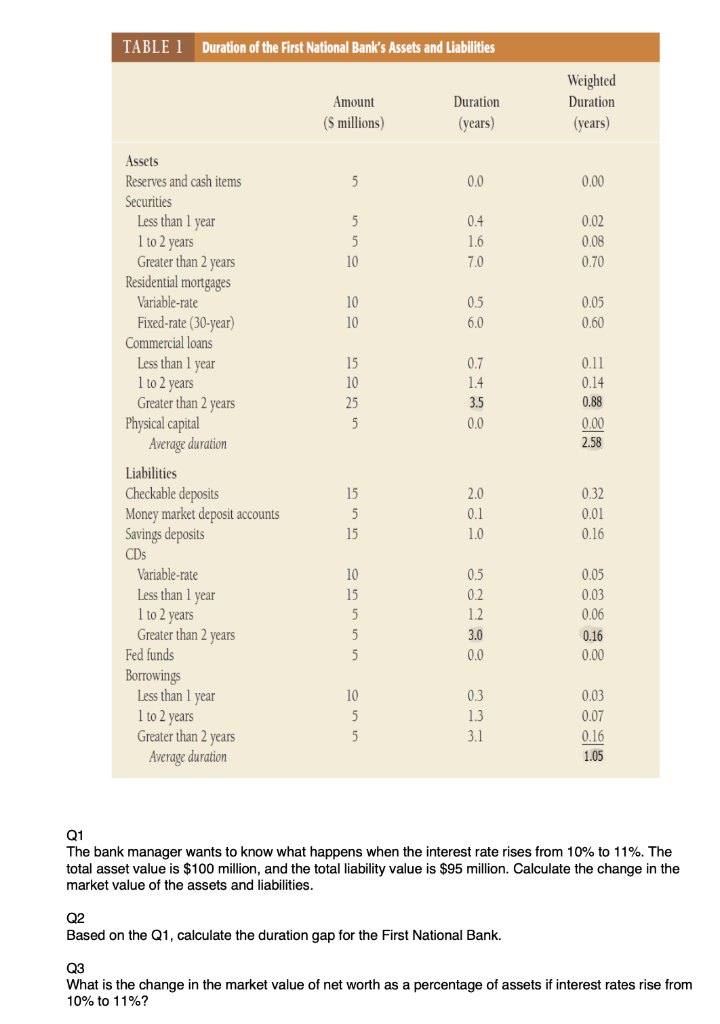

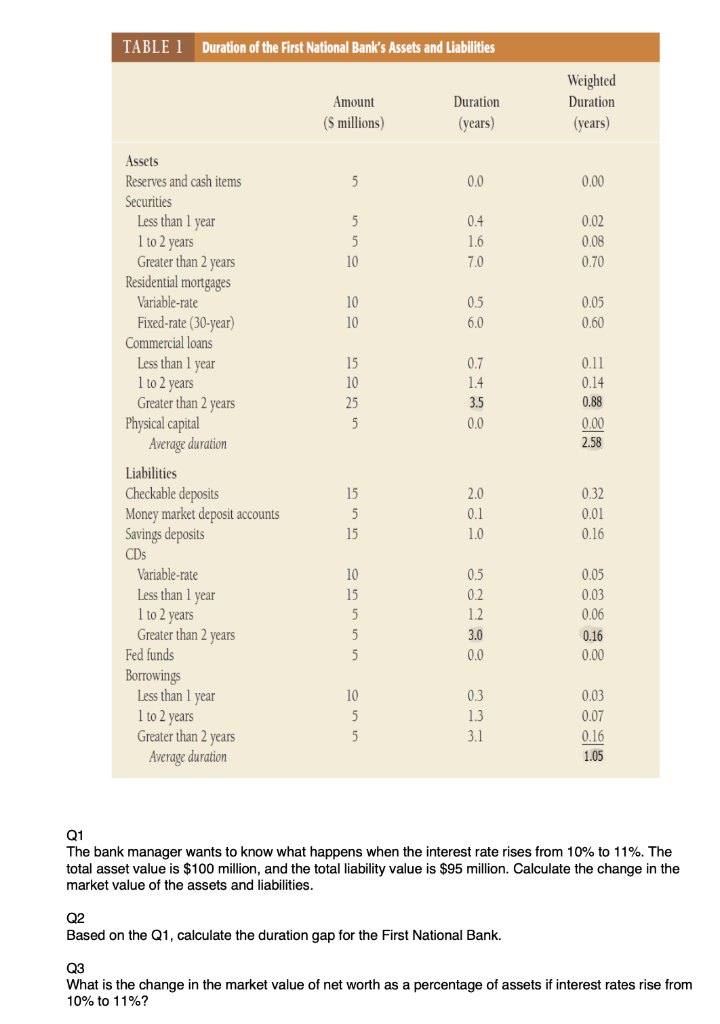

TABLE 1 Duration of the First National Bank's Assets and Liabilities Amount (5 millions) Duration (years) Weighted Duration (years) 5 0.0 0.00 5 5 10 0.4 1.6 7.0 0.02 0.08 0.70 10 10 0.5 6.0 0.05 0.60 15 10 25 5 0.7 1.4 3.5 0.0 Assets Reserves and cash items Securities Less than 1 year 1 to 2 years Greater than 2 years Residential mortgages Variable-rate Fixed-rate (30-year) Commercial loans Less than 1 year 1 to 2 years Greater than 2 years Physical capital Average duration Liabilities Checkable deposits Money market deposit accounts Savings deposits CDs Variable-rate Less than 1 year 1 to 2 years Greater than 2 years Fed funds Borrowings Less than 1 year 1 to 2 years Greater than 2 years 0.11 0.14 0.88 0.00 2.58 15 2.0 0.1 1.0 0.32 0.01 0.16 15 10 15 5 ununua 0.5 0.2 1.2 3.0 0.0 0.05 0.03 0.06 0.16 0.00 10 5 5 0.3 1.3 3.1 0.03 0.07 0.16 1.05 Average duration Q1 The bank manager wants to know what happens when the interest rate rises from 10% to 11%. The total asset value is $100 million, and the total liability value is $95 million. Calculate the change in the market value of the assets and liabilities. Q2 Based on the Q1, calculate the duration gap for the First National Bank. Q3 What is the change in the market value of net worth as a percentage of assets 10% to 11%? interest rates rise from TABLE 1 Duration of the First National Bank's Assets and Liabilities Amount (5 millions) Duration (years) Weighted Duration (years) 5 0.0 0.00 5 5 10 0.4 1.6 7.0 0.02 0.08 0.70 10 10 0.5 6.0 0.05 0.60 15 10 25 5 0.7 1.4 3.5 0.0 Assets Reserves and cash items Securities Less than 1 year 1 to 2 years Greater than 2 years Residential mortgages Variable-rate Fixed-rate (30-year) Commercial loans Less than 1 year 1 to 2 years Greater than 2 years Physical capital Average duration Liabilities Checkable deposits Money market deposit accounts Savings deposits CDs Variable-rate Less than 1 year 1 to 2 years Greater than 2 years Fed funds Borrowings Less than 1 year 1 to 2 years Greater than 2 years 0.11 0.14 0.88 0.00 2.58 15 2.0 0.1 1.0 0.32 0.01 0.16 15 10 15 5 ununua 0.5 0.2 1.2 3.0 0.0 0.05 0.03 0.06 0.16 0.00 10 5 5 0.3 1.3 3.1 0.03 0.07 0.16 1.05 Average duration Q1 The bank manager wants to know what happens when the interest rate rises from 10% to 11%. The total asset value is $100 million, and the total liability value is $95 million. Calculate the change in the market value of the assets and liabilities. Q2 Based on the Q1, calculate the duration gap for the First National Bank. Q3 What is the change in the market value of net worth as a percentage of assets 10% to 11%? interest rates rise from