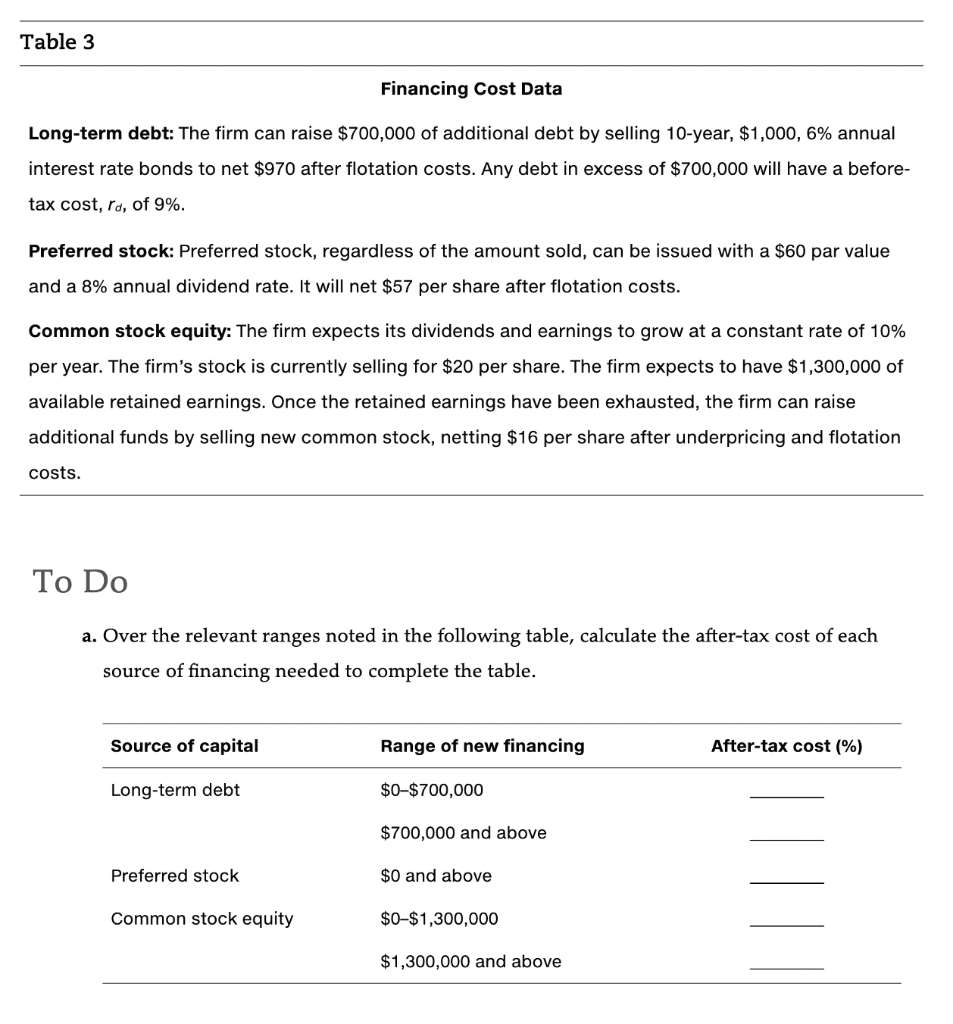

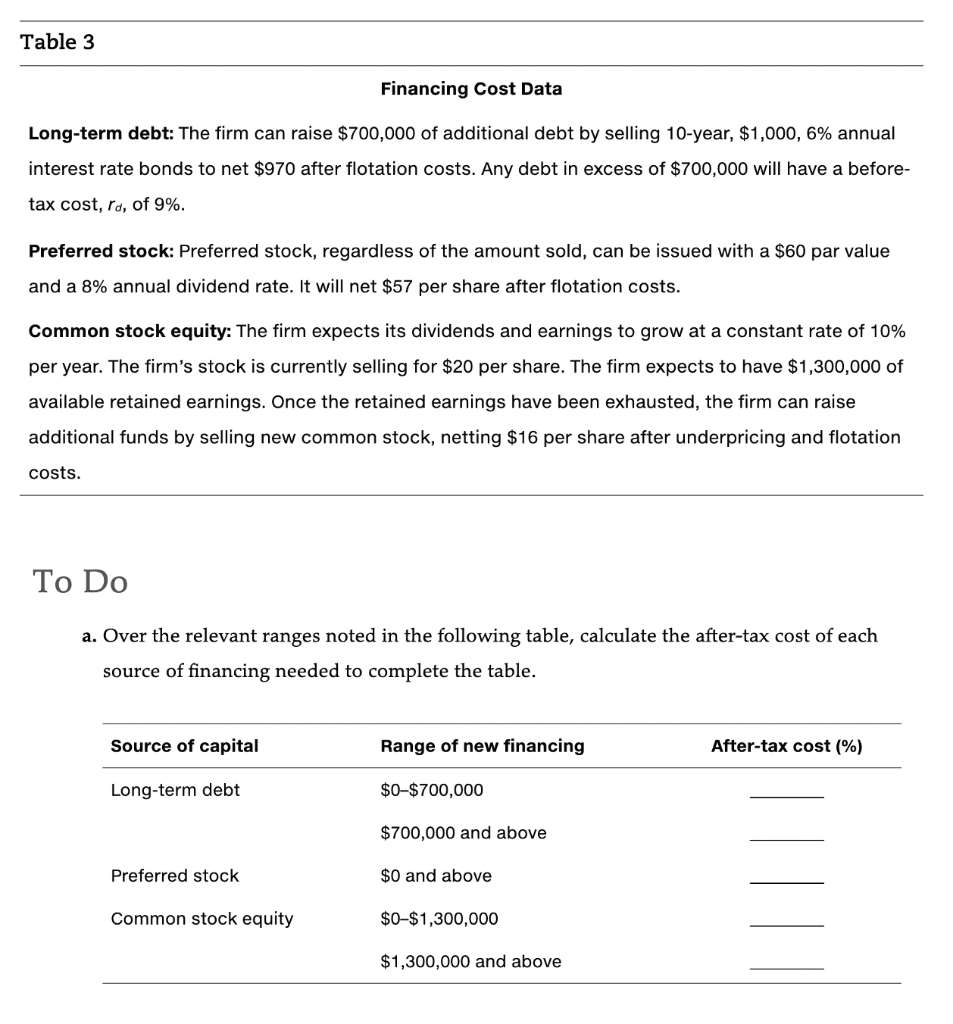

Table 3 Financing Cost Data Long-term debt: The firm can raise $700,000 of additional debt by selling 10-year, $1,000, 6% annual interest rate bonds to net $970 after flotation costs. Any debt in excess of $700,000 will have a before- tax cost, rd, of 9%. Preferred stock: Preferred stock, regardless of the amount sold, can be issued with a $60 par value and a 8% annual dividend rate. It will net $57 per share after flotation costs. Common stock equity: The firm expects its dividends and earnings to grow at a constant rate of 10% per year. The firm's stock is currently selling for $20 per share. The firm expects to have $1,300,000 of available retained earnings. Once the retained earnings have been exhausted, the firm can raise additional funds by selling new common stock, netting $16 per share after underpricing and flotation costs. To Do a. Over the relevant ranges noted in the following table, calculate the after-tax cost of each source of financing needed to complete the table. Source of capital Range of new financing After-tax cost (%) Long-term debt $0-$700,000 $700,000 and above Preferred stock $0 and above Common stock equity $0-$1,300,000 $1,300,000 and above Table 3 Financing Cost Data Long-term debt: The firm can raise $700,000 of additional debt by selling 10-year, $1,000, 6% annual interest rate bonds to net $970 after flotation costs. Any debt in excess of $700,000 will have a before- tax cost, rd, of 9%. Preferred stock: Preferred stock, regardless of the amount sold, can be issued with a $60 par value and a 8% annual dividend rate. It will net $57 per share after flotation costs. Common stock equity: The firm expects its dividends and earnings to grow at a constant rate of 10% per year. The firm's stock is currently selling for $20 per share. The firm expects to have $1,300,000 of available retained earnings. Once the retained earnings have been exhausted, the firm can raise additional funds by selling new common stock, netting $16 per share after underpricing and flotation costs. To Do a. Over the relevant ranges noted in the following table, calculate the after-tax cost of each source of financing needed to complete the table. Source of capital Range of new financing After-tax cost (%) Long-term debt $0-$700,000 $700,000 and above Preferred stock $0 and above Common stock equity $0-$1,300,000 $1,300,000 and above