Answered step by step

Verified Expert Solution

Question

1 Approved Answer

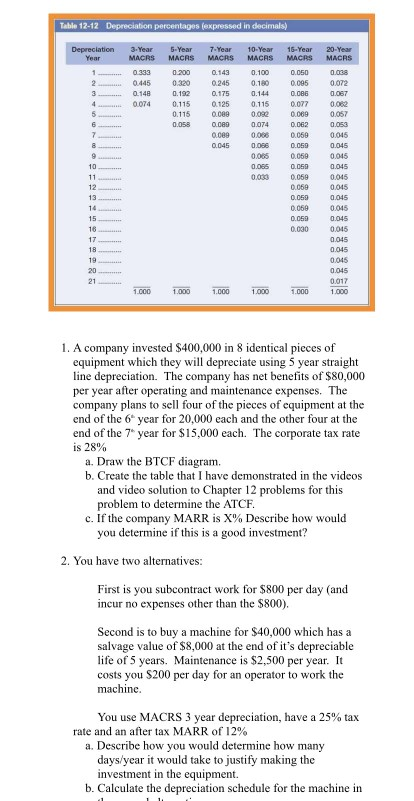

Table 12-12 Depreciation percentages (expressed in decimals) Depreciation 20-Year 3. Year 5 Year 7. Year MACRS MACAS MACAS 10-Year 16-Year MACAS MACRS 0.038 0.072 0.333

Table 12-12 Depreciation percentages (expressed in decimals) Depreciation 20-Year 3. Year 5 Year 7. Year MACRS MACAS MACAS 10-Year 16-Year MACAS MACRS 0.038 0.072 0.333 0445 0.148 0.074 0.200 0.320 0.192 0.115 0.143 0.245 0.175 0.125 0.100 0.180 0.144 0.115 0.050 0.095 0.086 0.077 0.087 0.058 0.074 0.062 0.069 089 0.045 0.015 0.045 0.059 0.005 0.055 0.00 0.045 0.045 0.045 0.045 0.015 0.045 0.045 0.045 0.045 0.017 21 1.000 1.000 1.000 1.000 1.000 1.000 1. A company invested $400,000 in 8 identical pieces of equipment which they will depreciate using 5 year straight line depreciation. The company has net benefits of $80,000 per year after operating and maintenance expenses. The company plans to sell four of the pieces of equipment at the end of the 6 year for 20,000 each and the other four at the end of the 7 year for $15,000 each. The corporate tax rate is 28% a. Draw the BTCF diagram. b. Create the table that I have demonstrated in the videos and video solution to Chapter 12 problems for this problem to determine the ATCF. c. If the company MARR is X% Describe how would you determine if this is a good investment? 2. You have two alternatives: First is you subcontract work for $800 per day (and incur no expenses other than the $800). Second is to buy a machine for $40,000 which has a salvage value of $8,000 at the end of it's depreciable life of 5 years. Maintenance is $2,500 per year. It costs you $200 per day for an operator to work the machine. You use MACRS 3 year depreciation, have a 25% tax rate and an after tax MARR of 12% a. Describe how you would determine how many days/year it would take to justify making the investment in the equipment. b. Calculate the depreciation schedule for the machine in Table 12-12 Depreciation percentages (expressed in decimals) Depreciation 20-Year 3. Year 5 Year 7. Year MACRS MACAS MACAS 10-Year 16-Year MACAS MACRS 0.038 0.072 0.333 0445 0.148 0.074 0.200 0.320 0.192 0.115 0.143 0.245 0.175 0.125 0.100 0.180 0.144 0.115 0.050 0.095 0.086 0.077 0.087 0.058 0.074 0.062 0.069 089 0.045 0.015 0.045 0.059 0.005 0.055 0.00 0.045 0.045 0.045 0.045 0.015 0.045 0.045 0.045 0.045 0.017 21 1.000 1.000 1.000 1.000 1.000 1.000 1. A company invested $400,000 in 8 identical pieces of equipment which they will depreciate using 5 year straight line depreciation. The company has net benefits of $80,000 per year after operating and maintenance expenses. The company plans to sell four of the pieces of equipment at the end of the 6 year for 20,000 each and the other four at the end of the 7 year for $15,000 each. The corporate tax rate is 28% a. Draw the BTCF diagram. b. Create the table that I have demonstrated in the videos and video solution to Chapter 12 problems for this problem to determine the ATCF. c. If the company MARR is X% Describe how would you determine if this is a good investment? 2. You have two alternatives: First is you subcontract work for $800 per day (and incur no expenses other than the $800). Second is to buy a machine for $40,000 which has a salvage value of $8,000 at the end of it's depreciable life of 5 years. Maintenance is $2,500 per year. It costs you $200 per day for an operator to work the machine. You use MACRS 3 year depreciation, have a 25% tax rate and an after tax MARR of 12% a. Describe how you would determine how many days/year it would take to justify making the investment in the equipment. b. Calculate the depreciation schedule for the machine in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started