Answered step by step

Verified Expert Solution

Question

1 Approved Answer

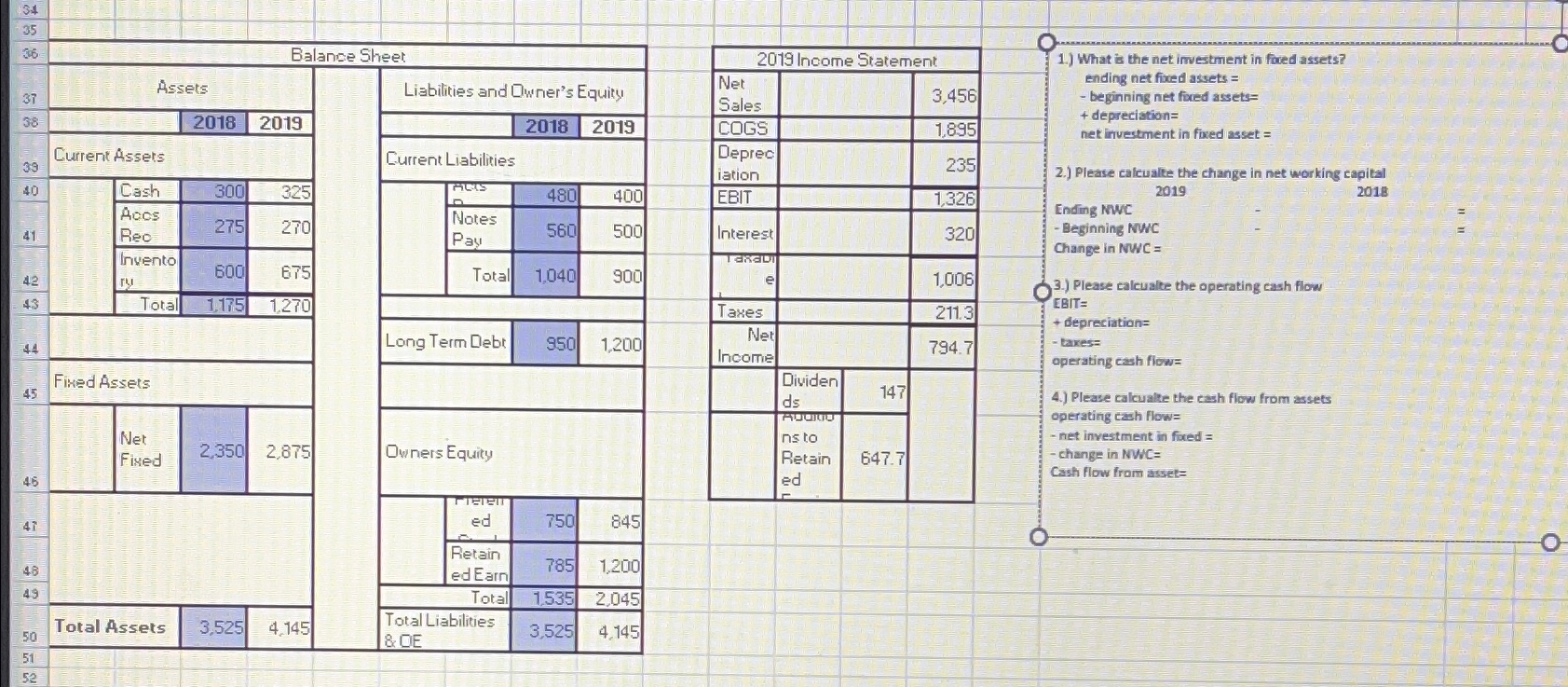

table [ [ 3 4 ] , [ 3 5 , , - , , , , ] , [ 3 6 , Balance

tableBalance SheetAssets,Liabilities and Qwner's EquityCurrent Assets,Current LiabilitiesCash,exstableAeosReotableNotesPaytableInventoryTotal,Total,Long Term Debt,Fiked Assets,,,tableNetFinedOwners EquitytableTeeedtableRetainedEainTotal,Total Assets,tableTotal Liabilities&OE

What is the net imvestment in fored assets? ending net fixed assets

beginning net fixed assets

depreciation

net irvestment in fixed asset

Please calcualte the change in net working capital

Ending NWC

Beginning NWC

Change in NWC

Please calcualte the operating cash flow EBIT

depreciation

taxes

aperating cash flow:

Please calcualte the cash flow from assets operating cash flow

net investment in foxed

change in NWW:C

Cash flow from asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started