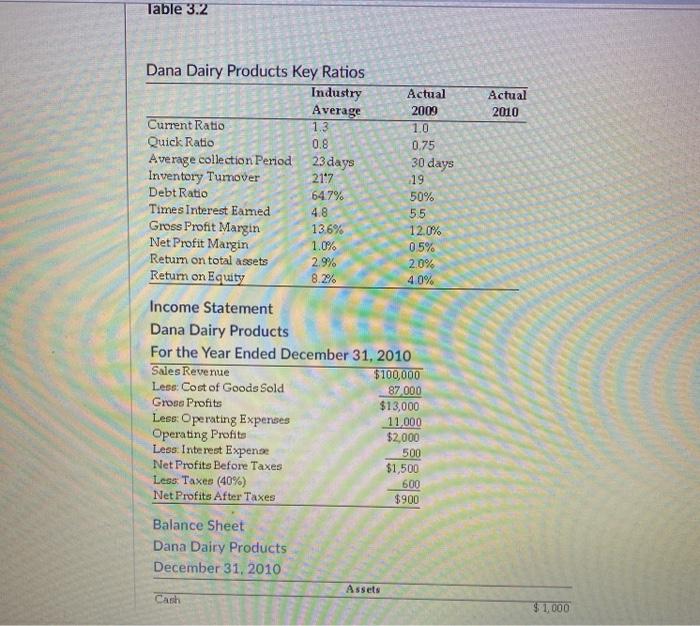

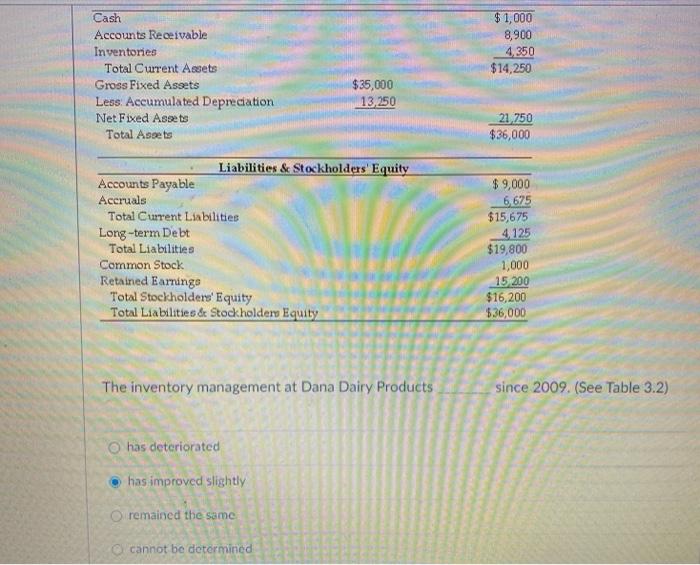

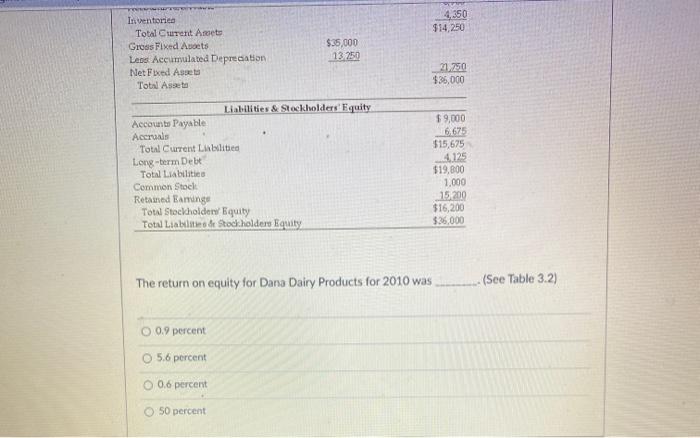

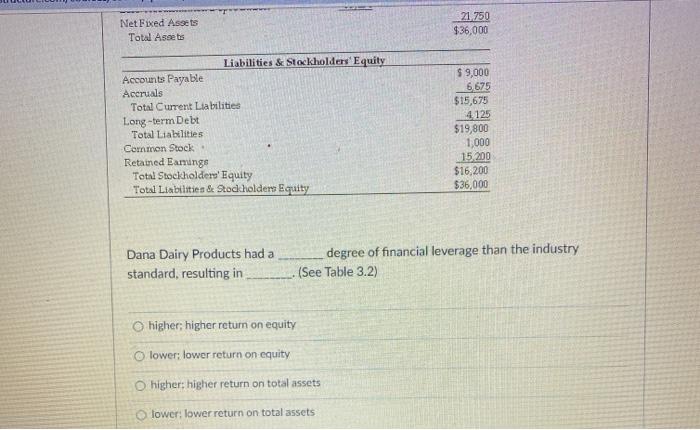

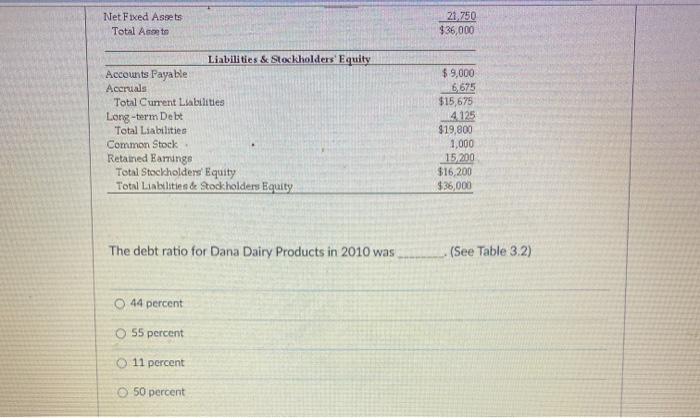

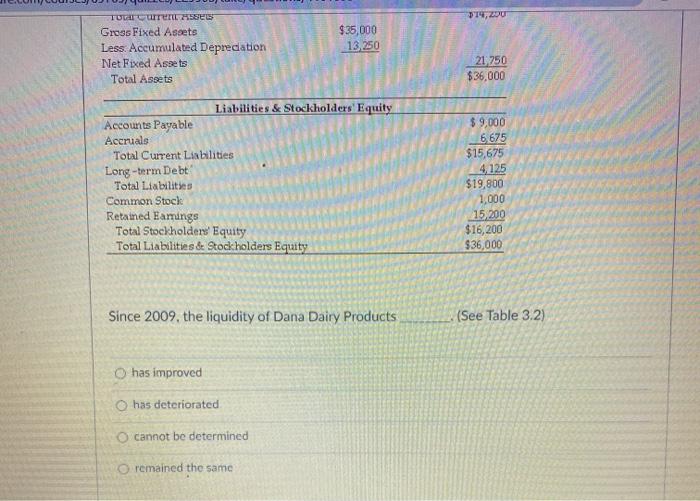

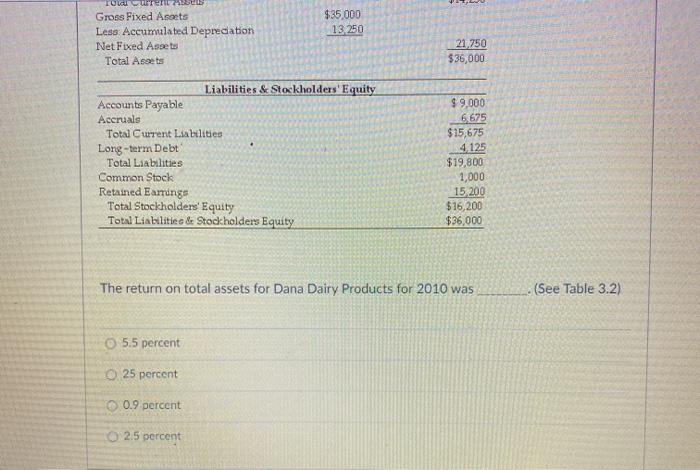

Table 3.2 Actual 2010 Dana Dairy Products Key Ratios Industry Actual Average 2009 Current Ratio 1.3 10 Quick Ratio 0.8 0.75 Average collection Period 23 days 30 days Inventory Tumover 2107 19 Debt Ratio 64.7% 50% Times Interest Eamed 4.8 55 Gross Profit Margin 13.6% 12.0% Net Profit Margin 1.0% 05% Return on total assets 2.9% 2.0% Return on Equity 8.2% 4.0% Income Statement Dana Dairy Products For the Year Ended December 31, 2010 Sales Revenue $100,000 Less: Cost of Goods Sold 87 000 Gross Profits $13,000 Less: Operating Expenses 11.000 Operating Profits $2,000 Less Interest Expense 500 Net Profits Before Taxes $1,500 Less Taxes (40%) 600 Net Profits After Taxes $900 Balance Sheet Dana Dairy Products December 31, 2010 Assets Cash $1,000 $ 1,000 8,900 4.350 $14,250 Cash Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less: Accumulated Depreciation Net Fixed Assets Total Assets $35,000 13,250 21,750 $36,000 Liabilities & Stockholders' Equity Accounts Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders Equity $9,000 6.675 $15,675 4125 $19,800 1,000 15 200 $16,200 $36,000 The inventory management at Dana Dairy Products since 2009. (See Table 3.2) has deteriorated has improved slightly O remained the same cannot be determined 4350 $14,250 Inventorico Total Curent Assets GrossFixed Aboets Lens Accumulated Deprecation Net Fixed Asset Total Asseto $35,000 13.250 $36,000 $9,000 6.675 $15,675 4125 Liabilities & Stockholders' Equity Accounts Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earringe Total Stockholders Equity Total Liabilitate de stockholders Equity $19,800 1.000 15200 $16,200 $36,000 The return on equity for Dana Dairy Products for 2010 was (See Table 3.2) O 0.9 percent O 5.6 percent 0.6 percent 50 percent Net Fixed Assets Total Assets 21.750 $36,000 Liabilities & Stockholders' Equity Accounts Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Eamings Total Stockholders' Equity Total Liabilities & Rod holders Equity $ 9,000 6.675 $15,675 4125 $19,800 1,000 15.200 $16,200 $36,000 Dana Dairy Products had a standard, resulting in degree of financial leverage than the industry (See Table 3.2) O higher; higher return on equity lower: lower return on equity higher: higher return on total assets lower: lower return on total assets Net Fixed Assets Total Aconto 21,750 $36,000 Liabilities & Stockholders' Equity Accounts Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders Equity $ 9,000 6 675 $15,675 4.125 $19,800 1,000 15200 $16,200 $36,000 The debt ratio for Dana Dairy Products in 2010 was (See Table 3.2) 44 percent 55 percent 11 percent 50 percent $19,ZDU TUGUEL HISSES Gross Fixed Assets Less. Accumulated Depreciation Net Fixed Assets Total Assets $35,000 13.250 21.750 $36,000 Liabilities & Stockholders' Equity Accounts Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Eamings Total Stockholders' Equity Total Liabilities & Stockholders Equity $9,000 6.675 $15,675 4,125 $19,800 1.000 15,200 $16, 200 $36,000 Since 2009, the liquidity of Dana Dairy Products (See Table 3.2) has improved has deteriorated O be determined O remained the same eri BUL $35 000 13.250 Gross Fixed Assets Less Accumulated Depreciation Net Fixed Assets Total Assets 21 750 $36,000 Liabilities & Stockholders' Equity Accounts Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earrings Total Stockholders' Equity Total Liabilities de Stockholders Equity $9,000 6675 $15,675 4 125 $19,800 1,000 15,200 $16,200 $36.000 The return on total assets for Dana Dairy Products for 2010 was (See Table 3.2) 5.5 percent 0.25 percent 0.9 percent 2.5 per