Answered step by step

Verified Expert Solution

Question

1 Approved Answer

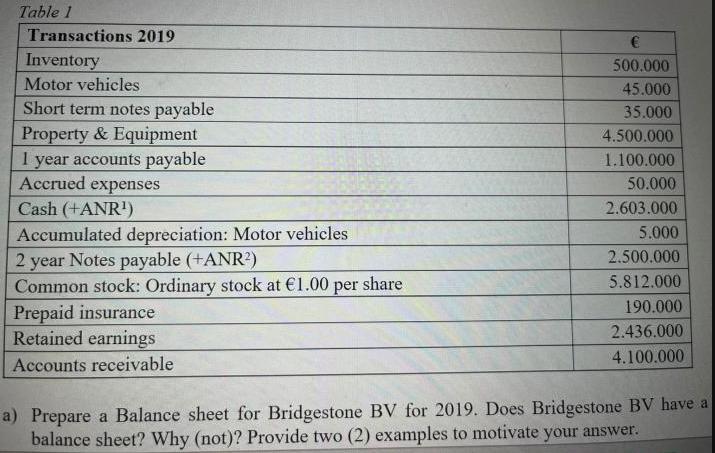

Table 1 Transactions 2019 Inventory Motor vehicles Short term notes payable Property & Equipment 1 year accounts payable Accrued expenses Cash (+ANR) Accumulated depreciation:

Table 1 Transactions 2019 Inventory Motor vehicles Short term notes payable Property & Equipment 1 year accounts payable Accrued expenses Cash (+ANR) Accumulated depreciation: Motor vehicles 2 year Notes payable (+ANR) Common stock: Ordinary stock at 1.00 per share Prepaid insurance Retained earnings Accounts receivable 500.000 45.000 35.000 4.500.000 1.100.000 50.000 2.603.000 5.000 2.500.000 5.812.000 190.000 2.436.000 4.100.000 a) Prepare a Balance sheet for Bridgestone BV for 2019. Does Bridgestone BV have a balance sheet? Why (not)? Provide two (2) examples to motivate your answer. a) Prepare a Balance sheet for Bridgestone BV for 2019. Does Bridgestone BV have a strong balance sheet? Why (not)? Provide two (2) examples to motivate your answer. b) Consider that Bridgestone BV is offered an equity investment of 5.000.000 from PECU Ventures, a Venture capital financing firm. In return for their investment, the VC firm receives newly issued stock at 1.00 per share. Prepare a short Balance sheet extract of this transaction for illustration, and explain what effect this transaction has on identified Balance sheet elements. Motivate your answer. c) Considering the impact of the above transaction (b) which claimants will benefit the most? Do they share the same incentives? Why (not)? Motivate your answer.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Bridgestone BV does have a balance sheet for 2019 which looks as follows ASSETS Cash ANR1 500000 Accounts receivable 2436000 Motor vehicles 45000 Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started