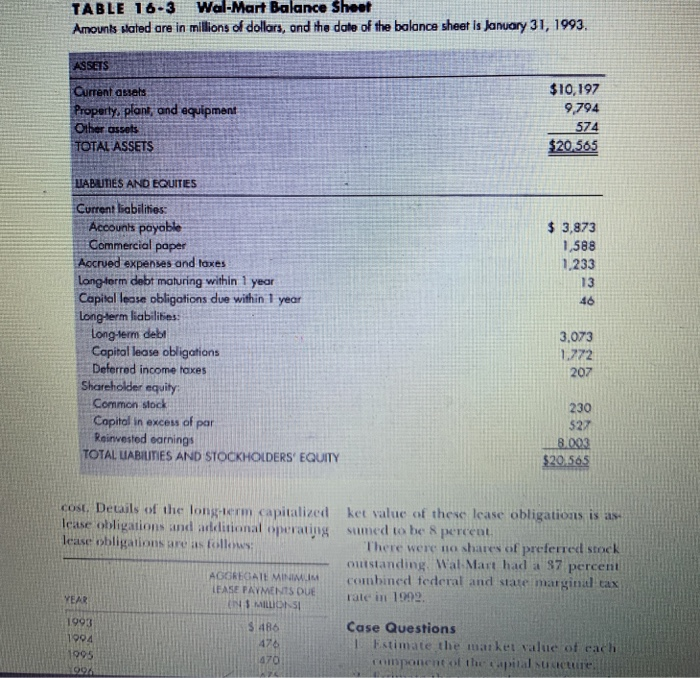

TABLE 16-3 Wal-Mart Balance Shoot Amounts Hated are in millions of dollars, and the date of the balance sheet Is January 31, 1993. ASSETS Current assets Property, plant, and equipment Other assets TOTAL ASSETS $10,197 9,794 574 $20,565 $ 3,873 1,588 1.233 UABUTIES AND EQUITIES Current liabilities: Accounts payable Commercial paper Accrued expenses and taxes long-term debt maturing within 1 year Capital lease obligations due within 1 year Long-term liabilities Long-term debit Capital lease obligations Deferred income taxes Shareholder equity Common stock Capital in excess of par Reinvested earnings TOTAL UABILITIES AND STOCKHOLDERS' EQUITY 3,073 1.272 207 230 527 8.003 $20.565 cost. Details of the long-term capitalized le se obligations and additional operating lease obligations are as follows: ket value of these lease obligations is as suned to be 8 percent. There were to shares of preferred stock outstanding Wal-Mart had a 87 percent combined federal and state marginal tax Tale in 1992 AGGREGATE MINIMUM TEASE PAYMENTS DUE IN MILLIONS VER 1993 1904 1995 Case Questions Estimate the market value of each component of the capital sucture Case Questions 1. Estimate the market value of each component of the capital structure. TABLE 16-3 Wal-Mart Balance Shoot Amounts Hated are in millions of dollars, and the date of the balance sheet Is January 31, 1993. ASSETS Current assets Property, plant, and equipment Other assets TOTAL ASSETS $10,197 9,794 574 $20,565 $ 3,873 1,588 1.233 UABUTIES AND EQUITIES Current liabilities: Accounts payable Commercial paper Accrued expenses and taxes long-term debt maturing within 1 year Capital lease obligations due within 1 year Long-term liabilities Long-term debit Capital lease obligations Deferred income taxes Shareholder equity Common stock Capital in excess of par Reinvested earnings TOTAL UABILITIES AND STOCKHOLDERS' EQUITY 3,073 1.272 207 230 527 8.003 $20.565 cost. Details of the long-term capitalized le se obligations and additional operating lease obligations are as follows: ket value of these lease obligations is as suned to be 8 percent. There were to shares of preferred stock outstanding Wal-Mart had a 87 percent combined federal and state marginal tax Tale in 1992 AGGREGATE MINIMUM TEASE PAYMENTS DUE IN MILLIONS VER 1993 1904 1995 Case Questions Estimate the market value of each component of the capital sucture Case Questions 1. Estimate the market value of each component of the capital structure