Answered step by step

Verified Expert Solution

Question

1 Approved Answer

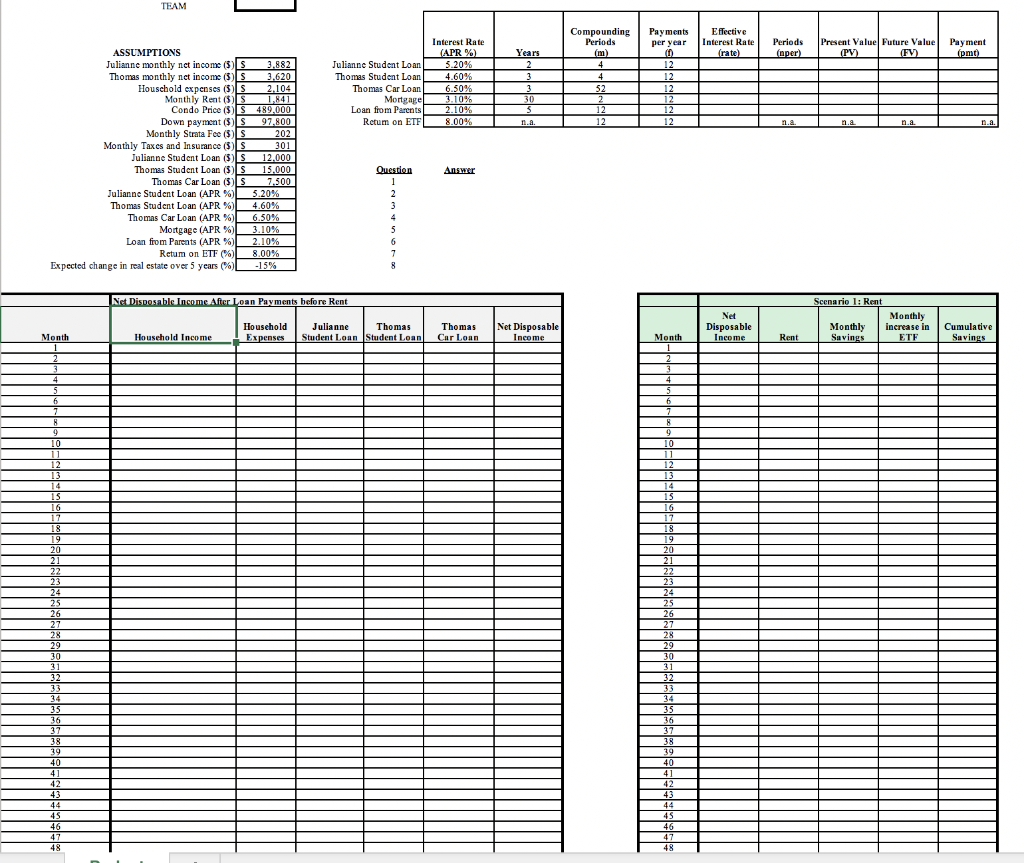

Table 1: Net Disposable Income After Loan Payments before Rent Table 2: Scenario 1: Rent Table 3: Scenario 2: Buy a Condominium Table 4: Mortgage

Table 1: Net Disposable Income After Loan Payments before Rent

Table 2: Scenario 1: Rent

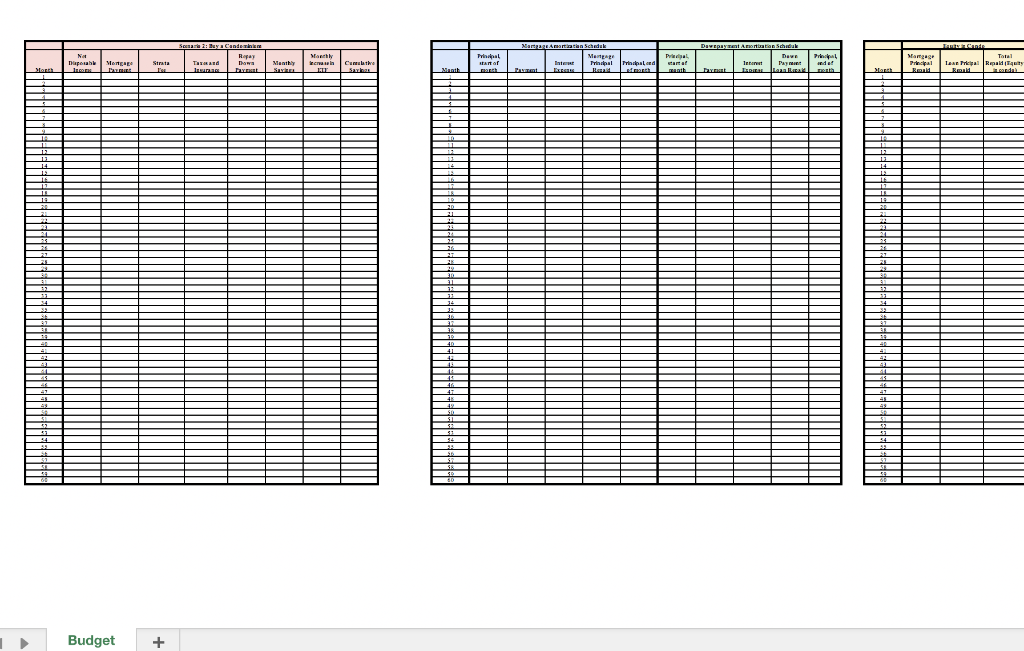

Table 3: Scenario 2: Buy a Condominium

Table 4: Mortgage Amortization Schedule and Downpayment Amortization Schedule

Table 5: Equity in Condo

Summary of the task:

- Fill all the above tables and answer the following questions:

- What is their combined net disposable income excluding rent?

- What are cumulative savings, at the end of the five years, under the Rent scenario?

- Under the Buy scenario, what are the cumulative savings after five years?

- How much principal do they still owe on the mortgage after five years?

- How much wealth they have in each scenario? (Wealth=Cumulative Savings + House Equity)

- Same question as 6, but if the condo value drops by 15%.

- At what percentage drop in condo value would they be indifferent between the two choices, Rent or Buy?

**Please Show the calculations in excel****

TEAM Payments per year Effective Interest Rate (rate) Periods (nper) Present Value Future Value (PV) (FV) Payment (pm) ( Julianne Student Loan Thomas Student Loan Thomas Car Loan Morteage Loan from Parents Retum on ETF Interest Rate (APR%) 5.20% 4.60% 6.50% 3.10% 2.10% 8.00% Years 2 3 3 30 5 Compounding Periods (m) 4 4 52 2 12 12 12 12 12 12 12 12 n. a. n.a. . n.a. n. a. ASSUMPTIONS Julianne monthly net income (5) 3.882 Thomas monthly net income (5 3.620 Household expenses (3) 2.104 Monthly Rent (5) S1,841 () Condo Price (5) S S 489,000 Down payment (3) 97,800 Monthly Strata Fee (5) S 202 Monthly Taxes and Insurance (5) 301 Julianne Student Loan (5) S 12.000 Thomas Student Loan (3) S 15.000 Thomas Car Loan (5) S 7,500 Julianne Student Loan (APR%) 5.20% Thomas Student Loan (APR % 4.60% Thomas Car Loan (APR%) 6.50% Mortgage (APR %) 3.10% Loan from Parents (APR %) 2.10% Retum on ETF (%) 8.00% Expected change in real estate over 5 years (%) -15% Answer Question 1 2 3 4 5 6 7 Net Disposable Income After Loan Payments before Rent Scenario 1: Ron Household Expenses Thomas Car Loan Julianne Thomas Student Loan Student Loan Net Disposable Income Net Disposable Income Monthly Savings Monthly increase in ETF Month Household Income Month Rent Cumulative Savings 2 3 4 5 6 7 8 Q 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 33 34 35 36 37 38 39 40 4 42 43 44 45 46 47 48 cena 2: Baya Candesh Roy Town Dhew Margus arep 22 Amarela Schedule Merapi P Trial war Bedah Dipesa Mer Map terasen Creathe HES Trial antar Total Real Monthly Davepala Scheda Devel len bayrat una Llena Brak most Stra Pay Budget + TEAM Payments per year Effective Interest Rate (rate) Periods (nper) Present Value Future Value (PV) (FV) Payment (pm) ( Julianne Student Loan Thomas Student Loan Thomas Car Loan Morteage Loan from Parents Retum on ETF Interest Rate (APR%) 5.20% 4.60% 6.50% 3.10% 2.10% 8.00% Years 2 3 3 30 5 Compounding Periods (m) 4 4 52 2 12 12 12 12 12 12 12 12 n. a. n.a. . n.a. n. a. ASSUMPTIONS Julianne monthly net income (5) 3.882 Thomas monthly net income (5 3.620 Household expenses (3) 2.104 Monthly Rent (5) S1,841 () Condo Price (5) S S 489,000 Down payment (3) 97,800 Monthly Strata Fee (5) S 202 Monthly Taxes and Insurance (5) 301 Julianne Student Loan (5) S 12.000 Thomas Student Loan (3) S 15.000 Thomas Car Loan (5) S 7,500 Julianne Student Loan (APR%) 5.20% Thomas Student Loan (APR % 4.60% Thomas Car Loan (APR%) 6.50% Mortgage (APR %) 3.10% Loan from Parents (APR %) 2.10% Retum on ETF (%) 8.00% Expected change in real estate over 5 years (%) -15% Answer Question 1 2 3 4 5 6 7 Net Disposable Income After Loan Payments before Rent Scenario 1: Ron Household Expenses Thomas Car Loan Julianne Thomas Student Loan Student Loan Net Disposable Income Net Disposable Income Monthly Savings Monthly increase in ETF Month Household Income Month Rent Cumulative Savings 2 3 4 5 6 7 8 Q 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 33 34 35 36 37 38 39 40 4 42 43 44 45 46 47 48 cena 2: Baya Candesh Roy Town Dhew Margus arep 22 Amarela Schedule Merapi P Trial war Bedah Dipesa Mer Map terasen Creathe HES Trial antar Total Real Monthly Davepala Scheda Devel len bayrat una Llena Brak most Stra Pay Budget +Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started