Wombat Bank charges 1% per annum loan origination fee, and price its loans based on the inter-bank lending rate, which is currently 4.0% per

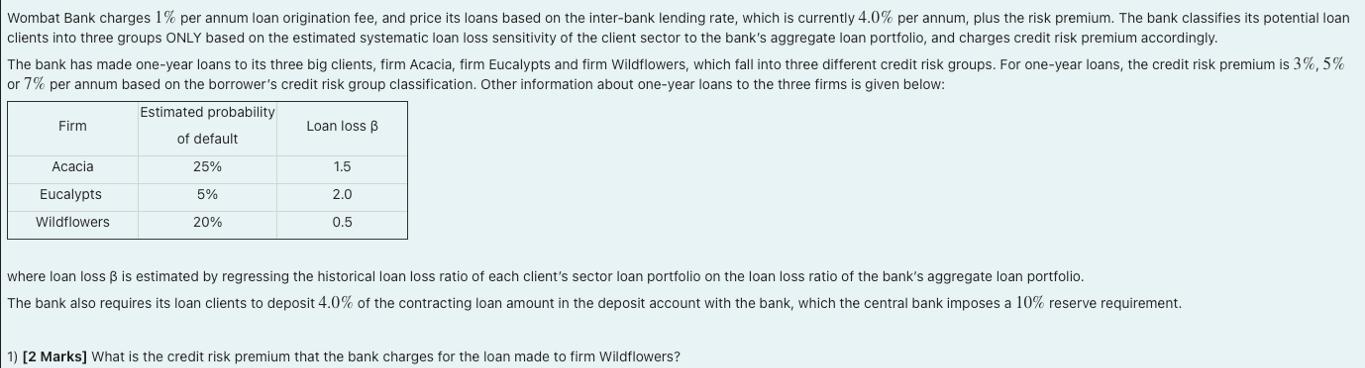

Wombat Bank charges 1% per annum loan origination fee, and price its loans based on the inter-bank lending rate, which is currently 4.0% per annum, plus the risk premium. The bank classifies its potential loan clients into three groups ONLY based on the estimated systematic loan loss sensitivity of the client sector to the bank's aggregate loan portfolio, and charges credit risk premium accordingly. The bank has made one-year loans to its three big clients, firm Acacia, firm Eucalypts and firm Wildflowers, which fall into three different credit risk groups. For one-year loans, the credit risk premium is 3%,5% or 7% per annum based on the borrower's credit risk group classification. Other information about one-year loans to the three firms is given below: Estimated probability of default 25% 5% 20% Firm Acacial Eucalypts Wildflowers Loan loss B 1.5 2.0 0.5 where loan loss is estimated by regressing the historical loan loss ratio of each client's sector loan portfolio on the loan loss ratio of the bank's aggregate loan portfolio. The bank also requires its loan clients to deposit 4.0% of the contracting loan amount in the deposit account with the bank, which the central bank imposes a 10% reserve requirement. 1) [2 Marks] What is the credit risk premium that the bank charges for the loan made to firm Wildflowers?

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To determine the credit risk premium for the loan made to firm W...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started