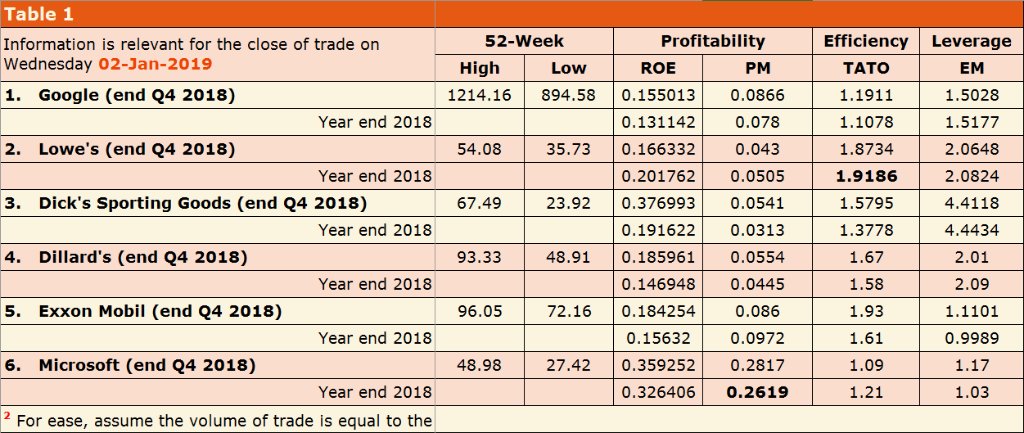

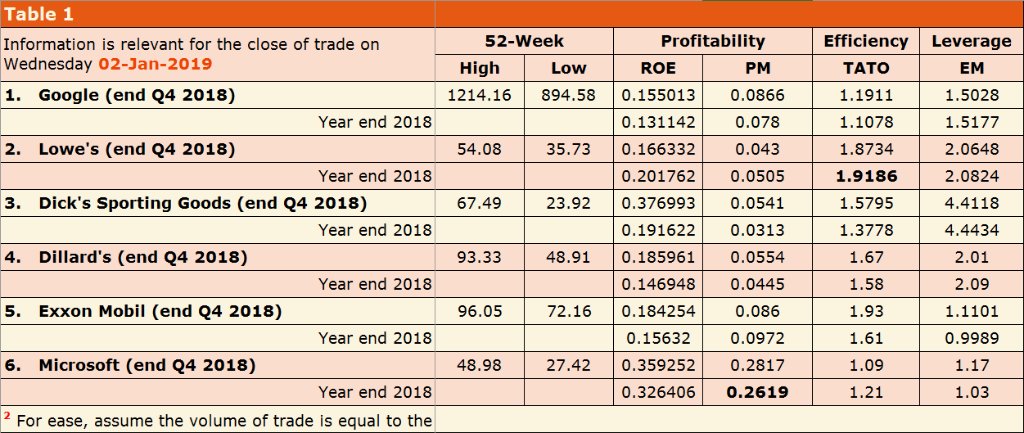

Table 1

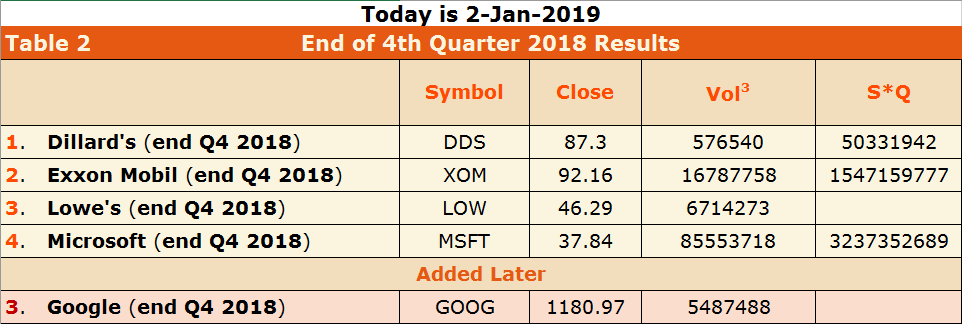

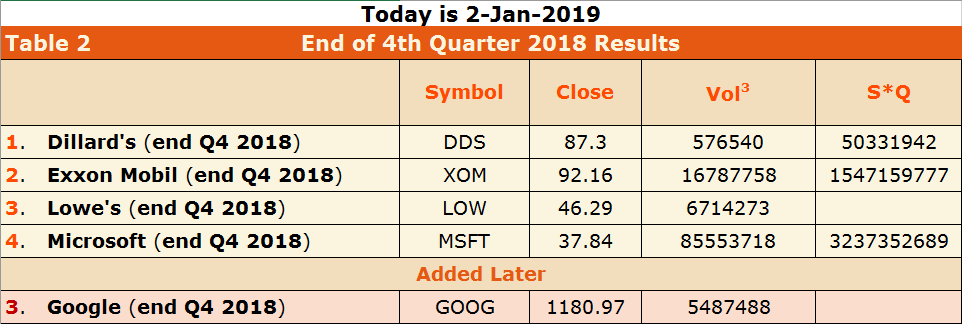

Table 2

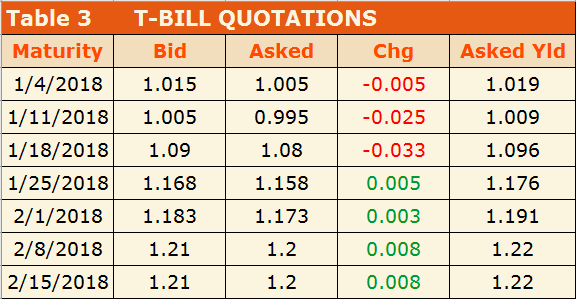

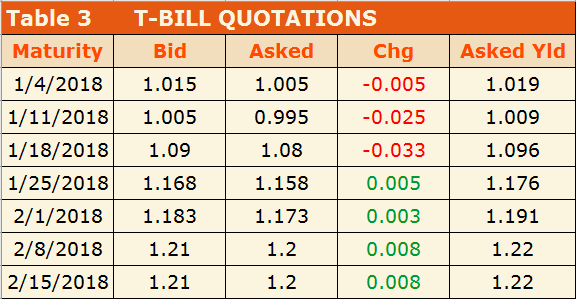

Table 3

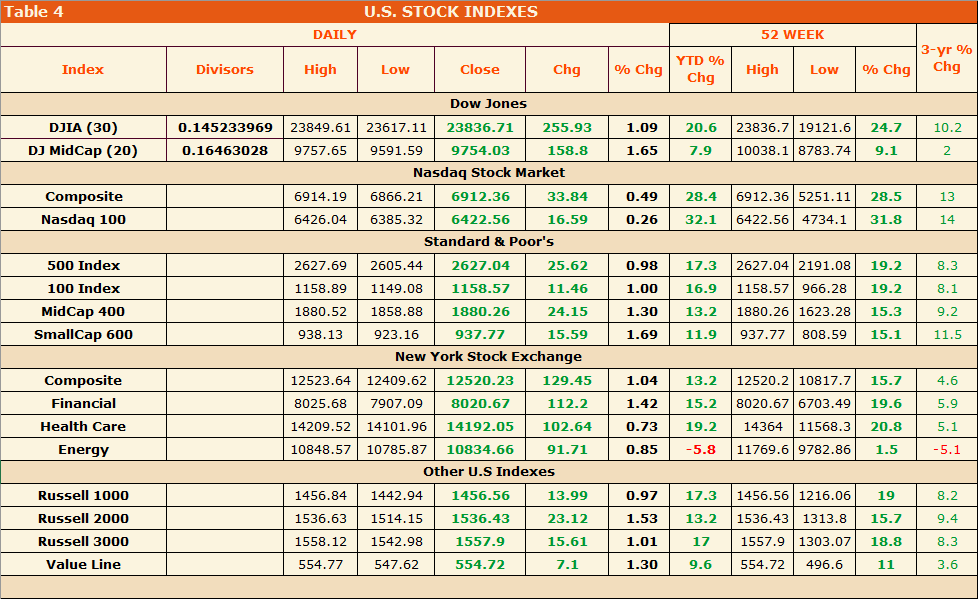

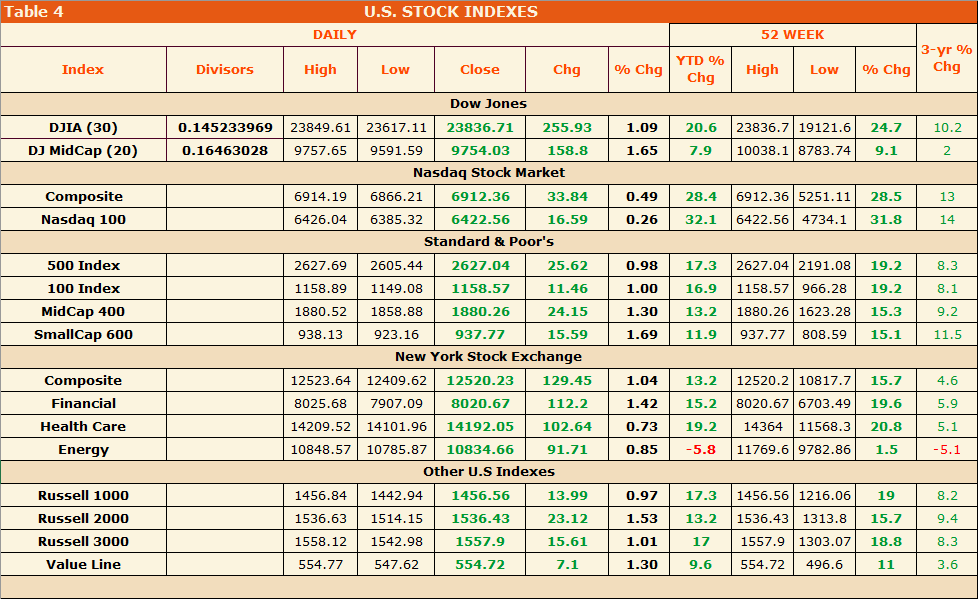

Table 4

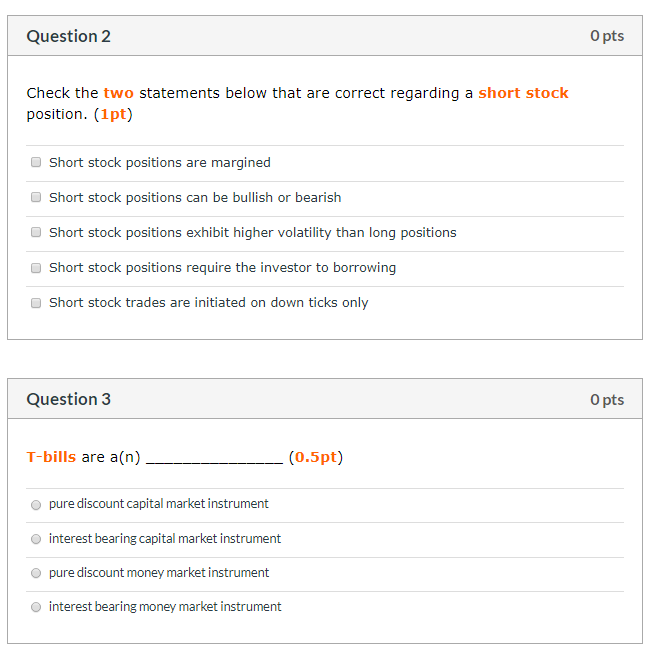

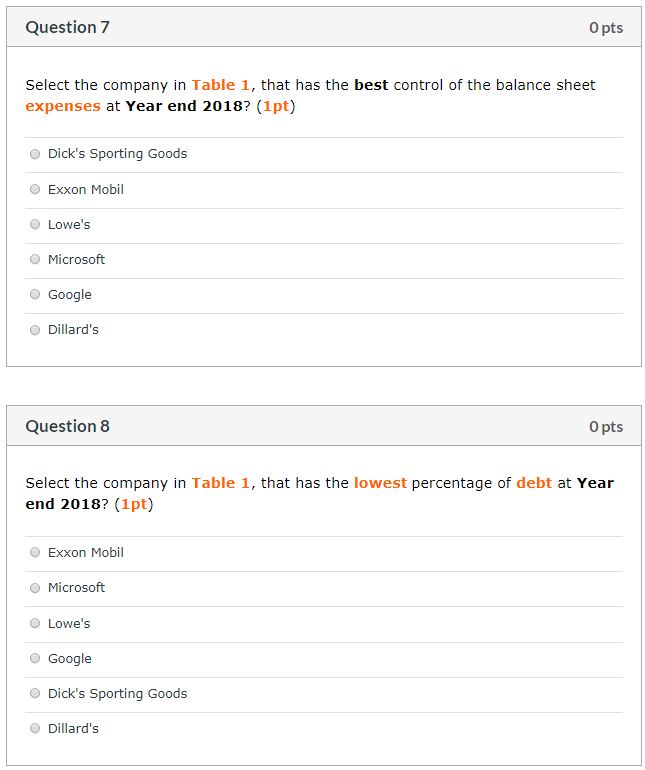

Table 1 Profitability Efficiency 52-Week Leverage Information is relevant for the close of trade on Wednesday 02-Jan-2019 High Low ROE PM TATO EM 1. Google (end Q4 2018) 894.58 0.0866 1.1911 1214.16 0.155013 1.5028 Year end 2018 0.131142 0.078 1.1078 1.5177 Lowe's (end Q4 2018) 2. 54.08 35.73 0.166332 0.043 1.8734 2.0648 Year end 2018 0.201762 0.0505 1.9186 2.0824 3. Dick's Sporting Goods (end Q4 2018) 23.92 1.5795 4.4118 67.49 0.376993 0.0541 Year end 2018 0.191622 0.0313 1.3778 4.4434 4. Dillard's (end Q4 2018) 48.91 0.185961 93.33 0.0554 1.67 2.01 Year end 2018 0.0445 2.09 0.146948 1.58 5. Exxon Mobil (end Q4 2018) 96.05 72.16 0.184254 0.086 1.93 1.1101 Year end 2018 0.15632 0.0972 1.61 0.9989 6. Microsoft (end Q4 2018) 48.98 0.359252 27.42 0.2817 1.09 1.17 0.326406 Year end 2018 0.2619 1.21 1.03 2 For ease, assume the volume of trade is equal to the Today is 2-Jan-2019 End of 4th Quarter 2018 Results Table 2 Vol3 Close S*Q Symbol Dillard's (end Q4 2018) 1. 87.3 DDS 576540 50331942 2. Exxon Mobil (end Q4 2018) 92.16 16787758 1547159777 Lowe's (end Q4 2018) 3. LOW 46,29 6714273 4. Microsoft (end Q4 2018) MSFT 37.84 85553718 3237352689 Added Later 3. Google (end Q4 2018) 5487488 GOOG 1180.97 Table 3 T-BILL QUOTATIONS Maturity Bid Asked Chg Asked Yld 1/4/2018 1.015 1.005 -0.005 1.019 1/11/2018 1.005 0.995 -0.025 1.009 1/18/2018 1.09 1.08 -0.033 1.096 1/25/2018 1.168 1.158 0.005 1.176 2/1/2018 1.183 1.173 0.003 1.191 2/8/2018 1.22 1.21 1.2 0.008 2/15/2018 1.21 1.2 0.008 1.22 Table 4 U.S. STOCK INDEXES 52 WEEK DAILY 3-yr % YTD % Chg % Chq Index Divisors High Close Chg High % Chq Low Low Chg Dow Jones DJIA (30) 23836.7 19121.6 0.145233969 23836.71 10.2 23849.61 23617.11 255.93 1.09 20.6 24.7 DJ MidCap (20) 9754.03 10038.1 8783.74 0.16463028 9757.65 9591.59 158,8 1.65 7.9 9.1 2 Nasdaq Stock Market 6912.36 5251.11 Composite 6914.19 6866.21 6912.36 33.84 0.49 28.4 28.5 13 Nasdaq 100 6385.32 0.26 32.1 6422.56 4734.1 14 6426.04 6422.56 16.59 31.8 Standard & Poor's 2627.04 2191.08 500 Index 2627.69 2605.44 2627.04 25.62 0.98 17.3 19.2 8.3 1158.57 966.28 100 Index 1158.89 1149.08 1158.57 11.46 1.00 16.9 19.2 8.1 1880.26 1623.28 MidCap 400 1880.52 1858.88 1880.26 24.15 1.30 13.2 15.3 9.2 SmallCap 600 938.13 15.59 15.1 11.5 923.16 937.77 1.69 11,9 937,77 808.59 New York Stock Exchange 12520.2 10817.7 12409.62 12520.23 Composite 129.45 12523.64 1.04 13.2 15.7 4.6 8020.67 6703.49 Financial 8025.68 7907.09 8020.67 112.2 1.42 15.2 19.6 5,9 Health Care 14364 11568.3 102.64 14209.52 14101.96 14192.05 0.73 19.2 20.8 5.1 10848.57 10785.87 10834.66 Energy 91.71 0.85 -5.8 11769.6 9782.86 1.5 -5.1 Other U.S Indexes Russell 1000 1456,56 1456.84 1442.94 1456.56 13.99 0.97 17.3 1216.06 19 8.2 1536.43 1313.8 Russell 2000 13.2 1536.63 1514.15 1536.43 23.12 1.53 15.7 9.4 Russell 3000 1542.98 1557.9 1557.9 1558.12 15.61 1.01 17 1303.07 18.8 8.3 Value Line 554.77 547.62 554.72 7.1 1.30 9.6 554.72 496.6 11 3.6 F Question 2 Opts Check the two statements below that are correct regarding a short stock position. (1pt) Short stock positions margined are Short stock positions can be bullish or bearish Short stock positions exhibit higher volatility than long positions Short stock positions require the investor to borrowing Short stock trades are initiated on down ticks only Question 3 O pts T-bills are a(n) (0.5pt) pure discount capital market instrument interest bearing capital market instrument pure discount money market instrument interest bearing money market instrument Question 7 Opts Select the company in Table 1, that has the best control of the balance sheet expenses at Year end 2018? (1pt) Dick's Sporting Goods Exxon Mobil Lowe's Microsoft Google Dillard's Question 8 O pts Select the company in Table 1, that has the lowest percentage of debt at Year end 2018? (1pt) Exxon Mobil Microsoft Lowe's Google Dick's Sporting Goods Dillard's