Question

Table 2 shows data on the yearly stock prices of Etisalat, EIB (Emirates Islamic Bank), and DU for 2014 to 2020. A researcher has

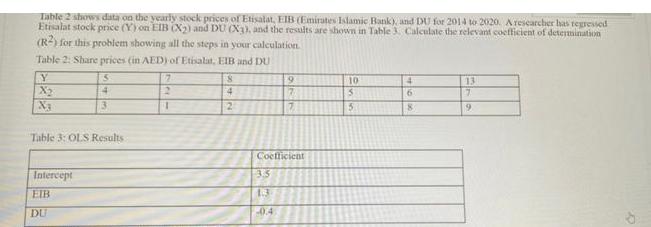

Table 2 shows data on the yearly stock prices of Etisalat, EIB (Emirates Islamic Bank), and DU for 2014 to 2020. A researcher has regressed Etisalat stock price (Y) on EIB (X2) and DU (X3), and the results are shown in Table 3. Calculate the relevant coefficient of determination (R2) for this problem showing all the steps in your calculation. Table 2: Share prices (in AED) of Etisalat, EIB and DU Y X 5 Intercept EIB DU 4 3 Table 3: OLS Results 7 2 1 8 4 2 9 7 3.3 1.3 -0.4 7 Coefficient 10 5 5 4 6 8 13 7 19

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the coefficient of determination R2 for the regression of Etisalat stock price V on EIB ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Paul Krugman, Robin Wells

3rd edition

978-1429283427, 1429283424, 978-1464104213, 1464104212, 978-1429283434

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App