Answered step by step

Verified Expert Solution

Question

1 Approved Answer

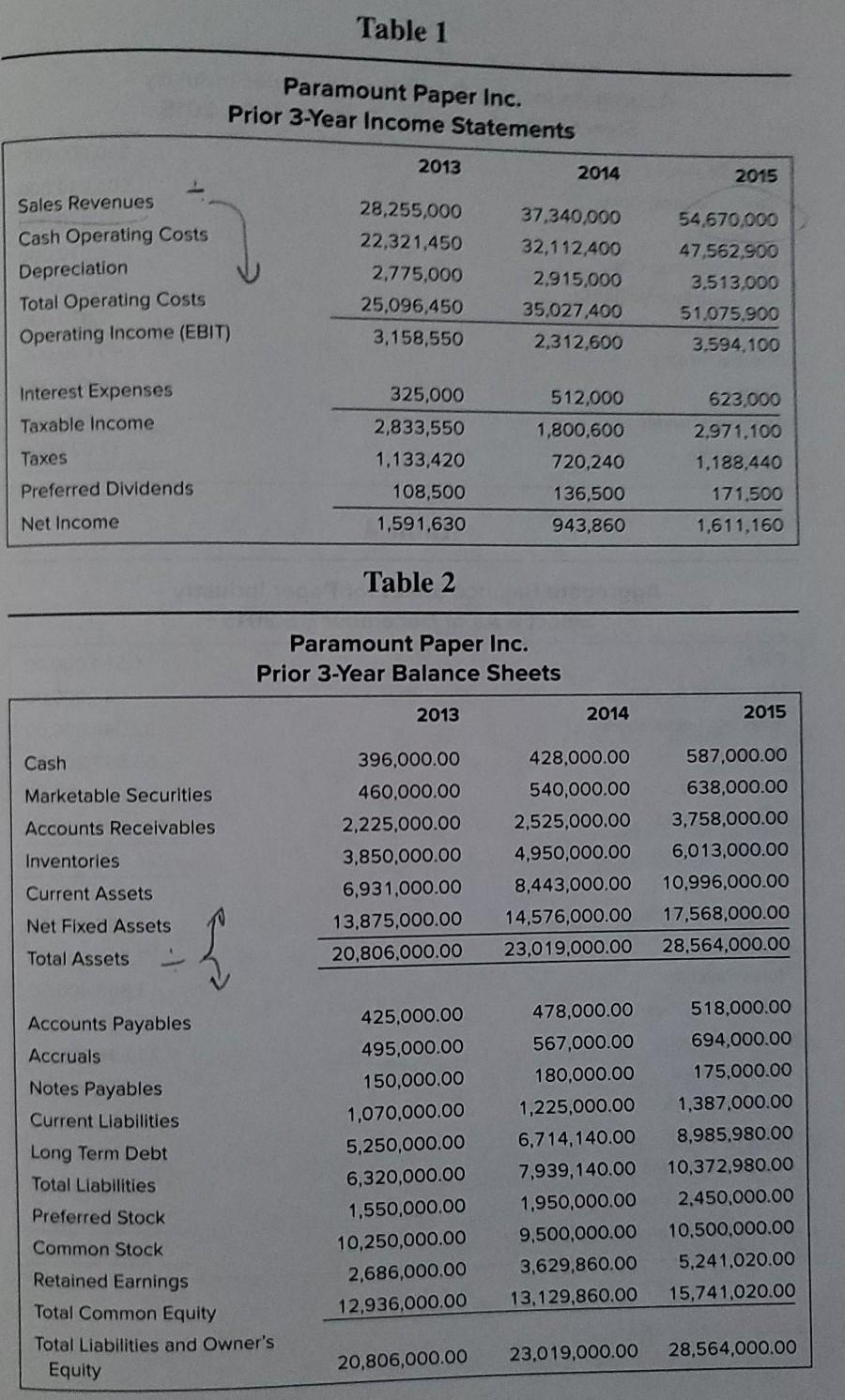

Table 1 Paramount Paper Inc. Prior 3-Year Income Statements 2013 2014 2015 Sales Revenues Cash Operating Costs Depreciation Total Operating Costs Operating Income (EBIT) 28,255,000

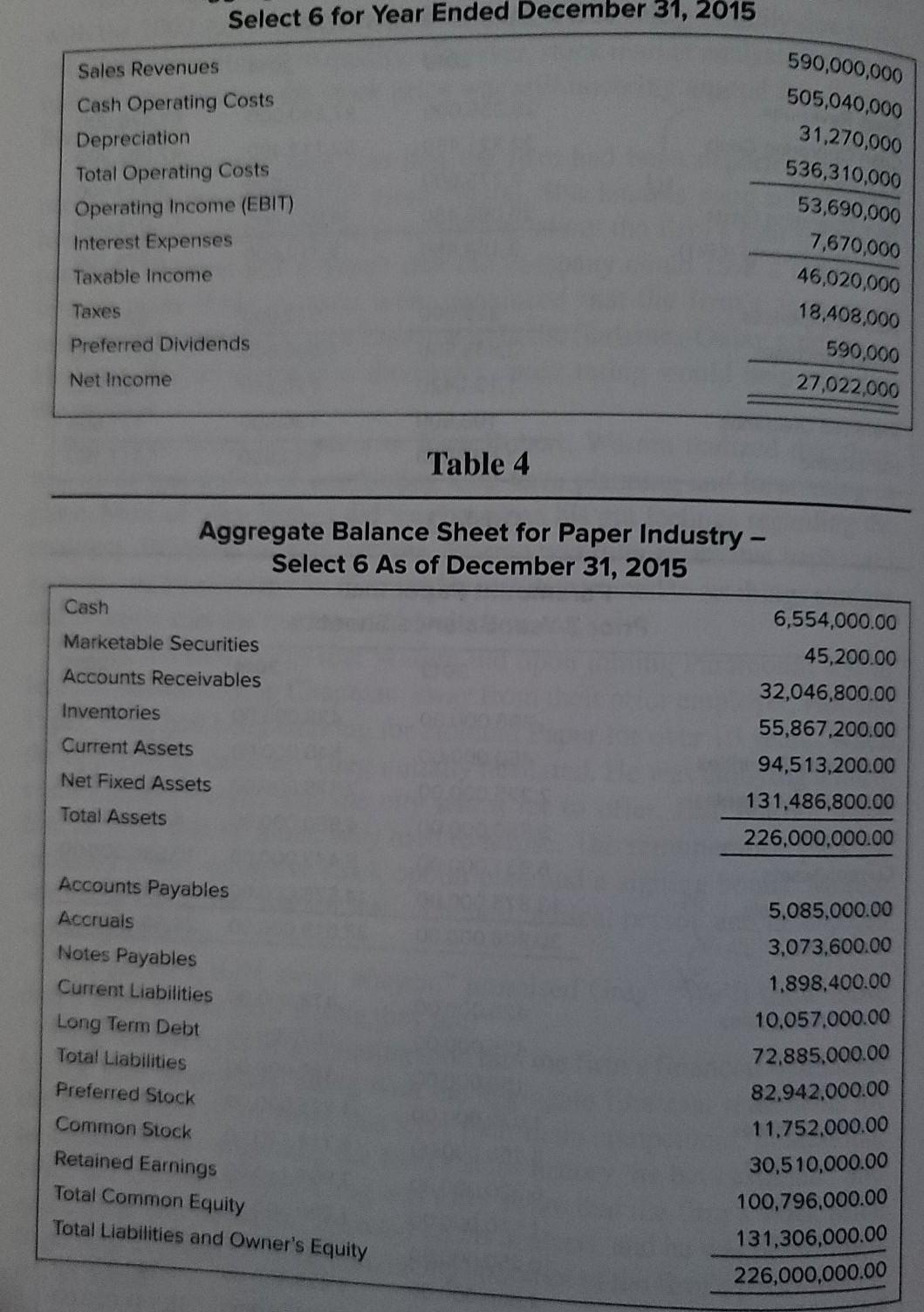

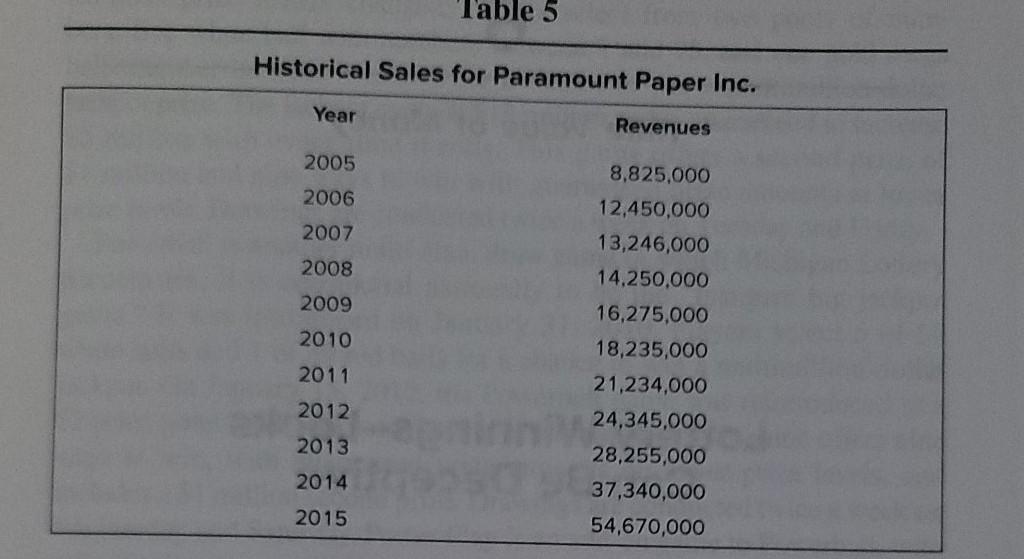

Table 1 Paramount Paper Inc. Prior 3-Year Income Statements 2013 2014 2015 Sales Revenues Cash Operating Costs Depreciation Total Operating Costs Operating Income (EBIT) 28,255,000 22,321,450 2,775,000 25,096,450 3,158,550 37,340,000 32,112,400 2.915,000 35.027,400 2,312,600 54,670,000 47.562.900 3.513,000 51.075.900 3.594,100 623,000 Interest Expenses Taxable income 325,000 2,833,550 1.133,420 108,500 1,591,630 512,000 1,800,600 720,240 136,500 2.971.100 1.188.440 Taxes Preferred Dividends 171.500 1,611,160 Net Income 943,860 Table 2 Paramount Paper Inc. Prior 3-Year Balance Sheets 2013 2014 2015 Cash Marketable Securities Accounts Receivables 396,000.00 460,000.00 2,225,000.00 3,850,000.00 6,931,000.00 13,875,000.00 20,806,000.00 Inventories 428,000.00 540,000.00 2,525,000.00 4,950,000.00 8,443,000.00 14,576,000.00 23.019,000.00 587,000.00 638,000.00 3,758,000.00 6,013,000.00 10,996,000.00 17,568,000.00 28,564,000.00 Current Assets Net Fixed Assets Total Assets Accounts Payables Accruals Notes Payables Current Liabilities Long Term Debt Total Liabilities Preferred Stock Common Stock Retained Earnings Total Common Equity Total Liabilities and Owner's Equity 425,000.00 495,000.00 150,000.00 1,070,000.00 5,250,000.00 6,320,000.00 1,550,000.00 10,250,000.00 2,686,000.00 12,936,000.00 478,000.00 567,000.00 180,000.00 1,225,000.00 6,714,140.00 7,939,140.00 1,950,000.00 9,500,000.00 3,629,860.00 13,129,860.00 518,000.00 694,000.00 175,000.00 1,387,000.00 8,985,980.00 10,372,980.00 2,450,000.00 10,500,000.00 5,241,020.00 15,741,020.00 23.019,000.00 28,564,000.00 20,806,000.00 Select 6 for Year Ended December 31, 2015 Sales Revenues Cash Operating Costs Depreciation Total Operating Costs Operating Income (EBIT) Interest Expenses Taxable income 590,000,000 505,040,000 31,270,000 536,310,000 53,690,000 7,670,000 46,020,000 18,408,000 590,000 27,022,000 Taxes Preferred Dividends Net Income Table 4 Aggregate Balance Sheet for Paper Industry - Select 6 As of December 31, 2015 Cash 6,554,000.00 Marketable Securities 45,200.00 Accounts Receivables Inventories Current Assets 32,046,800.00 55,867,200.00 94,513,200.00 131,486,800.00 226,000,000.00 Net Fixed Assets Total Assets Accounts Payables Accruals Notes Payables Current Liabilities Long Term Debt Total Liabilities Preferred Stock Common Stock Retained Earnings Total Common Equity Total Liabilities and Owner's Equity 5,085,000.00 3,073,600.00 1,898,400.00 10,057,000.00 72,885,000.00 82,942,000.00 11.752,000.00 30,510,000.00 100,796,000.00 131,306,000.00 226,000,000.00 Table 5 Historical Sales for Paramount Paper Inc. Year Revenues 2005 2006 2007 2008 2009 2010 8,825,000 12,450,000 13,246,000 14.250.000 16,275,000 18,235,000 21,234,000 24,345,000 28,255,000 37,340,000 54,670,000 2011 2012 2013 2014 2015 2. Analyze the firm's liquidity, leverage, turnover, and profitability using ratio analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started