 -0.90 1.15 -1.00 1.26 - 1.11 1.38 - 1.23 1.67 - 1.52 US Dollar 0.25 -0.10 0.13 -0.03 0.40 -0.22 0.24 - 0.14 0.60 - 0.40 0.87 -0.77 Japanese Yen 0.22--0.02 0.03 - -0.17 0.08--0.12 0.11 - -0.02 0.15--0.02 0.27 - 0.02 Singapore $ 0.40 -0.30 0.44 -0.19 0.43 -0.25 0.47 -0.28 0.56 -0.31 0.72 - 0.53 Source: Reuters. Short term rates are call for the US Dollar and Yen, others: two day's notice. Topic: Country risk & capital budgeting decisions Show all your calculations or you will receive no credit. HYEM Corp.'s is once again planning to invest part of its cash stockpile in Sovereign bonds. As part of a job market interview, you are asked your advice with respect to the purchase of one-year Egyptian pound (EGP)-denominated zero coupon bonds to be issued by the Republic of Egypt on March 15, 2022. Some information about Egypt: Continuing its record of economic transformation, Egypt has centered its recent policy choices on measures that promote job creation. Competitive tax rates and increasingly transparent regulations have supported the development of a vibrant entrepreneurial environment. Egypt's trade freedom has improved considerably over the past few years. In the financial sector, the state's presence has been phased out, and despite the challenging global financial environment, modernization has continued to progress. Deeper institutional reforms would however be necessary to sustain long-term economic growth and development. Those reforms include strengthening the judicial system, better protecting property rights, and effectively eradicating corruption, which is perceived to be widespread. Fitch recently assigned Egypt a debt rating to BBB- The spot exchange rate is EGP 15.68/USD and the one year forward rate is EGP 16.12/USD. The big questions: a. How much do you suggest HYEM to bid for a bond with a redemption value of Egyptian pounds (EGP) 100,000,000? In particular, focus on how to incorporate country risk in the valuation of those bonds. (Gather any additional data needed for this analysis from the attached tables from the Financial Times). (5 points) b. Assuming a recovery rate of 0%, what does the proposed price imply about the probability that Egypt defaults? Please determine such probability. (2.5 points) Table 1. Dollar Spot Forward Against the Dollar High 0.0 DOLLAR SPOT FORWARD AGAINST THE DOLLAR Closing Change Bid/offer Day's mid One month Three month One year J.P. Morgan Dec 31 mid-point on day spread Low Rate %PA Rate %PA Rate %PA Index Europe Czech Rep. (Koruna) 22.9040 0.0983 888-192 22.9192 22.7210 22.8930 0.6 22.8763 0.5 22.7380 0.7 Denmark (Danish Krone) 6.1538 0.0333 525-550 6.1552 6.1192 6.1518 0.4 6.1486 0.3 6.1196 0.6 Hungary (Forint) 260.940 2.0305 263-530 261.540 258.230 261.195 -1.2 261.620 -1.0 263.340 -0.9 Norway (Nor. Krone) 7.4976 0.0870 932-019 7.5013 7.3840 7.5041 -1.0 7.5172 -1.0 7.5387 -0.5 Poland (Zloty) 3.5520 0.0256 504-536 3.5530 3.5000 3.5571 1.7 3.5663 -1.6 3.5897 1.1 Russia (Rouble) 60.0000 4.3330 500-500 60.5600 55.2900 61.1600 -22.8 63.2790-20.7 69.7325-14.0 Sweden (Krona) 7.8283 0.0777 241-324 7.8442 7.6964 7.8275 0.1 7.8256 0.1 7.8015 0.3 Switzerland (Fr) 0.9937 0.0051 934-939 0.9938 0.9877 0.9932 0.6 0.9919 0.7 0.9840 1.0 Turkey (New Lira) 2.3378 0.0127 372-383 2.3380 2.3200 2.3550 -8.8 2.3846 -7.9 2.5269 -7.5 UK () 1.5593 0.0032 590-595 1.5619 1.5547 1.5589 0.3 1.5581 0.3 1.5562 0.2 Euro (Euro) 1.2101 -0.0064 099-102 1.2170 1.2096 1.2105 -0.4 1.2111 -0.3 1.2165 -0.5 SDR (SDR) 0.6917 0.0013 Americas Argentina (Peso) 8.4645 -0.0860 635-655 8.4655 8.8150 -47.7 9.3350-37.3 11.9810-29.4 Brazil (Real) 2.6582 -0.0056 572-592 2.6592 2.6792 -9.4 2.7261-10.0 2.9417 .9.6 Canada (Canadian $) 1.1583 -0.0022 581-584 1.1615 1.1563 1.1590 -0.8 1.1606 -0.8 1.1671 -0.8 95.5 Mexico (Mexican Peso) 14.7398 0.0063 379-416 14.7690 14.6910 14.7675 -2.3 14.8234 2.3 15.0930 -2.3 122.3 Peru (New Sol) 2.9765 -0.0115 750-780 2.9935 2.9740 3.0000 -9.4 3.0375 -8.0 3.1411 -5.2 USA (US$) 81.4000 -0.0 Pacific/Middle East/Africa Australia (A$) 1.2220 0.0021 217-222 1.2222 1.2217 1.2247 2.7 1.2301 -2.6 1.2035 1.5 127.0 Hong Kong (HK$) 7.7549 -0.0023 543-554 7.7581 7.7535 7.7551 0.0 7.7551 0.0 7.7554 0.0 85.1 India (Indian Rupee) 63.1225 -0.2625 150-300 63.3850 63.0300 63.5375 -7.8 64.3525 -7.6 67.4425 -6.4 Indonesia (Rupiah) 12385.0-61.5000000-000 12450.0 12350.0 12452.5 -6.5 12590.0 -6.5 13235.0 -6.4 (Rial) 13569.0 -0.5000000-000 0.0 Israel (Shekel) 3.8915 -0.0011 896-933 3.9035 3.8746 3.8914 0.0 3.8895 0.2 3.8741 0.4 Japan (Yen) 119.895 0.5200 880-910 119.930 119.220 119.864 0.3 119.792 0.3 119.174 0.6 90.7 Kuwait (Kuwaiti Dinar) 0.2929 0.0003 928-930 0.2930 0.2921 0.2930 0.2 0.2931 0.3 0.2940 -0.4 Malaysia (Ringgit) 3.4965 -0.0020 950-980 3.4980 3.4890 3.5052 -3.0 3.5228 -3.0 3.5835 -2.4 New Zealand (NZ$) 1.2794 0.0051 791-798 0.7818 0.7814 1.2837 -4.0 1.2909 -3.5 1.3241 -3.4 108.9 Philippines (Peso) 44.7325 250-400 44.7750 44.7250 44.8025 -1.9 44.9075 -1.6 45.3875 -1.4 Saudi Arabia (Riyal) 3.7525 -0.0002 522-527 3.7532 3.7515 3.7522 0.1 3.7522 0.0 3.7572 -0.1 Singapore ($) 1.3251 0.0040 248-254 1.3254 1.3194 1.3262.1.0 1.3270 -0.6 1.3290 -0.3 85.2 South Africa (Rand) 11.5688 0.0135 637-738 11.5962 11.5330 11.6259 -5.9 11.7457 -6.0 12.3182 -6.1 Korea South (Won) 1099.15 900-930 1099.30 1086.67 1100.95 -2.0 1103.70 -1.6 1109.95 -1.0 142.2 Taiwan ($) 31.6020 -0.1225 000-040 31.7200 31.5300 31.5980 0.2 31.5800 0.3 31.3660 0.8 Thailand (Baht) 32.9000 900-100 32.9700 32.8000 32.9538 -2.0 33.0415 -1.7 33.3350 -1.3 UAE (Dirham) 3.6730 -0.0001 729-731 3.6730 3.6720 3.6729 0.0 3.6729 0.0 3.6743 0.0 *The closing mid-point rates for the Euro and are shown in brackets. The other figures in both rows are in the reciprocal form in line with market convention. Official rates set by Malaysian Government. The WM/Reuters rate for the valuation of capital assets in 2.80 MYR/USD. Bid/offer spreads in the Dollar Spot table show only the last three decimal places. J.P. Morgan nominal indices: Base average 2000 = 100. Bid, offer, mid spot rates and forward rates in both this and the pound table are derived from the WM/Reuters 4pm (London time) CLOSING SPOT and FORWARD RATE services. Some values are rounded by the F.T. Iran - BONDS - HIGH YIELD & EMERGING MARKET Day's Mth's Spread Red Ratings Bid Bid chge chge VS Dec 31 date Coupon S* M* F* price yield yield yield US High Yield US$ Bertin 10/16 10.25 BB Ba3 0 109.34 4.62 -0.06 0.79 3.94 High Yield Euro Kazkommerts Int 02/17 6.88 B Caal B 90.00 12.54 0.04 5.05 12.64 Emerging US$ Bulgaria 01/15 8.25 BB+ Baa2 BBB- 100.10 4.32 0.13 2.15 4.35 Peru 02/15 9.88 BBB+ A3 BBB+ 100.74 0.93 -0.04 1.54 0.89 Brazil 03/15 7.88 BBB- Baa2 BBB 101.33 0.04 -1.08 -0.52 -0.01 Mexico 09/16 11.38 BBB+ A3 BBB+ 117.63 0.86 -0.12 -0.04 0.19 Philippines 01/19 9.88 BBB Baa2 BBB- 130.56 1.94 -0.02 -0.14 0.28 Brazil 01/20 12.75 BBB- Baa2 BBB 144.00 3.20 -0.02 0.21 1.55 Colombia 02/20 11.75 BBB Baa2 BBB 140.24 3.19 -0.01 0.26 1.52 Russia 03/30 7.50 BBB- Baa2 BBB 103.25 6.72 0.26 1.40 5.07 Mexico 08/31 8.30 BBB+ A3 BBB+ 149.33 4.16 -0.05 -0.03 1.99 Indonesia 02/37 6.63 BB+ Baa3 BBB- 116.91 5.32 0.01 0.14 2.57 Emerging Euro Brazil 02/15 7.38 BBB- Baa2 BBB 100.31 3.62 0.14 2.36 3.82 Poland 02/16 3.63 A- A2 A- 103.50 0.35 -0.22 -0.10 0.43 Turkey 03/16 5.00 NR Baa3 BBB- 104.90 0.71 -0.25 -0.28 0.78 Mexico 02/20 5.50 BBB+ A3 BBB+ 119.77 1.46 -0.06 0.06 1.45 US $ denominated bonds NY close; all other London close. *S - Standard & Poor's, M - Moody's, F - Fitch. Source: Thomson Reuters Dec 31 Short 7 days One Three Six One term notice month month month year Euro 0.04 - -0.02 0.02 - -0.08 0.06 -0.01 0.12 -0.07 0.18 -0.08 0.42 -0.32 Danish Krone 0.10--0.10 0.26 -0.01 0.21--0.04 0.22--0.08 0.28--0.02 0.44 -0.14 Sterling 0.55 -0.35 0.58 -0.48 0.65 -0.40 0.75 -0.45 0.85 -0.50 1.10 - 0.75 Swiss Franc 0.10 - -0.20 0.20--0.30 -0.05--0.35 -0.09--0.39 0.03 - -0.07 0.12--0.18 Canadian Dollar 1.20 - 0.85 1.05 -0.90 1.15 -1.00 1.26 - 1.11 1.38 - 1.23 1.67 - 1.52 US Dollar 0.25 -0.10 0.13 -0.03 0.40 -0.22 0.24 - 0.14 0.60 - 0.40 0.87 -0.77 Japanese Yen 0.22--0.02 0.03 - -0.17 0.08--0.12 0.11 - -0.02 0.15--0.02 0.27 - 0.02 Singapore $ 0.40 -0.30 0.44 -0.19 0.43 -0.25 0.47 -0.28 0.56 -0.31 0.72 - 0.53 Source: Reuters. Short term rates are call for the US Dollar and Yen, others: two day's notice. Topic: Country risk & capital budgeting decisions Show all your calculations or you will receive no credit. HYEM Corp.'s is once again planning to invest part of its cash stockpile in Sovereign bonds. As part of a job market interview, you are asked your advice with respect to the purchase of one-year Egyptian pound (EGP)-denominated zero coupon bonds to be issued by the Republic of Egypt on March 15, 2022. Some information about Egypt: Continuing its record of economic transformation, Egypt has centered its recent policy choices on measures that promote job creation. Competitive tax rates and increasingly transparent regulations have supported the development of a vibrant entrepreneurial environment. Egypt's trade freedom has improved considerably over the past few years. In the financial sector, the state's presence has been phased out, and despite the challenging global financial environment, modernization has continued to progress. Deeper institutional reforms would however be necessary to sustain long-term economic growth and development. Those reforms include strengthening the judicial system, better protecting property rights, and effectively eradicating corruption, which is perceived to be widespread. Fitch recently assigned Egypt a debt rating to BBB- The spot exchange rate is EGP 15.68/USD and the one year forward rate is EGP 16.12/USD. The big questions: a. How much do you suggest HYEM to bid for a bond with a redemption value of Egyptian pounds (EGP) 100,000,000? In particular, focus on how to incorporate country risk in the valuation of those bonds. (Gather any additional data needed for this analysis from the attached tables from the Financial Times). (5 points) b. Assuming a recovery rate of 0%, what does the proposed price imply about the probability that Egypt defaults? Please determine such probability. (2.5 points)