Question

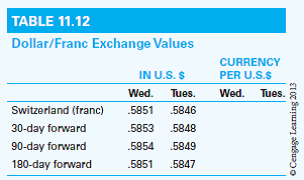

Table 11.12 gives hypothetical dollar/franc exchange values for Wednesday, May 5, 2008. a. Fill in the last two columns of the table with the reciprocal

Table 11.12 gives hypothetical dollar/franc exchange values for Wednesday, May 5, 2008.

a. Fill in the last two columns of the table with the reciprocal price of the dollar in terms of the franc.

b. On Wednesday, the spot price of the two currencies was_____ dollars per franc, or ________francs per dollar.

c. From Tuesday to Wednesday, in the spot market the dollar (appreciated/depreciated) against the franc; the franc (appreciated/depreciated) against the dollar

d. In Wednesdays spot market, the cost of buying 100 francs was _____dollars; the cost of buying 100 dollars was _____francs.

e. On Wednesday, the 30-day forward franc was at a (premium/discount) of _____dollars, which equaled____ percent on an annual basis. What about the 90-day forward franc?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started