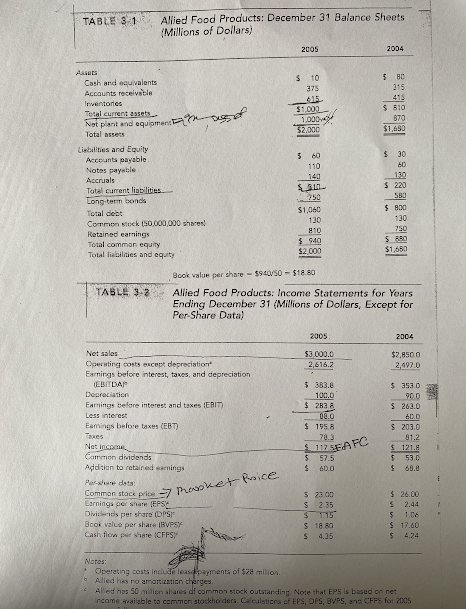

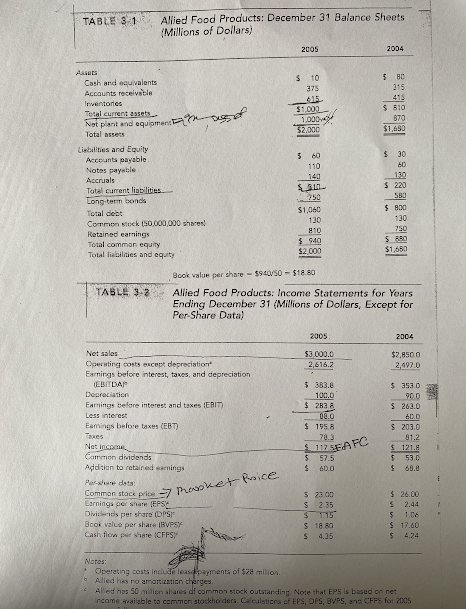

TABLE 3-1 Allied Food Products: December 31 Balance Sheets (Millions of Dollars) 2005 2004 $ 10 375 615 $1.000 1.0004 $2,000 5 80 315 415 S 510 870 $1,690 $ 30 Cash and equivalents Accounts receivable Inventories Total current assets Not plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilit Long-term bonds Total debt Common stock (50,000,000 shares! Retained earnings Total common equity Total liabilities and equity 5 60 110 140 $1,060 130 810 $ MO $2.000 130 S 220 550 $ 800 130 750 SRO $1,050 Book value per share - $940/50 - $18.80 TABLE 3-2 Allied Food Products: Income Statements for Years Ending December 31 (Millions of Dollars, Except for Per Share Data) 2005 2004 $3000.0 2,616.2 $2,8500 2,497.0 Net sales Operating costs except depreciation Earnings before interest, taxes, and depreciation TEBITLAP | Depreciation Earnings before interest and taxes (EBIT) Less nterest Eamings before taxes (EBT) Taxes $ 383.6 100.0 $ 2838 12.0 $ 1958 78.3 $ 353.0 900 S 263.0 6.D S 203.0 91.2 $ 121. $ 53.0 68.8 1175FAFC Common dividends Addition to retained earnings Pas share data $ $ 57.5 60.0 Commor tace prios -> Toket Rice Earnings per Share EPSC Dividends per share (DPS Book value per share (BVPSY Cash flow Dershare ICFFS $ 2305 S 235 $ 115 S1880 S 4.35 $26.00 $ $ 1.06 $17.60 $ Notes: Operating costs include leasd payments of $28 milion Alied has no amortization charges Alied has 50 milion shares de common stock outstanding. Note that EPS is based on net Income Brailable to common stockholders Calculations of EPS, OPS, BVPs, and CFFs for 2005 TABLE 3-1 Allied Food Products: December 31 Balance Sheets (Millions of Dollars) 2005 2004 $ 10 375 615 $1.000 1.0004 $2,000 5 80 315 415 S 510 870 $1,690 $ 30 Cash and equivalents Accounts receivable Inventories Total current assets Not plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilit Long-term bonds Total debt Common stock (50,000,000 shares! Retained earnings Total common equity Total liabilities and equity 5 60 110 140 $1,060 130 810 $ MO $2.000 130 S 220 550 $ 800 130 750 SRO $1,050 Book value per share - $940/50 - $18.80 TABLE 3-2 Allied Food Products: Income Statements for Years Ending December 31 (Millions of Dollars, Except for Per Share Data) 2005 2004 $3000.0 2,616.2 $2,8500 2,497.0 Net sales Operating costs except depreciation Earnings before interest, taxes, and depreciation TEBITLAP | Depreciation Earnings before interest and taxes (EBIT) Less nterest Eamings before taxes (EBT) Taxes $ 383.6 100.0 $ 2838 12.0 $ 1958 78.3 $ 353.0 900 S 263.0 6.D S 203.0 91.2 $ 121. $ 53.0 68.8 1175FAFC Common dividends Addition to retained earnings Pas share data $ $ 57.5 60.0 Commor tace prios -> Toket Rice Earnings per Share EPSC Dividends per share (DPS Book value per share (BVPSY Cash flow Dershare ICFFS $ 2305 S 235 $ 115 S1880 S 4.35 $26.00 $ $ 1.06 $17.60 $ Notes: Operating costs include leasd payments of $28 milion Alied has no amortization charges Alied has 50 milion shares de common stock outstanding. Note that EPS is based on net Income Brailable to common stockholders Calculations of EPS, OPS, BVPs, and CFFs for 2005