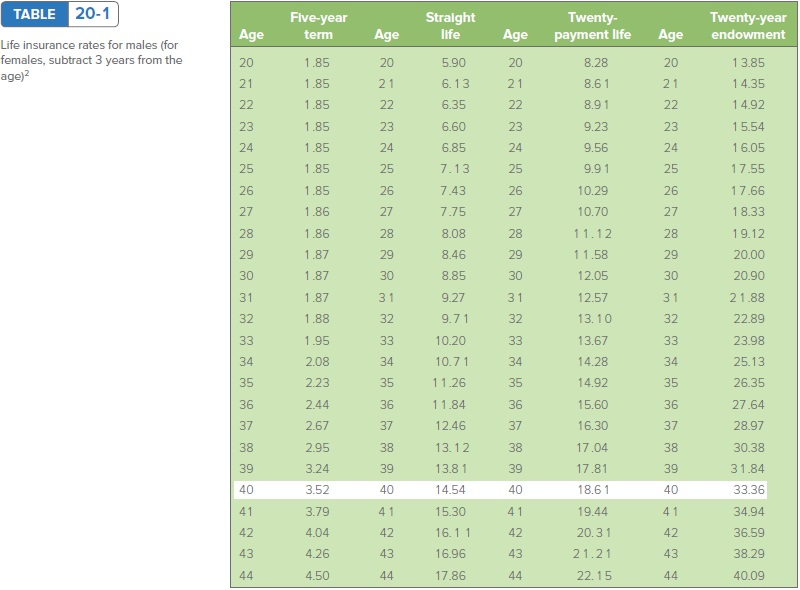

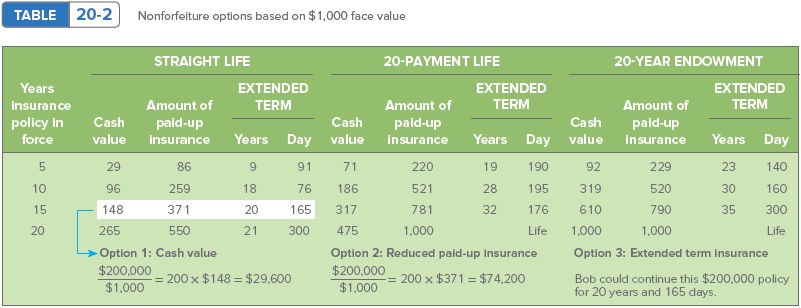

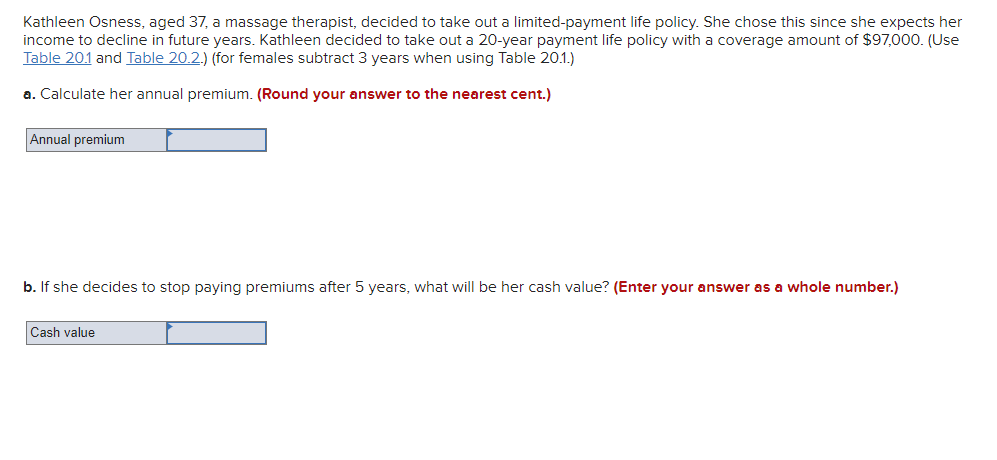

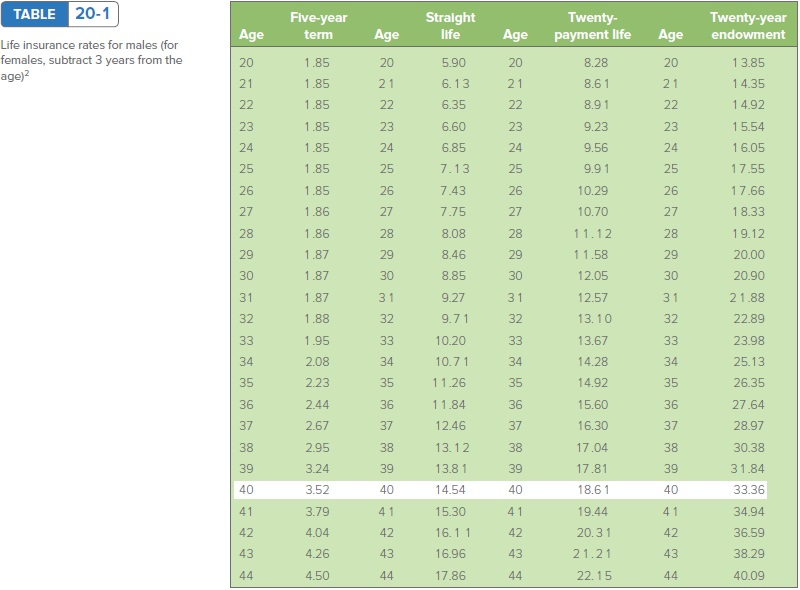

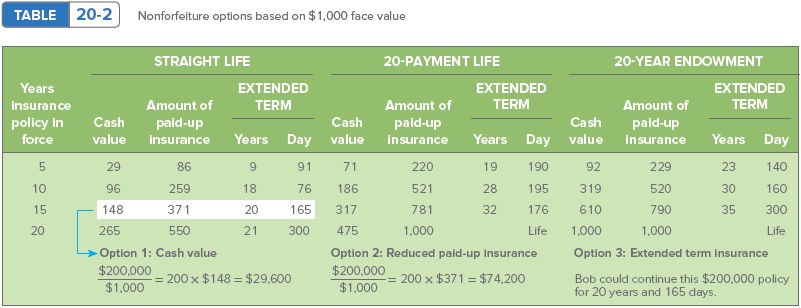

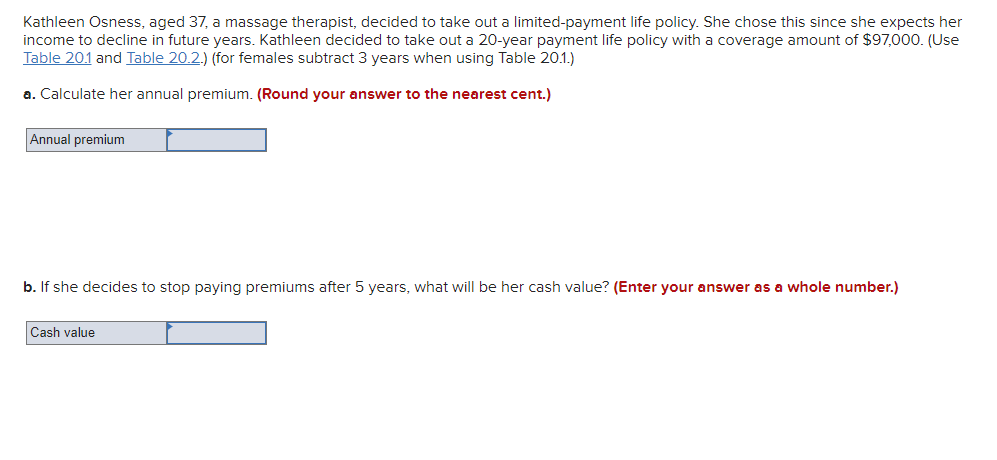

TABLE 20-1 Five-year term Straight life Twenty-year endowment Age Age Twenty- payment life Age Age Life insurance rates for males (for females, subtract 3 years from the age) 20 1.85 20 5.90 20 8.28 20 13.85 21 21 6.13 21 21 14.35 1.85 1.85 8.61 8.91 22 22 6.35 22 22 14.92 23 1.85 23 6.60 23 9.23 23 15.54 24 24 6.85 24 24 16.05 1.85 1.85 9.56 9.91 25 25 7.13 25 25 17.55 26 1.85 26 7.43 26 10.29 26 17.66 27 1.86 27 7.75 27 10.70 27 18.33 28 1.86 28 28 28 19.12 11.12 1 1.58 29 1.87 8.08 8.46 8.85 29 29 29 20.00 30 1.87 30 30 12.05 30 20.90 31 1.87 31 9.27 31 12.57 31 21.88 22.89 32 1.88 32 9.71 32 13.10 32 33 1.95 33 10.20 33 13.67 33 23.98 34 2.08 34 34 14.28 34 25.13 10.71 11.26 35 2.23 35 35 14.92 35 26.35 36 2.44 36 11.84 36 15.60 36 27.64 37 2.67 37 12.46 37 16.30 37 28.97 38 38 38 17.04 38 30.38 2.95 3.24 13.12 13.81 39 39 39 17.81 39 31.84 40 3.52 40 14.54 40 18.61 40 33.36 41 3.79 41 15.30 41 19.44 41 34.94 42 4.04 42 16.11 42 20.31 42 36.59 43 4.26 43 16.96 43 21.21 43 38.29 44 4.50 44 17.86 44 22.15 44 40.09 TABLE 20-2 Nonforfeiture options based on $1,000 face value Years insurance policy in force 5 STRAIGHT LIFE EXTENDED Amount of TERM Cash paid-up value insurance Years Day 29 86 9 91 96 18 76 148 371 20 165 265 550 21 300 Option 1: Cash value $200,000 = 200 x $148 = $29,600 $1,000 20-PAYMENT LIFE 20-YEAR ENDOWMENT EXTENDED EXTENDED Amount of TERM Amount of TERM Cash paid-up Cash pald-up value insurance Years Day value insurance Years Day 71 220 19 190 92 229 23 140 186 521 28 195 319 520 30 160 317 781 32 176 610 790 35 300 475 1.000 Life 1,000 1.000 Life Option 2: Reduced paid-up insurance Option 3: Extended term insurance $200,000 = 200 x $371 = $74.200 $1,000 Bob could continue this $200,000 policy for 20 years and 165 days. 10 259 15 20 Kathleen Osness, aged 37, a massage therapist, decided to take out a limited-payment life policy. She chose this since she expects her income to decline in future years. Kathleen decided to take out a 20-year payment life policy with a coverage amount of $97,000. (Use Table 20.1 and Table 20.2.) (for females subtract 3 years when using Table 20.1.) a. Calculate her annual premium. (Round your answer to the nearest cent.) Annual premium b. If she decides to stop paying premiums after 5 years, what will be her cash value? (Enter your answer as a whole number.) Cash value