Answered step by step

Verified Expert Solution

Question

1 Approved Answer

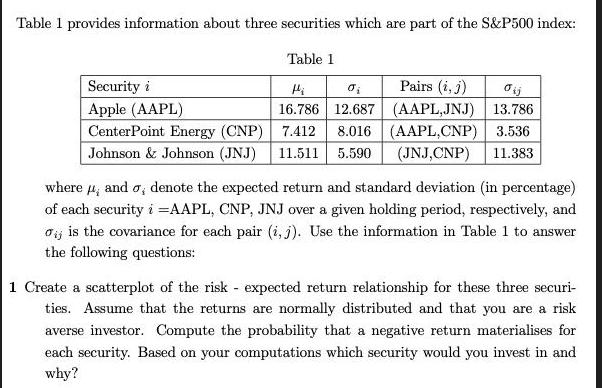

Table 1 provides information about three securities which are part of the S&P500 index: Table 1 Security i Hi Pairs (i, j) ij Apple

Table 1 provides information about three securities which are part of the S&P500 index: Table 1 Security i Hi Pairs (i, j) ij Apple (AAPL) 16.786 12.687 (AAPL,JNJ) 13.786 CenterPoint Energy (CNP) Johnson & Johnson (JNJ) 7.412 8.016 (AAPL,CNP) 3.536 11.511 5.590 (JNJ,CNP) 11.383 where, and , denote the expected return and standard deviation (in percentage) of each security i =AAPL, CNP, JNJ over a given holding period, respectively, and ij is the covariance for each pair (i, j). Use the information in Table 1 to answer the following questions: 1 Create a scatterplot of the risk expected return relationship for these three securi- ties. Assume that the returns are normally distributed and that you are a risk averse investor. Compute the probability that a negative return materialises for each security. Based on your computations which security would you invest in and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started