Answered step by step

Verified Expert Solution

Question

1 Approved Answer

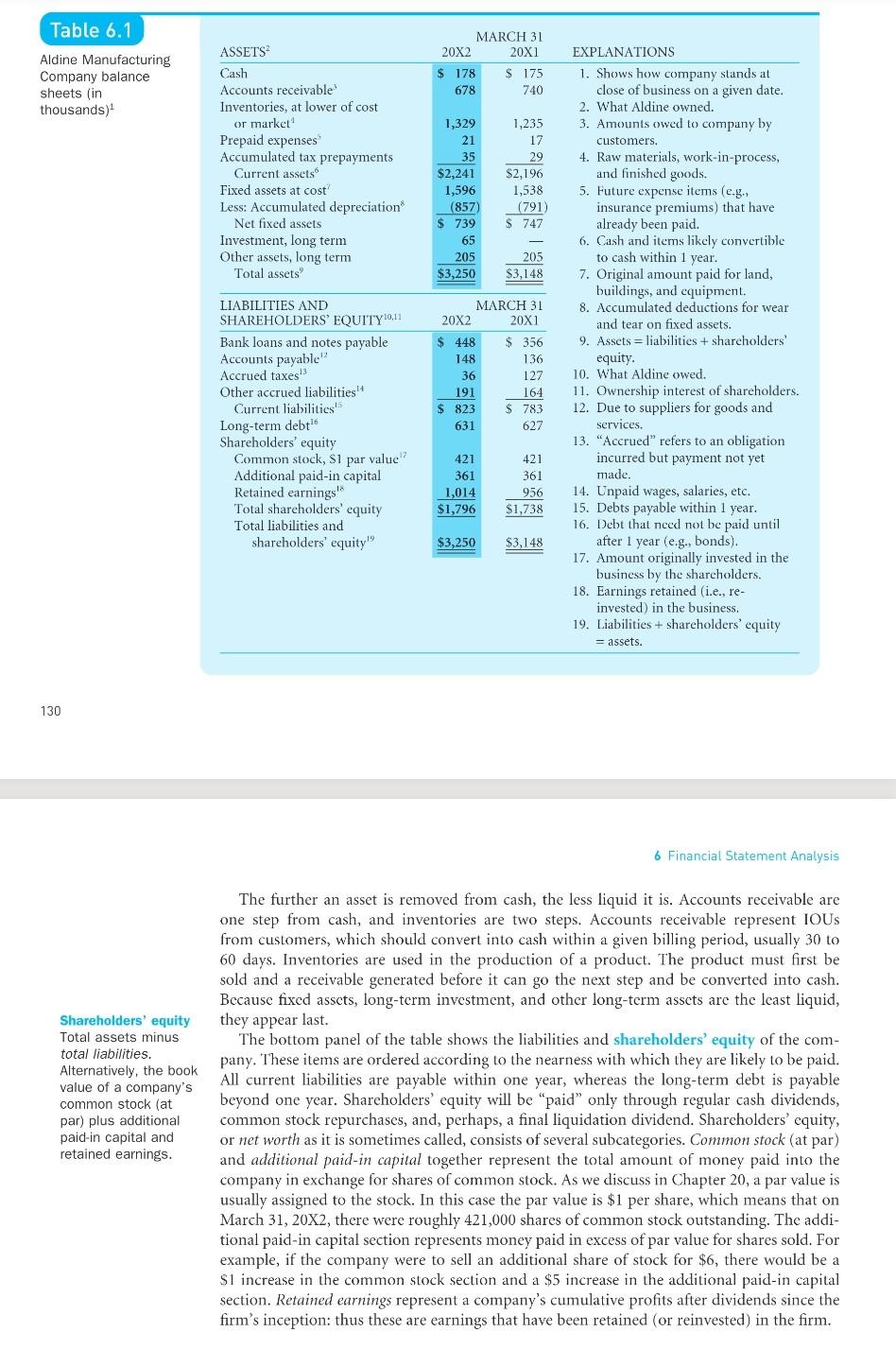

Table 6.1 Aldine Manufacturing Company balance sheets (in thousands) MARCH 31 20X2 20X1 $ 178 $ 175 678 740 ASSETS Cash Accounts receivable Inventories, at

Table 6.1 Aldine Manufacturing Company balance sheets (in thousands) MARCH 31 20X2 20X1 $ 178 $ 175 678 740 ASSETS Cash Accounts receivable Inventories, at lower of cost or market Prepaid expenses Accumulated tax prepayments Current assets Fixed assets at cost' Less: Accumulated depreciation Net fixed assets Investment, long term Other assets, long term Total assets 1,329 21 35 $2,241 1,596 (857) $ 739 65 205 $3,250 1,235 17 29 $2,196 1,538 (791) $ 747 205 $3,148 MARCH 31 20X2 20X1 LIABILITIES AND SHAREHOLDERS' EQUITY10,11 Bank loans and notes payable Accounts payable" Accrued taxes Other accrued liabilities14 Current liabilities Long-term debt16 Shareholders' equity Common stock, Si par value Additional paid-in capital Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 448 148 36 191 $ 823 631 $ 356 136 127 164 $ 783 627 EXPLANATIONS 1. Shows how company stands at close of business on a given date. 2. What Aldine owned. 3. Amounts owed to company by Customers. 4. Raw materials, work-in-process, and finished goods. 5. Future expense items (e.g. insurance premiums) that have already been paid. 6. Cash and items likely convertible to cash within 1 year. 7. Original amount paid for land, buildings, and equipment. 8. Accumulated deductions for wear and tear on fixed assets. 9. Assets = liabilities + shareholders' equity. 10. What Aldine owed. 11. Ownership interest of shareholders. 12. Due to suppliers for goods and services. 13. "Accrued" refers to an obligation incurred but payment not yet made. 14. Unpaid wages, salaries, etc. 15. Debts payable within 1 year. 16. Debt that need not be paid until after 1 year (e.g., bonds). 17. Amount originally invested in the business by the shareholders. 18. Earnings retained (i.e., re- invested) in the business, 19. Liabilities + shareholders' equity = assets. 421 361 1,014 $1,796 421 361 956 $1,738 $3,250 $3,148 130 6 Financial Statement Analysis Shareholders' equity Total assets minus total liabilities. Alternatively, the book value of a company's common stock (at par) plus additional paid-in capital and retained earnings. The further an asset is removed from cash, the less liquid it is. Accounts receivable are one step from cash, and inventories are two steps. Accounts receivable represent IOUS from customers, which should convert into cash within a given billing period, usually 30 to 60 days. Inventories are used in the production of a product. The product must first be sold and a receivable generated before it can go the next step and be converted into cash. Because fixed assets, long-term investment, and other long-term assets are the least liquid, they appear last. The bottom panel of the table shows the liabilities and shareholders' equity of the com- pany. These items are ordered according to the nearness with which they are likely to be paid. All current liabilities are payable within one year, whereas the long-term debt is payable beyond one year. Shareholders' equity will be paid only through regular cash dividends, common stock repurchases, and, perhaps, a final liquidation dividend. Shareholders' cquity, or net worth as it is sometimes called, consists of several subcategories. Common stock (at par) and additional paid-in capital together represent the total amount of money paid into the company in exchange for shares of common stock. As we discuss in Chapter 20, a par value is usually assigned to the stock. In this case the par value is $1 per share, which means that on March 31, 20X2, there were roughly 421,000 shares of common stock outstanding. The addi- tional paid-in capital section represents money paid in excess of par value for shares sold. For example, if the company were to sell an additional share of stock for $6, there would be a $1 increase in the common stock section and a $5 increase in the additional paid-in capital section. Retained earnings represent a company's cumulative profits after dividends since the firm's inception: thus these are earnings that have been retained (or reinvested) in the firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started