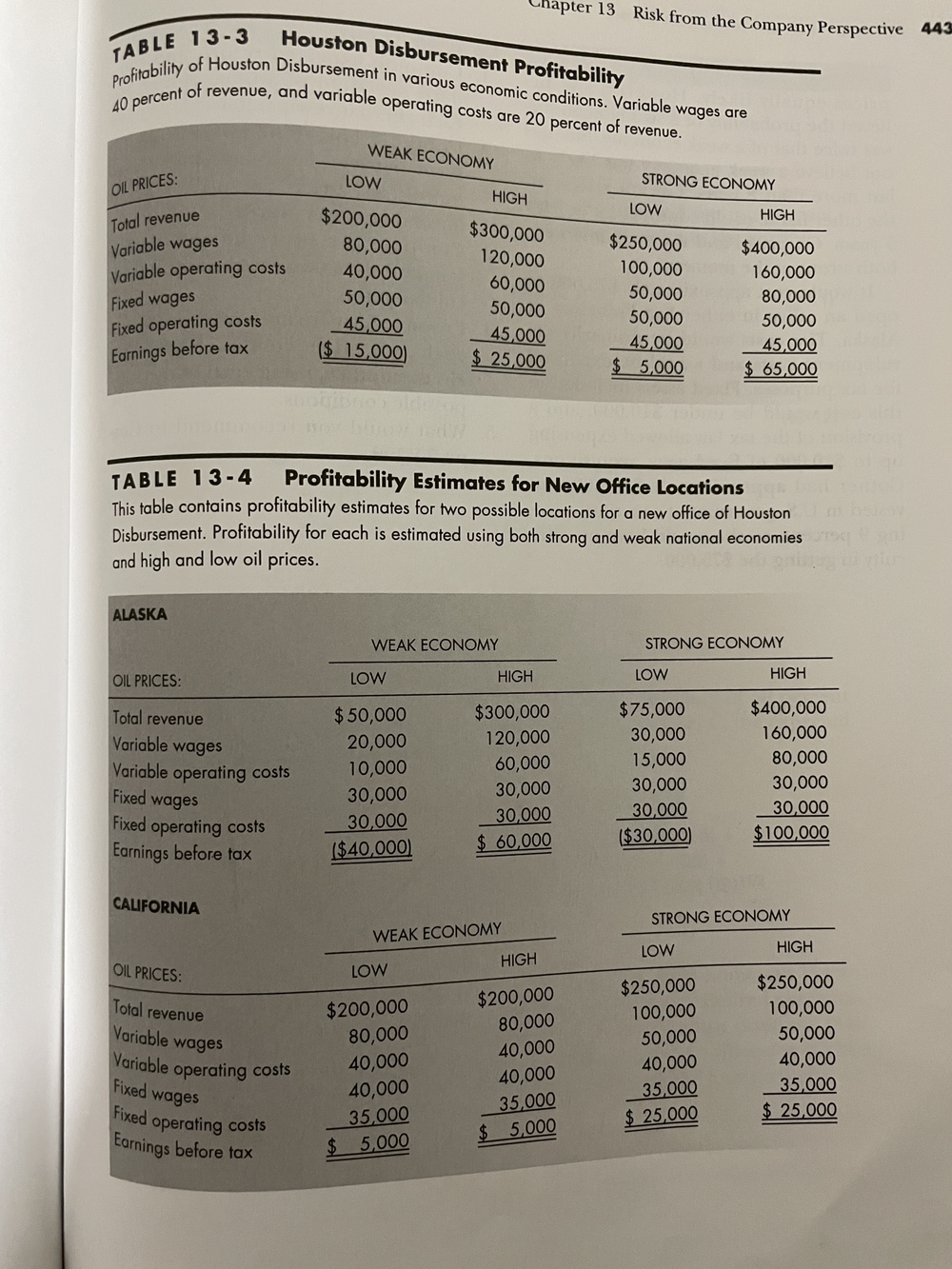

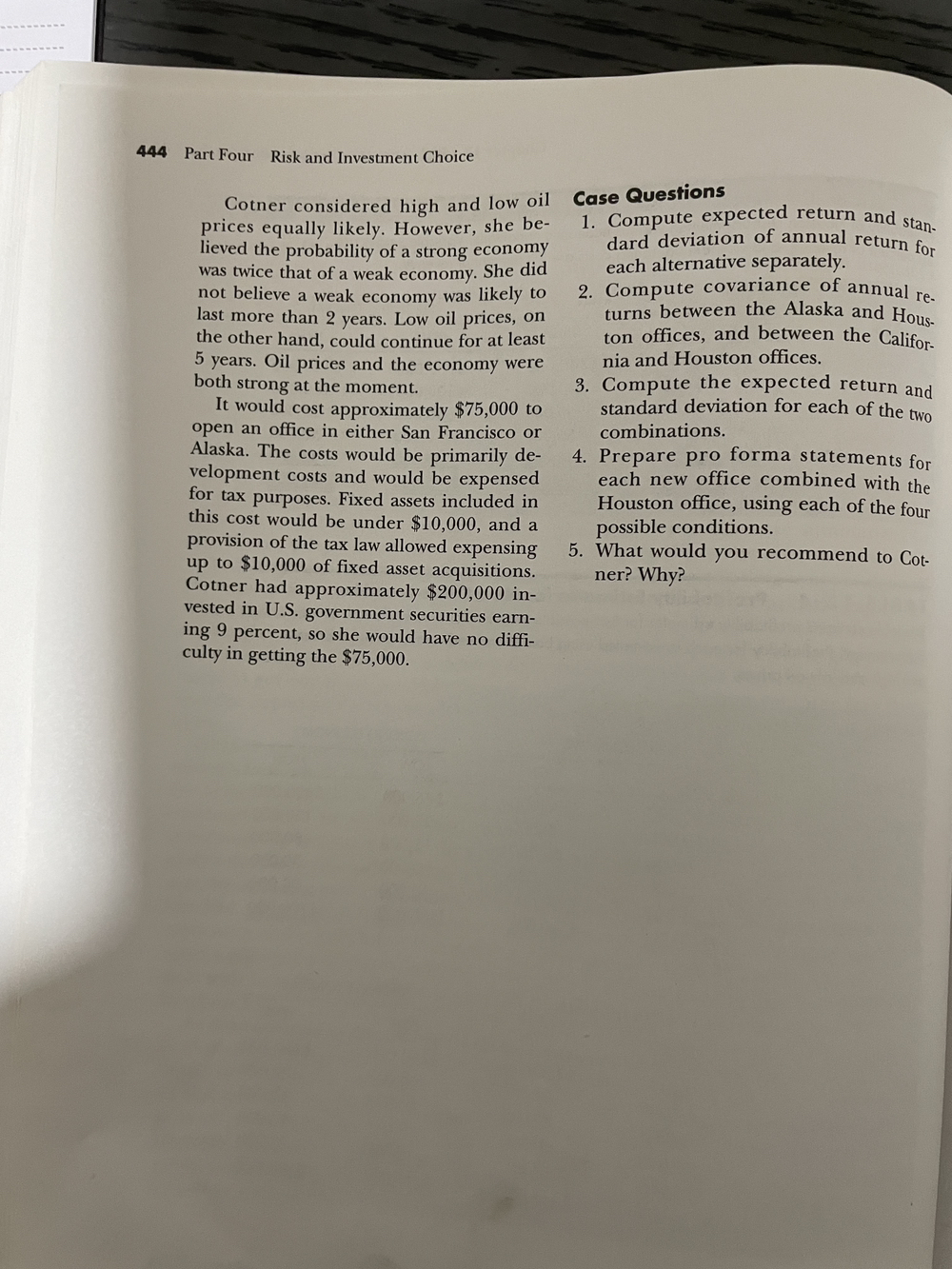

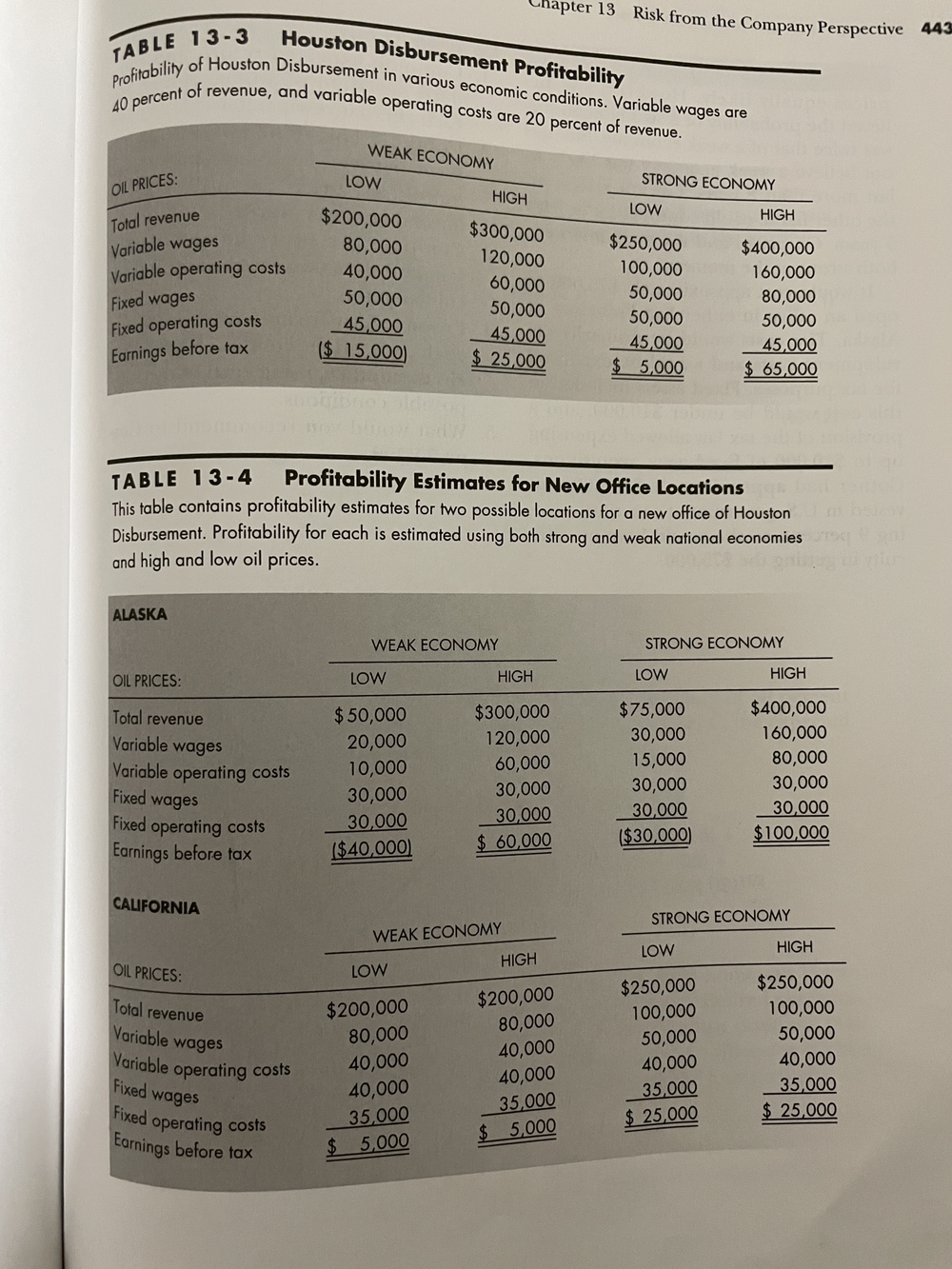

TABLE 13-3 Houston Disbursement Profitability profitability of Houston Disbursement in various economic conditions. Variable wages are 40 percent of revenue, and variable operating costs are 20 naranat-. TABLE 1 3-4 Profitability Estimates for New Office Locations This table contains profitability estimates for two possible locations for a new office of Houston Disbursement. Profitability for each is estimated using both strong and weak national economies and high and low oil prices. Cotner considered high and low oil Case Questions prices equally likely. However, she be- 1. Compute expected return and stan. lieved the probability of a strong economy dard deviation of annual return for was twice that of a weak economy. She did each alternative separately. not believe a weak economy was likely to 2. Compute covariance of annual relastmorethan2years.Lowoilprices,ontheotherhand,couldcontinueforatleastturnsbetweentheAlaskaandHous-tonoffices,andbetweentheCalifor 5 years. Oil prices and the economy were nia and Houston offices. both strong at the moment. 3. Compute the expected return and It would cost approximately $75,000 to openanofficeineitherSanFranciscoorcombinations.standarddeviationforeachofthetwo Alaska. The costs would be primarily de- velopment costs and would be expensed each new office combined with for for tax purposes. Fixed assets included in each new office combined with the this cost would be under $10,000, and a Houston office, using each of the four provision of the tax law allowed expensing 5. What conditions. up to $10,000 of fixed asset acquisitions. Cotner had approximately $200,000 invested in U.S. government securities earning 9 percent, so she would have no difficulty in getting the $75,000. TABLE 13-3 Houston Disbursement Profitability profitability of Houston Disbursement in various economic conditions. Variable wages are 40 percent of revenue, and variable operating costs are 20 naranat-. TABLE 1 3-4 Profitability Estimates for New Office Locations This table contains profitability estimates for two possible locations for a new office of Houston Disbursement. Profitability for each is estimated using both strong and weak national economies and high and low oil prices. Cotner considered high and low oil Case Questions prices equally likely. However, she be- 1. Compute expected return and stan. lieved the probability of a strong economy dard deviation of annual return for was twice that of a weak economy. She did each alternative separately. not believe a weak economy was likely to 2. Compute covariance of annual relastmorethan2years.Lowoilprices,ontheotherhand,couldcontinueforatleastturnsbetweentheAlaskaandHous-tonoffices,andbetweentheCalifor 5 years. Oil prices and the economy were nia and Houston offices. both strong at the moment. 3. Compute the expected return and It would cost approximately $75,000 to openanofficeineitherSanFranciscoorcombinations.standarddeviationforeachofthetwo Alaska. The costs would be primarily de- velopment costs and would be expensed each new office combined with for for tax purposes. Fixed assets included in each new office combined with the this cost would be under $10,000, and a Houston office, using each of the four provision of the tax law allowed expensing 5. What conditions. up to $10,000 of fixed asset acquisitions. Cotner had approximately $200,000 invested in U.S. government securities earning 9 percent, so she would have no difficulty in getting the $75,000