Answered step by step

Verified Expert Solution

Question

1 Approved Answer

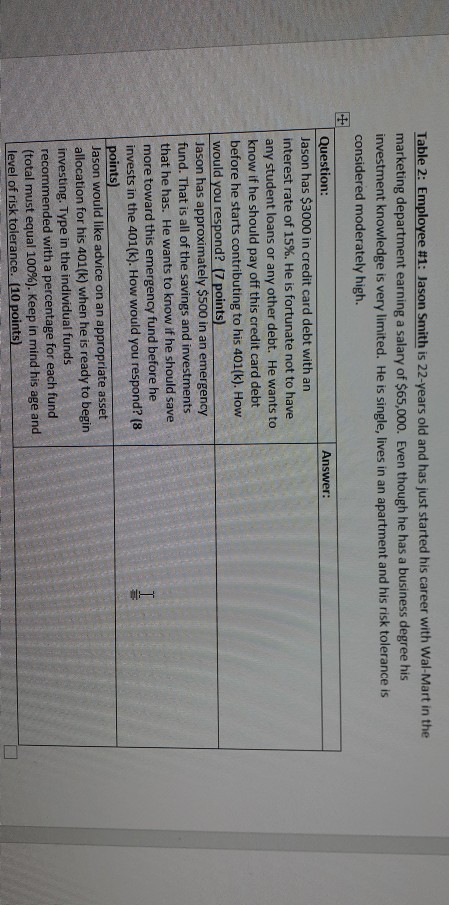

Table 2: Employee #1: Jason Smith is 22-years old and has just started his career with Wal-Mart in the marketing department earning a salary of

Table 2: Employee #1: Jason Smith is 22-years old and has just started his career with Wal-Mart in the marketing department earning a salary of $65,000. Even though he has a business degree his investment knowledge is very limited. He is single, lives in an apartment and his risk tolerance is considered moderately high. Answer: Question: Jason has $3000 in credit card debt with an interest rate of 15%. He is fortunate not to have any student loans or any other debt. He wants to know if he should pay off this credit card debt before he starts contributing to his 401(k). How would you respond? (7 points) Jason has approximately $500 in an emergency fund. That is all of the savings and investments that he has. He wants to know if he should save more toward this emergency fund before he invests in the 401(k). How would you respond? (8 points) Jason would like advice on an appropriate asset allocation for his 401(k) when he is ready to begin investing. Type in the individual funds recommended with a percentage for each fund (total must equal 100%). Keep in mind his age and level of risk tolerance. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started