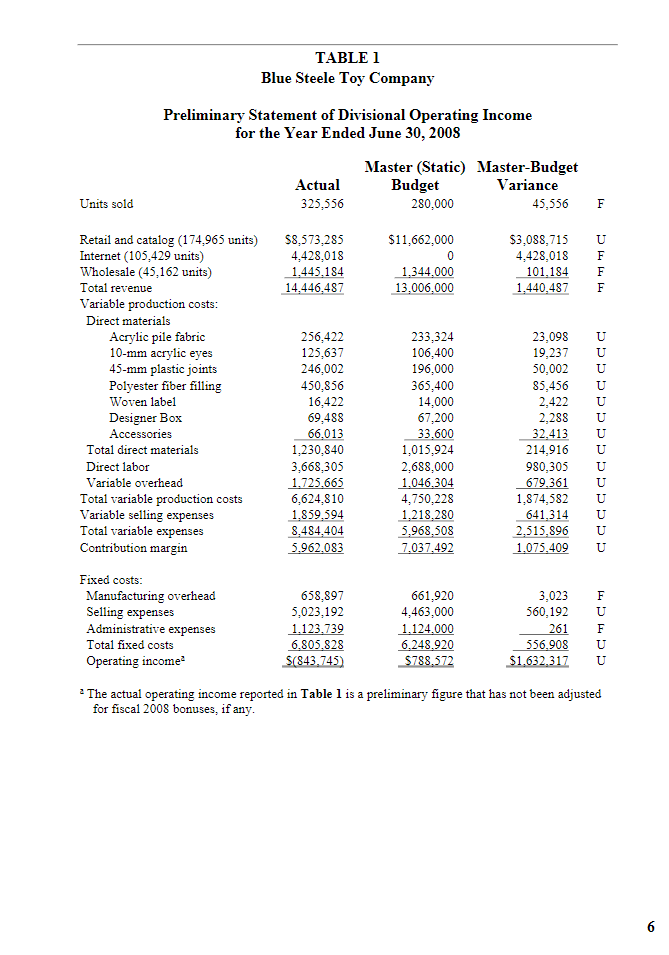

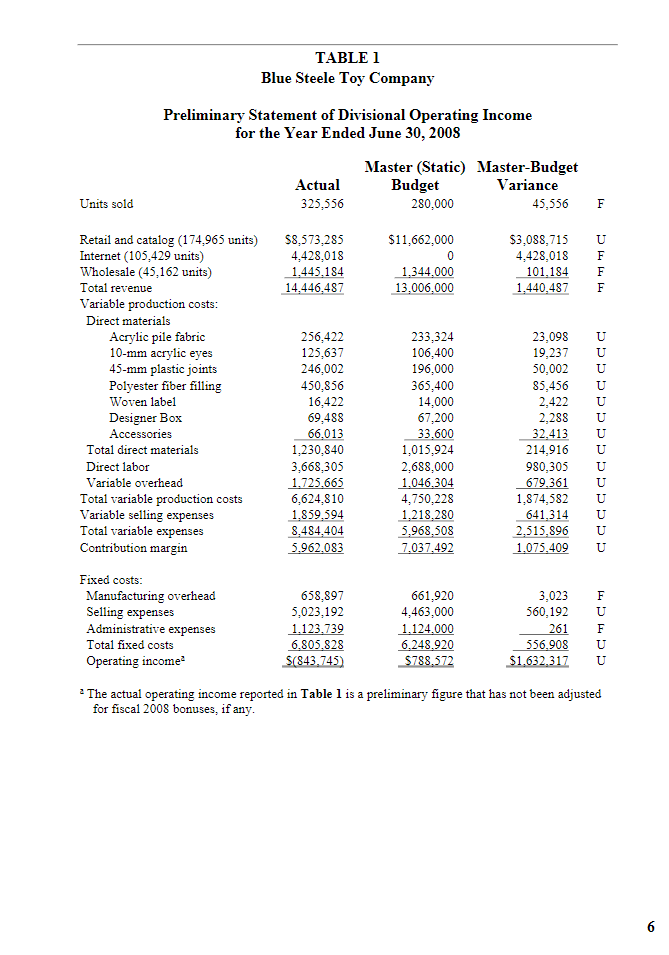

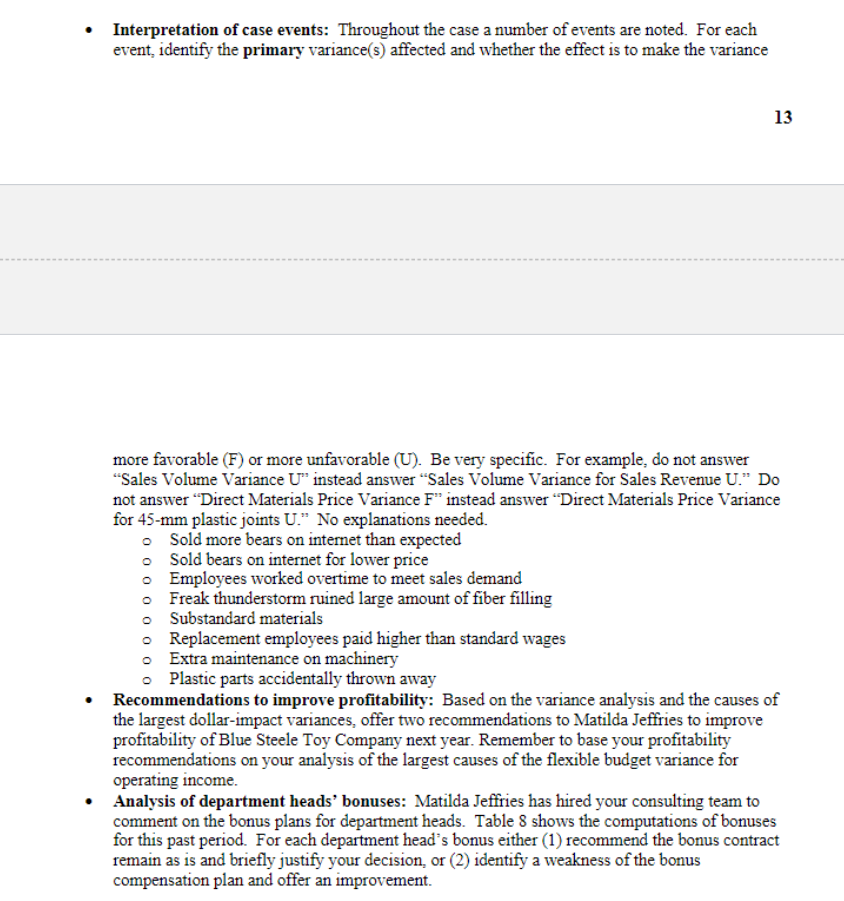

TABLE 1Blue Steele Toy CompanyPreliminary Statement of Divisional Operating Incomefor the Year Ended June 30, 2008ActualMaster (Static)BudgetMaster-BudgetVarianceUnits sold325,556280,00045,556FRetail and catalog (174,965 units)$8,573,285$11,662,000$3,088,715UInternet (105,429 units)4,428,01804,428,018FWholesale (45,162 units) 1,445,184 1,344,000 101,184FTotal revenue 14,446,487 13,006,000 1,440,487FVariable production costs:Direct materials Acrylic pile fabric256,422233,32423,098U 10-mm acrylic eyes125,637106,40019,237U 45-mm plastic joints246,002196,00050,002U Polyester fiber filling450,856365,40085,456U Woven label16,42214,0002,422U Designer Box69,48867,2002,288U Accessories 66,013 33,600 32,413UTotal direct materials1,230,8401,015,924214,916UDirect labor3,668,3052,688,000980,305UVariable overhead 1,725,665 1,046,304 679,361UTotal variable production costs6,624,8104,750,2281,874,582UVariable selling expenses 1,859,594 1,218,280 641,314UTotal variable expenses 8,484,404 5,968,508 2,515,896UContribution margin 5,962,083 7,037,492 1,075,409UFixed costs:Manufacturing overhead658,897661,9203,023FSelling expenses5,023,1924,463,000560,192UAdministrative expenses 1,123,739 1,124,000 261FTotal fixed costs 6,805,828 6,248,920 556,908UOperating incomea $(843,745) $788,572 $1,632,317Ua The actual operating income reported in Table 1 is a preliminary figure that has not been adjusted for fiscal 2008 bonuses, if any.

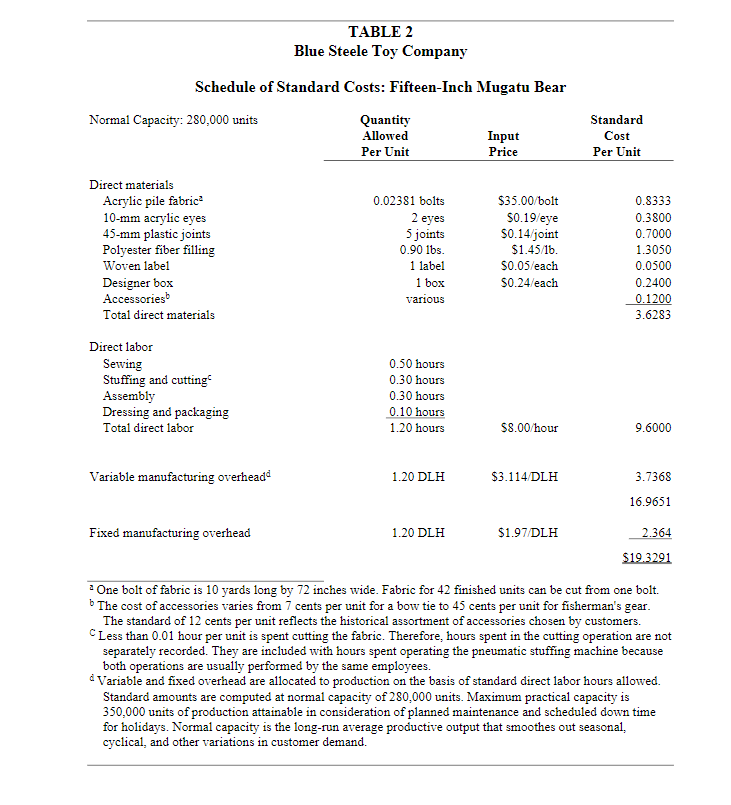

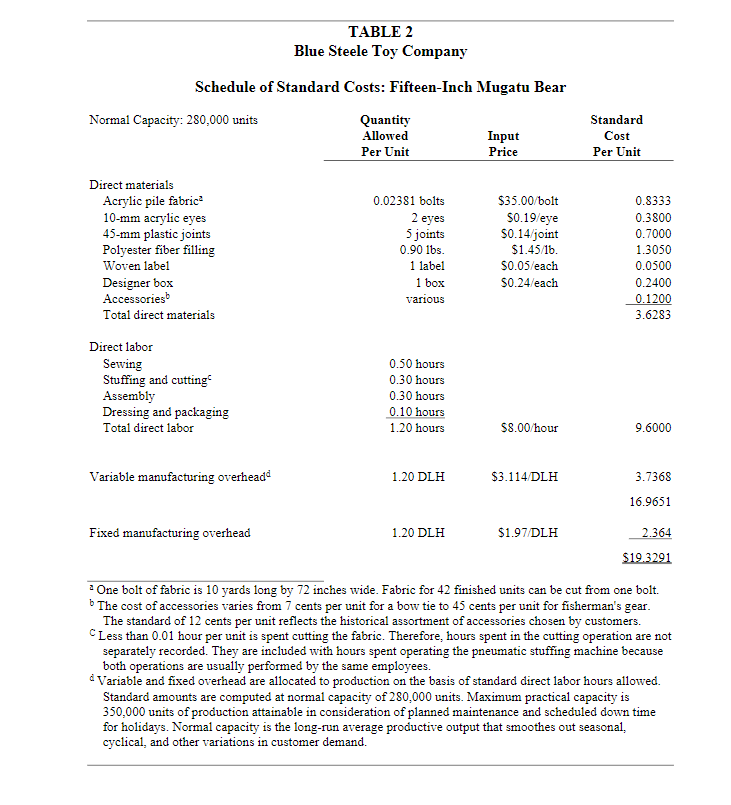

7TABLE 2Blue Steele Toy CompanySchedule of Standard Costs: Fifteen-Inch Mugatu BearNormal Capacity: 280,000 unitsQuantityStandardAllowedInputCostPer UnitPricePer UnitDirect materialsAcrylic pile fabrica0.02381 bolts$35.00/bolt0.833310-mm acrylic eyes2 eyes$0.19/eye0.380045-mm plastic joints5 joints$0.14/joint0.7000Polyester fiber filling0.90 lbs.$1.45/lb.1.3050Woven label1 label$0.05/each0.0500Designer box1 box$0.24/each0.2400Accessoriesbvarious 0.1200Total direct materials3.6283Direct laborSewing0.50 hoursStuffing and cuttingc0.30 hoursAssembly0.30 hoursDressing and packaging 0.10 hoursTotal direct labor 1.20 hours$8.00/hour9.6000Variable manufacturing overheadd1.20 DLH$3.114/DLH3.736816.9651Fixed manufacturing overhead1.20 DLH$1.97/DLH 2.364$19.3291a One bolt of fabric is 10 yards long by 72 inches wide. Fabric for 42 finished units can be cut from one bolt.b The cost of accessories varies from 7 cents per unit for a bow tie to 45 cents per unit for fisherman's gear. The standard of 12 cents per unit reflects the historical assortment of accessories chosen by customers.C Less than 0.01 hour per unit is spent cutting the fabric. Therefore, hours spent in the cutting operation are not separately recorded. They are included with hours spent operating the pneumatic stuffing machine because both operations are usually performed by the same employees.d Variable and fixed overhead are allocated to production on the basis of standard direct labor hours allowed. Standard amounts are computed at normal capacity of 280,000 units. Maximum practical capacity is 350,000 units of production attainable in consideration of planned maintenance and scheduled down time for holidays. Normal capacity is the long-run average productive output that smoothes out seasonal, cyclical, and other variations in customer demand.

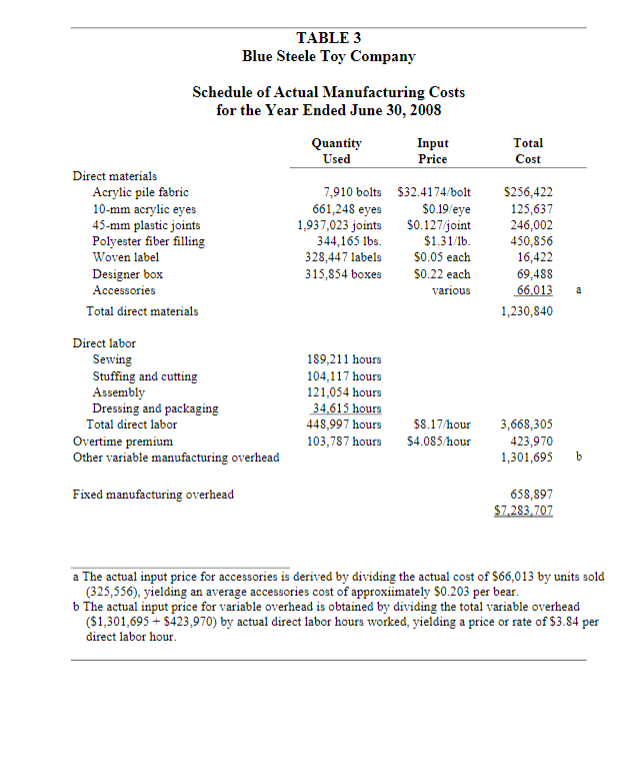

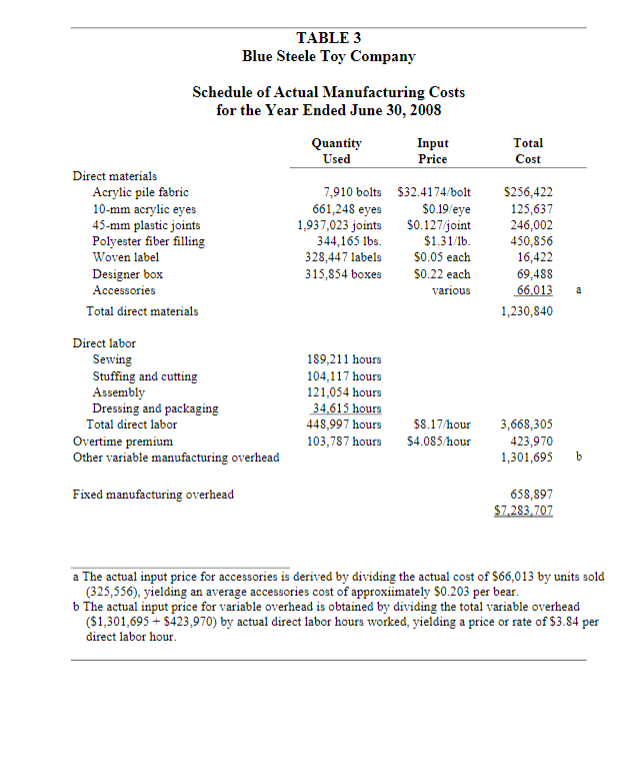

8TABLE 3Blue Steele Toy CompanySchedule of Actual Manufacturing Costsfor the Year Ended June 30, 2008QuantityInputTotalUsedPriceCostDirect materialsAcrylic pile fabric7,910 bolts$32.4174/bolt$256,42210-mm acrylic eyes661,248 eyes$0.l9/eye125,63745-mm plastic joints1,937,023 joints$0.127/joint246,002Polyester fiber filling344,165 lbs.$1.31/lb.450,856Woven label328,447 labels$0.05 each16,422Designer box315,854 boxes$0.22 each69,488Accessoriesvarious 66,013aTotal direct materials1,230,840Direct laborSewing189,211 hoursStuffing and cutting104,117 hoursAssembly121,054 hoursDressing and packaging 34,615 hoursTotal direct labor448,997 hours$8.17/hour3,668,305Overtime premium103,787 hours$4.085/hour423,970Other variable manufacturing overhead1,301,695bFixed manufacturing overhead658,897$7,283,707a The actual input price for accessories is derived by dividing the actual cost of $66,013 by units sold (325,556), yielding an average accessories cost of approxiimately $0.203 per bear.b The actual input price for variable overhead is obtained by dividing the total variable overhead ($1,301,695 + $423,970) by actual direct labor hours worked, yielding a price or rate of $3.84 per direct labor hour.8TABLE 3Blue Steele Toy CompanySchedule of Actual Manufacturing Costsfor the Year Ended June 30, 2008QuantityInputTotalUsedPriceCostDirect materialsAcrylic pile fabric7,910 bolts$32.4174/bolt$256,42210-mm acrylic eyes661,248 eyes$0.l9/eye125,63745-mm plastic joints1,937,023 joints$0.127/joint246,002Polyester fiber filling344,165 lbs.$1.31/lb.450,856Woven label328,447 labels$0.05 each16,422Designer box315,854 boxes$0.22 each69,488Accessoriesvarious 66,013aTotal direct materials1,230,840Direct laborSewing189,211 hoursStuffing and cutting104,117 hoursAssembly121,054 hoursDressing and packaging 34,615 hoursTotal direct labor448,997 hours$8.17/hour3,668,305Overtime premium103,787 hours$4.085/hour423,970Other variable manufacturing overhead1,301,695bFixed manufacturing overhead658,897$7,283,707a The actual input price for accessories is derived by dividing the actual cost of $66,013 by units sold (325,556), yielding an average accessories cost of approxiimately $0.203 per bear.b The actual input price for variable overhead is obtained by dividing the total variable overhead ($1,301,695 + $423,970) by actual direct labor hours worked, yielding a price or rate of $3.84 per direct labor hour.

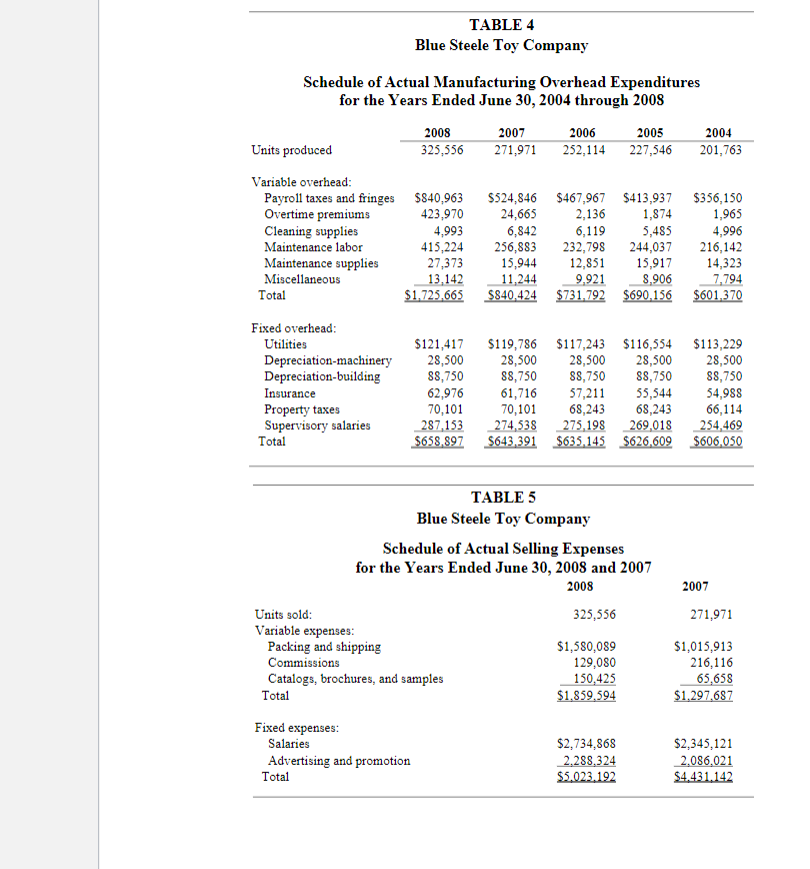

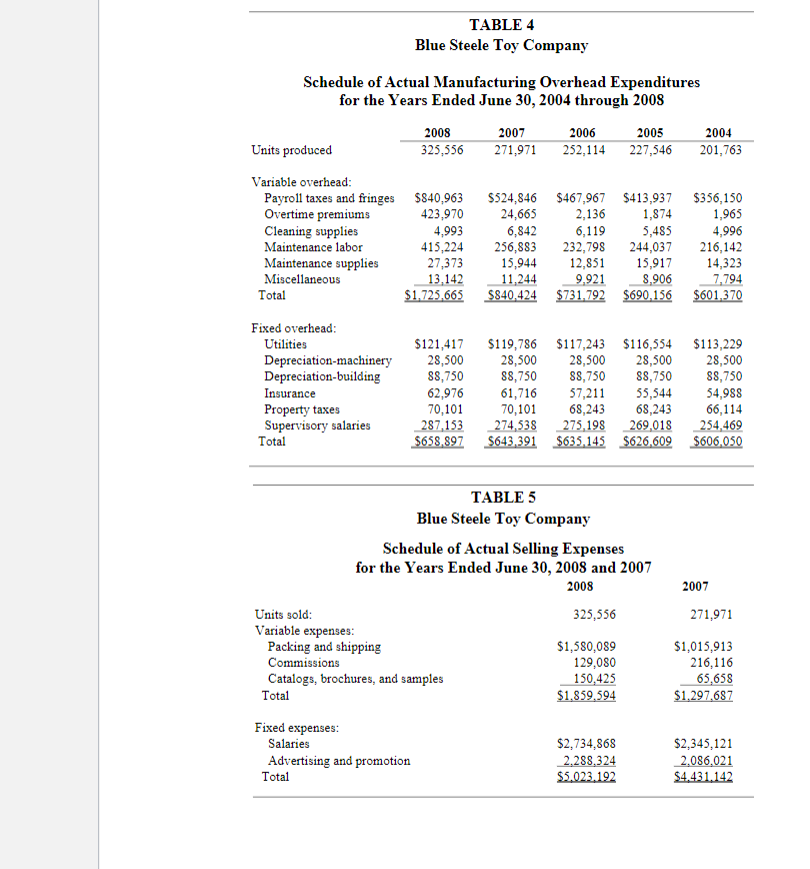

9TABLE 4Blue Steele Toy CompanySchedule of Actual Manufacturing Overhead Expendituresfor the Years Ended June 30, 2004 through 200820082007200620052004Units produced325,556271,971252,114227,546201,763Variable overhead:Payroll taxes and fringes$840,963$524,846$467,967$413,937$356,150Overtime premiums423,97024,6652,1361,8741,965Cleaning supplies4,9936,8426,1195,4854,996Maintenance labor415,224256,883232,798244,037216,142Maintenance supplies27,37315,94412,85115,91714,323Miscellaneous 13,142 11,244 9,921 8,906 7,794Total$1,725,665 $840,424$731,792$690,156$601,370Fixed overhead:Utilities$121,417$119,786$117,243$116,554$113,229Depreciation-machinery28,50028,50028,50028,50028,500Depreciation-building88,75088,75088,75088,75088,750Insurance62,97661,71657,21155,54454,988Property taxes70,10170,10168,24368,24366,114Supervisory salaries 287,153 274,538 275,198 269,018 254,469Total $658,897 $643,391 $635,145 $626,609 $606,050TABLE 5Blue Steele Toy CompanySchedule of Actual Selling Expensesfor the Years Ended June 30, 2008 and 200720082007Units sold:325,556271,971Variable expenses:Packing and shipping$1,580,089$1,015,913Commissions129,080216,116Catalogs, brochures, and samples 150,425 65,658Total$1,859,594$1,297,687Fixed expenses:Salaries$2,734,868$2,345,121Advertising and promotion 2,288,324 2,086,021Total$5,023,192$4,431,142

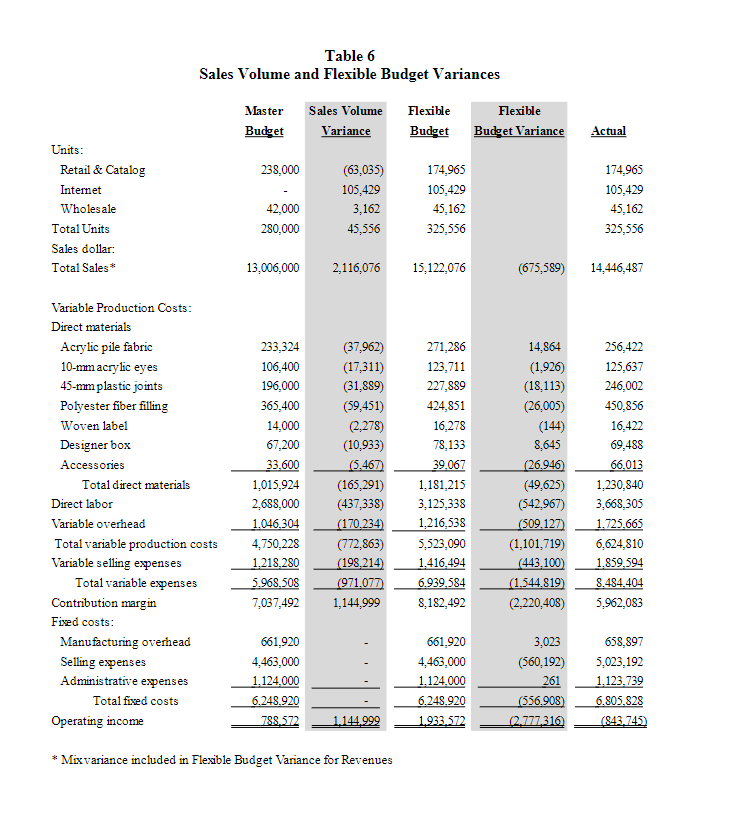

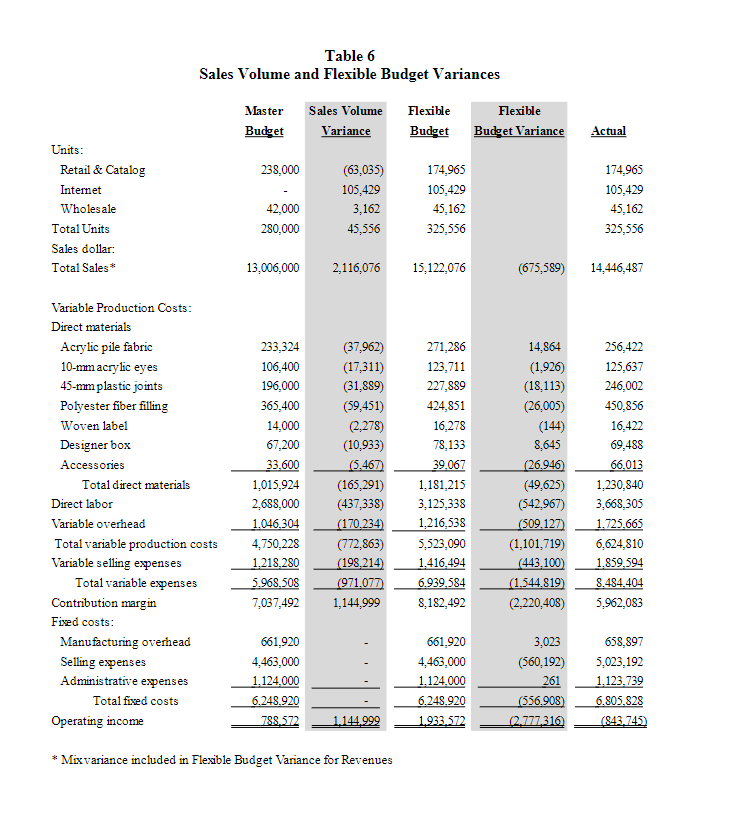

10Table 6Sales Volume and Flexible Budget VariancesMasterSalesVolumeFlexibleFlexibleBudgetVarianceBudgetBudgetVarianceActualUnits:Retail&Catalog238,000(63,035)174,965174,965Internet-105,429105,429105,429Wholesale42,0003,16245,16245,162TotalUnits280,00045,556325,556325,556Salesdollar:TotalSales*13,006,0002,116,07615,122,076(675,589)14,446,487VariableProductionCosts:DirectmaterialsAcrylicpilefabric233,324(37,962)271,28614,864256,42210-mmacryliceyes106,400(17,311)123,711(1,926)125,63745-mmplasticjoints196,000(31,889)227,889(18,113)246,002Polyesterfiberfilling365,400(59,451)424,851(26,005)450,856Wovenlabel14,000(2,278)16,278(144)16,422Designerbox67,200(10,933)78,1338,64569,488Accessories33,600(5,467)39,067(26,946)66,013Totaldirectmaterials1,015,924(165,291)1,181,215(49,625)1,230,840Directlabor2,688,000(437,338)3,125,338(542,967)3,668,305Variableoverhead1,046,304(170,234)1,216,538(509,127)1,725,665Totalvariableproductioncosts4,750,228(772,863)5,523,090(1,101,719)6,624,810Variablesellingexpenses1,218,280(198,214)1,416,494(443,100)1,859,594Totalvariableexpenses5,968,508(971,077)6,939,584(1,544,819)8,484,404Contributionmargin7,037,4921,144,9998,182,492(2,220,408)5,962,083Fixedcosts:Manufacturingoverhead661,920-661,9203,023658,897Sellingexpenses4,463,000-4,463,000(560,192)5,023,192Administrativeexpenses1,124,000-1,124,0002611,123,739Totalfixedcosts6,248,920-6,248,920(556,908)6,805,828Operatingincome788,5721,144,9991,933,572(2,777,316)(843,745)*MixvarianceincludedinFlexibleBudgetVarianceforRevenues

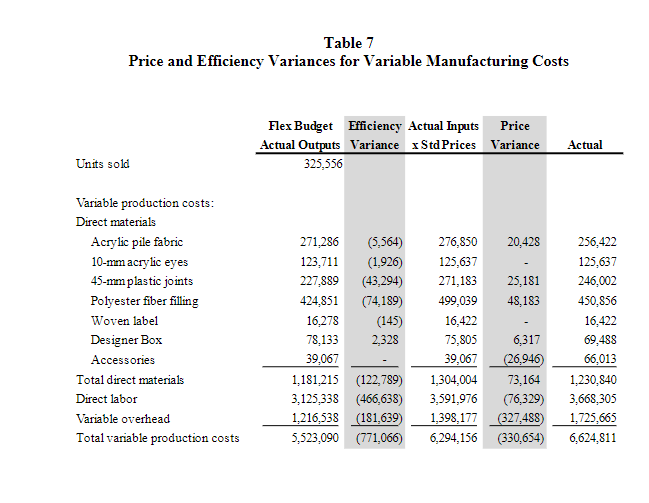

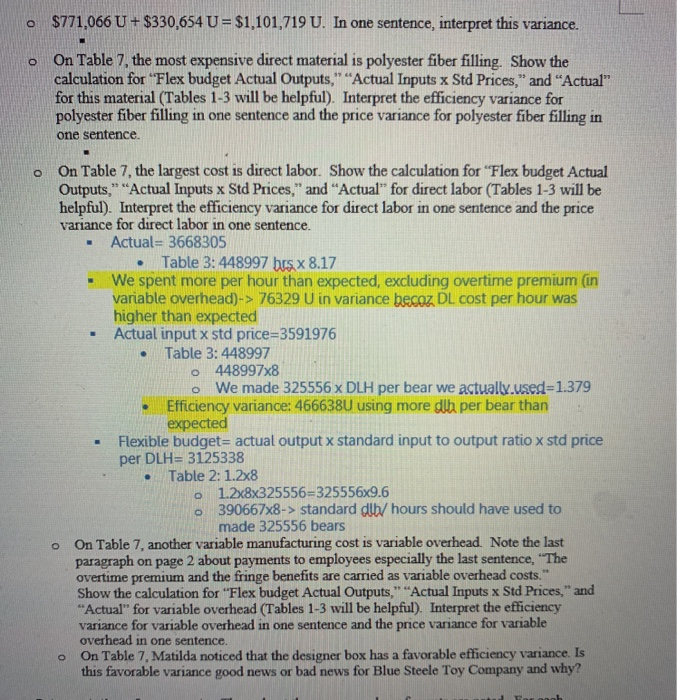

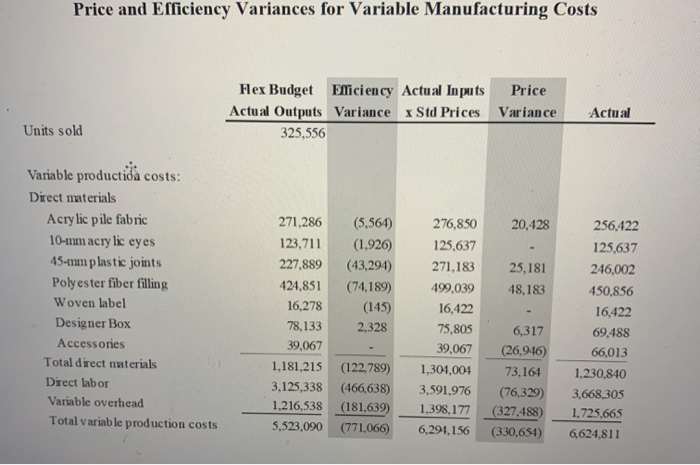

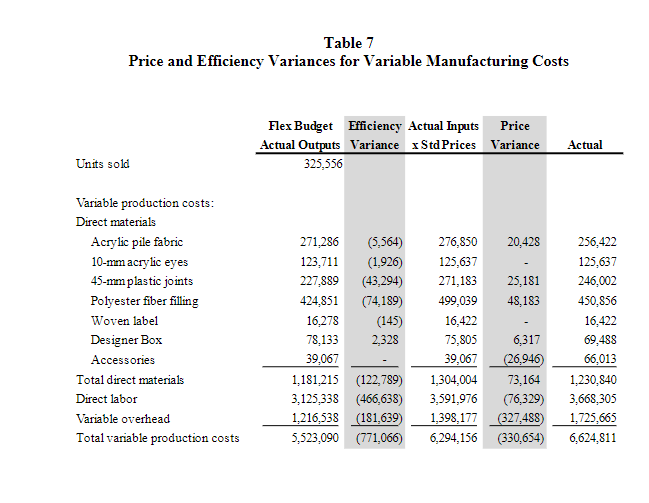

11Table 7Price and Efficiency Variances for Variable Manufacturing CostsFlexBudgetEfficiencyActualInputsPriceActualOutputsVariancexStdPricesVarianceActualUnitssold325,556Variableproductioncosts:DirectmaterialsAcrylicpilefabric271,286(5,564)276,85020,428256,42210-mmacryliceyes123,711(1,926)125,637-125,63745-mmplasticjoints227,889(43,294)271,18325,181246,002Polyesterfiberfilling424,851(74,189)499,03948,183450,856Wovenlabel16,278(145)16,422-16,422DesignerBox78,1332,32875,8056,31769,488Accessories39,067-39,067(26,946)66,013Totaldirectmaterials1,181,215(122,789)1,304,00473,1641,230,840Directlabor3,125,338(466,638)3,591,976(76,329)3,668,305Variableoverhead1,216,538(181,639)1,398,177(327,488)1,725,665Totalvariableproductioncosts5,523,090(771,066)6,294,156(330,654)6,624,811

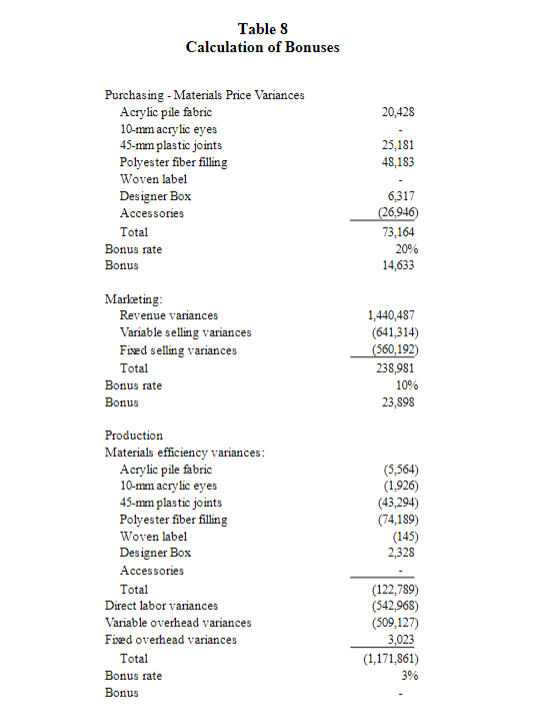

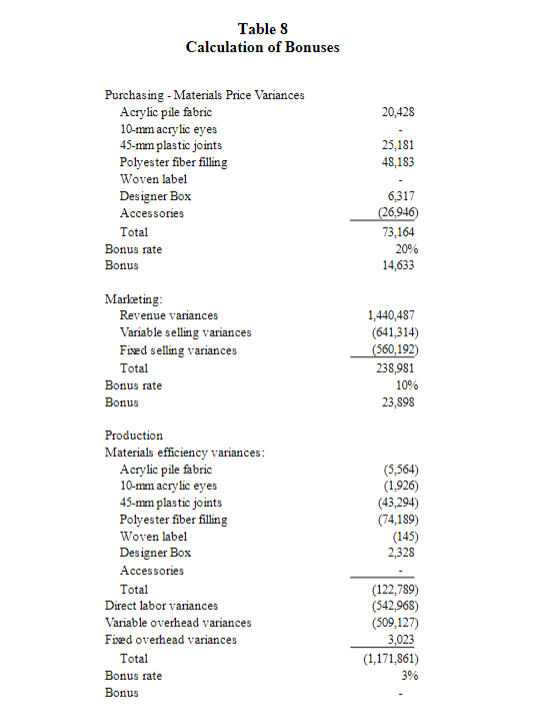

12Table 8Calculation of BonusesPurchasing-MaterialsPriceVariancesAcrylicpilefabric20,42810-mmacryliceyes-45-mmplasticjoints25,181Polyesterfiberfilling48,183Wovenlabel-DesignerBox6,317Accessories(26,946)Total73,164Bonusrate20%Bonus14,633Marketing:Revenuevariances1,440,487Variablesellingvariances(641,314)Fixedsellingvariances(560,192)Total238,981Bonusrate10%Bonus23,898ProductionMaterialsefficiencyvariances:Acrylicpilefabric(5,564)10-mmacryliceyes(1,926)45-mmplasticjoints(43,294)Polyesterfiberfilling(74,189)Wovenlabel(145)DesignerBox2,328Accessories-Total(122,789)Directlaborvariances(542,968)Variableoverheadvariances(509,127)Fixedoverheadvariances3,023Total(1,171,861)Bonusrate3%Bonus-

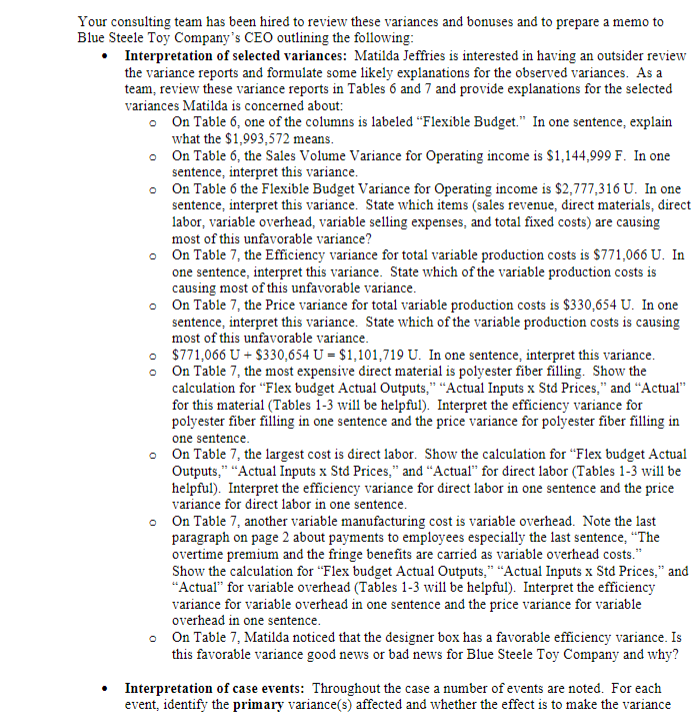

The blue part is what the instructor mentioned during lecture. The black part are the questions unsolved.

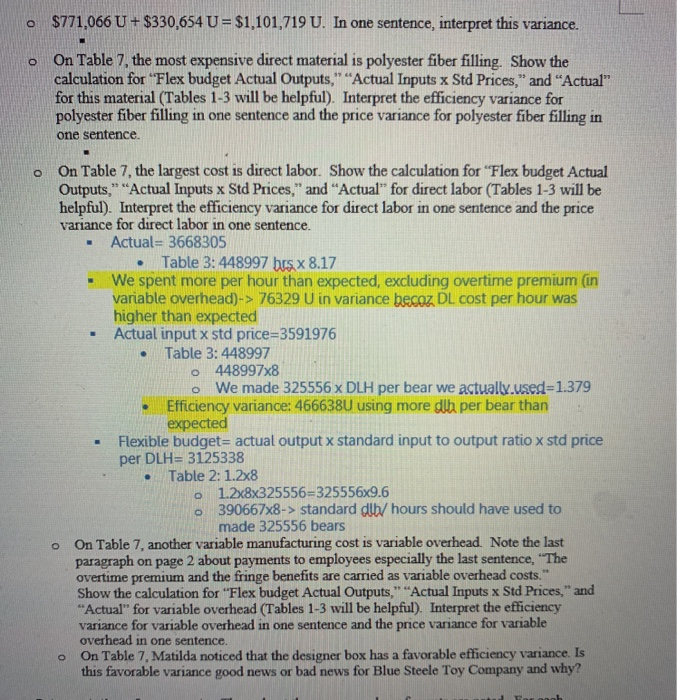

TABLE 1 Blue Steele Toy Company Preliminary Statement of Divisional Operating Income for the Year Ended June 30, 2008 Actual 325,556 Master (Static) Master-Budget Budget Variance 280,000 45,556 Units sold F $8,573,285 4.428,018 1.445.184 14.446,487 $11,662,000 0 1.344,000 13,006,000 $3,088,715 4,428,018 101.184 1,440,487 U F F F Retail and catalog (174,965 units) Internet (105,429 units) Wholesale (45,162 units) Total revenue Variable production costs: Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total direct materials Direct labor Variable overhead Total variable production costs Variable selling expenses Total variable expenses Contribution margin 256,422 125,637 246,002 450,856 16,422 69,488 66,013 1.230.840 3,668,305 1.725.665 6,624.810 1.859,594 8.484.404 5.962.083 233,324 106,400 196,000 365,400 14,000 67,200 33.600 1,015,924 2,688,000 1,046,304 4,750,228 1,218,280 5.968,508 7.037.492 23,098 19,237 50,002 85,456 2.422 2,288 32.413 214,916 980,305 679.361 1,874,582 641,314 2.515,896 1,075,409 U U U U U U U U U U U U U U Fixed costs: Manufacturing overhead 658,897 661,920 3,023 F Selling expenses 5,023,192 4,463,000 560,192 U Administrative expenses 1.123,739 1.124.000 261 F Total fixed costs 6.805.828 6.248.920 556.908 U Operating income S(843.745) $788,572 $1.632.317 U 2 The actual operating income reported in Table 1 is a preliminary figure that has not been adjusted for fiscal 2008 bonuses, if any. 6 TABLE 2 Blue Steele Toy Company Standard Cost Per Unit Schedule of Standard Costs: Fifteen-Inch Mugatu Bear Normal Capacity: 280,000 units Quantity Allowed Input Per Unit Price Direct materials Acrylic pile fabric 0.02381 bolts $35.00/bolt 10-mm acrylic eyes $0.19/eye 45-mm plastic joints 5 joints $0.14/joint Polyester fiber filling 0.90 lbs. $1.45/16. Woven label 1 label $0.05/each Designer box 1 box 50.24/each Accessories various Total direct materials 2 eyes 0.8333 0.3800 0.7000 1.3050 0.0500 0.2400 0.1200 3.6283 Direct labor Sewing Stuffing and cutting Assembly Dressing and packaging Total direct labor 0.50 hours 0.30 hours 0.30 hours 0.10 hours 1.20 hours $8.00 hour 9.6000 Variable manufacturing overheads 1.20 DLH $3.114/DLH 3.7368 16.9651 Fixed manufacturing overhead 1.20 DLH $1.97/DLH 2.364 $19.3291 One bolt of fabric is 10 yards long by 72 inches wide. Fabric for 42 finished units can be cut from one bolt. b The cost of accessories varies from 7 cents per unit for a bow tie to 45 cents per unit for fisherman's gear. The standard of 12 cents per unit reflects the historical assortment of accessories chosen by customers. Less than 0.01 hour per unit is spent cutting the fabric. Therefore hours spent in the cutting operation are not separately recorded. They are included with hours spent operating the pneumatic stuffing machine because both operations are usually performed by the same employees. d Variable and fixed overhead are allocated to production on the basis of standard direct labor hours allowed. Standard amounts are computed at normal capacity of 280,000 units. Maximum practical capacity is 350,000 units of production attainable in consideration of planned maintenance and scheduled down time for holidays. Normal capacity is the long-run average productive output that smoothes out seasonal, cyclical, and other variations in customer demand. TABLE 3 Blue Steele Toy Company Schedule of Actual Manufacturing Costs for the Year Ended June 30, 2008 Quantity Used Input Price Total Cost Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer box Accessories Total direct materials 7,910 bolts $32.4174/bolt 661,248 eyes $0.19/eye 1,937,023 joints $0.127/joint 344,165 lbs. $1.31/1b. 328,447 labels $0.05 each 315,854 boxes $0.22 each various $256,422 125,637 246,002 450,856 16,422 69,488 66,013 1,230,840 a Direct labor Sewing Stuffing and cutting Assembly Dressing and packaging Total direct labor Overtime premium Other variable manufacturing overhead 189,211 hours 104,117 hours 121,054 hours 34,615 hours 448,997 hours 103,787 hours $8.17/hour $4.085/hour 3,668,305 423,970 1,301,695 Fixed manufacturing overhead 658,897 $7,283,707 a The actual input price for accessories is derived by dividing the actual cost of $66,013 by units sold (325,556), yielding an average accessories cost of approxiimately $0.203 per bear. b The actual input price for variable overhead is obtained by dividing the total variable overhead ($1,301,695 + $423,970) by actual direct labor hours worked, yielding a price or rate of $3.84 per direct labor hour TABLE4 Blue Steele Toy Company Schedule of Actual Manufacturing Overhead Expenditures for the Years Ended June 30, 2004 through 2008 2008 2007 2006 2005 2004 Units produced 325,556 271,971 252,114 227,546 201,763 Variable overhead: Payroll taxes and fringes $840,963 Overtime premiums 423,970 Cleaning supplies 4,9 Maintenance labor 415,224 Maintenance supplies 27,373 Miscellaneous 13,142 Total $1,725,665 $524,846 $467,967 $413,937 $356,150 24,665 2,136 1,874 1,965 6,842 6,11 5,485 4,996 256,883 232,798 244,037 216,142 15,944 12,851 15,917 14,323 11,244 9,921 8.906 7,794 $840,424 $731,792 $690,156 $601,370 Fixed overhead: Utilities Depreciation-machinery Depreciation building Insurance Property taxes Supervisory salaries Total $121,417 28,500 88,750 62,976 70,101 287,153 $658,897 $119,786 $117,243 $116,554 28,500 28,500 28,500 88,750 88,750 88,750 61,716 57,211 55,544 70,101 68,243 68,243 274,538 275,198 269,018 $643,391 $635,145 $626,609 $113,229 28,500 88,750 54,988 66,114 254,469 $606,050 TABLE 5 Blue Steele Toy Company Schedule of Actual Selling Expenses for the Years Ended June 30, 2008 and 2007 2008 2007 325,556 271,971 Units sold: Variable expenses: Packing and shipping Commissions Catalogs, brochures, and samples Total $1,580,089 129,080 150,425 $1,859,594 $1,015,913 216,116 65,658 $1.297,687 Fixed expenses: Salaries Advertising and promotion Total $2,734,868 2.288.324 $5.023.192 $2,345,121 2.086,021 $4.431.142 Table 6 Sales Volume and Flexible Budget Variances Master Budget Sales Volume Variance Flexible Budget Flexible Budget Variance Actual 238,000 Units: Retail & Catalog Internet Wholesale Total Units Sales dollar: Total Sales* 42,000 280,000 (63,035) 105,429 3.162 45,556 174,965 105,429 45,162 325,556 174,965 105,429 45,162 325,556 13,006,000 2,116,076 15.122,076 (675,589) 14,446,487 Variable Production Costs: Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer box Accessories Total direct materials Direct labor Variable overhead Total variable production costs Variable selling expenses Total variable expenses Contribution margin Fixed costs: Manufacturing overhead Selling expenses Administrative expenses Total fixed costs Operating income 233,324 106,400 196,000 365,400 14.000 67,200 33.600 1,015,924 2.688,000 1.046,304 4,750,228 1.218.280 5.968.508 7.037,492 (37.962) (17.311) (31,889) (59,451) (2,278) (10.933) (5.467 (165,291) (437,338) (170.234 (772.863) (198.214) (971.077) 1,144,999 271,286 123,711 227,889 424,851 16,278 78,133 39.067 1,181,215 3.125,338 1,216,538 5,523,090 1.416,494 6.939.584 8.182,492 14,864 (1.926) (18,113) (26,005) (144) 8.645 (26.946 (49.625) (542,967) (509.127) (1,101,719) (443.100) (1.544.819) (2.220,408) 256,422 125.637 246,002 450,856 16,422 69,488 66.013 1.230.840 3,668,305 1.725,665 6,624,810 1,859,594 8.484,404 5.962,083 661,920 4.463,000 1.124.000 6.248.920 788.572 661,920 4.463,000 1.124.000 6.248.920 1.933.572 3,023 (560,192) 261 (556.908) (2.777,310 658,897 5,023,192 1.123.739 6.805.828 (843.745) 1.144.999 * Mix variance included in Flexible Budget Variance for Revenues Table 7 Price and Efficiency Variances for Variable Manufacturing Costs Flex Budget Efficiency Actual Inputs Price Actual Outputs Variance x Std Prices Variance 325,556 Actual Units sold 20,428 25,181 48,183 Variable production costs: Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total direct materials Direct labor Variable overhead Total variable production costs 271,286 (5,564) 123,711 (1,926) 227,889 (43,294) 424,851 (74,189) 16,278 (145) 78,133 2,328 39,067 1,181,215 (122,789) 3,125,338 (466,638) 1,216,538 (181,639) 5,523,090 (771,066) 276,850 125,637 271,183 499,039 16,422 75,805 39,067 1,304,004 3.591,976 1,398,177 6,294,156 6,317 (26,946 73,164 (76,329) (327,488 (330,654) 256,422 125.637 246,002 450.856 16.422 69,488 66,013 1,230,840 3,668,305 1,725,665 6,624.811 Table 8 Calculation of Bonuses 20,428 25,181 48,183 Purchasing - Materials Price Variances Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total Bonus rate Bonus 6,317 (26,946 73,164 20% 14,633 Marketing: Revenue variances Variable selling variances Fixed selling variances Total Bonus rate Bonus 1,440,487 (641,314) (560,192) 238,981 10% 23,898 (5,564) (1.926) (43,294) (74,189) (145) 2,328 Production Materials efficiency variances: Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total Direct labor variances Variable overhead variances Fixed overhead variances Total Bonus rate Bonus (122,789) (542,968) (509,127) 3,023 (1,171,861) 3% Your consulting team has been hired to review these variances and bonuses and to prepare a memo to Blue Steele Toy Company's CEO outlining the following: Interpretation of selected variances: Matilda Jeffries is interested in having an outsider review the variance reports and formulate some likely explanations for the observed variances. As a team, review these variance reports in Tables 6 and 7 and provide explanations for the selected variances Matilda is concerned about: On Table 6, one of the columns is labeled Flexible Budget." In one sentence, explain what the $1,993,572 means. On Table 6, the Sales Volume Variance for Operating income is $1,144,999 F. In one sentence, interpret this variance. On Table 6 the Flexible Budget Variance for Operating income is $2,777,316 U. In one sentence, interpret this variance. State which items (sales revenue, direct materials, direct labor, variable overhead, variable selling expenses, and total fixed costs) are causing most of this unfavorable variance? o On Table 7, the Efficiency variance for total variable production costs is $771,066 U. In one sentence, interpret this variance. State which of the variable production costs is causing most of this unfavorable variance. On Table 7, the Price variance for total variable production costs is $330,654 U. In one sentence, interpret this variance. State which of the variable production costs is causing most of this unfavorable variance. $771,066 U + $330,654 U = $1,101,719 U. In one sentence, interpret this variance. On Table 7, the most expensive direct material is polyester fiber filling. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for this material (Tables 1-3 will be helpful). Interpret the efficiency variance for polyester fiber filling in one sentence and the price variance for polyester fiber filling in one sentence. o On Table 7, the largest cost is direct labor. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for direct labor (Tables 1-3 will be helpful). Interpret the efficiency variance for direct labor in one sentence and the price variance for direct labor in one sentence. o On Table 7, another variable manufacturing cost is variable overhead. Note the last paragraph on page 2 about payments to employees especially the last sentence, The overtime premium and the fringe benefits are carried as variable overhead costs." Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for variable overhead (Tables 1-3 will be helpful). Interpret the efficiency variance for variable overhead in one sentence and the price variance for variable overhead in one sentence. o On Table 7, Matilda noticed that the designer box has a favorable efficiency variance. Is this favorable variance good news or bad news for Blue Steele Toy Company and why? Interpretation of case events: Throughout the case a number of events are noted. For each event, identify the primary variance(s) affected and whether the effect is to make the variance o $771,066 U + $330,654 U = $1,101,719 U. In one sentence, interpret this variance. O On Table 7, the most expensive direct material is polyester fiber filling. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for this material (Tables 1-3 will be helpful). Interpret the efficiency variance for polyester fiber filling in one sentence and the price variance for polyester fiber filling in one sentence. O . . On Table 7, the largest cost is direct labor. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual for direct labor (Tables 1-3 will be helpful). Interpret the efficiency variance for direct labor in one sentence and the price variance for direct labor in one sentence. Actual= 3668305 Table 3:448997 bus x 8.17 . We spent more per hour than expected, excluding overtime premium (in variable overhead)-> 76329 U in variance becoz DL cost per hour was higher than expected Actual input x std price=3591976 Table 3: 448997 o 448997x8 . We made 325556 x DLH per bear we actually used=1.379 Efficiency variance: 466638U using more dlh per bear than expected Flexible budget= actual output x standard input to output ratio x std price per DLH= 3125338 Table 2: 1.2x8 1.2x8x325556=325556x9.6 390667x8-> standard dib/hours should have used to made 325556 bears On Table 7, another variable manufacturing cost is variable overhead. Note the last paragraph on page 2 about payments to employees especially the last sentence, "The overtime premium and the fringe benefits are carried as variable overhead costs. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for variable overhead (Tables 1-3 will be helpful). Interpret the efficiency variance for variable overhead in one sentence and the price variance for variable overhead in one sentence. On Table 7. Matilda noticed that the designer box has a favorable efficiency variance. Is this favorable variance good news or bad news for Blue Steele Toy Company and why? . O O o o Price and Efficiency Variances for Variable Manufacturing Costs Flex Budget Fliciency Actual Inputs Price Actual Outputs Variance Std Prices Variance 325,556 Actual Units sold 20,428 Variable productia costs: Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total direct materials Direct labor Variable overhead Total variable production costs 25,181 48,183 271,286 (5,564) 123,711 (1.926) 227,889 (43,294) 424.851 (74,189) 16,278 (145) 78,133 2,328 39,067 1,181,215 (122,789) 3,125,338 (466,638) 1.216,538 (181,639) 5,523,090 (771,066) 276,850 125,637 271,183 499,039 16,422 75,805 39,067 1,301,004 3,591,976 1,398,177 6,291, 156 6,317 (26,946) 73,164 (76,329) (327.488) (330,654) 256,422 125,637 246,002 450,856 16,422 69,488 66,013 1.230,840 3,668,305 1.725,665 6,624,811 TABLE 1 Blue Steele Toy Company Preliminary Statement of Divisional Operating Income for the Year Ended June 30, 2008 Actual 325,556 Master (Static) Master-Budget Budget Variance 280,000 45,556 Units sold F $8,573,285 4.428,018 1.445.184 14.446,487 $11,662,000 0 1.344,000 13,006,000 $3,088,715 4,428,018 101.184 1,440,487 U F F F Retail and catalog (174,965 units) Internet (105,429 units) Wholesale (45,162 units) Total revenue Variable production costs: Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total direct materials Direct labor Variable overhead Total variable production costs Variable selling expenses Total variable expenses Contribution margin 256,422 125,637 246,002 450,856 16,422 69,488 66,013 1.230.840 3,668,305 1.725.665 6,624.810 1.859,594 8.484.404 5.962.083 233,324 106,400 196,000 365,400 14,000 67,200 33.600 1,015,924 2,688,000 1,046,304 4,750,228 1,218,280 5.968,508 7.037.492 23,098 19,237 50,002 85,456 2.422 2,288 32.413 214,916 980,305 679.361 1,874,582 641,314 2.515,896 1,075,409 U U U U U U U U U U U U U U Fixed costs: Manufacturing overhead 658,897 661,920 3,023 F Selling expenses 5,023,192 4,463,000 560,192 U Administrative expenses 1.123,739 1.124.000 261 F Total fixed costs 6.805.828 6.248.920 556.908 U Operating income S(843.745) $788,572 $1.632.317 U 2 The actual operating income reported in Table 1 is a preliminary figure that has not been adjusted for fiscal 2008 bonuses, if any. 6 TABLE 2 Blue Steele Toy Company Standard Cost Per Unit Schedule of Standard Costs: Fifteen-Inch Mugatu Bear Normal Capacity: 280,000 units Quantity Allowed Input Per Unit Price Direct materials Acrylic pile fabric 0.02381 bolts $35.00/bolt 10-mm acrylic eyes $0.19/eye 45-mm plastic joints 5 joints $0.14/joint Polyester fiber filling 0.90 lbs. $1.45/16. Woven label 1 label $0.05/each Designer box 1 box 50.24/each Accessories various Total direct materials 2 eyes 0.8333 0.3800 0.7000 1.3050 0.0500 0.2400 0.1200 3.6283 Direct labor Sewing Stuffing and cutting Assembly Dressing and packaging Total direct labor 0.50 hours 0.30 hours 0.30 hours 0.10 hours 1.20 hours $8.00 hour 9.6000 Variable manufacturing overheads 1.20 DLH $3.114/DLH 3.7368 16.9651 Fixed manufacturing overhead 1.20 DLH $1.97/DLH 2.364 $19.3291 One bolt of fabric is 10 yards long by 72 inches wide. Fabric for 42 finished units can be cut from one bolt. b The cost of accessories varies from 7 cents per unit for a bow tie to 45 cents per unit for fisherman's gear. The standard of 12 cents per unit reflects the historical assortment of accessories chosen by customers. Less than 0.01 hour per unit is spent cutting the fabric. Therefore hours spent in the cutting operation are not separately recorded. They are included with hours spent operating the pneumatic stuffing machine because both operations are usually performed by the same employees. d Variable and fixed overhead are allocated to production on the basis of standard direct labor hours allowed. Standard amounts are computed at normal capacity of 280,000 units. Maximum practical capacity is 350,000 units of production attainable in consideration of planned maintenance and scheduled down time for holidays. Normal capacity is the long-run average productive output that smoothes out seasonal, cyclical, and other variations in customer demand. TABLE 3 Blue Steele Toy Company Schedule of Actual Manufacturing Costs for the Year Ended June 30, 2008 Quantity Used Input Price Total Cost Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer box Accessories Total direct materials 7,910 bolts $32.4174/bolt 661,248 eyes $0.19/eye 1,937,023 joints $0.127/joint 344,165 lbs. $1.31/1b. 328,447 labels $0.05 each 315,854 boxes $0.22 each various $256,422 125,637 246,002 450,856 16,422 69,488 66,013 1,230,840 a Direct labor Sewing Stuffing and cutting Assembly Dressing and packaging Total direct labor Overtime premium Other variable manufacturing overhead 189,211 hours 104,117 hours 121,054 hours 34,615 hours 448,997 hours 103,787 hours $8.17/hour $4.085/hour 3,668,305 423,970 1,301,695 Fixed manufacturing overhead 658,897 $7,283,707 a The actual input price for accessories is derived by dividing the actual cost of $66,013 by units sold (325,556), yielding an average accessories cost of approxiimately $0.203 per bear. b The actual input price for variable overhead is obtained by dividing the total variable overhead ($1,301,695 + $423,970) by actual direct labor hours worked, yielding a price or rate of $3.84 per direct labor hour TABLE4 Blue Steele Toy Company Schedule of Actual Manufacturing Overhead Expenditures for the Years Ended June 30, 2004 through 2008 2008 2007 2006 2005 2004 Units produced 325,556 271,971 252,114 227,546 201,763 Variable overhead: Payroll taxes and fringes $840,963 Overtime premiums 423,970 Cleaning supplies 4,9 Maintenance labor 415,224 Maintenance supplies 27,373 Miscellaneous 13,142 Total $1,725,665 $524,846 $467,967 $413,937 $356,150 24,665 2,136 1,874 1,965 6,842 6,11 5,485 4,996 256,883 232,798 244,037 216,142 15,944 12,851 15,917 14,323 11,244 9,921 8.906 7,794 $840,424 $731,792 $690,156 $601,370 Fixed overhead: Utilities Depreciation-machinery Depreciation building Insurance Property taxes Supervisory salaries Total $121,417 28,500 88,750 62,976 70,101 287,153 $658,897 $119,786 $117,243 $116,554 28,500 28,500 28,500 88,750 88,750 88,750 61,716 57,211 55,544 70,101 68,243 68,243 274,538 275,198 269,018 $643,391 $635,145 $626,609 $113,229 28,500 88,750 54,988 66,114 254,469 $606,050 TABLE 5 Blue Steele Toy Company Schedule of Actual Selling Expenses for the Years Ended June 30, 2008 and 2007 2008 2007 325,556 271,971 Units sold: Variable expenses: Packing and shipping Commissions Catalogs, brochures, and samples Total $1,580,089 129,080 150,425 $1,859,594 $1,015,913 216,116 65,658 $1.297,687 Fixed expenses: Salaries Advertising and promotion Total $2,734,868 2.288.324 $5.023.192 $2,345,121 2.086,021 $4.431.142 Table 6 Sales Volume and Flexible Budget Variances Master Budget Sales Volume Variance Flexible Budget Flexible Budget Variance Actual 238,000 Units: Retail & Catalog Internet Wholesale Total Units Sales dollar: Total Sales* 42,000 280,000 (63,035) 105,429 3.162 45,556 174,965 105,429 45,162 325,556 174,965 105,429 45,162 325,556 13,006,000 2,116,076 15.122,076 (675,589) 14,446,487 Variable Production Costs: Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer box Accessories Total direct materials Direct labor Variable overhead Total variable production costs Variable selling expenses Total variable expenses Contribution margin Fixed costs: Manufacturing overhead Selling expenses Administrative expenses Total fixed costs Operating income 233,324 106,400 196,000 365,400 14.000 67,200 33.600 1,015,924 2.688,000 1.046,304 4,750,228 1.218.280 5.968.508 7.037,492 (37.962) (17.311) (31,889) (59,451) (2,278) (10.933) (5.467 (165,291) (437,338) (170.234 (772.863) (198.214) (971.077) 1,144,999 271,286 123,711 227,889 424,851 16,278 78,133 39.067 1,181,215 3.125,338 1,216,538 5,523,090 1.416,494 6.939.584 8.182,492 14,864 (1.926) (18,113) (26,005) (144) 8.645 (26.946 (49.625) (542,967) (509.127) (1,101,719) (443.100) (1.544.819) (2.220,408) 256,422 125.637 246,002 450,856 16,422 69,488 66.013 1.230.840 3,668,305 1.725,665 6,624,810 1,859,594 8.484,404 5.962,083 661,920 4.463,000 1.124.000 6.248.920 788.572 661,920 4.463,000 1.124.000 6.248.920 1.933.572 3,023 (560,192) 261 (556.908) (2.777,310 658,897 5,023,192 1.123.739 6.805.828 (843.745) 1.144.999 * Mix variance included in Flexible Budget Variance for Revenues Table 7 Price and Efficiency Variances for Variable Manufacturing Costs Flex Budget Efficiency Actual Inputs Price Actual Outputs Variance x Std Prices Variance 325,556 Actual Units sold 20,428 25,181 48,183 Variable production costs: Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total direct materials Direct labor Variable overhead Total variable production costs 271,286 (5,564) 123,711 (1,926) 227,889 (43,294) 424,851 (74,189) 16,278 (145) 78,133 2,328 39,067 1,181,215 (122,789) 3,125,338 (466,638) 1,216,538 (181,639) 5,523,090 (771,066) 276,850 125,637 271,183 499,039 16,422 75,805 39,067 1,304,004 3.591,976 1,398,177 6,294,156 6,317 (26,946 73,164 (76,329) (327,488 (330,654) 256,422 125.637 246,002 450.856 16.422 69,488 66,013 1,230,840 3,668,305 1,725,665 6,624.811 Table 8 Calculation of Bonuses 20,428 25,181 48,183 Purchasing - Materials Price Variances Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total Bonus rate Bonus 6,317 (26,946 73,164 20% 14,633 Marketing: Revenue variances Variable selling variances Fixed selling variances Total Bonus rate Bonus 1,440,487 (641,314) (560,192) 238,981 10% 23,898 (5,564) (1.926) (43,294) (74,189) (145) 2,328 Production Materials efficiency variances: Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total Direct labor variances Variable overhead variances Fixed overhead variances Total Bonus rate Bonus (122,789) (542,968) (509,127) 3,023 (1,171,861) 3% Your consulting team has been hired to review these variances and bonuses and to prepare a memo to Blue Steele Toy Company's CEO outlining the following: Interpretation of selected variances: Matilda Jeffries is interested in having an outsider review the variance reports and formulate some likely explanations for the observed variances. As a team, review these variance reports in Tables 6 and 7 and provide explanations for the selected variances Matilda is concerned about: On Table 6, one of the columns is labeled Flexible Budget." In one sentence, explain what the $1,993,572 means. On Table 6, the Sales Volume Variance for Operating income is $1,144,999 F. In one sentence, interpret this variance. On Table 6 the Flexible Budget Variance for Operating income is $2,777,316 U. In one sentence, interpret this variance. State which items (sales revenue, direct materials, direct labor, variable overhead, variable selling expenses, and total fixed costs) are causing most of this unfavorable variance? o On Table 7, the Efficiency variance for total variable production costs is $771,066 U. In one sentence, interpret this variance. State which of the variable production costs is causing most of this unfavorable variance. On Table 7, the Price variance for total variable production costs is $330,654 U. In one sentence, interpret this variance. State which of the variable production costs is causing most of this unfavorable variance. $771,066 U + $330,654 U = $1,101,719 U. In one sentence, interpret this variance. On Table 7, the most expensive direct material is polyester fiber filling. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for this material (Tables 1-3 will be helpful). Interpret the efficiency variance for polyester fiber filling in one sentence and the price variance for polyester fiber filling in one sentence. o On Table 7, the largest cost is direct labor. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for direct labor (Tables 1-3 will be helpful). Interpret the efficiency variance for direct labor in one sentence and the price variance for direct labor in one sentence. o On Table 7, another variable manufacturing cost is variable overhead. Note the last paragraph on page 2 about payments to employees especially the last sentence, The overtime premium and the fringe benefits are carried as variable overhead costs." Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for variable overhead (Tables 1-3 will be helpful). Interpret the efficiency variance for variable overhead in one sentence and the price variance for variable overhead in one sentence. o On Table 7, Matilda noticed that the designer box has a favorable efficiency variance. Is this favorable variance good news or bad news for Blue Steele Toy Company and why? Interpretation of case events: Throughout the case a number of events are noted. For each event, identify the primary variance(s) affected and whether the effect is to make the variance o $771,066 U + $330,654 U = $1,101,719 U. In one sentence, interpret this variance. O On Table 7, the most expensive direct material is polyester fiber filling. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for this material (Tables 1-3 will be helpful). Interpret the efficiency variance for polyester fiber filling in one sentence and the price variance for polyester fiber filling in one sentence. O . . On Table 7, the largest cost is direct labor. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual for direct labor (Tables 1-3 will be helpful). Interpret the efficiency variance for direct labor in one sentence and the price variance for direct labor in one sentence. Actual= 3668305 Table 3:448997 bus x 8.17 . We spent more per hour than expected, excluding overtime premium (in variable overhead)-> 76329 U in variance becoz DL cost per hour was higher than expected Actual input x std price=3591976 Table 3: 448997 o 448997x8 . We made 325556 x DLH per bear we actually used=1.379 Efficiency variance: 466638U using more dlh per bear than expected Flexible budget= actual output x standard input to output ratio x std price per DLH= 3125338 Table 2: 1.2x8 1.2x8x325556=325556x9.6 390667x8-> standard dib/hours should have used to made 325556 bears On Table 7, another variable manufacturing cost is variable overhead. Note the last paragraph on page 2 about payments to employees especially the last sentence, "The overtime premium and the fringe benefits are carried as variable overhead costs. Show the calculation for "Flex budget Actual Outputs," "Actual Inputs x Std Prices," and "Actual" for variable overhead (Tables 1-3 will be helpful). Interpret the efficiency variance for variable overhead in one sentence and the price variance for variable overhead in one sentence. On Table 7. Matilda noticed that the designer box has a favorable efficiency variance. Is this favorable variance good news or bad news for Blue Steele Toy Company and why? . O O o o Price and Efficiency Variances for Variable Manufacturing Costs Flex Budget Fliciency Actual Inputs Price Actual Outputs Variance Std Prices Variance 325,556 Actual Units sold 20,428 Variable productia costs: Direct materials Acrylic pile fabric 10-mm acrylic eyes 45-mm plastic joints Polyester fiber filling Woven label Designer Box Accessories Total direct materials Direct labor Variable overhead Total variable production costs 25,181 48,183 271,286 (5,564) 123,711 (1.926) 227,889 (43,294) 424.851 (74,189) 16,278 (145) 78,133 2,328 39,067 1,181,215 (122,789) 3,125,338 (466,638) 1.216,538 (181,639) 5,523,090 (771,066) 276,850 125,637 271,183 499,039 16,422 75,805 39,067 1,301,004 3,591,976 1,398,177 6,291, 156 6,317 (26,946) 73,164 (76,329) (327.488) (330,654) 256,422 125,637 246,002 450,856 16,422 69,488 66,013 1.230,840 3,668,305 1.725,665 6,624,811