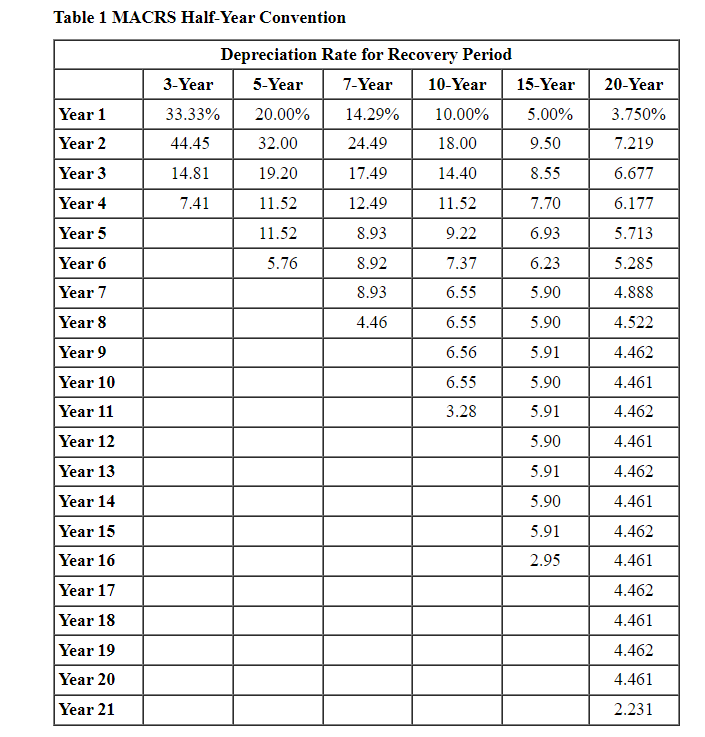

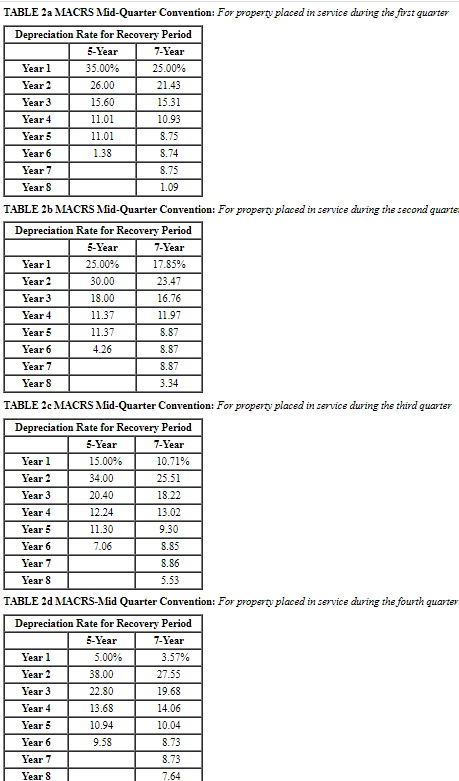

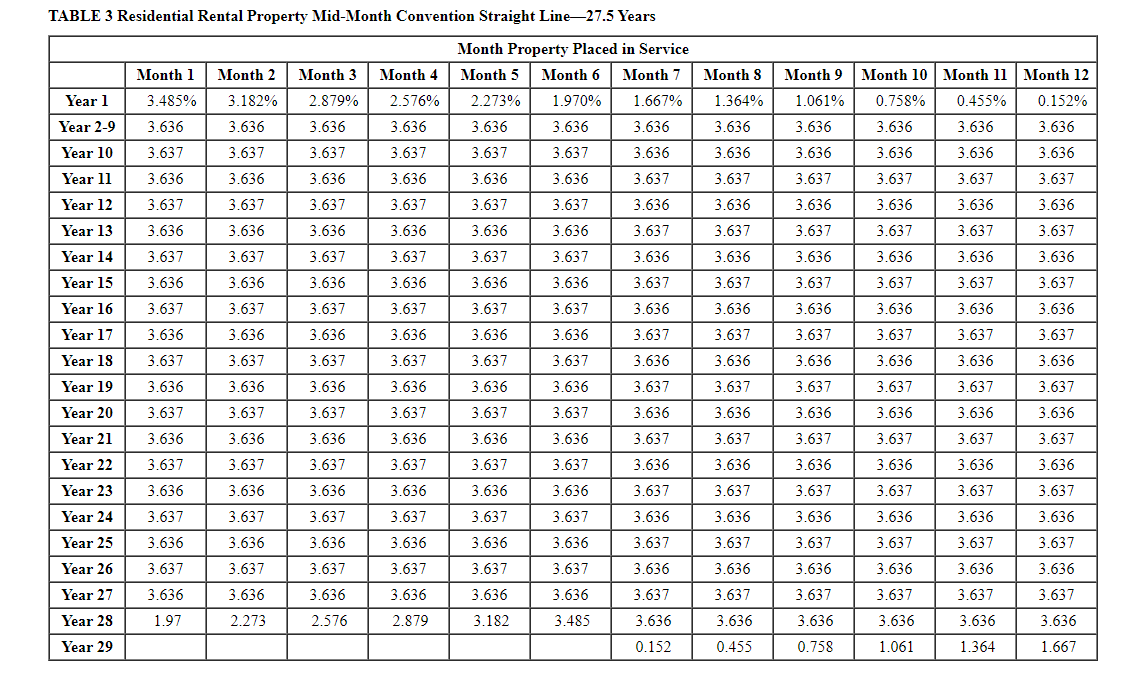

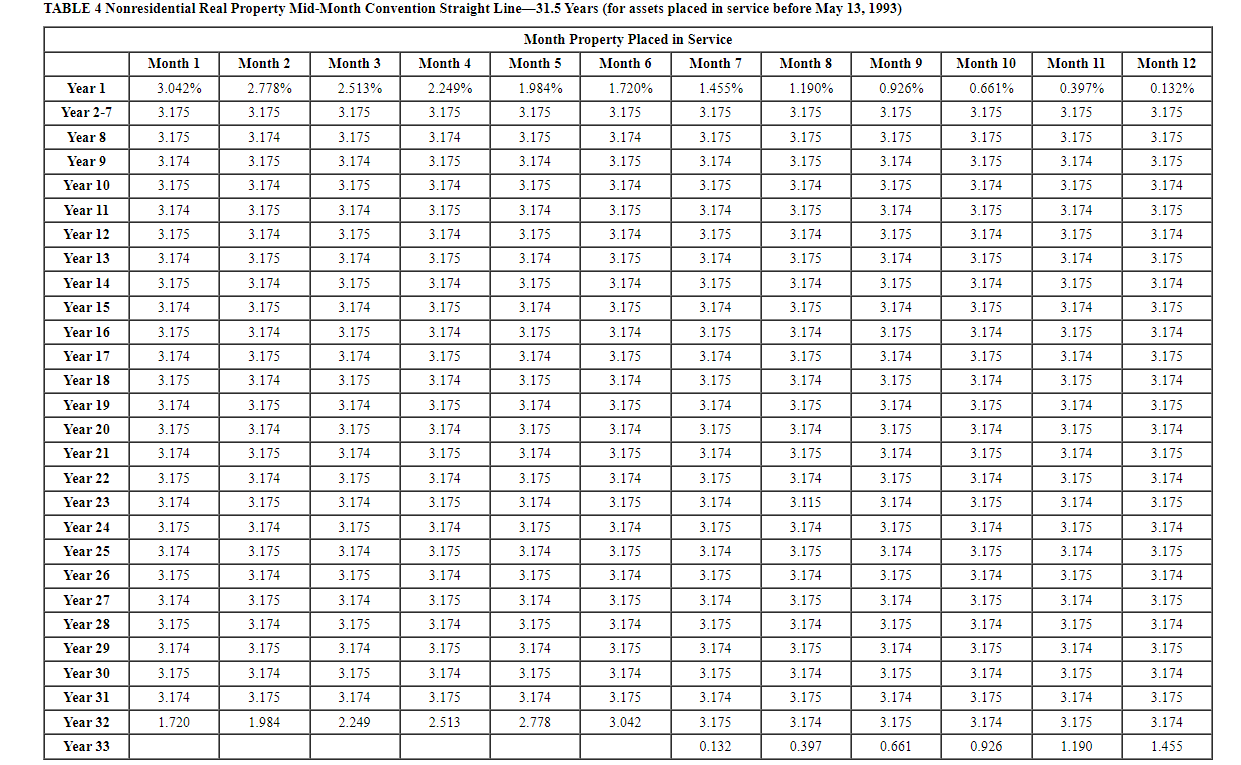

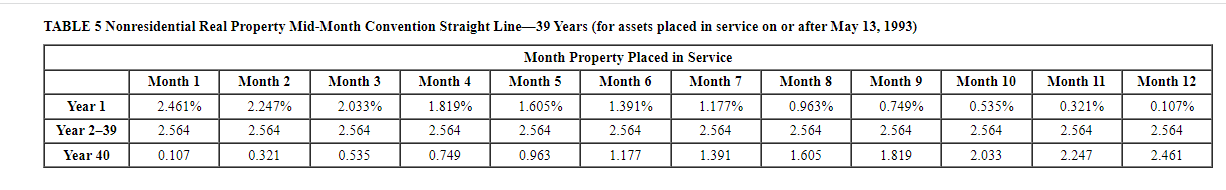

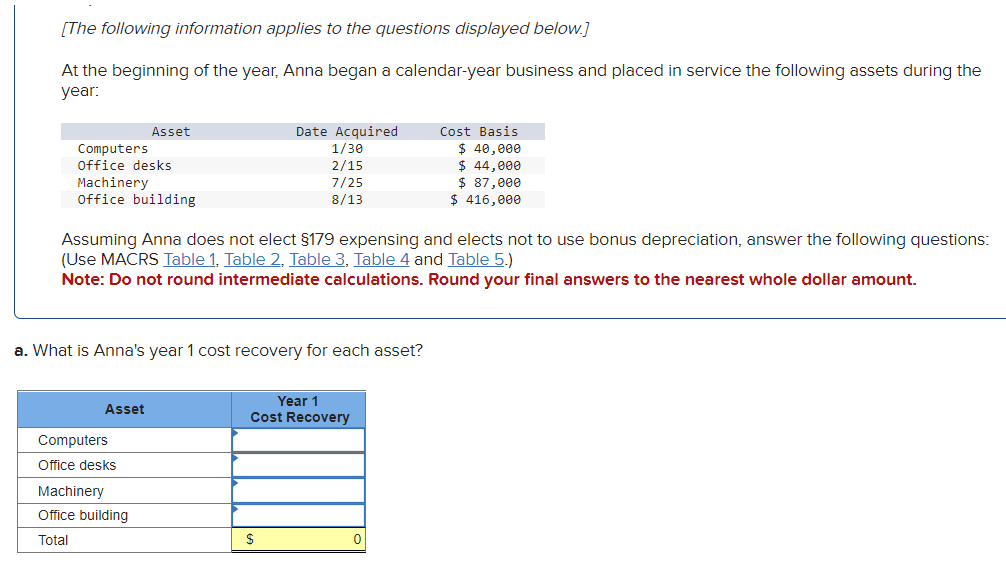

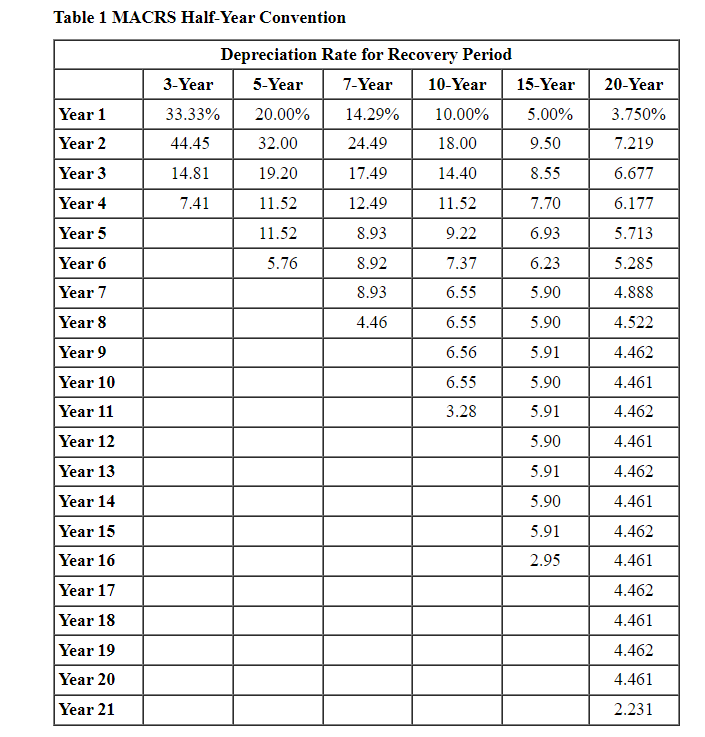

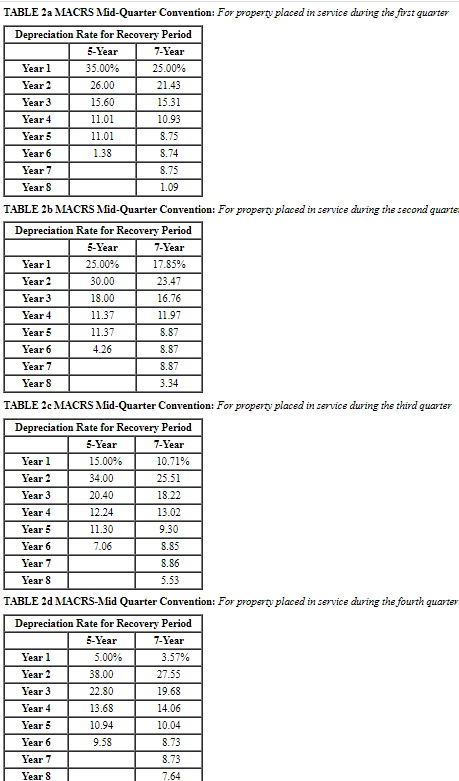

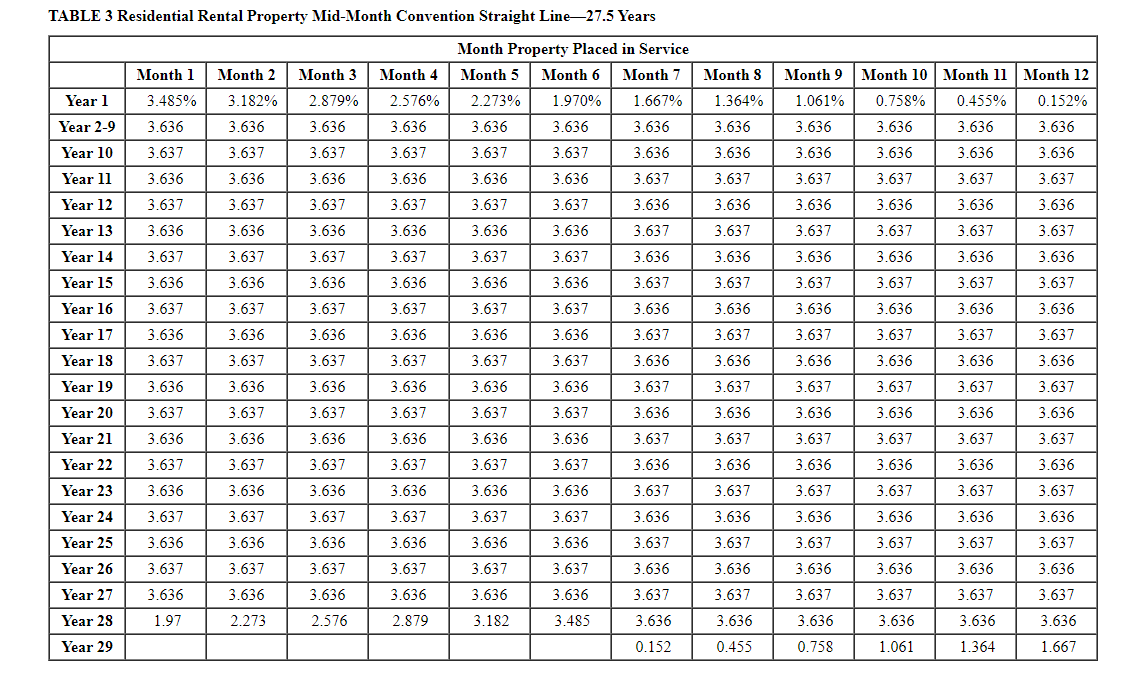

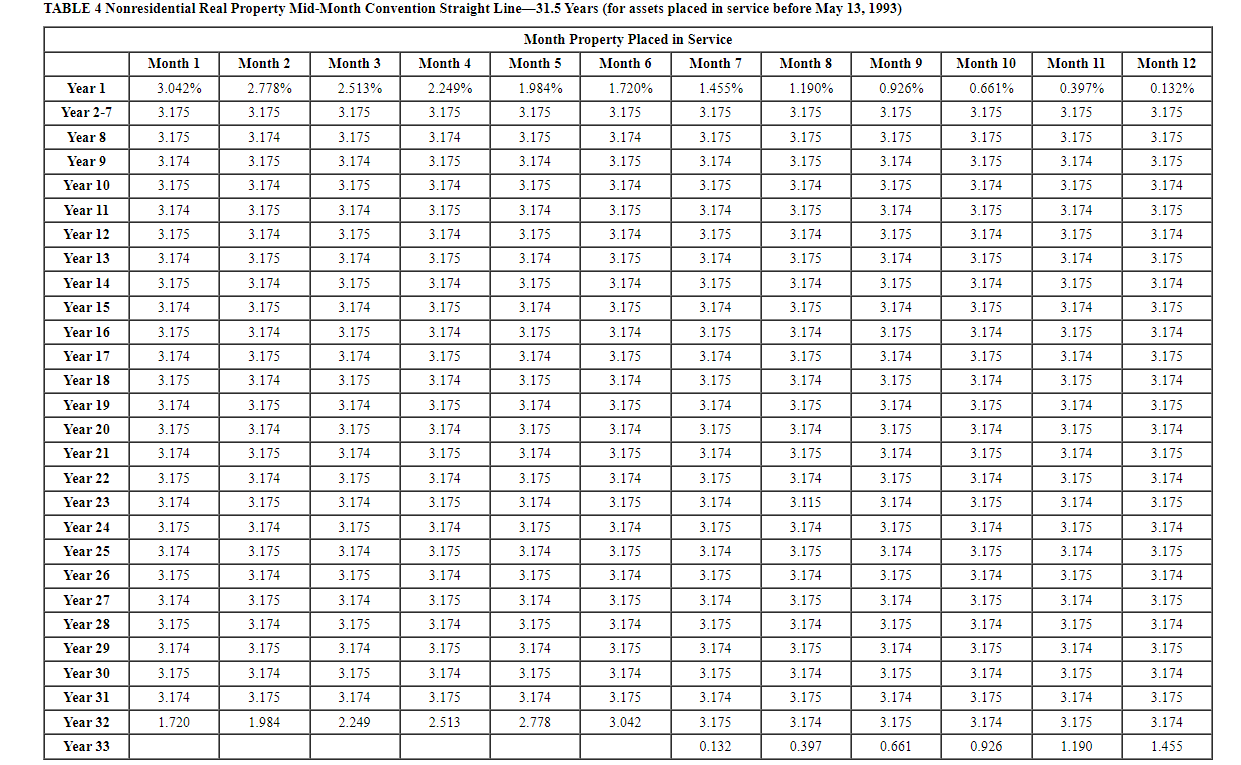

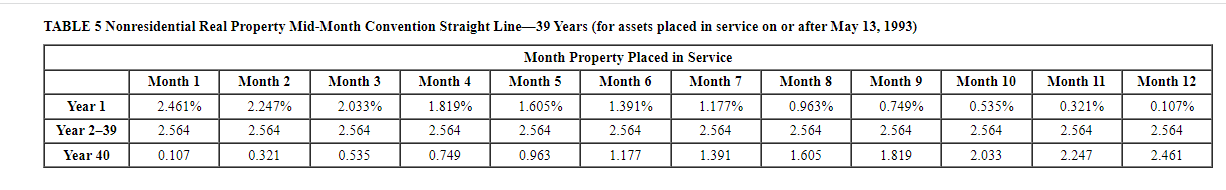

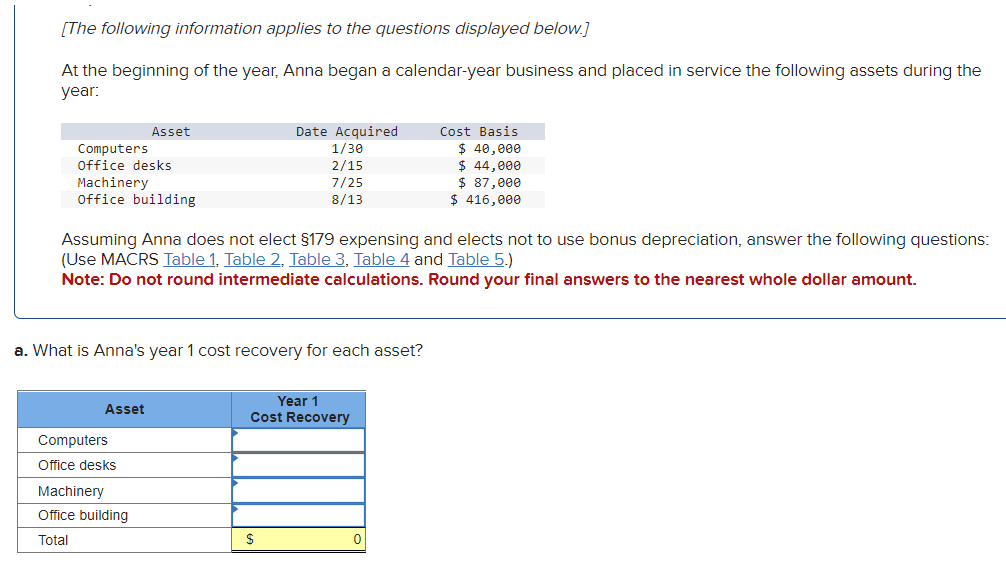

Table 1 MACRS Half-Year Convention TABLE 2 a MACRS Mid-Quarter Convention: For property placed in service choing the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarte TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quartel TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line-31.5 Years (for assets placed in service before May 13 , 1993 ) TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993 ) [The following information applies to the questions displayed below.] At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Assuming Anna does not elect $179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dount. a. What is Anna's year 1 cost recovery for each asset? Table 1 MACRS Half-Year Convention TABLE 2 a MACRS Mid-Quarter Convention: For property placed in service choing the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarte TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quartel TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years TABLE 4 Nonresidential Real Property Mid-Month Convention Straight Line-31.5 Years (for assets placed in service before May 13 , 1993 ) TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993 ) [The following information applies to the questions displayed below.] At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Assuming Anna does not elect $179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dount. a. What is Anna's year 1 cost recovery for each asset